-

Rusia

Russia – New tax requirements for foreign IT companies

4 diciembre 2018

- Derecho Fiscal y Tributario

Climate change has become part of our everyday lives. This includes tax lawyers on the lookout of tax incentives for their clients. Below you will find an outline of green tax incentives for industrial or commercial buildings in Belgium. Indeed, such tax incentives may help you achieve your companies’ sustainability goals. Other green tax incentives exist in Belgium but the focus here is on industrial and commercial buildings.

Reduction of Machinery and equipment tax (MET)

Fixed assets, such as machinery & equipment in industrial or commercial companies are considered immovables (buildings), subject to property tax (the MET). In Belgium this is a regional tax. The Brussels Capital Region and the Walloon Region abolished the MET.

The Flemish Region adopted a different policy by reducing (possibly to nothing) the MET and by incentivizing companies to invest in new machinery and equipment or to replace older machinery and equipment.

How is this achieved?

- No indexation of the taxable base

- A (full) reduction of the portion of the Flemish treasury in the MET (the local authority where the company is situated receives the proceeds of the MET)

- Exemption for new investments or the replacement of machinery & equipment: the exemption depends on an energy policy agreement between the company and the Flemish government (on the basis of the Flemish Energy Code). The purpose is to reduce CO2-emissions and to enhance energy efficiency.

However, companies with a historical presence in the Flemish region (brownfield companies) felt that they had a competitive disadvantage compared to greenfield companies: their older machinery was taxed as before. It must be noted that some of these companies employ a lot of people.

The Flemish government therefore adopted legislation that for investments in machinery and equipment between 01/2014 and 12/2019 a reduction of the taxable base of older machinery and equipment is granted on the basis of the taxable base of the new (exempted) investments. It is not yet confirmed that this tax exemption will be prolonged or made permanent beyond 2019, however it is expected that the above tax policy in the Flemish Region will be continued, thus reducing (possibly to nothing) the MET.

120% cost deduction for investments in bicycle infrastructure for employees

Personal and corporate income tax is mainly a national matter in Belgium. A 120% cost deduction has been put in place for investments in bicycle infrastructure for employees, such as a bicycle parking and other infrastructure for cyclists (shower, …).

Exemption of taxable profits for investments in new fixed assets

Another (national) income tax incentive is the exemption of taxable profits (‘investeringsaftrek’ – ‘déduction pour investissement’) of 13,5% of the investments in new fixed assets in energy efficient technology.

A tax credit for investments in sustainable fixed assets

In corporate income tax (as I said before a national matter) there is a tax credit for research and development (’belastingkrediet’ – ‘crédit d’impôt’) calculated on the basis of the corporate income tax rate (currently 29,58%) for investments in sustainable fixed assets.

Please note that Belgian corporate income tax for SME’s is 20% on the first 100.000,00 EURO turnover (subject to conditions). For all companies the corporate income tax rate will decrease to 25% as from 2020.

Hopes are that both at the national level and at the respective regional levels new green tax incentives will be adopted in order to encourage sustainable investments in Belgium.

As of January 01, 2019, the VAT rate will be increased in Russia from 18% to 20%.

Additional changes recently introduced to the Russian tax legislation require that foreign companies that render IT services in Russia shall register with the tax authorities in Russia; file VAT tax returns and pay VAT in Russia.

As from January 01, 2019 such obligation will be imposed on all foreign companies that render IT services in Russia independent of the fact who is the buyer of such IT services – a natural person, an individual entrepreneur or a legal entity.

Earlier the obligation to pay VAT was imposed only on customers of IT companies in Russia. As a rule, in case of sale of goods, works, services where the territory of Russia is recognized as a place of supply, the obligation to calculate and pay VAT is generally imposed on buyers of such services (legal entities or individual entrepreneurs registered with the tax authorities in Russia) recognized in such cases as tax agents.

In accordance with new tax requirements the foreign companies that render IT services where the territory of Russia is recognized as a place of supply of such IT services shall calculate and pay VAT themselves unless such obligation is imposed on a tax agent.

As from January 01, 2019 the tax agents in such cases will be considered only intermediaries (legal entities or individual entrepreneurs registered with the tax authorities in Russia) engaged in settlements directly with buyers of IT services on the basis of mandate, agency or commission agreements or similar contracts concluded with foreign companies that render such IT services (if there are several intermediaries involved, the intermediary who is involved in settlement directly with buyers will be recognized as the tax agent independent of the existence of the contract concluded with foreign IT company that renders such IT services).

Thus, as from January 01, 2019 the buyers of IT services from foreign companies are no longer considered as tax agents and respectively no longer obliged to calculate and pay VAT for foreign IT companies. Such obligation will be imposed on foreign IT companies themselves with some exceptions specified above.

As a result, all foreign companies that render IT services in Russia shall be registered with tax authorities in Russia in order to fulfil its tax obligations, file VAT tax returns in electronic form and pay taxes respectively.

The buyers of IT services (legal entities or individual entrepreneurs registered with the tax authorities in Russia) will have the right to deduct VAT paid to foreign IT companies provided that such foreign IT companies are duly registered with the tax authorities in Russia.

The registration of foreign IT companies in Russia will require submission of application and a set of documents. Such application can be filed by the representative of such foreign company, by mail or in electronic form through official Internet page of Russian tax authorities.

As an example, Facebook has already announced officially that all its clients in Russia both natural persons and legal entities will pay VAT in the amount of 20% from January 01, 2019. This will be applied to all advertisement accounts where Russia is specified as a country of the company.

The Italian Budget Law for 2017 (Law No. 232 of 11 December 2016), with the specific purpose of attracting high net worth individuals to Italy, introduced the new article 24-bis in the Italian Income Tax Code (“ITC”) which regulates an elective tax regime for individuals who transfer their tax residence to Italy.

The special tax regime provides for the payment of an annual substitutive tax of EUR 100.000,00 and the exemption from:

- any foreign income (except specific capital gains);

- tax on foreign real estate properties (IVIE ) and tax on foreign financial assets (IVAFE);

- the obligation to report foreign assets in the tax return;

- inheritance and gift tax on foreign assets.

Eligibility

Persons entitled to opt for the special tax regime are individuals transferring their tax residence to Italy pursuant to the Italian law and who have not been resident in Italy for tax purposes for at least nine out of the ten years preceding the year in which the regime becomes effective.

According to art. 2 of the ITC, residents of Italy for income tax purposes are those persons who, for the greater part of the year, are registered within the Civil Registry of the Resident Population or have the residence or the domicile in Italy under the Italian Civil Code. About this, it is worth noting that persons who have moved to a black listed jurisdiction are considered to have their tax residence in Italy unless proof to the contrary is provided.

According to the Italian Civil Code, the residence is the place where a person has his/her habitual abode, whilst the domicile is the place where the person has the principal center of his businesses and interests.

Exemptions

The special tax regime exempts any foreign income from the Italian individual income tax (IRPEF).

In particular the exemption applies to:

- income from self-employment generated from activities carried out abroad;

- income from business activities carried out abroad through a permanent establishment;

- income from employment carried out abroad;

- income from a property owned abroad;

- interests from foreign bank accounts;

- capital gains from the sale of shares in foreign companies;

However, according to an anti-avoidance provision, the exemption does not apply to capital gains deriving from the sale of “substantial” participations that occur within the first five tax years of the validity of the special tax regime. “Substantial” participations are, in particular, those representing more than 2% of the voting rights or 5% of the capital of listed companies or 20% of the voting rights or 25% of the capital of non-listed companies.

