-

Europe

EU – Request of exchange of information for tax purposes: the Berlioz case

26 October 2017

- Tax

Like in other jurisdictions, in Cyprus the term ‘joint venture’ connotes business arrangements that involve the pooling of resources, knowledge and experiences of the participants for the purposes of accomplishing or implementing a specific task, whether this is a particular project or business activity. There is no specific statute governing joint ventures yet in practice such arrangements take one of the following structures.

-

Corporate Joint Venture

The cooperation materialises through the setting up of a legal entity separate from its participants with constitutional documents governing its operation and the relations between the participants and the entity in addition to the statutory provisions of the Cyprus Company Law, Cap 113. A shareholders’ agreement is typically executed operating in parallel. It is possible that further agreements such as licences for use of intellectual property etc. will be signed. This vehicle might be more appropriate where it is expected that the joint venture will need to enter into contractual arrangements with third parties due to the limited liability benefits. The termination is usually addressed in a shareholders’ agreement which specifies events of termination e.g. change of control, insolvency of a participant, attainment of objective etc. as well as the relevant processes e.g. sale of shares among participants, liquidation etc.

Taxation of income occurs at the level of the company. Participants are not taxed on dividends in Cyprus if they are not tax residents or if they are companies. If the company is to be taxed in Cyprus, the management and control will need to be exercised in Cyprus. Any assets, including intellectual property created by the company, become property of the new entity. The setting up of the company might be subject to notification to the competent competition authority under merger control rules. Corporate joint ventures are commonly used by international clients aiming to benefit from the network of double tax treaties maintained by Cyprus. They are also a vehicle often employed to enter the Cyprus market with the assistance of a local participant.

Advantages:

- Limited liability; liability of participants limited to capital.

- Participants control the company through the power of appointment of the board of directors.

- The company is governed by the Cyprus Companies Law, Cap. 113, a statute based on English company law rules, which gives more legal certainty and familiarity for participants as well as the counterparties. The relationship is not purely contractual.

- Tax optimisation possibilities given the low rate of corporate taxation applicable in Cyprus (at the rate of 12.5%). The numerous double tax treaties maintained by Cyprus may be exploited.

Disadvantages:

- Less flexibility compared to the other structures due to the applicable legal framework both in terms of operation and compliance.

- Governance and control questions might need to be addressed e.g. to deal with deadlocks.

- Restrictions and or conditions for the transfer of shares are typically adopted.

- Both the corporate profit and the dividends returned to participants might, under certain circumstances, be subject to taxation e.g. where participants are natural persons residing in Cyprus.

-

Partnership Joint Venture

The relationship is governed by the relevant statute which specifies the liability of each partner depending on whether the partnership would be a general or limited partnership. In the first case, each partner has unlimited liability with the other partners for all debts and liabilities of the partnership. In the second case, only the general partner has unlimited liability; limited partners are only liable for the capital they agreed to invest but should not participate in the running of the business. The relevant statute imposes default and overriding rules governing the arrangement e.g. in relation to the termination or profit sharing. The termination of the partnership will typically be governed by the partnership agreement, but the statute also provides for specified circumstances which would apply unless the parties agree otherwise. Business assets and intellectual property contributed by each party become the property of the partnership (except if agreed otherwise) and should be exploited in accordance with the partnership agreement for the purposes of the partnership.

Partnerships are tax transparent, accordingly, taxation occurs at the level of the participants and profits and losses accrue to them. Partnerships might be subject to competition law rules prohibiting the restriction of competition. Further, the creation of a partnership might be subject to notification to the competent competition authority under merger control rules. Partnership joint ventures are regularly used for economic activities of professionals. They have also been used as a vehicle in the context of tenders (public or other).

Advantages:

- Relatively fewer formalities apply than in the case of corporate joint ventures.

- Registration requirements exist but no requirement for disclosure of the actual partnership agreement i.e. the constitutional document.

- Although the partnership has no legal personality, it may sue and be sued in its own name and may trade under its name.

- Apportionment of profits and losses on the basis of discretion.

- Attribution of profits to the partners; not to the partnership.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned. Wide options may be available due to the extensive network of double tax treaties maintained by Cyprus.

Disadvantages:

- Significant powers to unlimited partners. Given the powers of partners to bind the partnership, decision-making process needs to be addressed carefully.

- Liability comes with involvement in the management/control. Unlimited liability of general partners towards third parties. Solutions alleviating the effect of this may be possible.

- Tax transparency may not be beneficial where the partners are natural persons as they might be taxed at higher rates. Yet with appropriate structuring this may be avoided.

-

Contractual joint ventures

The basis of the cooperation of the participants is solely a contractual agreement between them. It is expected that such agreement will include detailed provisions regulating the rights and liabilities of the parties towards each other, the distinct role and input of each, their contributions, their share in the income generated etc. No separate legal personality is created. Business assets and intellectual property remain the property of the participant who contributed or developed them (unless of course the parties agree otherwise).

Profits and losses accrue to the participants and taxation is also incurred at the level of the participants. Such arrangements might be subject to competition law rules prohibiting the restriction of competition. Contractual joint ventures are commonly used in the context of tenders (public or other).

Advantages:

- Governed solely by contact law thus greater flexibility as to the operation and termination. Contract law in Cyprus is based on common law principles.

- No registration requirements.

- Minimal formalities compared to the other possible structures.

- No joint liability; liability towards third parties limited to own acts or omissions of each participant.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned.

