-

Libano

Lebanon – Credit Incentives and Financing Start-ups, Real Estate and Tourism

24 agosto 2017

- Derecho Societario

- Derecho Inmobiliario

The economy of a country is usually supported and boosted by the Government. In Lebanon, instead, the Central Bank or Banque du Liban (BdL) has taken on the role for years now, due to the long governmental inactivity and the political impasse. The recent formation of a national unity government – after the longest presidential vacancy in the country’s history – generated hope worldwide towards a new start for the country to get back on track both at the local and the international level. Nonetheless, BdL still plays an important role, providing critical support to the real economy, as well as acting as a backstop to the financial sector.

BdL acts according to the provisions of the Code of Money and Credit that includes, among other duties, “safeguarding economic stability” and “developing the monetary and financial market”. Over the past years, consecutive packages of subsidized loans for the private sector were issued, helping to support demand. Those actions were put in place amending the basic Decision no. 6116 of March 7, 1996 regarding “Facilities that may be granted by Banque du Liban to Banks and Financial Institutions”.

As the World Bank highlighted in the report “Lebanon Economic Monitor Fall 2016”, BdL’s stimulus packages and other initiatives, in conjunction with the contributory role played by Kafalat SAL, the loan guarantee financial company, have provided significant support to the real sector, by means of subsidizing interest payments of SME borrowers, extending special guarantees to SMEs, and granting exemptions on compulsory reserves of creditors.

The latest GDP increase would have been lower without BdL’s interventions, which involve largely the tech industry and the knowledge based economy (“KBE”), but also the real estate and tourism sector.

With regard to the tech industry, to support Lebanon’s entrepreneurial ecosystem, in 2013 BdL issued Circular 331 with the dual aim of retaining local talent and attracting the expatriates to setup business in the country. The initial $400 million USD funds gave impulse to develop the technological and digital sector, encouraging the incorporation of Lebanese companies, the operations in the country without a definite time limit.

In 2016, it increased the margin of funds that banks could dedicate to the financing of this sector, by authorizing them to invest, with BdL’s guarantee, up to 4% of their own funds, compared to 3% previously.

Circular 331 has created a lively and high-standard technological environment in Lebanon, where different actors interpret essential roles to contribute to the growth and the innovation of the country.

More than 1500 companies are working in the ICT field (1500 according to the 2016 report issued by the UK Tech Hub), in addition to 8 incubators and accelerators, mentorship and business educational groups, 6 local venture capital firms and others operating in the regions. It is a matter of time until the spill-over effect contributes to the GDP growth.

With regard to real estate, Circular 427 provides an incentive by allowing banks in Lebanon to offer credit facilities to companies, funds or special vehicles for the purpose of acquiring real estate projects. The loans are subject to certain conditions set up for a) the seller, i.e. specialized real estate companies, b) the properties, and c) the purchase itself. Credit is available up to 60 percent of the value of the purchase with the remaining 40 percent financed by the purchaser from their equity excluding debt.

The main target of the measure is to boost sales of existing new real estate stock that remains unsold. Another important outcome is the enhancement of the dialogue between the actors, creating synergies and a proactive business environment around the real estate sector.

In line with the spirit, in tourism sector the most recent Circular 465 aims to boost real estate projects related to hospitality, as well investments in the tourism like, leisure parks and medical centers, through commercial banks subsidized loans (up to $ 10 million USD) for a prolonged period.

In conclusion, on one hand, it is worth to notice that credit incentives, provided through the banking sector, have played a key role in boosting and supporting the numerous segments of the Lebanese economy. On the other hand, from a regulatory perspective, critical reforms are needed to put the country back on the right track. The Government and the Parliament are working towards this direction: new upcoming projects, new laws to approve and enact, and opportunities to invest in many other sectors, like telecommunication services, electricity and water distribution, and waste management.

The author of this post is Claudia Caluori.

Lebanon’s secure banking sector plays an important role in the country’s stability and economic status. High liquidity and compliance with all international regulatory standards make it one of the most profitable in the region.

Stability

The Lebanese banking sector owes its solidity primarily to the stringent policies applied by the Lebanese Central Bank (LCB). Efforts are constantly being made to fight money laundering and terrorism funding.