Any Italian source income shall be subject to regular income taxation.

It must be underlined that, under the special tax regime no foreign tax credit will be granted for taxes paid abroad. However, the taxpayer is allowed to exclude income arising in one or more foreign jurisdictions from the application of the special regime. This income will then be subject to the ordinary tax rule and the foreign tax credit will be granted.

The special tax regime exempts the taxpayer also from the obligation to report foreign assets in the annual tax return and from the payment of the IVIE and the IVAFE.

Finally, the special tax regime provides for the exemption from the inheritance and gift tax with regard to transfers by inheritance or donations made during the period of validity of the regime. The exemption is limited to assets and rights existing in the Italian territory at the time of the donation or the inheritance.

Substitutive Tax and Family Members

The taxpayer must pay an annual substitutive tax of EUR 100,000 regardless of the amount of foreign income realised.

The special tax regime can be extended to family members by paying an additional EUR 25,000 substitutive tax for each person included in the regime, provided that the same conditions, applicable to the qualifying taxpayer, are met.

In particular, the extension is applicable to

- spouses;

- children and, in their absence, the direct relative in the descending line;

- parents and, in their absence, the direct relative in the ascending line;

- adopters;

- sons–in-law and daughters-in-law;

- fathers-in-law and mothers-in-law;

- brothers and sisters.

How to apply

The option shall be made either in the tax return regarding the year in which the taxpayer becomes resident in Italy, or in the tax return of the following year.

Qualifying taxpayer may also submit a non-binding ruling request to the Italian Revenue Agency, in order to prove that all requirements to access the special regime are met. The ruling can be filed before the transfer of the tax residence to Italy.

The Revenue Agency shall respond within 120 days as from the receipt of the request. The reply is not binding for the taxpayer, but it is binding for the Revenue Agency.

If no ruling request is filed, the same information provided in the request must be provided together with the tax return where the election is made.

Termination

The option for the special tax regime is automatically renewed each year and it ends, in any case, after fifteen years from the first tax year of validity. However, the option can be revoked by the taxpayer at any time.

In case of termination or revocation, family members included in the election are also automatically excluded from the regime.

After the ordinary termination or revocation, it is no longer possible to apply for the special tax regime.

The author of this post is Valerio Cirimbilla.

Like in other jurisdictions, in Cyprus the term ‘joint venture’ connotes business arrangements that involve the pooling of resources, knowledge and experiences of the participants for the purposes of accomplishing or implementing a specific task, whether this is a particular project or business activity. There is no specific statute governing joint ventures yet in practice such arrangements take one of the following structures.

-

Corporate Joint Venture

The cooperation materialises through the setting up of a legal entity separate from its participants with constitutional documents governing its operation and the relations between the participants and the entity in addition to the statutory provisions of the Cyprus Company Law, Cap 113. A shareholders’ agreement is typically executed operating in parallel. It is possible that further agreements such as licences for use of intellectual property etc. will be signed. This vehicle might be more appropriate where it is expected that the joint venture will need to enter into contractual arrangements with third parties due to the limited liability benefits. The termination is usually addressed in a shareholders’ agreement which specifies events of termination e.g. change of control, insolvency of a participant, attainment of objective etc. as well as the relevant processes e.g. sale of shares among participants, liquidation etc.

Taxation of income occurs at the level of the company. Participants are not taxed on dividends in Cyprus if they are not tax residents or if they are companies. If the company is to be taxed in Cyprus, the management and control will need to be exercised in Cyprus. Any assets, including intellectual property created by the company, become property of the new entity. The setting up of the company might be subject to notification to the competent competition authority under merger control rules. Corporate joint ventures are commonly used by international clients aiming to benefit from the network of double tax treaties maintained by Cyprus. They are also a vehicle often employed to enter the Cyprus market with the assistance of a local participant.

Advantages:

- Limited liability; liability of participants limited to capital.

- Participants control the company through the power of appointment of the board of directors.

- The company is governed by the Cyprus Companies Law, Cap. 113, a statute based on English company law rules, which gives more legal certainty and familiarity for participants as well as the counterparties. The relationship is not purely contractual.

- Tax optimisation possibilities given the low rate of corporate taxation applicable in Cyprus (at the rate of 12.5%). The numerous double tax treaties maintained by Cyprus may be exploited.

Disadvantages:

- Less flexibility compared to the other structures due to the applicable legal framework both in terms of operation and compliance.

- Governance and control questions might need to be addressed e.g. to deal with deadlocks.

- Restrictions and or conditions for the transfer of shares are typically adopted.

- Both the corporate profit and the dividends returned to participants might, under certain circumstances, be subject to taxation e.g. where participants are natural persons residing in Cyprus.

-

Partnership Joint Venture

The relationship is governed by the relevant statute which specifies the liability of each partner depending on whether the partnership would be a general or limited partnership. In the first case, each partner has unlimited liability with the other partners for all debts and liabilities of the partnership. In the second case, only the general partner has unlimited liability; limited partners are only liable for the capital they agreed to invest but should not participate in the running of the business. The relevant statute imposes default and overriding rules governing the arrangement e.g. in relation to the termination or profit sharing. The termination of the partnership will typically be governed by the partnership agreement, but the statute also provides for specified circumstances which would apply unless the parties agree otherwise. Business assets and intellectual property contributed by each party become the property of the partnership (except if agreed otherwise) and should be exploited in accordance with the partnership agreement for the purposes of the partnership.

Partnerships are tax transparent, accordingly, taxation occurs at the level of the participants and profits and losses accrue to them. Partnerships might be subject to competition law rules prohibiting the restriction of competition. Further, the creation of a partnership might be subject to notification to the competent competition authority under merger control rules. Partnership joint ventures are regularly used for economic activities of professionals. They have also been used as a vehicle in the context of tenders (public or other).

Advantages:

- Relatively fewer formalities apply than in the case of corporate joint ventures.

- Registration requirements exist but no requirement for disclosure of the actual partnership agreement i.e. the constitutional document.

- Although the partnership has no legal personality, it may sue and be sued in its own name and may trade under its name.

- Apportionment of profits and losses on the basis of discretion.

- Attribution of profits to the partners; not to the partnership.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned. Wide options may be available due to the extensive network of double tax treaties maintained by Cyprus.

Disadvantages:

- Significant powers to unlimited partners. Given the powers of partners to bind the partnership, decision-making process needs to be addressed carefully.

- Liability comes with involvement in the management/control. Unlimited liability of general partners towards third parties. Solutions alleviating the effect of this may be possible.

- Tax transparency may not be beneficial where the partners are natural persons as they might be taxed at higher rates. Yet with appropriate structuring this may be avoided.

-

Contractual joint ventures

The basis of the cooperation of the participants is solely a contractual agreement between them. It is expected that such agreement will include detailed provisions regulating the rights and liabilities of the parties towards each other, the distinct role and input of each, their contributions, their share in the income generated etc. No separate legal personality is created. Business assets and intellectual property remain the property of the participant who contributed or developed them (unless of course the parties agree otherwise).

Profits and losses accrue to the participants and taxation is also incurred at the level of the participants. Such arrangements might be subject to competition law rules prohibiting the restriction of competition. Contractual joint ventures are commonly used in the context of tenders (public or other).

Advantages:

- Governed solely by contact law thus greater flexibility as to the operation and termination. Contract law in Cyprus is based on common law principles.

- No registration requirements.

- Minimal formalities compared to the other possible structures.

