-

Venezuela

The Venezuelan business environment

23 enero 2017

- Derecho Societario

Lebanon’s secure banking sector plays an important role in the country’s stability and economic status. High liquidity and compliance with all international regulatory standards make it one of the most profitable in the region.

Stability

The Lebanese banking sector owes its solidity primarily to the stringent policies applied by the Lebanese Central Bank (LCB). Efforts are constantly being made to fight money laundering and terrorism funding.

The Lebanese diaspora also contributes to the stability through the flux of transfers and deposits of extraterritorial income. Compared with an estimated population of 4.9 million inhabitants, about 16 million Lebanese live abroad, largely engaged in trade and finance, and mainly concentrated in South America.

The banking sector’s stability is also bolstered by the currency exchange rate, which has been stable since 1997, when the Lebanese Pound (LBP) was pegged to the United States Dollar (USD) at a rate of 1507.5 LBP to the USD.

Banking Secret and Automatic exchange of Information

The Lebanese Banking Secrecy Law of September 3, 1956 was a key aspect in the expansion of the sector. Bank secrecy is applied to any bank operating in Lebanon, local or foreign, and prohibits the disclosure of any details or information about any account or accountholder. For long time this law has increased confidence in Lebanese banking together with the amount of foreign capital coming into the country.

Before the last economic and financial global shocks, the veil of banking secrecy could be lifted only with prior approval of the accountholder, in case of bankruptcy; for the exchange of information between banks about indebted accounts; and in case of legal actions between a bank and a client or illicit enrichment.

Nowadays, banking secrecy does not apply to US citizens because of the Foreign Account Tax Compliance Act (FATCA) that requires foreign banks to report American accountholders to the tax authority of the US. Even though Lebanon has not agreed to be FATCA compliant as a whole, individual Lebanon banks have agreed to comply.

Moreover, in 2016 Lebanon joined the Global Forum on Transparency and the Automatic Exchange of Information (AEOI) for tax purposes, committing to implement a series of regulatory reforms to better comply with the Common Reporting Standards of OECD.

Consequently, if the requested information is protected under the Banking Secrecy Law of 1956, the request will be forwarded to the Special Investigation Commission (SIC) at the Central Bank with an opinion from the Ministry of Finance for review before it can be disclosed to the foreign tax authority based on an information exchange agreement.

The regulatory framework and supervision of the banking sector is already in compliance with international standards, such as Basel I, II, and III. Abiding by these laws does not eliminate banking secrecy. New regulations just aim to provide a more effective tool to counter the fight against tax evasion and to track suspicious operations for money laundering purposes, or self-laundering, based on tax offenses.

According to the AEOI, starting from September 2018 Lebanese Tax Authority will exchange information automatically on non-residents, and will have access to information on residents who hold assets abroad. No issues for Lebanese residents.

The new legislation will impact: banks, brokers, trusts, fiduciaries, insurance companies, although only for a few products, and certain collective investment funds.

Corporate Governance

As part of the strategy to integrate Lebanon further into the international community and the global economy, corporate governance in banks is necessary to guarantee fairness, transparency and accountability.

It is mandatory for banks while optional for other companies. In fact, an innovation took place in the banking sector on July 26, 2006 when the Governor of the Lebanese Central Bank enacted the Basic Decision No. 9382 to order to comply with the banking rules instituted by the Basel Committee.

Account freedom and flexibility

Lebanese banks are known for being open to foreign investors and have branches worldwide. Foreign individuals or companies can easily open a bank account in Lebanon in any currency and benefit from all banking advantages offered to Lebanese citizens. Further, amounts deposited in Lebanon are exempt from taxes and the interest received is subject to a tax rate of 5-percent.

The author of this post is Claudia Caluori.

The goal of this short article is to examine the annual business report, mandatory for all Swiss companies. The board of directors prepares the annual business report, which is composed of:

- The annual financial statements;

- The annual report, and;

- The consolidated financial statements if such statement are required by law.

The annual financial statements comprise the following three documents: profit and loss statement (or income statement), balance sheet, and annex.

The profit and loss statement must distinguish between operating and non-operating, as well as extraordinary, income and expenses. Income must be split separately between:

- Revenues from deliveries and services;

- Financial income, and;

- Profits from the disposition of capital assets.

Expense must at least show cost of goods sold, personnel expenses, financial expenses, as well as depreciation.

The balance sheet shall show the current assets and the capital assets, debts and equity. Current assets are divided into liquid assets, claims resulting from deliveries and services, other claims, as well as inventories. Capital assets are divided into financial assets, tangible and intangible assets. The outside funds are divided into debts resulting from deliveries and services, other short-term liabilities, long-term liabilities and provisions. Equity is divided into share capital, legal and other reserves, as well as a profit brought forward. Capital not paid in, the total amount of investments, the claims and liabilities against affiliates or against shareholders, accruals and deferrals, as well as losses carried forward are disclosed separately.

The Annex includes:

- The total amount of guarantees, indemnity liabilities and pledges in favour of third part;

- The total amount of assets pledged or assigned for the securing of own liabilities, as well as of assets with retention of title;

- The total amount of liabilities from leasing contracts not included in the balance sheet;

- The fire insurance value of assets;

- Liabilities to personnel welfare institutions;

- The amounts, interest rates and maturities of bonds issued by the company;

- Each participation essential for assessing the company’s financial situation;

- The total amount of dissolved hidden; reserves to the extent that such total amount that exceeds newly formed reserves of the same kind, and thereby show a considerably more favourable result;

- Information on the object and the amount of revaluations;

- Information on the acquisition, disposition, and number of own shares held by the company, including its shares held by another company in which it holds a majority participation; equally shown shall be the terms and conditions of such share transactions;

- The amount of the authorized capital increase and of the capital increase subject to a condition;

- Other information required by law.

The Annual report describes the development of the business, as well as the economic and the financial situation of the company. It reproduces the auditors’ report.

If the company, by majority vote or by another method joins one or more companies under a common control (group of companies), it is required to prepare consolidated financial statements. The company is exempted from consolidation if it, during two consecutive business years, together with the affiliates, does not exceed two of the following parameters:

- Balance sheet total: CHF. 10’000’000

- Revenues: CHF. 20’000’000

- Average annual number of employees: 200

However, consolidated statements shall be prepared if:

- the company has outstanding bond issues;

- the company’s shares are listed on a stock exchange;

- shareholders representing at least ten per cent of the share capital so request;

- this is necessary for assessing as reliably as possible the company’s financial condition and profitability.