Disadvantages:

- Lack of legal personality might cause difficulties in establishing commercial or contractual relationships with third parties.

- Need for detailed regulation of all aspects of the cooperation in the agreement due to the lack of legal framework for the relationship; careful and skilful planning is required.

- Depending on the facts and provisions adopted, risk of classification of the relationship as a partnership by a court with the consequence of joint liability.

-

European Economic Interest Grouping (EEIG)

A vehicle established and governed predominantly by European law (Council Regulation 2137/85) instead of national law. Specific purposes for EEIGs apply i.e. to facilitate or develop the economic activities of the members to enable them to improve their own results. In that context the activities of EEIGs must be related to the economic activities of the members but not replace them. The purpose is not to make profits for the EEIG itself. EEIGs are governed by a contract between their members and Council Regulation 2137/85. They have capacity, in their own name, to have rights and obligations of all kinds, to contract or accomplish other legal acts as well as to sue or be sued. There is unlimited joint liability of the participants for the debts and liabilities of the EEIG but the exclusion or restriction of liability of one or more members for a particular debt or liability is possible if it is specifically agreed between the third party and the EEIG. EEIGs enjoy tax transparency. Profits or losses are taxable at the hands of the participants.

Advantages:

- Established under European law; EEGIs might be ideal for alliances of firms in different member states of the European Union for joint promotion of activities.

- Relatively fewer formalities apply than in the case of corporate joint ventures though there are registration requirements.

- Tax transparency.

Disadvantages:

- Managers bind EEIGs as regards third parties, even if their acts do not fall within the objects (unless the third party had knowledge).

- Unlimited liability of participants.

- More limited scope for use due to the statutory purposes dictated.

Which option is the most appropriate and or efficient in terms of structuring in a particular case depends on the facts at hand and the actual needs of the participants. The different factors need to be carefully examined with the help of experts so that the most suitable solution is adopted.

Pursuant to the European Directive on administrative cooperation in the field of taxation (2011/16/EU), Member States must cooperate with each other with a view to exchanging information relevant for tax purposes. The directive allows, inter alia, that a Member State (the requesting Member State) requests another Member State (the requested Member State) to provide information concerning a specific taxpayer. The requested information must be ‘ foreseeably relevant ‘ to the tax authorities of the requesting Member State.

Based on the aforementioned directive, the tax authority of the requested Member State may request information from e.g. an affiliated company, a financial institution, an employer, … of the taxpayer. The tax authority of the requested Member State forwards the collected information to its counterpart in the requesting Member State.

A question that arises is whether that affiliated company, financial institution, employer, … may ask its national courts to verify the legality of the sanction imposed by its tax authority because of an incomplete answer and whether it may ask to vary the penalty. Another question is whether a court in the requested Member State may verify the relevance for tax purposes of the requested information.

These questions were raised in the Berlioz case of the Court of Justice (judgement of 16 May 2017): Berlioz (a Luxembourg company) only partially answered the request for information from the Luxembourg authorities (at the request of France). Berlioz stated in this regard that certain questions were irrelevant for tax purposes in the requesting Member State.

The answers to the questions raised are not obvious, as the starting point is that the requesting State has a margin of discretion as to what is foreseeably relevant for its tax purposes. This explains why (in this case the Luxembourg) courts doubted whether a relevance test was possible. The questions were referred for a preliminary ruling to the Court of Justice.

In its assessment, the court took into consideration the EU Charter of Fundamental Rights and, more specifically, the right to a fair hearing by an impartial judge.

The Court of Justice ruled that courts in the requested Member State may review the foreseeable relevance for tax purposes of the requested information and that they may vary the penalty imposed. The courts in the requested Member State should be reluctant however upon review of the legality of the request for information: the review is limited to verification whether the requested information manifestly has no relevance for tax purposes.

To this end, the courts must have access to the request for information. The affiliated company, financial institution, employer, … is only entitled to receive the identity of the person under investigation and to be informed about the tax purpose for which the information is sought. The Court of Justice indeed emphasizes in the interest of the investigation the principle that the request for information must remain secret.

Relevance of the judgment: When requested by a national tax authority to respond to a request for information from another Member State, it is important to check the relevance for tax purposes of the requested information. If the information requested is irrelevant to the tax investigation, a proceeding against the request for information or against the penalty may succeed. Regarding the foreseeable relevance for tax purposes, the national courts may only review whether the requested information manifestly has no relevance to the tax investigation in the requesting Member State.

Individuals coming to Portugal and here becoming residents for the first time, can be entitled to some important tax benefits under the “non habitual resident rules”. These rules are an important contribution for making Portugal one of the most attractive destinations for retired individuals, but also for entrepreneurs.

Who can benefit?

A non habitual resident is an individual becoming resident for tax purposes in Portugal for the first time in the last five years period. To become resident for tax purposes, one should be in Portugal for more than 183 days in any 12 months period or for a shorter period but in such conditions that the intention of becoming resident is sufficiently clear. After becoming resident for tax purposes and register as such before the Tax Authorities, the individual must register as a non habitual resident to be able to benefit from this regime.

High Value Added Activities.

Some of the benefits under the non habitual resident rules are only applicable to income arising from high value added activities. These activities include architects, engineers, artists, auditors and tax consultants, medical professions, university teachers, top managers and other liberal professionals in areas such as informatics (software and hardware) development and consultancy, science investigation and design.