- No joint liability; liability towards third parties limited to own acts or omissions of each participant.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned.

Disadvantages:

- Lack of legal personality might cause difficulties in establishing commercial or contractual relationships with third parties.

- Need for detailed regulation of all aspects of the cooperation in the agreement due to the lack of legal framework for the relationship; careful and skilful planning is required.

- Depending on the facts and provisions adopted, risk of classification of the relationship as a partnership by a court with the consequence of joint liability.

-

European Economic Interest Grouping (EEIG)

A vehicle established and governed predominantly by European law (Council Regulation 2137/85) instead of national law. Specific purposes for EEIGs apply i.e. to facilitate or develop the economic activities of the members to enable them to improve their own results. In that context the activities of EEIGs must be related to the economic activities of the members but not replace them. The purpose is not to make profits for the EEIG itself. EEIGs are governed by a contract between their members and Council Regulation 2137/85. They have capacity, in their own name, to have rights and obligations of all kinds, to contract or accomplish other legal acts as well as to sue or be sued. There is unlimited joint liability of the participants for the debts and liabilities of the EEIG but the exclusion or restriction of liability of one or more members for a particular debt or liability is possible if it is specifically agreed between the third party and the EEIG. EEIGs enjoy tax transparency. Profits or losses are taxable at the hands of the participants.

Advantages:

- Established under European law; EEGIs might be ideal for alliances of firms in different member states of the European Union for joint promotion of activities.

- Relatively fewer formalities apply than in the case of corporate joint ventures though there are registration requirements.

- Tax transparency.

Disadvantages:

- Managers bind EEIGs as regards third parties, even if their acts do not fall within the objects (unless the third party had knowledge).

- Unlimited liability of participants.

- More limited scope for use due to the statutory purposes dictated.

Which option is the most appropriate and or efficient in terms of structuring in a particular case depends on the facts at hand and the actual needs of the participants. The different factors need to be carefully examined with the help of experts so that the most suitable solution is adopted.

Pursuant to the European Directive on administrative cooperation in the field of taxation (2011/16/EU), Member States must cooperate with each other with a view to exchanging information relevant for tax purposes. The directive allows, inter alia, that a Member State (the requesting Member State) requests another Member State (the requested Member State) to provide information concerning a specific taxpayer. The requested information must be ‘ foreseeably relevant ‘ to the tax authorities of the requesting Member State.

Based on the aforementioned directive, the tax authority of the requested Member State may request information from e.g. an affiliated company, a financial institution, an employer, … of the taxpayer. The tax authority of the requested Member State forwards the collected information to its counterpart in the requesting Member State.

A question that arises is whether that affiliated company, financial institution, employer, … may ask its national courts to verify the legality of the sanction imposed by its tax authority because of an incomplete answer and whether it may ask to vary the penalty. Another question is whether a court in the requested Member State may verify the relevance for tax purposes of the requested information.

These questions were raised in the Berlioz case of the Court of Justice (judgement of 16 May 2017): Berlioz (a Luxembourg company) only partially answered the request for information from the Luxembourg authorities (at the request of France). Berlioz stated in this regard that certain questions were irrelevant for tax purposes in the requesting Member State.

The answers to the questions raised are not obvious, as the starting point is that the requesting State has a margin of discretion as to what is foreseeably relevant for its tax purposes. This explains why (in this case the Luxembourg) courts doubted whether a relevance test was possible. The questions were referred for a preliminary ruling to the Court of Justice.

In its assessment, the court took into consideration the EU Charter of Fundamental Rights and, more specifically, the right to a fair hearing by an impartial judge.

The Court of Justice ruled that courts in the requested Member State may review the foreseeable relevance for tax purposes of the requested information and that they may vary the penalty imposed. The courts in the requested Member State should be reluctant however upon review of the legality of the request for information: the review is limited to verification whether the requested information manifestly has no relevance for tax purposes.

To this end, the courts must have access to the request for information. The affiliated company, financial institution, employer, … is only entitled to receive the identity of the person under investigation and to be informed about the tax purpose for which the information is sought. The Court of Justice indeed emphasizes in the interest of the investigation the principle that the request for information must remain secret.

Relevance of the judgment: When requested by a national tax authority to respond to a request for information from another Member State, it is important to check the relevance for tax purposes of the requested information. If the information requested is irrelevant to the tax investigation, a proceeding against the request for information or against the penalty may succeed. Regarding the foreseeable relevance for tax purposes, the national courts may only review whether the requested information manifestly has no relevance to the tax investigation in the requesting Member State.

Individuals coming to Portugal and here becoming residents for the first time, can be entitled to some important tax benefits under the “non habitual resident rules”. These rules are an important contribution for making Portugal one of the most attractive destinations for retired individuals, but also for entrepreneurs.

Who can benefit?

A non habitual resident is an individual becoming resident for tax purposes in Portugal for the first time in the last five years period. To become resident for tax purposes, one should be in Portugal for more than 183 days in any 12 months period or for a shorter period but in such conditions that the intention of becoming resident is sufficiently clear. After becoming resident for tax purposes and register as such before the Tax Authorities, the individual must register as a non habitual resident to be able to benefit from this regime.

High Value Added Activities.

Some of the benefits under the non habitual resident rules are only applicable to income arising from high value added activities. These activities include architects, engineers, artists, auditors and tax consultants, medical professions, university teachers, top managers and other liberal professionals in areas such as informatics (software and hardware) development and consultancy, science investigation and design.

For how long?

The benefits arising from the non habitual resident status are valid for a ten year period and depend on the individual remaining as resident in Portugal for tax purposes. If, for any reason, the individual ceases to be resident, he can later benefit from the remaining period by becoming resident again.

What are the benefits?

Individuals becoming non habitual resident benefit from a more favorable tax treatment regarding both income from Portuguese source and income from foreign sources.

As to the income from Portuguese source arising from employment and self-employment, it is subject to a special tax of 20%. This benefit is only applicable to non habitual residents earning income from high value added activities.

As to the income from foreign sources arising from employment and pensions, it is exempted from taxes in Portugal, in most cases. This exemption also includes income arising from self-employment in high value added activities, and from intellectual and industrial property, capital and real estate gains.

Con la Legge di Bilancio 2017 (Ley de Presupuestos), vigente desde el 1 de enero de 2017, el Parlamento italiano ha implantado una nueva estrategia para fomentar la economía italiana mediante la adopción de una amplia gama de medidas, tanto financieras como fiscales, con la intención de apoyar a las start-ups y a las pequeñas y mediadas empresas y con el fin de hacerlas más atractivas para los inversores extranjeros.

La Ley de Presupuestos ha diseñado un plan integral que incluye ciertas exenciones fiscales, la posibilidad de que las PYMEs recauden fondos a través de plataformas de crowdfunding o micromecenazgo y para las llamadas start-ups «innovadoras» (es decir, aquellas empresas que se encuentran en fase inicial y que cumplen con ciertos criterios establecidos por la ley: p. ej. tecnología de alto nivel, gasto en I + D o un número de empleados graduados, etc.), para transferir sus pérdidas fiscales a sociedades cotizadas. En general, estas herramientas apuntan principalmente a desbloquear el sistema económico, que hasta ahora no ha demostrado ser lo suficientemente eficaz como para proporcionar a las start-ups y a las PYMEs los recursos financieros y beneficios fiscales suficientes que necesitan para desarrollar activos innovadores y ampliar su negocio.

Este conjunto de medidas puede dividirse en cuatro grupos, en función de los propósitos:

- Fomentar el espíritu empresarial y crear empresas innovadoras.