Swiss valuation principles are conservative. Assets are valued at the lower of cost or market. A full provision for all known liabilities must be made. In addition, the Code gives discretionary powers to the board to value assets at amounts lower than maximum carrying values prescribed by law, or to create hidden reserves. The maximum asset values permissible are set out in articles 664 through 670 of the Code. These are as follows:

Costs of incorporation, capital increase, and organization resulting from the establishment, expansion or reorganization of the business may be included in the balance sheet. They must be shown separately and amortized within five years. Capital assets are to be valued at a maximum of the acquisition or manufacturing costs less the necessary depreciation. Participations and other financial investments are also part of the capital assets. Participations are permanent investments in the capital of subsidiary companies; usually they give a controlling influence in the management of the affiliate. Share blocks representing at least twenty per cent of the votes are classified as participations.

Raw materials, semi-finished and finished products, as well as merchandise, shall be valued at a maximum of the acquisition or manufacturing cost. If the cost is higher than market value on the date of the balance sheet, then market value is used.

Listed securities shall be valued at a maximum of their average stock exchange price during the month preceding the date of the balance sheet. Unquoted securities shall be valued at a maximum of the acquisition cost under deduction of any necessary value adjustments.

Depreciation, value adjustments and provisions should be made to the extent required by generally accepted accounting principles. Provisions are to be established in particular to cover contingent liabilities and potential losses from pending business transactions. The board may take additional depreciation, make value adjustments and provisions and refrain from dissolving provisions, which are no longer justified. Hidden reserves exceeding the above are permitted to the extent justified in the interest of the continuing prosperity of the company or to enable the regular distribution of dividends, taking into account the interests of the shareholders. The auditors must be notified in detail of the creation and the dissolution of replacement reserves and hidden reserves exceeding the above.

If half of the sum of the share capital and legal reserves is lost, real estate property or participations whose fair market value has risen above cost may, for the purpose of eliminating the deficit, be re-valued up to a maximum of such deficit. The revaluation amount shall be shown separately as a revaluation reserve. The revaluation is only permitted if the auditors confirm in writing to the general meeting of shareholders that the legal provisions have been respected.

Companies are required to allocate five per cent of the annual profit to the legal reserve until it has reached twenty per cent of be paid-in share capital. Also, after having reached the statutory amount, the following shall be allocated to this reserve:

- any surplus over par value upon the issue of new shares;

- after deduction of the issue costs, to the extent such surplus is not used for depreciation or welfare purposes;

- the excess of the amount which was paid in on cancelled shares over any reduction on the issue price of replacement shares ten per cent of the amounts which are distributed as a share of profits after payment of a dividend of five per cent.

To the extent it does not exceed half of the share capital, the legal reserve shall only be used to remove an accounting deficit, to preserve the existence of the business enterprise in bad times, to counteract unemployment, or to soften its consequences.

There are no filing requirements in Switzerland for annual financial statements except in the case of banks, finance and insurance companies.

Chinese outbound M&A was one of the main topics of interest at the 2017 Hong Kong IFLR Forum on M&A in Asia, a great event with an outstanding level of speakers and very interesting discussions on various themes related to international investments.

All the attendants shared the view that momentum for Chinese overseas investments is still strong, despite the recent policy aiming at curbing the outflow of capitals from China.

A particularly interesting session was that on “best practices to overcome credibility and experience gaps increasingly faced by “off the radar” Chinese bidders”.

Opening a one-to-one negotiation or letting a Chinese company bid at an auction involves often great deal of uncertainty, as most participants to the session shared the experience of having seeing their Chinese counterpart walk away from the negotiation without any explanation (the so-called “Random Investors”).

I have scribbled down the take-aways of the discussion as follows.

Main clues to spot early on the Random investor:

- the Company pops out from nowhere and has no track record of overseas investments;

- the Company has no legal or financial advisors, or if they do, their advisors are not experienced in overseas transactions;

- the Company has excellent advisors… but has not paid their fees (yes, that happens)

- the target does not belong to the Company’s core business (and there is no explanation for their interest for the deal);

What should you do to be on the safe side?

- request a written declaration of interest, expressing the reasons why the Company wants to invest in the target and what is their mid term strategy, signed and stamped by the legal representative (if they are not ready to hand over this letter the game can stop here).

- If the Company represents a group of investors, require full disclosure and letters of confirmation from all parties, from day one (AC Milan’s case is a good example of what happens later on if there is no disclosure of all players, and their stakes in the deal);

- request proof that the Company has filed the application for the authorisation to invest overseas (due to the recent tightening of controls on capital outflow, this step is fundamental);

- request proof that they have the finance needed for the deal (either onshore or, better, off-shore);

- make clear that you will require a «break fee» (which can vary from 5 to 10%) in case they walk away from the negotiation (we have heard of US companies expecting 30 to 50% break fee on the value of the deal…)

En el actual mundo globalizado, las pequeñas y grandes empresas (PYMEs) poseen una creciente necesidad de internacionalizar su actividad y de adentrarse en nuevos mercados. Ya sea mediante la obtención de capital, tecnología, know-how o la producción de los socios comerciales en el extranjero, o estableciendo canales de distribución o presencia comercial en mercados extranjeros, las PYMEs se deben enfrentar a grandes desafíos comerciales, legales y culturales.

Por ello, los abogados especializados en jurisdicciones extranjeras son fundamentales para poder planificar y gestionar todos los aspectos del comercio internacional: el riesgo de litigios, la responsabilidad del producto, los acuerdos con los distribuidores, agentes y otros socios comerciales, la planificación fiscal y el respeto a las normas y leyes de los diferentes mercados.

Legalmondo es una plataforma de abogados y asesores independientes de más de 40 países, especializados en las diversas temáticas que las PYMEs afrontan cuando operan a nivel internacional. Legalmondo se creó por un equipo de abogados, especializados cada uno en su área, que han trabajado juntos durante años.

Con la práctica, nos hemos percatado de que las PYMEs y sus asesores a menudo tienen dificultades a la hora de identificar de manera apropiada un apoyo jurídico en el extranjero, por ello, la misión de Legalmondo es la de ofrecer a las PYMEs una red de asesores expertos para otorgarles la posibilidad de gestionar de modo eficaz los desafíos comerciales, legales y culturales en el extranjero.