For how long?

The benefits arising from the non habitual resident status are valid for a ten year period and depend on the individual remaining as resident in Portugal for tax purposes. If, for any reason, the individual ceases to be resident, he can later benefit from the remaining period by becoming resident again.

What are the benefits?

Individuals becoming non habitual resident benefit from a more favorable tax treatment regarding both income from Portuguese source and income from foreign sources.

As to the income from Portuguese source arising from employment and self-employment, it is subject to a special tax of 20%. This benefit is only applicable to non habitual residents earning income from high value added activities.

As to the income from foreign sources arising from employment and pensions, it is exempted from taxes in Portugal, in most cases. This exemption also includes income arising from self-employment in high value added activities, and from intellectual and industrial property, capital and real estate gains.

With the Legge di Bilancio 2017 (Budget Law), in force since January 1st 2017, the Parliament has implemented a new strategy in order to kick-start the Italian economy with the adoption of a wide array of measures to support startups and small-medium enterprises both financially and fiscally with the purpose of making them more appealing to foreign investors.

The Budget Law has designed a comprehensive plan that involves certain tax breaks, the possibility for SMEs to raise funds through crowdfunding platforms and for the so-called “innovative” startups (meaning early-stage companies that meet certain criteria set by the law: i.e. high level technology of the company’s scope, R&D expenditure or number of graduates employed, etc.) to sell transfer their tax losses to listed companies. Overall, these tools mainly aim at unlocking the economic system that so far has not proved to be capable enough to provide early-stage startups and SMEs both with financial resources and tax benefits they need to develop innovative assets and scale up their business.

This set of measures can be divided under four groups, based on the relevant purposes:

- Fostering entrepreneurship and setting up innovative companies;

- Stimulating private investments directed to innovative startup/small-medium enterprises;

- Supporting R&D expenditure and

- Modernizing existing companies’ assets by their digitalization and automation, along with the development of innovative technologies.

Economic relief for setting up new companies

The strategy laid down by the Parliament involves the Ministry of the Economic Development (Mise), the National Institute for Insurance against Accidents at Work (Inail), and other public agencies, such as Invitalia, in order to boost the incorporation of startup companies and the development of innovative SMEs.

As matter of fact, the endowment of the Fund for Sustainable Growth (FCS – Fondo per la Crescita Sostenibile), aimed at providing soft loans to support the incorporation of innovative startup companies, has increased by Euro 47,5 millions for 2017 and 2018, respectively.

Furthermore, the Budget Law has also allocated the same amount of Euro 47,5 millions for both 2017 and 2018 in order to foster self-employment and entrepreneurship. These funds will be managed by Invitalia, the Government agency for inward investment promotion and enterprise development, and will be mostly employed to sustain the incorporation of companies by women and young entrepreneurs (aged 18 to 35 years). Invitalia shall be able to grant subsidized zero-interest loans for a maximum of eight years, which could cover up to 75% of total expenses as budgeted for specific investments. Companies will then have to fund the remaining amount as allocated in the business plan and carry out the envisaged investment within 24 months of the signing the loan agreement.

The Ministry of the Economic Development (Mise) has also issued a sets of measures that grant subsidies to support development programs carried out by startup companies with a focus to the acquisition of new machineries and technological equipment; hardware and software technologies; patents and licenses along with non-patented technical know-how directly connected to production/managerial needs.

The Budget Law – pending the approval of the relevant Ministries – also introduces the possibility for Inail to invest in closed-end funds dedicated to innovative startups or to directly set up and participate in technological business ventures.

Streamlining bureaucracy

No need for a notary and exemption from stamp duty and other administrative fees are some of the measures aimed at streamlining the procedure to set up a startup company. It will also be possible to draw up the articles of association and its subsequent amendments through the online procedure by means of qualified electronic signature.

Tax breaks for investments in innovative start-ups and SMEs

Pending the final approval of the European Commission, the Budget Law has introduced new incentives for those subjects that will invest in startup companies. Tax breaks concerning this kind of investments are not something new. Introduced in 2012 and originally conceived as temporary, with the Budget Law, these measures has not only been converted into permanent incentives, but also increased from 19% and 20%, for individuals and companies respectively, to 30% with no distinction as to the status of the investor (potential shareholder) for investment capped at Euro 1 million for individuals and Euro 1,8 millions for entities.

Since these tax breaks are aimed at encouraging investments in startups, these benefits are balanced out by the condition that the investment which has benefited from these measures is maintained in the target company for three years (instead of two, as provided for under the previous Budget Law). Furthermore, the Budget Law has extended these benefits also to innovative SMEs, that is all the small-medium enterprises operating in the field of technological innovation, regardless of their date of incorporation, since these companies will be relieved from presenting a plan attesting their innovative assets programs in order to access the benefits, as provided for previously.

A partnership between startups and listed companies that may benefit both parties

In the accompanying report to the Budget Law, the Government also has stressed the importance of involving listed companies in financing directly or indirectly startup projects and therefore it has introduced the possibility for startup companies to transfer the tax losses accrued in the first three fiscal years to a listed company provided that the certain requirements are met.

The transfer will be conducted according to the rule provided for the transfer of corporate tax credits; the transferee will be called to make up for the benefit received from the transferor and the remuneration paid to the startup will not be subject to taxation. Through this mechanism, the companies would benefit one another: the startup would find a financial “sponsor” and the listed company would be able to fully offset its taxable income with the tax losses received, considering also the possibility to carry forward the exceeding part to the following year.