- Estimular las inversiones privadas dirigidas a las start-ups innovadoras y a las PYMEs.

- Apoyar los gastos de I + D.

- Modernizar los activos de las empresas existentes mediante su digitalización y automatización, junto con el desarrollo de tecnologías innovadoras.

Ayuda económica para la creación de nuevas empresas

La estrategia establecida por el Parlamento involucra al Ministerio de Desarrollo Económico (Mise), al Instituto Nacional de Seguros contra los Accidentes Laborales (Inail) y a otros organismos públicos, como Invitalia, con el objetivo de impulsar la constitución de start-ups y desarrollar las PYMEs innovadoras.

De hecho, la dotación del Fondo para el Crecimiento Sostenible (FCS- Fondo per la Crescita Sostenibile), cuyo objetivo es proporcionar préstamos ventajosos para apoyar la constitución de start-up innovadoras, ha sido aumentado en un 47,5 millones de euros para 2017 y 2018, respectivamente.

Además, la Ley de Presupuestos también ha asignado la misma cantidad de 47,5 millones de euros para 2017 y 2018 con el fin de fomentar el autoempleo y el espíritu empresarial. Estos fondos serán administrados por Invitalia, agencia gubernamental para el fomento de la inversión interna y el desarrollo empresarial, y serán empleados principalmente para impulsar la incorporación de mujeres y jóvenes emprendedores (de 18 a 35 años) a empresas. Invitalia podrá conceder préstamos a interés cero, subvencionados por un máximo de ocho años, lo que podría cubrir hasta el 75% del gasto total, tal como se presupuestó para inversiones específicas. En ese caso, las empresas tendrán que financiar el importe restante según lo asignado en el plan de negocios y llevar a cabo la inversión prevista dentro de los 24 meses siguientes a la concesión del contrato de préstamo.

El Ministerio de Desarrollo Económico (Mise) también ha aprobado un conjunto de medidas que otorgan subsidios para apoyar los programas de desarrollo llevados a cabo por las start-ups que adquieran nuevas maquinarias y equipos tecnológicos; tecnologías de hardware y software; patentes y licencias tecnológicas no patentadas directamente relacionadas con las necesidades de producción y gestión.

La Ley de Presupuesto -a la espera de aprobación por parte de los Ministerios competentes- también ha introducido la posibilidad de que el Inail pueda invertir en fondos de inversión cerrados dedicados a las start-ups innovadoras, o que directamente pueda establecer y participar en proyectos empresariales tecnológicos.

Reducción de la burocracia

La no necesidad de acudir ante un notario o la exención del impuesto de timbre y otros gastos administrativos, son algunas de las medidas tomadas para simplificar el procedimiento de constitución de una nueva sociedad. Además, será posible redactar los estatutos de la sociedad y sus modificaciones posteriores a través de un procedimiento online mediante el reconocimiento de la firma electrónica.

Incentivos fiscales para las inversiones en start-ups innovadoras y en las PYMEs

A la espera de la aprobación final de la Comisión Europea, la Ley de Presupuestos ha introducido nuevos incentivos para aquellos sujetos que inviertan en start-ups. Los incentivos fiscales relacionados con este tipo de inversiones no son algo nuevo. Fueron introducidos en el año 2012 y originariamente concebidos como temporales, con la Ley de Presupuestos estas medidas no solo se han convertido en incentivos permanentes, sino que además se han incrementado desde un 19% y un 20% para personas físicas y personas jurídicas, respectivamente, a un 30% sin distinguir el tipo de inversor (potencial accionista) para invertir un máximo de 1 millón de euros para personas físicas y de 1,8 millones de euros para personas jurídicas.

Desde la implantación de los incentivos fiscales, se han fomentado las inversiones en start-ups, tales beneficios se han equilibrado por el hecho de que la inversión se mantiene durante tres años (en lugar de dos años, según lo previsto en la Ley de Presupuestos anterior). Por otra parte, la Ley de Presupuestos ha extendido dichos beneficios también a las PYMEs innovadoras, esto es, a todas las pequeñas y medianas empresas que operan en el campo de la innovación tecnológica, con independencia de la fecha de constitución de las mismas, para ello basta con que las empresas presenten un plan estratégico que incorpore los programas innovadores activos.

Una alianza entre Start-ups y sociedades cotizadas y que puedan beneficiarse ambas partes

En el preámbulo de la Ley de Presupuestos, el Gobierno ha hecho hincapié en la importancia de involucrar a las sociedades cotizadas en la financiación directa o indirecta de los proyectos de las Start-ups y, por ello, ha introducido la posibilidad para que las Start-ups puedan transferir sus pérdidas fiscales acumuladas en los primeros tres años fiscales a una sociedad cotizada, siempre que se cumplan algunos requisitos.

La transferencia se lleva a cabo atendiendo las normas para la transferencia de créditos de impuestos corporativos; el cesionario será llamado a compensar el beneficio recibido del cedente y la remuneración pagada en un inicio no estará sujeta a impuestos. A través de este mecanismo, ambas empresas se beneficiarían: la Start-up encontraría un «patrocinador» financiero y la sociedad cotizada podría compensar sus ingresos gravables con las pérdidas fiscales recibidas, considerando la posibilidad de mantener la parte excedente para el año siguiente.

Crowdfunding o micromecenazgo

A través de una matización de la Ley de Finanzas italiana (Testo Unico Finanza), la Ley de Presupuestos se deshizo de algunas restricciones que impedían que el mercado del crowdfunding despegase en Italia e introdujo la posibilidad de que cualquier tipo de PYME pudiera acceder a la financiación equitativa. La Ley anterior, limitaba la posibilidad de recaudar fondos a través de este sistema solo a las Start-ups innovativas, lo que limitaba el desarrollo de las PYMEs y de la industria del crowdfunding.

Si bien las reglas que regulan la equidad del crowdfunding serán las mismas desde el lado de los operadores (es decir, las plataformas de crowdfunding), las pequeñas y medianas empresas tendrán ahora un nuevo medio para recabar capital, aparte de los canales tradicionales como la financiación bancaria y la cotización bursátil.

Incentivo fiscal en gastos de I+D

El incentivo fiscal relacionado con los gastos de Investigación y Desarrollo, introducido en 2013, se ha prorrogado hasta diciembre de 2020 y ha sido mejorado al pasar de un 25% a un 50% en todos los gastos subvencionables en actividades de I + D, con un máximo anual de 20 millones de euros (cinco veces superior al límite máximo anteriormente establecido).

Las empresas podrán reducir su factura de impuestos y podrán reclamar la compensación proporcionalmente a sus gastos de I + D. La disposición se aplica a todos los gastos de I + D, incluyendo la contratación de personal dedicado a actividades de I + D (sin requisitos particulares en cuanto a su cualificación) y a cualquier tipo de empresa (residente y no residente), grupo o red de empresas, de la dimensión de la empresa, de sus estatutos jurídicos y del sector de referencia.

Dicho incentivo fiscal puede combinarse con otro aplicable a cualquier empleado que se beneficie de los incentivos fiscales previstos en los planes de trabajo para la equidad por parte de las Start-ups innovadoras. Esto significa que, en el caso de que el personal que realiza las actividades de I + D se beneficie de algún incentivo fiscal por un plan de equidad, la empresa en cuestión se beneficiará de ambas exenciones fiscales al mismo tiempo.