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

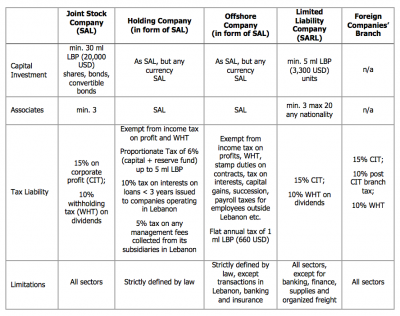

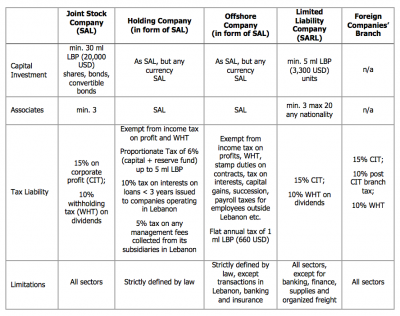

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

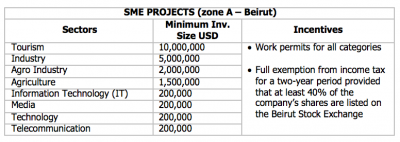

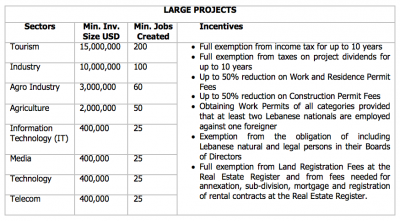

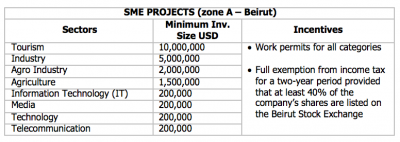

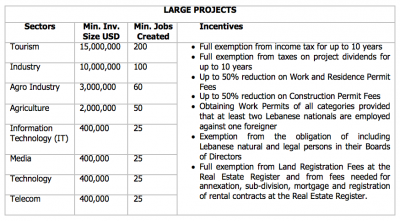

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.

The options available to foreign companies to set up business in Venezuela are (a) the registration of a branch; (b) the corporation; (c) the limited liability company; (d) the general partnership, (e) the limited partnership; (f) the stock limited partnership; and (g) the consortium. In this memorandum we use the term “company” to indistinctively refer to any of the options described in this paragraph, including the branch, the corporation or any of the partnership, but excluding the consortium.

The branch and the corporation are the two most common options used by foreign companies to do business in Venezuela. The corporate features of the companies are set forth in the Venezuelan code of commerce.

Corporation

The Venezuelan corporation is owned by shareholders and is a legal entity separate and distinct from its shareholders. The corporation is indistinctively known as compañía anónima (C.A.) or sociedad anónima (S.A.).

Limited Liability

The liability of the shareholders of a corporation is limited to the payment of the nominal value (and premium, if any) of the shares such shareholder owns. As a general rule, the shareholders of the corporation are not liable for the obligations of the corporation.

However, most Venezuelan commentators accept the piercing of the corporate veil by a Venezuelan court in the event of certain exceptional circumstances, such as: (a) when the corporate form −a legal and valid mean to conduct business− has been intentionally used against the purpose of the law to circumvent the application of a mandatory rule or to attain an otherwise illegal result (fraude a la ley or fraus legis); or (b) when there has been an abuse of the corporate form that has caused damages or an unfair consequence (abuso de derecho). Venezuelan courts have also accepted the application of the piercing of corporate veil when the separation of the legal entity from its shareholders would produce an unfair situation or when the corporate form is abused to avoid a legal consequence. In addition, the Constitutional Chamber of the Venezuelan Supreme Court issued a widely criticized opinion (Transporte Saet case) in which it applied the piercing of corporate veil doctrine without explaining or invoking an exceptional circumstance to do so. In the decision, the Supreme Court held that any company that is part of an economic group may be held liable for the obligations of any other party of the group. Note however, that this decision was related to a labor matter.

Foreign Direct Investments

The only areas currently reserved to companies owned or controlled by Venezuelan investors are open-air television, radio broadcasting, newspapers in Spanish and professional services regulated by law. There are other areas, such as oil, that are reserved to the Venezuelan government in which foreign investors may participate only through minority participations in joint venture companies with the Republic or Venezuelan state-owned companies.

Foreign investors (i.e., foreign companies (head offices), foreign shareholders or foreign partners) must register their direct foreign investments in a Venezuelan company (branch, corporation or partnership) with the Venezuelan foreign investment authority within 60 days following the date on which investment was made (the “foreign investment registration”).

Several documents must be submitted to the Venezuelan foreign investment authority by the foreign investor to obtain the foreign investment registration, including evidence that the capital of the company was paid with foreign currency or contribution in kind that entered Venezuela. To obtain such evidence, the foreign investor must (a) in case of payment in cash, order a wire transfer to the Venezuelan bank account of the company from an account of the foreign investor located outside Venezuela (as a result of the wire transfer, foreign currency transferred out of the offshore account of the investor will be converted into bolivars at the official exchange rate and deposited in bolivars in the Venezuelan bank account), and (b) in the case of contribution in kind, demonstrate that the asset being contributed to the capital of the company was imported into Venezuela (copies of the import manifest, commercial invoice and other custom documents).

The foreign investment registration must be updated annually by the foreign investor within 120 days of the end of the fiscal year.

Financing a company

The corporation must have a stated or subscribed capital (“stated capital”), which is the amount of capital that the shareholders of the corporation agree to subscribe.

Although there are no statutory minimum capital requirements applicable to the stated capital, each Venezuelan commercial registry sets forth a minimum stated capital requirement on a case-by-case basis or depending on the purpose of the corporation.

The stated capital of the corporation can be paid in cash or in kind. In case of payment in cash, at least 20% of the stated capital must be paid by the shareholders at the time of the registration of the shareholders’ meeting approving the incorporation of the corporation or the corresponding capital increase (the amount of stated capital already paid by the shareholders is known as “paid-in capital”). Payment in cash of the stated capital must be made by a deposit in bolivars in a bank account opened with a Venezuelan bank under the name of the corporation. In case of payment in kind, assets for a value equal to 100% of the stated capital must be contributed to the corporation. To be eligible for foreign investment registration, the stated capital must be paid out of foreign currency or assets brought into Venezuela from abroad.

The stated capital of the corporation is represented by shares. The shares can only be issued in registered form (bearer shares are not permitted). All shares must have a par value (valor nominal), and such par value must be denominated in bolivars. The stated capital of the corporation is equal to the sum of the nominal value of the shares.

The corporation can issue different classes of shares. Issuance of shares of different classes is convenient where different shareholders or groups of shareholders are each entitled to appoint a number of directors. Preferred shares can also be issued, granting their holders preferences in the payment of dividends, liquidation or otherwise.

The ownership of the shares of a corporation is evidenced by the notations made in the book of shareholders kept by the corporation. Shares can also be represented in certificates, but the issuance of share certificates is not required

The corporation must have at least two shareholders at the time of incorporation. However, immediately after incorporation, all the shares of the corporation may be transferred to one of the shareholders and thus the corporation may become a wholly-owned subsidiary of such shareholder.

The only areas currently reserved to companies owned or controlled by Venezuelan investors are open-air television, radio broadcasting, newspapers in Spanish and professional services regulated by law. There are other areas, such as oil, that are reserved to the Venezuelan government in which foreign investors may participate only through minority participations in joint venture companies with the Republic or Venezuelan state-owned companies.