Crowdfunding

Through a tweak to the Italian Consolidated Law on Finance (i.e. Testo Unico Finanza), the Budget Law got rid of some of the restrictions that prevented crowdfunding market to take off in Italy and introduced the possibility for any kind of SMEs to access equity crowdfunding. Previous legislation limited the possibility to raise funds through this system only to the innovative startups thus limiting the development of both SMEs and crowdfunding industry.

While the rules governing equity crowdfunding will be the same from the operators’ side (i.e. crowdfunding platforms), small-middle size companies will now have a new mean for collecting capital aside from those traditional channels such as bank financing and stock exchange listing.

Tax credit on R&D expenses

The tax credit related to the Research & Development expenses, introduced in 2013, has been extended until December 2020 and enhanced passing from 25% to 50% on all the eligible expenses in R&D activities, with an annual threshold capped at Euro 20 million (five times higher than the previous maximum limit).

Companies will be able to reduce their tax bill and claim compensation as a proportion of their R&D expenditure. The provision is now applicable to all R&D expenses, including the hiring of staff dedicated to R&D activities (with no particular requirement as to their qualification) and to any kind of company (resident and non-resident), group or network of enterprises, regardless of the dimension of the firm, its legal status and industry of reference.

This fiscal incentive can be combined with another one applicable to any employee benefiting the tax incentives provided for under work for equity schemes by innovative startups. Breaking it down, this means that in case the staff carrying out the R&D activities is benefiting of any work for equity plan, the company at issue will benefit of both of the tax breaks.

Development contracts for large investment projects

The development contracts (Contratti di sviluppo) are agreements between the Ministry of Economic Development (Mise), Invitalia and one or several companies (the latter through network contracts) engaged in development projects.

First introduced in 2011, these contracts have been devised to support large industrial/productive investments with a size of at least 20 million euro (7,5 millions only with regards to the agro-food industry).

Development contracts are financed by the Mise, with the participation of the relevant Regions involved (which could also participate in the investment). Invitalia acts as a referent for the promoting companies and it is also the subjects in charge of managing the resources along with the assessment of the applications.

These “contracts” target Italian as well as Italian-based foreign companies and provide financial benefits such as block grants on plant and equipment, soft loans and interest subsidies, whose dimension could vary depending on the size of the company and the type of project at issue (R&D expenditure, innovation-directed investments).

Invitalia sets a fast pace for the admission procedure as well as for the subsequent development plan: once the project has been approved, the companies will have 90 days to submit all the documents required; they will then have 6 months to start and 36 months to carry out the investment project.

As a token of the country’s will to come through, the program also provides for special fast-track courses for particular productive and digitalization-related investment projects.

Super Depreciation and Hyper depreciation

With regard to companies as widely considered, the Budget Law also extends the extra 40% depreciation deduction (which makes up a total tax depreciation of 140%) through 2017. Then, companies could deduct the expenses borne in order purchase tangible assets whose depreciation rate exceeds 6,5%. The incentive will be applicable only to those assets whose purchase order has been accepted by the supplier and paid for at least 20% by 31 December 2017. Aside from this, the Law has introduced a new extra 150% depreciation deduction (the so-called “hyper depreciation” that combined with the existing would make a total 250% depreciation deduction) for the purchase (or lease) of new technological assets, such as digitally-controlled machineries, equipment and so forth (the law outlines the complete range of eligible assets), acquired in order to atomize and digitalize enterprises.

Sabatini-ter

The Budget Law has also reintroduced the so-called “Sabatini”, a special legislation aimed at facilitating the purchase (or lease) of capital goods by small-medium enterprises by covering part of the interests on bank loans between Euro 20,000 and Euro 2 million, that has been extended until 31 December 2018. A specific and more generous measure will apply to the purchase of new assets connected with the Industry 4.0 plan. Part of the resources allocated will be directed to support innovation, efficiency and the creation of a “digital” industrial system that invests in new technological equipment such as cloud computing, broadband connections, cybersecurity, robotics, mechatronics and so forth.

In conclusion, the above-mentioned measures, applicable to any company based in Italy, represent a strategic milestone in the way to making Italian companies more competitive in the global market, in terms of both technology and financial resources. Given the lack of regulatory barriers to entry, this set of new rules can vitalize the Italian economic system also attracting foreign investors.

The author of this post is Milena Prisco.

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

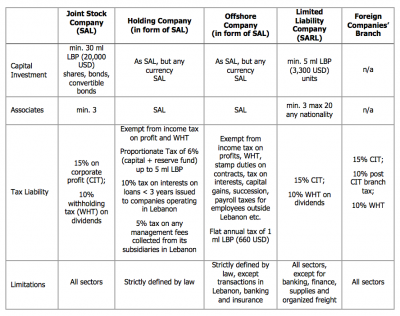

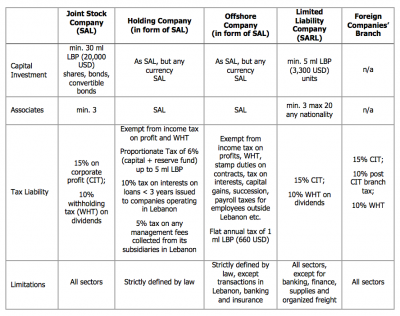

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

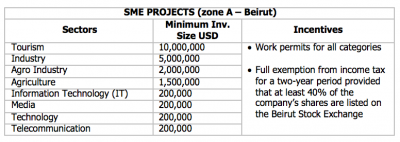

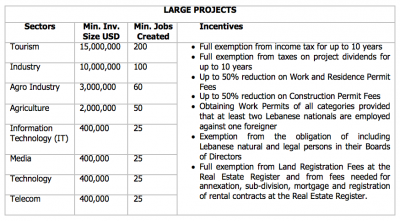

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.