Contratos de desarrollo para grandes proyectos de inversión

Los contratos de desarrollo (Contratti di sviluppo) son acuerdos tomados entre el Ministerio de Desarrollo Económico (Mise), Invitalia y una o varias empresas (estas últimas mediante contratos de red) que participan en proyectos de desarrollo.

Dichos contratos, fueron creados por primera vez en 2011 y se diseñaron para apoyar grandes inversiones industriales/productivas con un tamaño de al menos 20 millones de euros (7,5 millones solo para la industria agroalimentaria).

Los contratos de desarrollo son financiados por el Mise, con la participación de las Regiones involucradas (que también podrán participar en la inversión). Invitalia actúa como referente para las empresas promotoras y también se encarga de gestionar los recursos y de evaluar las aplicaciones.

Estos “contratos” se dirigen a empresas italianas y empresas italianas afincadas en el extranjero y proporcionan beneficios financieros como por ejemplo: subvenciones en bloque sobre instalaciones y equipos, préstamos blandos y bonificaciones de intereses, cuya dimensión puede variar en función del tamaño de la empresa y del tipo de proyecto (gastos de I + D, inversiones orientadas a la innovación).

Invitalia establece unos plazos breves tanto para el procedimiento de admisión como para el plan de desarrollo posterior: una vez aprobado el proyecto, las empresas dispondrán de 90 días para presentar todos los documentos requeridos; posteriormente tendrán 6 meses para comenzar y otros 36 meses para llevar a cabo el proyecto de inversión.

Como muestra de la voluntad del país, el programa también prevé cursos breves especiales para proyectos de inversión productivos y de digitalización.

Super-depreciación e Híper-depreciación

En lo que respecta a las empresas ampliamente consideradas, la Ley de Presupuestos también extiende la deducción de depreciación adicional del 40% (que constituye una depreciación fiscal total del 140%) hasta 2017. Después, las empresas podrán deducir los gastos soportados para comprar activos tangibles cuya tasa de depreciación supere el 6,5%. El incentivo sólo se aplicará a los activos cuya orden de compra hayan sido aceptadas por el proveedor y pagadas al menos en un 20% a 31 de diciembre de 2017. Además, la Ley ha introducido una nueva deducción de depreciación adicional del 150% (denominada la «híper-depreciación» que combinada con la existente sería una deducción total de la depreciación del 250%) para la compra (o arrendamiento) de nuevos activos tecnológicos, tales como maquinarias controladas digitalmente, equipos y otros (la ley describe toda la gama de activos), adquiridos con el fin de atomizar y digitalizar las empresas.

Sabatini-ter

La Ley de Presupuestos también ha reintroducido la denominada «Sabatini», una legislación especial destinada a facilitar la compra (o arrendamiento) de bienes de capital por pequeñas y medianas empresas, cubriendo una parte de los intereses de los préstamos bancarios de entre 20.000 euros y 2 millones de euros, la cual ha sido prorrogada hasta el 31 de diciembre de 2018. Una medida específica y más generosa se aplicará a la compra de nuevos activos relacionados con el plan de industria 4.0. Parte de los recursos asignados se destinarán a apoyar la innovación, la eficiencia y la creación de un sistema industrial «digital» que invierta en nuevos equipos tecnológicos como nubes informáticas, conexiones de banda ancha, ciberseguridad, robótica, mecatrónica, etc.

En conclusión, las medidas mencionadas, aplicables a cualquier empresa con sede en Italia, representan un hito estratégico en el modo de convertir a las empresas italianas en más competitivas en el mercado global, tanto en tecnología como en recursos financieros. Teniendo en cuenta la falta de barreras legales para entrar, este conjunto de nuevas reglas puede vitalizar el sistema económico italiano, además de atraer a los inversores extranjeros.

La autora de este post es Milena Prisco.

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

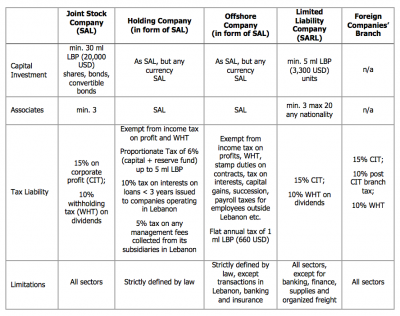

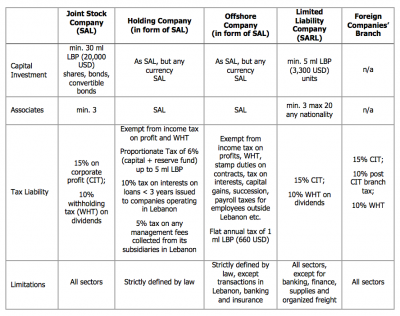

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

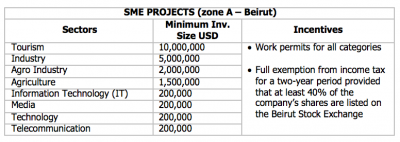

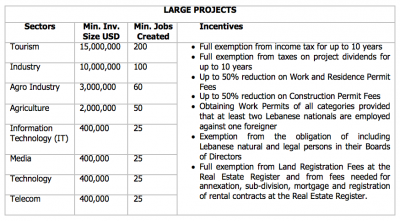

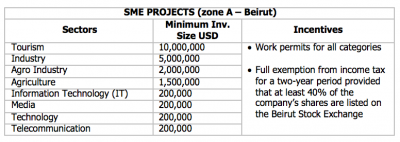

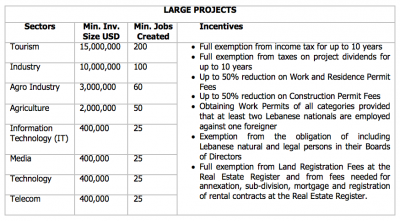

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.

Contacta con Alexander

Italy – Flat tax for new residents

27 noviembre 2018

-

Italia

- Derecho Fiscal y Tributario

Climate change has become part of our everyday lives. This includes tax lawyers on the lookout of tax incentives for their clients. Below you will find an outline of green tax incentives for industrial or commercial buildings in Belgium. Indeed, such tax incentives may help you achieve your companies’ sustainability goals. Other green tax incentives exist in Belgium but the focus here is on industrial and commercial buildings.

Reduction of Machinery and equipment tax (MET)

Fixed assets, such as machinery & equipment in industrial or commercial companies are considered immovables (buildings), subject to property tax (the MET). In Belgium this is a regional tax. The Brussels Capital Region and the Walloon Region abolished the MET.

The Flemish Region adopted a different policy by reducing (possibly to nothing) the MET and by incentivizing companies to invest in new machinery and equipment or to replace older machinery and equipment.

How is this achieved?

- No indexation of the taxable base

- A (full) reduction of the portion of the Flemish treasury in the MET (the local authority where the company is situated receives the proceeds of the MET)

- Exemption for new investments or the replacement of machinery & equipment: the exemption depends on an energy policy agreement between the company and the Flemish government (on the basis of the Flemish Energy Code). The purpose is to reduce CO2-emissions and to enhance energy efficiency.

However, companies with a historical presence in the Flemish region (brownfield companies) felt that they had a competitive disadvantage compared to greenfield companies: their older machinery was taxed as before. It must be noted that some of these companies employ a lot of people.

The Flemish government therefore adopted legislation that for investments in machinery and equipment between 01/2014 and 12/2019 a reduction of the taxable base of older machinery and equipment is granted on the basis of the taxable base of the new (exempted) investments. It is not yet confirmed that this tax exemption will be prolonged or made permanent beyond 2019, however it is expected that the above tax policy in the Flemish Region will be continued, thus reducing (possibly to nothing) the MET.