As in most other jurisdictions, there are certain controls on money laundering which generally require banks and other professional bodies to identify clients and their sources of funding and to report suspicious transactions.

Opening a branch office

The registration of a branch (sucursal) in Venezuela by a foreign company does not result in a separate legal entity being formed in Venezuela. Therefore, the foreign company (head office) will be liable for all the obligations assumed by the branch.

The branch must be registered with a Venezuelan commercial registry located in the city of domicile of the branch, and such registration must then be published in a Venezuelan newspaper. The foreign company can choose the domicile of the branch.

The name generally used for the branch is the same name of the foreign company (head office) or its abbreviation followed by the expression Sucursal Venezuela (which means Venezuelan branch).

The branch must have at least one representative. The branch representative will have full powers to represent and manage the branch, except for the power to sell or transfer the business (unless such power is expressly granted to the representative). Any limitations to the powers of the representative are not effective against third parties. If the branch representative is not a Venezuelan citizen, he may have to obtain a working visa in order to sign documents on behalf of the branch before public notaries or registries in Venezuela.

The foreign company must assign a capital to the branch (capital asignado or “branch capital”). The branch capital does not constitute a limitation of the liability of the foreign company (head office), since the branch is not considered a legal entity separate from the foreign company. Although there are no statutory minimum capital requirements applicable to the branch capital, the Venezuelan commercial registry sets forth a minimum branch capital requirement on a case-by-case basis.

The branch capital must be paid by the foreign company (head office), either in cash or in kind. In case of payment in cash, an amount in bolivars equal to the branch capital must be deposited in a bank account opened with a Venezuelan bank under the name of the branch. In case of payment in kind, assets for a value equal to the branch capital must be contributed to the branch. To be eligible for foreign investment registration, the branch capital must be paid out of foreign currency or assets brought into Venezuela from abroad.

Unlike the corporation, the branch is not required to appoint statutory auditors or file annual balance sheets with the commercial registry. However, the branch is required to keep accounting books for tax purposes, i.e. the journal book, the ledger book, the inventory book and the VAT books.

The branch capital and any subsequent increases in the branch capital are subject to a registration tax equal to 1-2% of the branch capital, plus other registration fees and expenses, the tax depend on the commercial registry.

Filings with the Commercial Registry

All Venezuelan companies must be registered with a Commercial Registry. The Commercial Registry contains copies of the company’s articles of incorporation and by-laws, information on its standing (i.e. annual financial statements, liquidation or bankruptcy proceedings), registered address, directors and officers, the existence of branches, and other information. All information filed with the Commercial Registries is public. Companies must notify the Commercial Registry of changes to their articles of incorporation and by-laws and update other information filed with the registry. Companies must also file annual financial statements and periodically file minutes of shareholders appointing directors and officers.

Opening a bank account

Opening a Venezuelan bank account is required to incorporate a corporation or register a branch in Venezuela. The bank account shall be opened with a Venezuelan bank under the name of the corporation or the branch by one of its authorized representatives.

A non-resident (individual or corporation) can also open a bank account in Venezuela. The bank must only check the non-resident’s identity and capacity. In the case of a corporation, the requirements are: (i) the articles of incorporation duly apostilled or legalized by the Consulate of Venezuela in the respective country and translated in Spanish by interpreter public; (ii) the Fiscal Information Registry (RIF) issued by the Venezuelan fiscal authorities; (iii) the Identity Card for Venezuelan or foreign natural persons resident in the country, empowered to mobilize the account; and (iv) the minutes of shareholders meeting in which the authorization granted to the persons empowered to mobilize the account to act on behalf of the Company.

Additional information may be required by banks to better identify the corporation or the persons authorized to mobilize the account in accordance with anti-money laundering and other banking regulation.

Utilising office space

Office spaces may either be owned by the Company or rented. Multinational companies may often acquire offices or acquire land and construct their own offices, especially given the existing Venezuelan exchange controls, see section on Regulatory Compliance below.

Rental rates in Venezuela, and in particular in Caracas, are usually high, even when compared to international standards, Residential leases are strictly controlled under Venezuelan law; these controls do not apply to commercial leases.

Immigration controls

Foreign individuals intending to work in Venezuela are required to obtain a working visa or a business visa. Working visas grant their holders the right to a continued stay in Venezuela for an extendable one-year term, renewable for the same term, and authorize their holders to work in Venezuela as well as to enter into and depart from Venezuelan without restrictions. Business visas are granted to foreign citizens traveling to Venezuela to conduct business or to take part in commercial, technical, advisory, scientific, or cultural activities. Business visas are primarily designed for brief stays in the country and are valid for one year from the date of issue, renewable for the same term, entitling the holders to multiple entries during that term. However, under this type of visa the holder is limited to a maximum length of stay in the country of not more than six months. The process to obtain visas may be cumbersome.

The author of this post is Fulvio Italiani

There are three bodies in a Swiss corporation, namely: the general meeting of shareholders (the supreme body), the board of directors and the auditors.

Shareholder’s meeting

The general meeting of shareholders is the supreme authority of the company and is composed of all shareholders. There are two types of meetings:

- Ordinary general meeting. This is held annually within six months after the close of the business year;

- Extraordinary general meeting, which is called as often as considered necessary.

The general meeting of shareholders has the right to adopt and amend the articles, to appoint directors and auditors, to approve the financial statements and the directors’ report, to ratify certain decisions of the Board, and, in general, to make all important decisions which are not delegated to any other body. The shareholders must also approve the proposal of the Board relative to the distribution of annual profits. A general meeting is called by the board or, if it fails in its duties, by the auditors. One or more shareholders, representing together at least 10 % of the share capital, may at any time request the calling of an extraordinary shareholders’ meeting. This must be done in writing, indicating the purpose of the meeting. In general, a simple majority of votes represented at the general meeting is sufficient to pass a resolution and hold elections. However, certain decisions require a vote of two thirds of the votes represented and the absolute majority of the· par value of the shares represented (such as change of corporate purpose, extension of scope of business, distribution of shares with privileged voting rights etc.).

Shareholders cannot be deprived of their acquired rights without their consent. The term acquired rights includes the right to vote, to dividends, to a share of the liquidation proceeds and to receive sufficient information on the financial condition of the company. The Swiss Code distinguishes two kinds of shareholders rights: financial interests and personal membership rights.

Each shareholder has the right to a proportionate share of the profits distributed. Dividends may only be paid out of net profits or out of reserves specially created for this purpose. There is no interest payable on the ordinary share capital and a company may not declare interim dividends out of current year profits. Dividends can only be declared by the general meeting of shareholders and after attribution to the legal reserve. A share of the net profits may be paid to members of the board of directors if:

- the articles specifically provide for such payments,

- the allocations to the legal reserve fund have been made and,

- a dividend of at least five percent has been paid to the shareholders.