Portugal – Tax Benefits for New Residents

26 June 2017

-

Portugal

- Immigration

- Tax

Like in other jurisdictions, in Cyprus the term ‘joint venture’ connotes business arrangements that involve the pooling of resources, knowledge and experiences of the participants for the purposes of accomplishing or implementing a specific task, whether this is a particular project or business activity. There is no specific statute governing joint ventures yet in practice such arrangements take one of the following structures.

-

Corporate Joint Venture

The cooperation materialises through the setting up of a legal entity separate from its participants with constitutional documents governing its operation and the relations between the participants and the entity in addition to the statutory provisions of the Cyprus Company Law, Cap 113. A shareholders’ agreement is typically executed operating in parallel. It is possible that further agreements such as licences for use of intellectual property etc. will be signed. This vehicle might be more appropriate where it is expected that the joint venture will need to enter into contractual arrangements with third parties due to the limited liability benefits. The termination is usually addressed in a shareholders’ agreement which specifies events of termination e.g. change of control, insolvency of a participant, attainment of objective etc. as well as the relevant processes e.g. sale of shares among participants, liquidation etc.

Taxation of income occurs at the level of the company. Participants are not taxed on dividends in Cyprus if they are not tax residents or if they are companies. If the company is to be taxed in Cyprus, the management and control will need to be exercised in Cyprus. Any assets, including intellectual property created by the company, become property of the new entity. The setting up of the company might be subject to notification to the competent competition authority under merger control rules. Corporate joint ventures are commonly used by international clients aiming to benefit from the network of double tax treaties maintained by Cyprus. They are also a vehicle often employed to enter the Cyprus market with the assistance of a local participant.

Advantages:

- Limited liability; liability of participants limited to capital.

- Participants control the company through the power of appointment of the board of directors.

- The company is governed by the Cyprus Companies Law, Cap. 113, a statute based on English company law rules, which gives more legal certainty and familiarity for participants as well as the counterparties. The relationship is not purely contractual.

- Tax optimisation possibilities given the low rate of corporate taxation applicable in Cyprus (at the rate of 12.5%). The numerous double tax treaties maintained by Cyprus may be exploited.

Disadvantages:

- Less flexibility compared to the other structures due to the applicable legal framework both in terms of operation and compliance.

- Governance and control questions might need to be addressed e.g. to deal with deadlocks.

- Restrictions and or conditions for the transfer of shares are typically adopted.

- Both the corporate profit and the dividends returned to participants might, under certain circumstances, be subject to taxation e.g. where participants are natural persons residing in Cyprus.

-

Partnership Joint Venture

The relationship is governed by the relevant statute which specifies the liability of each partner depending on whether the partnership would be a general or limited partnership. In the first case, each partner has unlimited liability with the other partners for all debts and liabilities of the partnership. In the second case, only the general partner has unlimited liability; limited partners are only liable for the capital they agreed to invest but should not participate in the running of the business. The relevant statute imposes default and overriding rules governing the arrangement e.g. in relation to the termination or profit sharing. The termination of the partnership will typically be governed by the partnership agreement, but the statute also provides for specified circumstances which would apply unless the parties agree otherwise. Business assets and intellectual property contributed by each party become the property of the partnership (except if agreed otherwise) and should be exploited in accordance with the partnership agreement for the purposes of the partnership.

Partnerships are tax transparent, accordingly, taxation occurs at the level of the participants and profits and losses accrue to them. Partnerships might be subject to competition law rules prohibiting the restriction of competition. Further, the creation of a partnership might be subject to notification to the competent competition authority under merger control rules. Partnership joint ventures are regularly used for economic activities of professionals. They have also been used as a vehicle in the context of tenders (public or other).

Advantages:

- Relatively fewer formalities apply than in the case of corporate joint ventures.

- Registration requirements exist but no requirement for disclosure of the actual partnership agreement i.e. the constitutional document.

- Although the partnership has no legal personality, it may sue and be sued in its own name and may trade under its name.

- Apportionment of profits and losses on the basis of discretion.

- Attribution of profits to the partners; not to the partnership.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned. Wide options may be available due to the extensive network of double tax treaties maintained by Cyprus.

Disadvantages:

- Significant powers to unlimited partners. Given the powers of partners to bind the partnership, decision-making process needs to be addressed carefully.

- Liability comes with involvement in the management/control. Unlimited liability of general partners towards third parties. Solutions alleviating the effect of this may be possible.

- Tax transparency may not be beneficial where the partners are natural persons as they might be taxed at higher rates. Yet with appropriate structuring this may be avoided.

-

Contractual joint ventures

The basis of the cooperation of the participants is solely a contractual agreement between them. It is expected that such agreement will include detailed provisions regulating the rights and liabilities of the parties towards each other, the distinct role and input of each, their contributions, their share in the income generated etc. No separate legal personality is created. Business assets and intellectual property remain the property of the participant who contributed or developed them (unless of course the parties agree otherwise).