120% cost deduction for investments in bicycle infrastructure for employees

Personal and corporate income tax is mainly a national matter in Belgium. A 120% cost deduction has been put in place for investments in bicycle infrastructure for employees, such as a bicycle parking and other infrastructure for cyclists (shower, …).

Exemption of taxable profits for investments in new fixed assets

Another (national) income tax incentive is the exemption of taxable profits (‘investeringsaftrek’ – ‘déduction pour investissement’) of 13,5% of the investments in new fixed assets in energy efficient technology.

A tax credit for investments in sustainable fixed assets

In corporate income tax (as I said before a national matter) there is a tax credit for research and development (’belastingkrediet’ – ‘crédit d’impôt’) calculated on the basis of the corporate income tax rate (currently 29,58%) for investments in sustainable fixed assets.

Please note that Belgian corporate income tax for SME’s is 20% on the first 100.000,00 EURO turnover (subject to conditions). For all companies the corporate income tax rate will decrease to 25% as from 2020.

Hopes are that both at the national level and at the respective regional levels new green tax incentives will be adopted in order to encourage sustainable investments in Belgium.

As of January 01, 2019, the VAT rate will be increased in Russia from 18% to 20%.

Additional changes recently introduced to the Russian tax legislation require that foreign companies that render IT services in Russia shall register with the tax authorities in Russia; file VAT tax returns and pay VAT in Russia.

As from January 01, 2019 such obligation will be imposed on all foreign companies that render IT services in Russia independent of the fact who is the buyer of such IT services – a natural person, an individual entrepreneur or a legal entity.

Earlier the obligation to pay VAT was imposed only on customers of IT companies in Russia. As a rule, in case of sale of goods, works, services where the territory of Russia is recognized as a place of supply, the obligation to calculate and pay VAT is generally imposed on buyers of such services (legal entities or individual entrepreneurs registered with the tax authorities in Russia) recognized in such cases as tax agents.

In accordance with new tax requirements the foreign companies that render IT services where the territory of Russia is recognized as a place of supply of such IT services shall calculate and pay VAT themselves unless such obligation is imposed on a tax agent.

As from January 01, 2019 the tax agents in such cases will be considered only intermediaries (legal entities or individual entrepreneurs registered with the tax authorities in Russia) engaged in settlements directly with buyers of IT services on the basis of mandate, agency or commission agreements or similar contracts concluded with foreign companies that render such IT services (if there are several intermediaries involved, the intermediary who is involved in settlement directly with buyers will be recognized as the tax agent independent of the existence of the contract concluded with foreign IT company that renders such IT services).

Thus, as from January 01, 2019 the buyers of IT services from foreign companies are no longer considered as tax agents and respectively no longer obliged to calculate and pay VAT for foreign IT companies. Such obligation will be imposed on foreign IT companies themselves with some exceptions specified above.

As a result, all foreign companies that render IT services in Russia shall be registered with tax authorities in Russia in order to fulfil its tax obligations, file VAT tax returns in electronic form and pay taxes respectively.

The buyers of IT services (legal entities or individual entrepreneurs registered with the tax authorities in Russia) will have the right to deduct VAT paid to foreign IT companies provided that such foreign IT companies are duly registered with the tax authorities in Russia.

The registration of foreign IT companies in Russia will require submission of application and a set of documents. Such application can be filed by the representative of such foreign company, by mail or in electronic form through official Internet page of Russian tax authorities.

As an example, Facebook has already announced officially that all its clients in Russia both natural persons and legal entities will pay VAT in the amount of 20% from January 01, 2019. This will be applied to all advertisement accounts where Russia is specified as a country of the company.

The Italian Budget Law for 2017 (Law No. 232 of 11 December 2016), with the specific purpose of attracting high net worth individuals to Italy, introduced the new article 24-bis in the Italian Income Tax Code (“ITC”) which regulates an elective tax regime for individuals who transfer their tax residence to Italy.

The special tax regime provides for the payment of an annual substitutive tax of EUR 100.000,00 and the exemption from:

- any foreign income (except specific capital gains);

- tax on foreign real estate properties (IVIE ) and tax on foreign financial assets (IVAFE);

- the obligation to report foreign assets in the tax return;

- inheritance and gift tax on foreign assets.

Eligibility

Persons entitled to opt for the special tax regime are individuals transferring their tax residence to Italy pursuant to the Italian law and who have not been resident in Italy for tax purposes for at least nine out of the ten years preceding the year in which the regime becomes effective.

According to art. 2 of the ITC, residents of Italy for income tax purposes are those persons who, for the greater part of the year, are registered within the Civil Registry of the Resident Population or have the residence or the domicile in Italy under the Italian Civil Code. About this, it is worth noting that persons who have moved to a black listed jurisdiction are considered to have their tax residence in Italy unless proof to the contrary is provided.

According to the Italian Civil Code, the residence is the place where a person has his/her habitual abode, whilst the domicile is the place where the person has the principal center of his businesses and interests.

Exemptions

The special tax regime exempts any foreign income from the Italian individual income tax (IRPEF).

In particular the exemption applies to:

- income from self-employment generated from activities carried out abroad;

- income from business activities carried out abroad through a permanent establishment;

- income from employment carried out abroad;

- income from a property owned abroad;

- interests from foreign bank accounts;

- capital gains from the sale of shares in foreign companies;

However, according to an anti-avoidance provision, the exemption does not apply to capital gains deriving from the sale of “substantial” participations that occur within the first five tax years of the validity of the special tax regime. “Substantial” participations are, in particular, those representing more than 2% of the voting rights or 5% of the capital of listed companies or 20% of the voting rights or 25% of the capital of non-listed companies.

Any Italian source income shall be subject to regular income taxation.

It must be underlined that, under the special tax regime no foreign tax credit will be granted for taxes paid abroad. However, the taxpayer is allowed to exclude income arising in one or more foreign jurisdictions from the application of the special regime. This income will then be subject to the ordinary tax rule and the foreign tax credit will be granted.

The special tax regime exempts the taxpayer also from the obligation to report foreign assets in the annual tax return and from the payment of the IVIE and the IVAFE.

Finally, the special tax regime provides for the exemption from the inheritance and gift tax with regard to transfers by inheritance or donations made during the period of validity of the regime. The exemption is limited to assets and rights existing in the Italian territory at the time of the donation or the inheritance.

Substitutive Tax and Family Members

The taxpayer must pay an annual substitutive tax of EUR 100,000 regardless of the amount of foreign income realised.

The special tax regime can be extended to family members by paying an additional EUR 25,000 substitutive tax for each person included in the regime, provided that the same conditions, applicable to the qualifying taxpayer, are met.

In particular, the extension is applicable to

- spouses;

- children and, in their absence, the direct relative in the descending line;

- parents and, in their absence, the direct relative in the ascending line;

- adopters;

- sons–in-law and daughters-in-law;

- fathers-in-law and mothers-in-law;

- brothers and sisters.

How to apply

The option shall be made either in the tax return regarding the year in which the taxpayer becomes resident in Italy, or in the tax return of the following year.

Qualifying taxpayer may also submit a non-binding ruling request to the Italian Revenue Agency, in order to prove that all requirements to access the special regime are met. The ruling can be filed before the transfer of the tax residence to Italy.

The Revenue Agency shall respond within 120 days as from the receipt of the request. The reply is not binding for the taxpayer, but it is binding for the Revenue Agency.