Unless otherwise stated in the articles or in the resolution for the increase in share capital, each shareholder has an option to subscribe to new shares in the same proportion that his original holding bears to the total shares issued.

Each shareholder is entitled to a proportionate share of the proceeds of liquidation unless the articles of incorporation provide otherwise. The proceeds are calculated in proportion to the amounts paid in on the share capital.

Most personal membership rights are acquired rights which means that even with the general meeting’s consent, the shareholder cannot be deprived thereof. These include the following:

- Shareholders exercise their rights at the general meeting of shareholders. Every shareholder may attend the meeting in person or be represented by his proxy. A holder of bearer shares is considered authorized to attend if he presents the share. On the other hand, registered shares can only be represented if a written proxy is produced.

- Voting rights.

- Shareholders are entitled to review the financial statements, which must be available for inspection at the address of the company not later than 20 day prior to the annual general meeting. Any shareholder may request a copy to be sent to him before the meeting.

Board of Directors

The company is managed by the board composed of one or more individual directors who must be shareholders. A majority of board members must be Swiss citizens residing in Switzerland. If the board consists of a single member, he or she must be a Swiss citizen residing in Switzerland. The directors are elected at the general meeting for a period fixed by the articles (maximum six years). The directors can however be re-elected indefinitely.

The articles may require that during their term of office they must deposit a certain number of shares at the corporation’s registered domicile. This is designed to protect the corporation against damages that directors may cause in the fulfilment of their duties. The board can delegate part of its authority to either an executive committee or to individual directors, to officers or to agents. At least one director must have power and authority to represent the company. The board designates the individuals authorized to represent the company vis-a-vis third parties and determines the details concerning the signatory powers. The company is unrestricted in the selection of its executive personnel, such as managers and officers, although managers and employees of foreign nationality require a permit to take up residence and employment in Switzerland.

The board is responsible for the preparation of the general meeting. It gives the necessary instructions to the management for the proper conduct of the company’s business and supervises those authorized to act on behalf of the company. It is the primary responsibility of the board, although generally delegated to management, to keep the accounting records and to prepare the annual financial statements. Furthermore, the board must submit a written annual report on the company’s financial position and the results of its activities to the general meeting of shareholders.

Auditors

The general meeting of shareholders elects one or more independent auditors who may be individuals or legal entities. Auditors must be professionally qualified to fulfil their duties. At least one auditor must have his domicile, registered office, or a registered branch in Switzerland. The auditors may not serve as directors nor be otherwise employed by the company, nor may they assume managerial functions for the company. Auditors may be elected for a maximum period of three years. Re-election is possible.

Auditors must have special professional qualifications if the audited entity:

- has outstanding bond issues;

- has shares listed on a Swiss stock exchange;

- exceeds two of the following parameters in two consecutive years:

- Balance sheet total: CHF 20’000’000

- Revenues: CHF 40’000’000

- Average number of employees: 200

The auditors must report on whether the accounting records and the financial statements, as well as the proposal concerning the appropriation of the available profit, comply with the law and the articles of incorporation. If the auditors, in the course of their examination, find violations either of law or of the articles, they report this in writing to the board of directors and, in important cases, to the general meeting of shareholders. In the event of obvious over-indebtedness, the auditors must notify the judge if the board fails to do so. Auditors are liable to the shareholders and creditors for damage caused by intentional or negligent failure to perform their duties. The auditors are required to attend the general meeting of shareholders.

The Bolivarian Republic of Venezuela (“Venezuela” or the “Republic”) is one of the largest Latin American economies, given its status as one of the world’s largest oil producers and exporters.

Over the last few years, however, the Venezuelan Government has nationalized a number of businesses in the telecom, power, oil, oil service, bank, and several other industries. The Government has also imposed price controls on many core goods and significant exchange control restrictions that limit the ability to purchase foreign currency.

Despite all these setbacks, Venezuela continues to be a country with significant business opportunities for foreign investors willing to assume risks.

The business environment

Venezuela has the fifth largest proven oil reserves in the world (and the largest in the Western Hemisphere), and the second largest proved natural gas reserves in the Western Hemisphere. If we include an estimated 235 billion barrels of extra heavy crude oil in the Orinoco Belt region, Venezuela holds the largest hydrocarbons reserves in the world. PDVSA, Venezuela’s oil and gas state-owned company, is one of the world’s largest oil companies: they have acknowledged that significant additional foreign investment would be required to achieve its production goals. The Government has signed joint venture agreements for the development of oil and gas projects with international partners from China, India, Italy, Japan, Russia, Spain, the United States of America, and Vietnam among others. All of this creates enormous business opportunities for companies in the oil and gas sector.

The Venezuelan market is also a significant source of profits for several multinational consumer-products makers operating in the country since Venezuelans spend a relatively high proportion of discretionary income on personal products and services, beverages and tobacco, apparel, communications (mobile and smartphones), TV and electronic products. In the next few years, imports are expected to increase much faster than exports with the expansion of consumer demand and the decreasing in the national production of consumer goods.

Venezuela has signed economic cooperation treaties with several countries, including Brazil, China and Russia, providing an adequate framework for investments in projects by companies from such countries.

Venezuela is also a party to international treaties to avoid double taxation with several countries that protect investors against certain changes in tax legislation and is a party to bilateral investment treaties with several European, Latin American and Asian countries, which provide for adequate compensation in case of expropriation or nationalization and access to international arbitration in a neutral forum. Despite Venezuela’s withdrawal from the International Centre for Settlement of Investment Disputes, several of the existing bilateral investment treaties permit arbitration under the UNCITRAL Arbitration Rules and the ICSID’s Additional Facility rules. In certain cases, the Venezuelan Government has reached agreements with foreign investors in businesses subject to nationalization and has paid compensation in U.S. dollars.

The Venezuelan government has engaged in infrastructure and other strategic projects with foreign investors under contracts providing for payments in foreign currency and, in certain cases, for international arbitration to settle potential disputes.

Venezuela is divided into three levels of government: the national level, the state level and the municipal level. There are 23 states, a capital district and various federal dependencies, and each state is divided into several municipalities. The political structure of Venezuela is governed by the Constitution of 1999, as amended in February 2009.

At the national level, the government is divided in the executive, legislative, judicial, civic and electoral branches. The President of Venezuela (the “President”) is the head of state, head of the national executive branch, and the commander-in-chief of Venezuela’s armed forces. All executive powers are vested in the President. The President is also entitled to veto laws passed by the National Assembly.