Profits and losses accrue to the participants and taxation is also incurred at the level of the participants. Such arrangements might be subject to competition law rules prohibiting the restriction of competition. Contractual joint ventures are commonly used in the context of tenders (public or other).

Advantages:

- Governed solely by contact law thus greater flexibility as to the operation and termination. Contract law in Cyprus is based on common law principles.

- No registration requirements.

- Minimal formalities compared to the other possible structures.

- No joint liability; liability towards third parties limited to own acts or omissions of each participant.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned.

Disadvantages:

- Lack of legal personality might cause difficulties in establishing commercial or contractual relationships with third parties.

- Need for detailed regulation of all aspects of the cooperation in the agreement due to the lack of legal framework for the relationship; careful and skilful planning is required.

- Depending on the facts and provisions adopted, risk of classification of the relationship as a partnership by a court with the consequence of joint liability.

-

European Economic Interest Grouping (EEIG)

A vehicle established and governed predominantly by European law (Council Regulation 2137/85) instead of national law. Specific purposes for EEIGs apply i.e. to facilitate or develop the economic activities of the members to enable them to improve their own results. In that context the activities of EEIGs must be related to the economic activities of the members but not replace them. The purpose is not to make profits for the EEIG itself. EEIGs are governed by a contract between their members and Council Regulation 2137/85. They have capacity, in their own name, to have rights and obligations of all kinds, to contract or accomplish other legal acts as well as to sue or be sued. There is unlimited joint liability of the participants for the debts and liabilities of the EEIG but the exclusion or restriction of liability of one or more members for a particular debt or liability is possible if it is specifically agreed between the third party and the EEIG. EEIGs enjoy tax transparency. Profits or losses are taxable at the hands of the participants.

Advantages:

- Established under European law; EEGIs might be ideal for alliances of firms in different member states of the European Union for joint promotion of activities.

- Relatively fewer formalities apply than in the case of corporate joint ventures though there are registration requirements.

- Tax transparency.

Disadvantages:

- Managers bind EEIGs as regards third parties, even if their acts do not fall within the objects (unless the third party had knowledge).

- Unlimited liability of participants.

- More limited scope for use due to the statutory purposes dictated.

Which option is the most appropriate and or efficient in terms of structuring in a particular case depends on the facts at hand and the actual needs of the participants. The different factors need to be carefully examined with the help of experts so that the most suitable solution is adopted.

Pursuant to the European Directive on administrative cooperation in the field of taxation (2011/16/EU), Member States must cooperate with each other with a view to exchanging information relevant for tax purposes. The directive allows, inter alia, that a Member State (the requesting Member State) requests another Member State (the requested Member State) to provide information concerning a specific taxpayer. The requested information must be ‘ foreseeably relevant ‘ to the tax authorities of the requesting Member State.

Based on the aforementioned directive, the tax authority of the requested Member State may request information from e.g. an affiliated company, a financial institution, an employer, … of the taxpayer. The tax authority of the requested Member State forwards the collected information to its counterpart in the requesting Member State.

A question that arises is whether that affiliated company, financial institution, employer, … may ask its national courts to verify the legality of the sanction imposed by its tax authority because of an incomplete answer and whether it may ask to vary the penalty. Another question is whether a court in the requested Member State may verify the relevance for tax purposes of the requested information.

These questions were raised in the Berlioz case of the Court of Justice (judgement of 16 May 2017): Berlioz (a Luxembourg company) only partially answered the request for information from the Luxembourg authorities (at the request of France). Berlioz stated in this regard that certain questions were irrelevant for tax purposes in the requesting Member State.

The answers to the questions raised are not obvious, as the starting point is that the requesting State has a margin of discretion as to what is foreseeably relevant for its tax purposes. This explains why (in this case the Luxembourg) courts doubted whether a relevance test was possible. The questions were referred for a preliminary ruling to the Court of Justice.

In its assessment, the court took into consideration the EU Charter of Fundamental Rights and, more specifically, the right to a fair hearing by an impartial judge.

The Court of Justice ruled that courts in the requested Member State may review the foreseeable relevance for tax purposes of the requested information and that they may vary the penalty imposed. The courts in the requested Member State should be reluctant however upon review of the legality of the request for information: the review is limited to verification whether the requested information manifestly has no relevance for tax purposes.

To this end, the courts must have access to the request for information. The affiliated company, financial institution, employer, … is only entitled to receive the identity of the person under investigation and to be informed about the tax purpose for which the information is sought. The Court of Justice indeed emphasizes in the interest of the investigation the principle that the request for information must remain secret.

Relevance of the judgment: When requested by a national tax authority to respond to a request for information from another Member State, it is important to check the relevance for tax purposes of the requested information. If the information requested is irrelevant to the tax investigation, a proceeding against the request for information or against the penalty may succeed. Regarding the foreseeable relevance for tax purposes, the national courts may only review whether the requested information manifestly has no relevance to the tax investigation in the requesting Member State.

Individuals coming to Portugal and here becoming residents for the first time, can be entitled to some important tax benefits under the “non habitual resident rules”. These rules are an important contribution for making Portugal one of the most attractive destinations for retired individuals, but also for entrepreneurs.

Who can benefit?

A non habitual resident is an individual becoming resident for tax purposes in Portugal for the first time in the last five years period. To become resident for tax purposes, one should be in Portugal for more than 183 days in any 12 months period or for a shorter period but in such conditions that the intention of becoming resident is sufficiently clear. After becoming resident for tax purposes and register as such before the Tax Authorities, the individual must register as a non habitual resident to be able to benefit from this regime.