The Lebanese diaspora also contributes to the stability through the flux of transfers and deposits of extraterritorial income. Compared with an estimated population of 4.9 million inhabitants, about 16 million Lebanese live abroad, largely engaged in trade and finance, and mainly concentrated in South America.

The banking sector’s stability is also bolstered by the currency exchange rate, which has been stable since 1997, when the Lebanese Pound (LBP) was pegged to the United States Dollar (USD) at a rate of 1507.5 LBP to the USD.

Banking Secret and Automatic exchange of Information

The Lebanese Banking Secrecy Law of September 3, 1956 was a key aspect in the expansion of the sector. Bank secrecy is applied to any bank operating in Lebanon, local or foreign, and prohibits the disclosure of any details or information about any account or accountholder. For long time this law has increased confidence in Lebanese banking together with the amount of foreign capital coming into the country.

Before the last economic and financial global shocks, the veil of banking secrecy could be lifted only with prior approval of the accountholder, in case of bankruptcy; for the exchange of information between banks about indebted accounts; and in case of legal actions between a bank and a client or illicit enrichment.

Nowadays, banking secrecy does not apply to US citizens because of the Foreign Account Tax Compliance Act (FATCA) that requires foreign banks to report American accountholders to the tax authority of the US. Even though Lebanon has not agreed to be FATCA compliant as a whole, individual Lebanon banks have agreed to comply.

Moreover, in 2016 Lebanon joined the Global Forum on Transparency and the Automatic Exchange of Information (AEOI) for tax purposes, committing to implement a series of regulatory reforms to better comply with the Common Reporting Standards of OECD.

Consequently, if the requested information is protected under the Banking Secrecy Law of 1956, the request will be forwarded to the Special Investigation Commission (SIC) at the Central Bank with an opinion from the Ministry of Finance for review before it can be disclosed to the foreign tax authority based on an information exchange agreement.

The regulatory framework and supervision of the banking sector is already in compliance with international standards, such as Basel I, II, and III. Abiding by these laws does not eliminate banking secrecy. New regulations just aim to provide a more effective tool to counter the fight against tax evasion and to track suspicious operations for money laundering purposes, or self-laundering, based on tax offenses.

According to the AEOI, starting from September 2018 Lebanese Tax Authority will exchange information automatically on non-residents, and will have access to information on residents who hold assets abroad. No issues for Lebanese residents.

The new legislation will impact: banks, brokers, trusts, fiduciaries, insurance companies, although only for a few products, and certain collective investment funds.

Corporate Governance

As part of the strategy to integrate Lebanon further into the international community and the global economy, corporate governance in banks is necessary to guarantee fairness, transparency and accountability.

It is mandatory for banks while optional for other companies. In fact, an innovation took place in the banking sector on July 26, 2006 when the Governor of the Lebanese Central Bank enacted the Basic Decision No. 9382 to order to comply with the banking rules instituted by the Basel Committee.

Account freedom and flexibility

Lebanese banks are known for being open to foreign investors and have branches worldwide. Foreign individuals or companies can easily open a bank account in Lebanon in any currency and benefit from all banking advantages offered to Lebanese citizens. Further, amounts deposited in Lebanon are exempt from taxes and the interest received is subject to a tax rate of 5-percent.

The author of this post is Claudia Caluori.

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

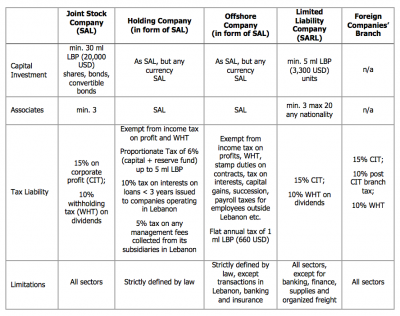

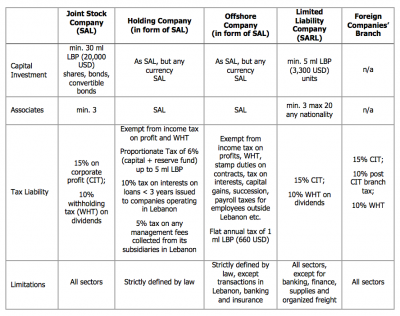

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

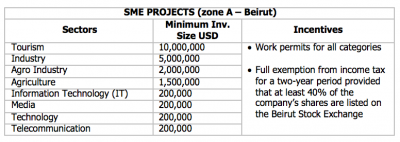

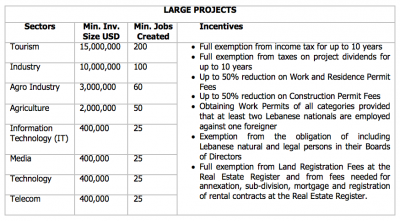

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.