If no ruling request is filed, the same information provided in the request must be provided together with the tax return where the election is made.

Termination

The option for the special tax regime is automatically renewed each year and it ends, in any case, after fifteen years from the first tax year of validity. However, the option can be revoked by the taxpayer at any time.

In case of termination or revocation, family members included in the election are also automatically excluded from the regime.

After the ordinary termination or revocation, it is no longer possible to apply for the special tax regime.

The author of this post is Valerio Cirimbilla.

Like in other jurisdictions, in Cyprus the term ‘joint venture’ connotes business arrangements that involve the pooling of resources, knowledge and experiences of the participants for the purposes of accomplishing or implementing a specific task, whether this is a particular project or business activity. There is no specific statute governing joint ventures yet in practice such arrangements take one of the following structures.

-

Corporate Joint Venture

The cooperation materialises through the setting up of a legal entity separate from its participants with constitutional documents governing its operation and the relations between the participants and the entity in addition to the statutory provisions of the Cyprus Company Law, Cap 113. A shareholders’ agreement is typically executed operating in parallel. It is possible that further agreements such as licences for use of intellectual property etc. will be signed. This vehicle might be more appropriate where it is expected that the joint venture will need to enter into contractual arrangements with third parties due to the limited liability benefits. The termination is usually addressed in a shareholders’ agreement which specifies events of termination e.g. change of control, insolvency of a participant, attainment of objective etc. as well as the relevant processes e.g. sale of shares among participants, liquidation etc.

Taxation of income occurs at the level of the company. Participants are not taxed on dividends in Cyprus if they are not tax residents or if they are companies. If the company is to be taxed in Cyprus, the management and control will need to be exercised in Cyprus. Any assets, including intellectual property created by the company, become property of the new entity. The setting up of the company might be subject to notification to the competent competition authority under merger control rules. Corporate joint ventures are commonly used by international clients aiming to benefit from the network of double tax treaties maintained by Cyprus. They are also a vehicle often employed to enter the Cyprus market with the assistance of a local participant.

Advantages:

- Limited liability; liability of participants limited to capital.

- Participants control the company through the power of appointment of the board of directors.

- The company is governed by the Cyprus Companies Law, Cap. 113, a statute based on English company law rules, which gives more legal certainty and familiarity for participants as well as the counterparties. The relationship is not purely contractual.

- Tax optimisation possibilities given the low rate of corporate taxation applicable in Cyprus (at the rate of 12.5%). The numerous double tax treaties maintained by Cyprus may be exploited.

Disadvantages:

- Less flexibility compared to the other structures due to the applicable legal framework both in terms of operation and compliance.

- Governance and control questions might need to be addressed e.g. to deal with deadlocks.

- Restrictions and or conditions for the transfer of shares are typically adopted.

- Both the corporate profit and the dividends returned to participants might, under certain circumstances, be subject to taxation e.g. where participants are natural persons residing in Cyprus.

-

Partnership Joint Venture

The relationship is governed by the relevant statute which specifies the liability of each partner depending on whether the partnership would be a general or limited partnership. In the first case, each partner has unlimited liability with the other partners for all debts and liabilities of the partnership. In the second case, only the general partner has unlimited liability; limited partners are only liable for the capital they agreed to invest but should not participate in the running of the business. The relevant statute imposes default and overriding rules governing the arrangement e.g. in relation to the termination or profit sharing. The termination of the partnership will typically be governed by the partnership agreement, but the statute also provides for specified circumstances which would apply unless the parties agree otherwise. Business assets and intellectual property contributed by each party become the property of the partnership (except if agreed otherwise) and should be exploited in accordance with the partnership agreement for the purposes of the partnership.

Partnerships are tax transparent, accordingly, taxation occurs at the level of the participants and profits and losses accrue to them. Partnerships might be subject to competition law rules prohibiting the restriction of competition. Further, the creation of a partnership might be subject to notification to the competent competition authority under merger control rules. Partnership joint ventures are regularly used for economic activities of professionals. They have also been used as a vehicle in the context of tenders (public or other).

Advantages:

- Relatively fewer formalities apply than in the case of corporate joint ventures.

- Registration requirements exist but no requirement for disclosure of the actual partnership agreement i.e. the constitutional document.

- Although the partnership has no legal personality, it may sue and be sued in its own name and may trade under its name.

- Apportionment of profits and losses on the basis of discretion.

- Attribution of profits to the partners; not to the partnership.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned. Wide options may be available due to the extensive network of double tax treaties maintained by Cyprus.

Disadvantages:

- Significant powers to unlimited partners. Given the powers of partners to bind the partnership, decision-making process needs to be addressed carefully.

- Liability comes with involvement in the management/control. Unlimited liability of general partners towards third parties. Solutions alleviating the effect of this may be possible.

- Tax transparency may not be beneficial where the partners are natural persons as they might be taxed at higher rates. Yet with appropriate structuring this may be avoided.

-

Contractual joint ventures

The basis of the cooperation of the participants is solely a contractual agreement between them. It is expected that such agreement will include detailed provisions regulating the rights and liabilities of the parties towards each other, the distinct role and input of each, their contributions, their share in the income generated etc. No separate legal personality is created. Business assets and intellectual property remain the property of the participant who contributed or developed them (unless of course the parties agree otherwise).

Profits and losses accrue to the participants and taxation is also incurred at the level of the participants. Such arrangements might be subject to competition law rules prohibiting the restriction of competition. Contractual joint ventures are commonly used in the context of tenders (public or other).

Advantages:

- Governed solely by contact law thus greater flexibility as to the operation and termination. Contract law in Cyprus is based on common law principles.

- No registration requirements.

- Minimal formalities compared to the other possible structures.

- No joint liability; liability towards third parties limited to own acts or omissions of each participant.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned.

Disadvantages:

- Lack of legal personality might cause difficulties in establishing commercial or contractual relationships with third parties.

- Need for detailed regulation of all aspects of the cooperation in the agreement due to the lack of legal framework for the relationship; careful and skilful planning is required.

- Depending on the facts and provisions adopted, risk of classification of the relationship as a partnership by a court with the consequence of joint liability.

-

European Economic Interest Grouping (EEIG)

A vehicle established and governed predominantly by European law (Council Regulation 2137/85) instead of national law. Specific purposes for EEIGs apply i.e. to facilitate or develop the economic activities of the members to enable them to improve their own results. In that context the activities of EEIGs must be related to the economic activities of the members but not replace them. The purpose is not to make profits for the EEIG itself. EEIGs are governed by a contract between their members and Council Regulation 2137/85. They have capacity, in their own name, to have rights and obligations of all kinds, to contract or accomplish other legal acts as well as to sue or be sued. There is unlimited joint liability of the participants for the debts and liabilities of the EEIG but the exclusion or restriction of liability of one or more members for a particular debt or liability is possible if it is specifically agreed between the third party and the EEIG. EEIGs enjoy tax transparency. Profits or losses are taxable at the hands of the participants.

Advantages:

- Established under European law; EEGIs might be ideal for alliances of firms in different member states of the European Union for joint promotion of activities.

- Relatively fewer formalities apply than in the case of corporate joint ventures though there are registration requirements.

- Tax transparency.

Disadvantages:

- Managers bind EEIGs as regards third parties, even if their acts do not fall within the objects (unless the third party had knowledge).

- Unlimited liability of participants.

- More limited scope for use due to the statutory purposes dictated.

Which option is the most appropriate and or efficient in terms of structuring in a particular case depends on the facts at hand and the actual needs of the participants. The different factors need to be carefully examined with the help of experts so that the most suitable solution is adopted.

