-

Italien

How to manage the impact of tariffs on the international supply chain

9 Februar 2025

- Vertrieb

Duties are not paid by foreign governments (as Donald Trump repeatedly said on the electoral campaign) but by the importing companies of the country that issued the tax on the value of the imported product, i.e., in the case of the Trump administration’s recent round of tariffs, U.S. companies. Similarly, Canadian, Mexican, Chinese, and – probably – European companies will pay the import duties on U.S.-origin products levied by their respective countries as a trade retaliation measure against U.S. tariffs.

In this context, several scenarios open up, all of them problematic

- U.S. companies will pay the import taxes

- foreign companies exporting taxed products to the U.S., will see export volumes fall as a result of the price increase

- foreign companies that import products from the U.S., in turn, will pay tariffs imposed by their countries in retaliation to U.S. duties

- intermediate or end customers in markets affected by the tariffs will pay a higher price for imported products

Does the imposition of the duty constitute force majeure?

A frequent first objection of the party affected by the duty (it may be the buyer-importer or the one who resells the product after paying the duty), in such cases, is to invoke force majeure to evade the performance of the contract, which, as a result of the duty has become too onerous.

The application of the duty, however, does not fall under force majeure since we are not faced with an unforeseeable event, resulting in the objective impossibility of fulfilling the contract. The buyer/importer, in fact, can always fulfill the contract, with only the issue of price increase.

Does the imposition of the duty constitute a cause of hardship?

If a situation of excessive onerousness arises after the conclusion of the contract (hardship), the affected party has the right to demand a revision of the price or to terminate the contract.

Is this the case for tariffs? A case-by-case assessment is needed, leading to a finding of recurrence of hardship if an extraordinary and unforeseeable situation exists (in the case of the U.S. duties, which have been announced for months, it isn’t easy to support this) and the price, as a result of the application of the tariff, is manifestly excessive.

These are exceptional situations, rarely applied, and should be investigated further based on the law applicable to the contract. Generally, price fluctuations in international markets are part of business risk and do not constitute sufficient grounds for renegotiating concluded agreements, which remain binding unless the parties have included a hardship clause (discussed below).

Does the application of the tariff entail a right to renegotiate prices?

Contracts already concluded, such as orders already accepted and supply schedules with agreed prices for a certain period, are binding and must be fulfilled according to the original agreements.

In the absence of specific clauses in the contract, the party affected by the tariff is therefore obliged to comply with the previously agreed price and give fulfillment to the agreement.

The parties are free to renegotiate future contracts, e.g.

- the seller may give a discount to lessen the impact of the duty affecting the buyer-importer, or

- the buyer may agree to a price increase to compensate for a duty that the seller has paid to import a component or semi-finished product into his country, and then export the finished product

but this does not affect the validity of contracts already negotatied, which remain binding.

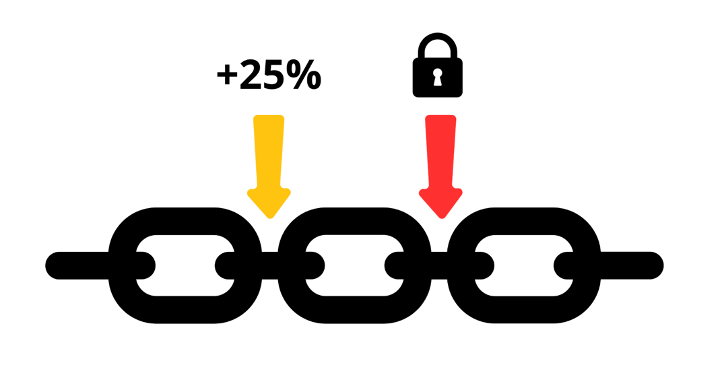

The situation is particularly delicate for companies in the middle of the supply chain, such as those who import raw materials or components from abroad (potentially subject to tariffs, including double duties in the case of repeated import and export) and resell the semi-finished or finished products, since they are not entitled to pass the cost on to the following link in the supply chain, unless this was expressly provided for in the contract with the customer.

What can be done in case of imposition of future duties affecting foreign suppliers or customers?

It is advisable to expressly provide for the right to renegotiate prices, if necessary by adding an addendum to the original agreement. This can be achieved, for example, by a clause providing that in case future events, including any duties, cause an increase in the overall cost of the product above a certain threshold (e.g., 10 percent), the party affected by the tariffs has the right to initiate a renegotiation of the price and, in the event of a failure to agree, can withdraw from the contract.

An example of a clause might be as follows:

Import Duties Adjustment

„If any new import duties, tariffs, or similar governmental charges are imposed after the conclusion of this Contract, and such measures increase a Party’s costs exceeding X% of the agreed price of the Products, the affected Party shall have the right to request an immediate renegotiation of the price. The Parties shall engage in good faith negotiations to reach a fair adjustment of the contractual price to reflect the increased costs.

If the Parties fail to reach an agreement within [X] days from the affected Party’s request for renegotiation, the latter shall have the right to terminate this Contract with [Y] days‚ written notice to other Party, without liability for damages, except for the fulfillment of obligations already accrued.“