The national legislative power is vested in the Asamblea Nacional or National Assembly. The National Assembly has only one chamber, and its members (diputados) are elected by universal suffrage for terms of five years, and may be re-elected for unlimited five-year terms. The National Assembly is empowered to enact laws, which require the promulgation of the President and its publication in the Official Gazette to become effective. The work of the members of the National Assembly is done through several Commissions and Sub-Commissions.

The judicial branch is vested in the Venezuelan Supreme Tribunal (Tribunal Supremo de Justicia) and various lower tribunals. The Supreme Tribunal is the final court of appeals. It has the power to void laws, regulations and other acts or decisions of the executive or legislative branches that conflict with the Constitution or the laws. The current number of justices of the Supreme Tribunal is 32. Justices of the Supreme Tribunal are appointed by the National Assembly for twelve-year terms

The Supreme Court has five chambers, the Constitutional Chamber, the Social Cassation Chamber, the Civil Cassation Chamber, the Criminal Chamber, Electoral Chamber and the Political-Administrative Chamber. Each Chamber is composed of three justices, except for the Constitutional Chamber which is composed by five.

The Venezuelan court system is a national system; there are no state courts, but there are national courts sitting in each respective state. Judges are appointed by the Supreme Court. The jurisdictions of courts are divided by subject matter: civil, commercial, labor, tax, administrative, criminal and family, among others.

Venezuelan courts are generally biased in favor of the Venezuelan government (the Republic or Venezuelan state-owned companies); therefore, it would be very difficult to win a case against the Venezuelan government in a Venezuelan court. In addition, bringing judicial proceedings against the Venezuelan government may have adverse effects on the business of the claimant and on its ability to be awarded further projects or contracts from the government.

At the state level, the government is divided in the executive and legislative branches. The executive branch of a state is in charge of its governor (gobernador) elected by universal suffrage within each state. State legislative power is vested in state assemblies whose members are also elected by universal suffrage within each state. States have virtually no taxing power but they may create taxes on non-precious metals and minerals that are not reserved to the State.

At the municipal level, the government is divided in the executive and legislative branches. The executive branch of a municipality is in charge of its mayor (alcalde), elected by universal suffrage within each municipality. Municipal legislative power is vested in municipal assemblies (consejos municipales) whose members (concejales) are also elected by universal suffrage within each state. Municipalities are empowered to levy business tax on gross income and to approve construction projects in cities and other population centers.

The author of this post is Fulvio Italiani

Setting up a company in Switzerland: Incorporation and Shares

3 enero 2017

-

Suiza

- Derecho Societario

Lebanon’s secure banking sector plays an important role in the country’s stability and economic status. High liquidity and compliance with all international regulatory standards make it one of the most profitable in the region.

Stability

The Lebanese banking sector owes its solidity primarily to the stringent policies applied by the Lebanese Central Bank (LCB). Efforts are constantly being made to fight money laundering and terrorism funding.

The Lebanese diaspora also contributes to the stability through the flux of transfers and deposits of extraterritorial income. Compared with an estimated population of 4.9 million inhabitants, about 16 million Lebanese live abroad, largely engaged in trade and finance, and mainly concentrated in South America.

The banking sector’s stability is also bolstered by the currency exchange rate, which has been stable since 1997, when the Lebanese Pound (LBP) was pegged to the United States Dollar (USD) at a rate of 1507.5 LBP to the USD.

Banking Secret and Automatic exchange of Information

The Lebanese Banking Secrecy Law of September 3, 1956 was a key aspect in the expansion of the sector. Bank secrecy is applied to any bank operating in Lebanon, local or foreign, and prohibits the disclosure of any details or information about any account or accountholder. For long time this law has increased confidence in Lebanese banking together with the amount of foreign capital coming into the country.

Before the last economic and financial global shocks, the veil of banking secrecy could be lifted only with prior approval of the accountholder, in case of bankruptcy; for the exchange of information between banks about indebted accounts; and in case of legal actions between a bank and a client or illicit enrichment.

Nowadays, banking secrecy does not apply to US citizens because of the Foreign Account Tax Compliance Act (FATCA) that requires foreign banks to report American accountholders to the tax authority of the US. Even though Lebanon has not agreed to be FATCA compliant as a whole, individual Lebanon banks have agreed to comply.

Moreover, in 2016 Lebanon joined the Global Forum on Transparency and the Automatic Exchange of Information (AEOI) for tax purposes, committing to implement a series of regulatory reforms to better comply with the Common Reporting Standards of OECD.

Consequently, if the requested information is protected under the Banking Secrecy Law of 1956, the request will be forwarded to the Special Investigation Commission (SIC) at the Central Bank with an opinion from the Ministry of Finance for review before it can be disclosed to the foreign tax authority based on an information exchange agreement.

The regulatory framework and supervision of the banking sector is already in compliance with international standards, such as Basel I, II, and III. Abiding by these laws does not eliminate banking secrecy. New regulations just aim to provide a more effective tool to counter the fight against tax evasion and to track suspicious operations for money laundering purposes, or self-laundering, based on tax offenses.

According to the AEOI, starting from September 2018 Lebanese Tax Authority will exchange information automatically on non-residents, and will have access to information on residents who hold assets abroad. No issues for Lebanese residents.

The new legislation will impact: banks, brokers, trusts, fiduciaries, insurance companies, although only for a few products, and certain collective investment funds.

Corporate Governance

As part of the strategy to integrate Lebanon further into the international community and the global economy, corporate governance in banks is necessary to guarantee fairness, transparency and accountability.

It is mandatory for banks while optional for other companies. In fact, an innovation took place in the banking sector on July 26, 2006 when the Governor of the Lebanese Central Bank enacted the Basic Decision No. 9382 to order to comply with the banking rules instituted by the Basel Committee.

Account freedom and flexibility

Lebanese banks are known for being open to foreign investors and have branches worldwide. Foreign individuals or companies can easily open a bank account in Lebanon in any currency and benefit from all banking advantages offered to Lebanese citizens. Further, amounts deposited in Lebanon are exempt from taxes and the interest received is subject to a tax rate of 5-percent.

The author of this post is Claudia Caluori.

The goal of this short article is to examine the annual business report, mandatory for all Swiss companies. The board of directors prepares the annual business report, which is composed of:

- The annual financial statements;

- The annual report, and;

- The consolidated financial statements if such statement are required by law.

The annual financial statements comprise the following three documents: profit and loss statement (or income statement), balance sheet, and annex.

The profit and loss statement must distinguish between operating and non-operating, as well as extraordinary, income and expenses. Income must be split separately between:

- Revenues from deliveries and services;

- Financial income, and;

- Profits from the disposition of capital assets.

Expense must at least show cost of goods sold, personnel expenses, financial expenses, as well as depreciation.