High Value Added Activities.

Some of the benefits under the non habitual resident rules are only applicable to income arising from high value added activities. These activities include architects, engineers, artists, auditors and tax consultants, medical professions, university teachers, top managers and other liberal professionals in areas such as informatics (software and hardware) development and consultancy, science investigation and design.

For how long?

The benefits arising from the non habitual resident status are valid for a ten year period and depend on the individual remaining as resident in Portugal for tax purposes. If, for any reason, the individual ceases to be resident, he can later benefit from the remaining period by becoming resident again.

What are the benefits?

Individuals becoming non habitual resident benefit from a more favorable tax treatment regarding both income from Portuguese source and income from foreign sources.

As to the income from Portuguese source arising from employment and self-employment, it is subject to a special tax of 20%. This benefit is only applicable to non habitual residents earning income from high value added activities.

As to the income from foreign sources arising from employment and pensions, it is exempted from taxes in Portugal, in most cases. This exemption also includes income arising from self-employment in high value added activities, and from intellectual and industrial property, capital and real estate gains.

With the Legge di Bilancio 2017 (Budget Law), in force since January 1st 2017, the Parliament has implemented a new strategy in order to kick-start the Italian economy with the adoption of a wide array of measures to support startups and small-medium enterprises both financially and fiscally with the purpose of making them more appealing to foreign investors.

The Budget Law has designed a comprehensive plan that involves certain tax breaks, the possibility for SMEs to raise funds through crowdfunding platforms and for the so-called “innovative” startups (meaning early-stage companies that meet certain criteria set by the law: i.e. high level technology of the company’s scope, R&D expenditure or number of graduates employed, etc.) to sell transfer their tax losses to listed companies. Overall, these tools mainly aim at unlocking the economic system that so far has not proved to be capable enough to provide early-stage startups and SMEs both with financial resources and tax benefits they need to develop innovative assets and scale up their business.

This set of measures can be divided under four groups, based on the relevant purposes:

- Fostering entrepreneurship and setting up innovative companies;

- Stimulating private investments directed to innovative startup/small-medium enterprises;

- Supporting R&D expenditure and

- Modernizing existing companies’ assets by their digitalization and automation, along with the development of innovative technologies.

Economic relief for setting up new companies

The strategy laid down by the Parliament involves the Ministry of the Economic Development (Mise), the National Institute for Insurance against Accidents at Work (Inail), and other public agencies, such as Invitalia, in order to boost the incorporation of startup companies and the development of innovative SMEs.

As matter of fact, the endowment of the Fund for Sustainable Growth (FCS – Fondo per la Crescita Sostenibile), aimed at providing soft loans to support the incorporation of innovative startup companies, has increased by Euro 47,5 millions for 2017 and 2018, respectively.

Furthermore, the Budget Law has also allocated the same amount of Euro 47,5 millions for both 2017 and 2018 in order to foster self-employment and entrepreneurship. These funds will be managed by Invitalia, the Government agency for inward investment promotion and enterprise development, and will be mostly employed to sustain the incorporation of companies by women and young entrepreneurs (aged 18 to 35 years). Invitalia shall be able to grant subsidized zero-interest loans for a maximum of eight years, which could cover up to 75% of total expenses as budgeted for specific investments. Companies will then have to fund the remaining amount as allocated in the business plan and carry out the envisaged investment within 24 months of the signing the loan agreement.

The Ministry of the Economic Development (Mise) has also issued a sets of measures that grant subsidies to support development programs carried out by startup companies with a focus to the acquisition of new machineries and technological equipment; hardware and software technologies; patents and licenses along with non-patented technical know-how directly connected to production/managerial needs.

The Budget Law – pending the approval of the relevant Ministries – also introduces the possibility for Inail to invest in closed-end funds dedicated to innovative startups or to directly set up and participate in technological business ventures.

Streamlining bureaucracy

No need for a notary and exemption from stamp duty and other administrative fees are some of the measures aimed at streamlining the procedure to set up a startup company. It will also be possible to draw up the articles of association and its subsequent amendments through the online procedure by means of qualified electronic signature.

Tax breaks for investments in innovative start-ups and SMEs

Pending the final approval of the European Commission, the Budget Law has introduced new incentives for those subjects that will invest in startup companies. Tax breaks concerning this kind of investments are not something new. Introduced in 2012 and originally conceived as temporary, with the Budget Law, these measures has not only been converted into permanent incentives, but also increased from 19% and 20%, for individuals and companies respectively, to 30% with no distinction as to the status of the investor (potential shareholder) for investment capped at Euro 1 million for individuals and Euro 1,8 millions for entities.

Since these tax breaks are aimed at encouraging investments in startups, these benefits are balanced out by the condition that the investment which has benefited from these measures is maintained in the target company for three years (instead of two, as provided for under the previous Budget Law). Furthermore, the Budget Law has extended these benefits also to innovative SMEs, that is all the small-medium enterprises operating in the field of technological innovation, regardless of their date of incorporation, since these companies will be relieved from presenting a plan attesting their innovative assets programs in order to access the benefits, as provided for previously.

A partnership between startups and listed companies that may benefit both parties

In the accompanying report to the Budget Law, the Government also has stressed the importance of involving listed companies in financing directly or indirectly startup projects and therefore it has introduced the possibility for startup companies to transfer the tax losses accrued in the first three fiscal years to a listed company provided that the certain requirements are met.