The Lebanese Banking Sector

12 abril 2017

-

Libano

- Bancario

- Derecho Societario

The economy of a country is usually supported and boosted by the Government. In Lebanon, instead, the Central Bank or Banque du Liban (BdL) has taken on the role for years now, due to the long governmental inactivity and the political impasse. The recent formation of a national unity government – after the longest presidential vacancy in the country’s history – generated hope worldwide towards a new start for the country to get back on track both at the local and the international level. Nonetheless, BdL still plays an important role, providing critical support to the real economy, as well as acting as a backstop to the financial sector.

BdL acts according to the provisions of the Code of Money and Credit that includes, among other duties, “safeguarding economic stability” and “developing the monetary and financial market”. Over the past years, consecutive packages of subsidized loans for the private sector were issued, helping to support demand. Those actions were put in place amending the basic Decision no. 6116 of March 7, 1996 regarding “Facilities that may be granted by Banque du Liban to Banks and Financial Institutions”.

As the World Bank highlighted in the report “Lebanon Economic Monitor Fall 2016”, BdL’s stimulus packages and other initiatives, in conjunction with the contributory role played by Kafalat SAL, the loan guarantee financial company, have provided significant support to the real sector, by means of subsidizing interest payments of SME borrowers, extending special guarantees to SMEs, and granting exemptions on compulsory reserves of creditors.

The latest GDP increase would have been lower without BdL’s interventions, which involve largely the tech industry and the knowledge based economy (“KBE”), but also the real estate and tourism sector.

With regard to the tech industry, to support Lebanon’s entrepreneurial ecosystem, in 2013 BdL issued Circular 331 with the dual aim of retaining local talent and attracting the expatriates to setup business in the country. The initial $400 million USD funds gave impulse to develop the technological and digital sector, encouraging the incorporation of Lebanese companies, the operations in the country without a definite time limit.

In 2016, it increased the margin of funds that banks could dedicate to the financing of this sector, by authorizing them to invest, with BdL’s guarantee, up to 4% of their own funds, compared to 3% previously.

Circular 331 has created a lively and high-standard technological environment in Lebanon, where different actors interpret essential roles to contribute to the growth and the innovation of the country.

More than 1500 companies are working in the ICT field (1500 according to the 2016 report issued by the UK Tech Hub), in addition to 8 incubators and accelerators, mentorship and business educational groups, 6 local venture capital firms and others operating in the regions. It is a matter of time until the spill-over effect contributes to the GDP growth.

With regard to real estate, Circular 427 provides an incentive by allowing banks in Lebanon to offer credit facilities to companies, funds or special vehicles for the purpose of acquiring real estate projects. The loans are subject to certain conditions set up for a) the seller, i.e. specialized real estate companies, b) the properties, and c) the purchase itself. Credit is available up to 60 percent of the value of the purchase with the remaining 40 percent financed by the purchaser from their equity excluding debt.

The main target of the measure is to boost sales of existing new real estate stock that remains unsold. Another important outcome is the enhancement of the dialogue between the actors, creating synergies and a proactive business environment around the real estate sector.

In line with the spirit, in tourism sector the most recent Circular 465 aims to boost real estate projects related to hospitality, as well investments in the tourism like, leisure parks and medical centers, through commercial banks subsidized loans (up to $ 10 million USD) for a prolonged period.

In conclusion, on one hand, it is worth to notice that credit incentives, provided through the banking sector, have played a key role in boosting and supporting the numerous segments of the Lebanese economy. On the other hand, from a regulatory perspective, critical reforms are needed to put the country back on the right track. The Government and the Parliament are working towards this direction: new upcoming projects, new laws to approve and enact, and opportunities to invest in many other sectors, like telecommunication services, electricity and water distribution, and waste management.