The balance sheet shall show the current assets and the capital assets, debts and equity. Current assets are divided into liquid assets, claims resulting from deliveries and services, other claims, as well as inventories. Capital assets are divided into financial assets, tangible and intangible assets. The outside funds are divided into debts resulting from deliveries and services, other short-term liabilities, long-term liabilities and provisions. Equity is divided into share capital, legal and other reserves, as well as a profit brought forward. Capital not paid in, the total amount of investments, the claims and liabilities against affiliates or against shareholders, accruals and deferrals, as well as losses carried forward are disclosed separately.

The Annex includes:

- The total amount of guarantees, indemnity liabilities and pledges in favour of third part;

- The total amount of assets pledged or assigned for the securing of own liabilities, as well as of assets with retention of title;

- The total amount of liabilities from leasing contracts not included in the balance sheet;

- The fire insurance value of assets;

- Liabilities to personnel welfare institutions;

- The amounts, interest rates and maturities of bonds issued by the company;

- Each participation essential for assessing the company’s financial situation;

- The total amount of dissolved hidden; reserves to the extent that such total amount that exceeds newly formed reserves of the same kind, and thereby show a considerably more favourable result;

- Information on the object and the amount of revaluations;

- Information on the acquisition, disposition, and number of own shares held by the company, including its shares held by another company in which it holds a majority participation; equally shown shall be the terms and conditions of such share transactions;

- The amount of the authorized capital increase and of the capital increase subject to a condition;

- Other information required by law.

The Annual report describes the development of the business, as well as the economic and the financial situation of the company. It reproduces the auditors’ report.

If the company, by majority vote or by another method joins one or more companies under a common control (group of companies), it is required to prepare consolidated financial statements. The company is exempted from consolidation if it, during two consecutive business years, together with the affiliates, does not exceed two of the following parameters:

- Balance sheet total: CHF. 10’000’000

- Revenues: CHF. 20’000’000

- Average annual number of employees: 200

However, consolidated statements shall be prepared if:

- the company has outstanding bond issues;

- the company’s shares are listed on a stock exchange;

- shareholders representing at least ten per cent of the share capital so request;

- this is necessary for assessing as reliably as possible the company’s financial condition and profitability.

Swiss valuation principles are conservative. Assets are valued at the lower of cost or market. A full provision for all known liabilities must be made. In addition, the Code gives discretionary powers to the board to value assets at amounts lower than maximum carrying values prescribed by law, or to create hidden reserves. The maximum asset values permissible are set out in articles 664 through 670 of the Code. These are as follows:

Costs of incorporation, capital increase, and organization resulting from the establishment, expansion or reorganization of the business may be included in the balance sheet. They must be shown separately and amortized within five years. Capital assets are to be valued at a maximum of the acquisition or manufacturing costs less the necessary depreciation. Participations and other financial investments are also part of the capital assets. Participations are permanent investments in the capital of subsidiary companies; usually they give a controlling influence in the management of the affiliate. Share blocks representing at least twenty per cent of the votes are classified as participations.

Raw materials, semi-finished and finished products, as well as merchandise, shall be valued at a maximum of the acquisition or manufacturing cost. If the cost is higher than market value on the date of the balance sheet, then market value is used.

Listed securities shall be valued at a maximum of their average stock exchange price during the month preceding the date of the balance sheet. Unquoted securities shall be valued at a maximum of the acquisition cost under deduction of any necessary value adjustments.

Depreciation, value adjustments and provisions should be made to the extent required by generally accepted accounting principles. Provisions are to be established in particular to cover contingent liabilities and potential losses from pending business transactions. The board may take additional depreciation, make value adjustments and provisions and refrain from dissolving provisions, which are no longer justified. Hidden reserves exceeding the above are permitted to the extent justified in the interest of the continuing prosperity of the company or to enable the regular distribution of dividends, taking into account the interests of the shareholders. The auditors must be notified in detail of the creation and the dissolution of replacement reserves and hidden reserves exceeding the above.

If half of the sum of the share capital and legal reserves is lost, real estate property or participations whose fair market value has risen above cost may, for the purpose of eliminating the deficit, be re-valued up to a maximum of such deficit. The revaluation amount shall be shown separately as a revaluation reserve. The revaluation is only permitted if the auditors confirm in writing to the general meeting of shareholders that the legal provisions have been respected.

Companies are required to allocate five per cent of the annual profit to the legal reserve until it has reached twenty per cent of be paid-in share capital. Also, after having reached the statutory amount, the following shall be allocated to this reserve:

- any surplus over par value upon the issue of new shares;

- after deduction of the issue costs, to the extent such surplus is not used for depreciation or welfare purposes;

- the excess of the amount which was paid in on cancelled shares over any reduction on the issue price of replacement shares ten per cent of the amounts which are distributed as a share of profits after payment of a dividend of five per cent.

To the extent it does not exceed half of the share capital, the legal reserve shall only be used to remove an accounting deficit, to preserve the existence of the business enterprise in bad times, to counteract unemployment, or to soften its consequences.

There are no filing requirements in Switzerland for annual financial statements except in the case of banks, finance and insurance companies.

Chinese outbound M&A was one of the main topics of interest at the 2017 Hong Kong IFLR Forum on M&A in Asia, a great event with an outstanding level of speakers and very interesting discussions on various themes related to international investments.

All the attendants shared the view that momentum for Chinese overseas investments is still strong, despite the recent policy aiming at curbing the outflow of capitals from China.

A particularly interesting session was that on “best practices to overcome credibility and experience gaps increasingly faced by “off the radar” Chinese bidders”.

Opening a one-to-one negotiation or letting a Chinese company bid at an auction involves often great deal of uncertainty, as most participants to the session shared the experience of having seeing their Chinese counterpart walk away from the negotiation without any explanation (the so-called “Random Investors”).

I have scribbled down the take-aways of the discussion as follows.

Main clues to spot early on the Random investor:

- the Company pops out from nowhere and has no track record of overseas investments;

- the Company has no legal or financial advisors, or if they do, their advisors are not experienced in overseas transactions;

- the Company has excellent advisors… but has not paid their fees (yes, that happens)

- the target does not belong to the Company’s core business (and there is no explanation for their interest for the deal);

What should you do to be on the safe side?

- request a written declaration of interest, expressing the reasons why the Company wants to invest in the target and what is their mid term strategy, signed and stamped by the legal representative (if they are not ready to hand over this letter the game can stop here).