Pursuant to the European Directive on administrative cooperation in the field of taxation (2011/16/EU), Member States must cooperate with each other with a view to exchanging information relevant for tax purposes. The directive allows, inter alia, that a Member State (the requesting Member State) requests another Member State (the requested Member State) to provide information concerning a specific taxpayer. The requested information must be ‘ foreseeably relevant ‘ to the tax authorities of the requesting Member State.

Based on the aforementioned directive, the tax authority of the requested Member State may request information from e.g. an affiliated company, a financial institution, an employer, … of the taxpayer. The tax authority of the requested Member State forwards the collected information to its counterpart in the requesting Member State.

A question that arises is whether that affiliated company, financial institution, employer, … may ask its national courts to verify the legality of the sanction imposed by its tax authority because of an incomplete answer and whether it may ask to vary the penalty. Another question is whether a court in the requested Member State may verify the relevance for tax purposes of the requested information.

These questions were raised in the Berlioz case of the Court of Justice (judgement of 16 May 2017): Berlioz (a Luxembourg company) only partially answered the request for information from the Luxembourg authorities (at the request of France). Berlioz stated in this regard that certain questions were irrelevant for tax purposes in the requesting Member State.

The answers to the questions raised are not obvious, as the starting point is that the requesting State has a margin of discretion as to what is foreseeably relevant for its tax purposes. This explains why (in this case the Luxembourg) courts doubted whether a relevance test was possible. The questions were referred for a preliminary ruling to the Court of Justice.

In its assessment, the court took into consideration the EU Charter of Fundamental Rights and, more specifically, the right to a fair hearing by an impartial judge.

The Court of Justice ruled that courts in the requested Member State may review the foreseeable relevance for tax purposes of the requested information and that they may vary the penalty imposed. The courts in the requested Member State should be reluctant however upon review of the legality of the request for information: the review is limited to verification whether the requested information manifestly has no relevance for tax purposes.

To this end, the courts must have access to the request for information. The affiliated company, financial institution, employer, … is only entitled to receive the identity of the person under investigation and to be informed about the tax purpose for which the information is sought. The Court of Justice indeed emphasizes in the interest of the investigation the principle that the request for information must remain secret.

Relevance of the judgment: When requested by a national tax authority to respond to a request for information from another Member State, it is important to check the relevance for tax purposes of the requested information. If the information requested is irrelevant to the tax investigation, a proceeding against the request for information or against the penalty may succeed. Regarding the foreseeable relevance for tax purposes, the national courts may only review whether the requested information manifestly has no relevance to the tax investigation in the requesting Member State.

Individuals coming to Portugal and here becoming residents for the first time, can be entitled to some important tax benefits under the “non habitual resident rules”. These rules are an important contribution for making Portugal one of the most attractive destinations for retired individuals, but also for entrepreneurs.

Who can benefit?

A non habitual resident is an individual becoming resident for tax purposes in Portugal for the first time in the last five years period. To become resident for tax purposes, one should be in Portugal for more than 183 days in any 12 months period or for a shorter period but in such conditions that the intention of becoming resident is sufficiently clear. After becoming resident for tax purposes and register as such before the Tax Authorities, the individual must register as a non habitual resident to be able to benefit from this regime.

High Value Added Activities.

Some of the benefits under the non habitual resident rules are only applicable to income arising from high value added activities. These activities include architects, engineers, artists, auditors and tax consultants, medical professions, university teachers, top managers and other liberal professionals in areas such as informatics (software and hardware) development and consultancy, science investigation and design.

For how long?

The benefits arising from the non habitual resident status are valid for a ten year period and depend on the individual remaining as resident in Portugal for tax purposes. If, for any reason, the individual ceases to be resident, he can later benefit from the remaining period by becoming resident again.

What are the benefits?

Individuals becoming non habitual resident benefit from a more favorable tax treatment regarding both income from Portuguese source and income from foreign sources.

As to the income from Portuguese source arising from employment and self-employment, it is subject to a special tax of 20%. This benefit is only applicable to non habitual residents earning income from high value added activities.

As to the income from foreign sources arising from employment and pensions, it is exempted from taxes in Portugal, in most cases. This exemption also includes income arising from self-employment in high value added activities, and from intellectual and industrial property, capital and real estate gains.

Con la Legge di Bilancio 2017 (Ley de Presupuestos), vigente desde el 1 de enero de 2017, el Parlamento italiano ha implantado una nueva estrategia para fomentar la economía italiana mediante la adopción de una amplia gama de medidas, tanto financieras como fiscales, con la intención de apoyar a las start-ups y a las pequeñas y mediadas empresas y con el fin de hacerlas más atractivas para los inversores extranjeros.

La Ley de Presupuestos ha diseñado un plan integral que incluye ciertas exenciones fiscales, la posibilidad de que las PYMEs recauden fondos a través de plataformas de crowdfunding o micromecenazgo y para las llamadas start-ups «innovadoras» (es decir, aquellas empresas que se encuentran en fase inicial y que cumplen con ciertos criterios establecidos por la ley: p. ej. tecnología de alto nivel, gasto en I + D o un número de empleados graduados, etc.), para transferir sus pérdidas fiscales a sociedades cotizadas. En general, estas herramientas apuntan principalmente a desbloquear el sistema económico, que hasta ahora no ha demostrado ser lo suficientemente eficaz como para proporcionar a las start-ups y a las PYMEs los recursos financieros y beneficios fiscales suficientes que necesitan para desarrollar activos innovadores y ampliar su negocio.

Este conjunto de medidas puede dividirse en cuatro grupos, en función de los propósitos:

- Fomentar el espíritu empresarial y crear empresas innovadoras.

- Estimular las inversiones privadas dirigidas a las start-ups innovadoras y a las PYMEs.

- Apoyar los gastos de I + D.

- Modernizar los activos de las empresas existentes mediante su digitalización y automatización, junto con el desarrollo de tecnologías innovadoras.

Ayuda económica para la creación de nuevas empresas

La estrategia establecida por el Parlamento involucra al Ministerio de Desarrollo Económico (Mise), al Instituto Nacional de Seguros contra los Accidentes Laborales (Inail) y a otros organismos públicos, como Invitalia, con el objetivo de impulsar la constitución de start-ups y desarrollar las PYMEs innovadoras.

De hecho, la dotación del Fondo para el Crecimiento Sostenible (FCS- Fondo per la Crescita Sostenibile), cuyo objetivo es proporcionar préstamos ventajosos para apoyar la constitución de start-up innovadoras, ha sido aumentado en un 47,5 millones de euros para 2017 y 2018, respectivamente.

Además, la Ley de Presupuestos también ha asignado la misma cantidad de 47,5 millones de euros para 2017 y 2018 con el fin de fomentar el autoempleo y el espíritu empresarial. Estos fondos serán administrados por Invitalia, agencia gubernamental para el fomento de la inversión interna y el desarrollo empresarial, y serán empleados principalmente para impulsar la incorporación de mujeres y jóvenes emprendedores (de 18 a 35 años) a empresas. Invitalia podrá conceder préstamos a interés cero, subvencionados por un máximo de ocho años, lo que podría cubrir hasta el 75% del gasto total, tal como se presupuestó para inversiones específicas. En ese caso, las empresas tendrán que financiar el importe restante según lo asignado en el plan de negocios y llevar a cabo la inversión prevista dentro de los 24 meses siguientes a la concesión del contrato de préstamo.