The author of this post is Claudia Caluori.

Lebanon’s secure banking sector plays an important role in the country’s stability and economic status. High liquidity and compliance with all international regulatory standards make it one of the most profitable in the region.

Stability

The Lebanese banking sector owes its solidity primarily to the stringent policies applied by the Lebanese Central Bank (LCB). Efforts are constantly being made to fight money laundering and terrorism funding.

The Lebanese diaspora also contributes to the stability through the flux of transfers and deposits of extraterritorial income. Compared with an estimated population of 4.9 million inhabitants, about 16 million Lebanese live abroad, largely engaged in trade and finance, and mainly concentrated in South America.

The banking sector’s stability is also bolstered by the currency exchange rate, which has been stable since 1997, when the Lebanese Pound (LBP) was pegged to the United States Dollar (USD) at a rate of 1507.5 LBP to the USD.

Banking Secret and Automatic exchange of Information

The Lebanese Banking Secrecy Law of September 3, 1956 was a key aspect in the expansion of the sector. Bank secrecy is applied to any bank operating in Lebanon, local or foreign, and prohibits the disclosure of any details or information about any account or accountholder. For long time this law has increased confidence in Lebanese banking together with the amount of foreign capital coming into the country.

Before the last economic and financial global shocks, the veil of banking secrecy could be lifted only with prior approval of the accountholder, in case of bankruptcy; for the exchange of information between banks about indebted accounts; and in case of legal actions between a bank and a client or illicit enrichment.

Nowadays, banking secrecy does not apply to US citizens because of the Foreign Account Tax Compliance Act (FATCA) that requires foreign banks to report American accountholders to the tax authority of the US. Even though Lebanon has not agreed to be FATCA compliant as a whole, individual Lebanon banks have agreed to comply.

Moreover, in 2016 Lebanon joined the Global Forum on Transparency and the Automatic Exchange of Information (AEOI) for tax purposes, committing to implement a series of regulatory reforms to better comply with the Common Reporting Standards of OECD.

Consequently, if the requested information is protected under the Banking Secrecy Law of 1956, the request will be forwarded to the Special Investigation Commission (SIC) at the Central Bank with an opinion from the Ministry of Finance for review before it can be disclosed to the foreign tax authority based on an information exchange agreement.

The regulatory framework and supervision of the banking sector is already in compliance with international standards, such as Basel I, II, and III. Abiding by these laws does not eliminate banking secrecy. New regulations just aim to provide a more effective tool to counter the fight against tax evasion and to track suspicious operations for money laundering purposes, or self-laundering, based on tax offenses.

According to the AEOI, starting from September 2018 Lebanese Tax Authority will exchange information automatically on non-residents, and will have access to information on residents who hold assets abroad. No issues for Lebanese residents.

The new legislation will impact: banks, brokers, trusts, fiduciaries, insurance companies, although only for a few products, and certain collective investment funds.

Corporate Governance

As part of the strategy to integrate Lebanon further into the international community and the global economy, corporate governance in banks is necessary to guarantee fairness, transparency and accountability.

It is mandatory for banks while optional for other companies. In fact, an innovation took place in the banking sector on July 26, 2006 when the Governor of the Lebanese Central Bank enacted the Basic Decision No. 9382 to order to comply with the banking rules instituted by the Basel Committee.

Account freedom and flexibility

Lebanese banks are known for being open to foreign investors and have branches worldwide. Foreign individuals or companies can easily open a bank account in Lebanon in any currency and benefit from all banking advantages offered to Lebanese citizens. Further, amounts deposited in Lebanon are exempt from taxes and the interest received is subject to a tax rate of 5-percent.

The author of this post is Claudia Caluori.

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

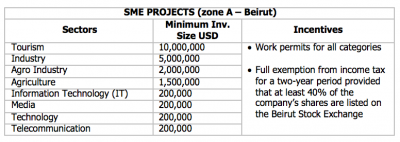

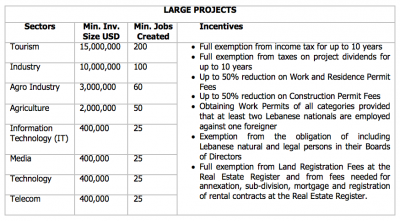

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.