- If the Company represents a group of investors, require full disclosure and letters of confirmation from all parties, from day one (AC Milan’s case is a good example of what happens later on if there is no disclosure of all players, and their stakes in the deal);

- request proof that the Company has filed the application for the authorisation to invest overseas (due to the recent tightening of controls on capital outflow, this step is fundamental);

- request proof that they have the finance needed for the deal (either onshore or, better, off-shore);

- make clear that you will require a «break fee» (which can vary from 5 to 10%) in case they walk away from the negotiation (we have heard of US companies expecting 30 to 50% break fee on the value of the deal…)

En el actual mundo globalizado, las pequeñas y grandes empresas (PYMEs) poseen una creciente necesidad de internacionalizar su actividad y de adentrarse en nuevos mercados. Ya sea mediante la obtención de capital, tecnología, know-how o la producción de los socios comerciales en el extranjero, o estableciendo canales de distribución o presencia comercial en mercados extranjeros, las PYMEs se deben enfrentar a grandes desafíos comerciales, legales y culturales.

Por ello, los abogados especializados en jurisdicciones extranjeras son fundamentales para poder planificar y gestionar todos los aspectos del comercio internacional: el riesgo de litigios, la responsabilidad del producto, los acuerdos con los distribuidores, agentes y otros socios comerciales, la planificación fiscal y el respeto a las normas y leyes de los diferentes mercados.

Legalmondo es una plataforma de abogados y asesores independientes de más de 40 países, especializados en las diversas temáticas que las PYMEs afrontan cuando operan a nivel internacional. Legalmondo se creó por un equipo de abogados, especializados cada uno en su área, que han trabajado juntos durante años.

Con la práctica, nos hemos percatado de que las PYMEs y sus asesores a menudo tienen dificultades a la hora de identificar de manera apropiada un apoyo jurídico en el extranjero, por ello, la misión de Legalmondo es la de ofrecer a las PYMEs una red de asesores expertos para otorgarles la posibilidad de gestionar de modo eficaz los desafíos comerciales, legales y culturales en el extranjero.

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.

The options available to foreign companies to set up business in Venezuela are (a) the registration of a branch; (b) the corporation; (c) the limited liability company; (d) the general partnership, (e) the limited partnership; (f) the stock limited partnership; and (g) the consortium. In this memorandum we use the term “company” to indistinctively refer to any of the options described in this paragraph, including the branch, the corporation or any of the partnership, but excluding the consortium.

The branch and the corporation are the two most common options used by foreign companies to do business in Venezuela. The corporate features of the companies are set forth in the Venezuelan code of commerce.

Corporation

The Venezuelan corporation is owned by shareholders and is a legal entity separate and distinct from its shareholders. The corporation is indistinctively known as compañía anónima (C.A.) or sociedad anónima (S.A.).

Limited Liability

The liability of the shareholders of a corporation is limited to the payment of the nominal value (and premium, if any) of the shares such shareholder owns. As a general rule, the shareholders of the corporation are not liable for the obligations of the corporation.

However, most Venezuelan commentators accept the piercing of the corporate veil by a Venezuelan court in the event of certain exceptional circumstances, such as: (a) when the corporate form −a legal and valid mean to conduct business− has been intentionally used against the purpose of the law to circumvent the application of a mandatory rule or to attain an otherwise illegal result (fraude a la ley or fraus legis); or (b) when there has been an abuse of the corporate form that has caused damages or an unfair consequence (abuso de derecho). Venezuelan courts have also accepted the application of the piercing of corporate veil when the separation of the legal entity from its shareholders would produce an unfair situation or when the corporate form is abused to avoid a legal consequence. In addition, the Constitutional Chamber of the Venezuelan Supreme Court issued a widely criticized opinion (Transporte Saet case) in which it applied the piercing of corporate veil doctrine without explaining or invoking an exceptional circumstance to do so. In the decision, the Supreme Court held that any company that is part of an economic group may be held liable for the obligations of any other party of the group. Note however, that this decision was related to a labor matter.

Foreign Direct Investments

The only areas currently reserved to companies owned or controlled by Venezuelan investors are open-air television, radio broadcasting, newspapers in Spanish and professional services regulated by law. There are other areas, such as oil, that are reserved to the Venezuelan government in which foreign investors may participate only through minority participations in joint venture companies with the Republic or Venezuelan state-owned companies.

Foreign investors (i.e., foreign companies (head offices), foreign shareholders or foreign partners) must register their direct foreign investments in a Venezuelan company (branch, corporation or partnership) with the Venezuelan foreign investment authority within 60 days following the date on which investment was made (the “foreign investment registration”).

Several documents must be submitted to the Venezuelan foreign investment authority by the foreign investor to obtain the foreign investment registration, including evidence that the capital of the company was paid with foreign currency or contribution in kind that entered Venezuela. To obtain such evidence, the foreign investor must (a) in case of payment in cash, order a wire transfer to the Venezuelan bank account of the company from an account of the foreign investor located outside Venezuela (as a result of the wire transfer, foreign currency transferred out of the offshore account of the investor will be converted into bolivars at the official exchange rate and deposited in bolivars in the Venezuelan bank account), and (b) in the case of contribution in kind, demonstrate that the asset being contributed to the capital of the company was imported into Venezuela (copies of the import manifest, commercial invoice and other custom documents).

The foreign investment registration must be updated annually by the foreign investor within 120 days of the end of the fiscal year.

Financing a company

The corporation must have a stated or subscribed capital (“stated capital”), which is the amount of capital that the shareholders of the corporation agree to subscribe.

Although there are no statutory minimum capital requirements applicable to the stated capital, each Venezuelan commercial registry sets forth a minimum stated capital requirement on a case-by-case basis or depending on the purpose of the corporation.

The stated capital of the corporation can be paid in cash or in kind. In case of payment in cash, at least 20% of the stated capital must be paid by the shareholders at the time of the registration of the shareholders’ meeting approving the incorporation of the corporation or the corresponding capital increase (the amount of stated capital already paid by the shareholders is known as “paid-in capital”). Payment in cash of the stated capital must be made by a deposit in bolivars in a bank account opened with a Venezuelan bank under the name of the corporation. In case of payment in kind, assets for a value equal to 100% of the stated capital must be contributed to the corporation. To be eligible for foreign investment registration, the stated capital must be paid out of foreign currency or assets brought into Venezuela from abroad.

The stated capital of the corporation is represented by shares. The shares can only be issued in registered form (bearer shares are not permitted). All shares must have a par value (valor nominal), and such par value must be denominated in bolivars. The stated capital of the corporation is equal to the sum of the nominal value of the shares.

The corporation can issue different classes of shares. Issuance of shares of different classes is convenient where different shareholders or groups of shareholders are each entitled to appoint a number of directors. Preferred shares can also be issued, granting their holders preferences in the payment of dividends, liquidation or otherwise.

The ownership of the shares of a corporation is evidenced by the notations made in the book of shareholders kept by the corporation. Shares can also be represented in certificates, but the issuance of share certificates is not required

The corporation must have at least two shareholders at the time of incorporation. However, immediately after incorporation, all the shares of the corporation may be transferred to one of the shareholders and thus the corporation may become a wholly-owned subsidiary of such shareholder.