The transfer will be conducted according to the rule provided for the transfer of corporate tax credits; the transferee will be called to make up for the benefit received from the transferor and the remuneration paid to the startup will not be subject to taxation. Through this mechanism, the companies would benefit one another: the startup would find a financial “sponsor” and the listed company would be able to fully offset its taxable income with the tax losses received, considering also the possibility to carry forward the exceeding part to the following year.

Crowdfunding

Through a tweak to the Italian Consolidated Law on Finance (i.e. Testo Unico Finanza), the Budget Law got rid of some of the restrictions that prevented crowdfunding market to take off in Italy and introduced the possibility for any kind of SMEs to access equity crowdfunding. Previous legislation limited the possibility to raise funds through this system only to the innovative startups thus limiting the development of both SMEs and crowdfunding industry.

While the rules governing equity crowdfunding will be the same from the operators’ side (i.e. crowdfunding platforms), small-middle size companies will now have a new mean for collecting capital aside from those traditional channels such as bank financing and stock exchange listing.

Tax credit on R&D expenses

The tax credit related to the Research & Development expenses, introduced in 2013, has been extended until December 2020 and enhanced passing from 25% to 50% on all the eligible expenses in R&D activities, with an annual threshold capped at Euro 20 million (five times higher than the previous maximum limit).

Companies will be able to reduce their tax bill and claim compensation as a proportion of their R&D expenditure. The provision is now applicable to all R&D expenses, including the hiring of staff dedicated to R&D activities (with no particular requirement as to their qualification) and to any kind of company (resident and non-resident), group or network of enterprises, regardless of the dimension of the firm, its legal status and industry of reference.

This fiscal incentive can be combined with another one applicable to any employee benefiting the tax incentives provided for under work for equity schemes by innovative startups. Breaking it down, this means that in case the staff carrying out the R&D activities is benefiting of any work for equity plan, the company at issue will benefit of both of the tax breaks.

Development contracts for large investment projects

The development contracts (Contratti di sviluppo) are agreements between the Ministry of Economic Development (Mise), Invitalia and one or several companies (the latter through network contracts) engaged in development projects.

First introduced in 2011, these contracts have been devised to support large industrial/productive investments with a size of at least 20 million euro (7,5 millions only with regards to the agro-food industry).

Development contracts are financed by the Mise, with the participation of the relevant Regions involved (which could also participate in the investment). Invitalia acts as a referent for the promoting companies and it is also the subjects in charge of managing the resources along with the assessment of the applications.

These “contracts” target Italian as well as Italian-based foreign companies and provide financial benefits such as block grants on plant and equipment, soft loans and interest subsidies, whose dimension could vary depending on the size of the company and the type of project at issue (R&D expenditure, innovation-directed investments).

Invitalia sets a fast pace for the admission procedure as well as for the subsequent development plan: once the project has been approved, the companies will have 90 days to submit all the documents required; they will then have 6 months to start and 36 months to carry out the investment project.

As a token of the country’s will to come through, the program also provides for special fast-track courses for particular productive and digitalization-related investment projects.

Super Depreciation and Hyper depreciation

With regard to companies as widely considered, the Budget Law also extends the extra 40% depreciation deduction (which makes up a total tax depreciation of 140%) through 2017. Then, companies could deduct the expenses borne in order purchase tangible assets whose depreciation rate exceeds 6,5%. The incentive will be applicable only to those assets whose purchase order has been accepted by the supplier and paid for at least 20% by 31 December 2017. Aside from this, the Law has introduced a new extra 150% depreciation deduction (the so-called “hyper depreciation” that combined with the existing would make a total 250% depreciation deduction) for the purchase (or lease) of new technological assets, such as digitally-controlled machineries, equipment and so forth (the law outlines the complete range of eligible assets), acquired in order to atomize and digitalize enterprises.

Sabatini-ter

The Budget Law has also reintroduced the so-called “Sabatini”, a special legislation aimed at facilitating the purchase (or lease) of capital goods by small-medium enterprises by covering part of the interests on bank loans between Euro 20,000 and Euro 2 million, that has been extended until 31 December 2018. A specific and more generous measure will apply to the purchase of new assets connected with the Industry 4.0 plan. Part of the resources allocated will be directed to support innovation, efficiency and the creation of a “digital” industrial system that invests in new technological equipment such as cloud computing, broadband connections, cybersecurity, robotics, mechatronics and so forth.

In conclusion, the above-mentioned measures, applicable to any company based in Italy, represent a strategic milestone in the way to making Italian companies more competitive in the global market, in terms of both technology and financial resources. Given the lack of regulatory barriers to entry, this set of new rules can vitalize the Italian economic system also attracting foreign investors.

The author of this post is Milena Prisco.

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

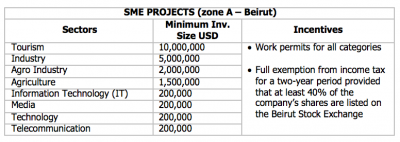

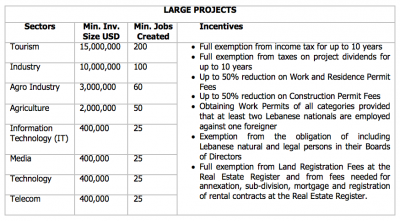

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.