-

Venezuela

Company Law in Venezuela

1 Febbraio 2017

- Diritto societario

In a previous post we outlined how a foreign investor may conduct a business in Argentina and, specifically, we analysed the main characteristics of the Limited Liability Companies (Sociedades de Responsabilidad Limitada “SRL”).

In this post we are going to focus the attention on another type of company: the Joint Stock Corporation – Sociedades Anónimas (“SA”).

The main differences between Sociedades de Responsabilidad Limitada and Sociedades Anónimas are the following:

- The transfer of SRL quotas shall be registered in the Registry of Commerce. On the contrary, the transfer of shares shall only be registered in the Shareholders’ Register of the SA.

- Number of partners cannot be more than 50 in the SRL, while in the SA there is only the minimum number of 2.

- Board of Directors of a SA has the obligation of meeting at least every 3 months, while in the SRL the management does not have such obligation.

- In a SRL, the partner who has the majority vote does not need the vote of another partner to approve decisions. On the other hand, one shareholder with the majority vote can manage a SA without the favorable vote of any other shareholder.

Main characteristics of the Argentinian Stock Corporations: las Sociedades Anónimas (“SA”)

Shareholders: A minimum of two shareholders is required, and they may be resident or non-resident in Argentina.

Corporate capital: The minimum capital currently required by law is equal to Argentina Pesos (ARS) 100.000 (approximately USD 6.250), of which only 25% must be paid in at the time of the corporate organization. The balance shall be paid within a maximum term of two years from the incorporation. However, the Public Registry of Commerce may require an initial corporate capital amount higher than ARS 100,000 in case – having regards to the nature and characteristics of the businesses involved by the corporate purpose – the corporate capital is considered overtly inappropriate.

Liability SA: Shareholders liability is limited to the amount of capital invested. The sole limitation to this rule is the “lifting of the corporate veil” doctrine, applicable only when a company has been organized or used for fraudulent purposes, in order to abuse the liability limitation.

Legal Books and Records SA: There are 4 company books and records provided by the law: 1) Shareholders’ Register; 2) Register of attendance at General Meetings; 3) Minutes of General Meetings; and 4) Minutes of Directors’ Meetings.

Administration: The Board of Directors is the body in charge of the company administration. Its members do not need to be shareholders or residents in Argentina. However, the law requires that the Board of Directors meets at least four times a year with the physical presence of the majority of its members. The law also requires that the majority of the Directors are domiciled in Argentina.

If the corporate capital amounts to ARS 10.000.000 (approximately USD 625.000) or more, the minimum number of Directors is three; otherwise, the law does not impose any minimum number of directors.

The President of the Board of Directors has the power of legal representation of the company and, in case of his/her absence, the Vice President may act as the company’s legal representative.

In addition to and notwithstanding the above, the company’s representation may be conferred through powers of attorney issued by the Board of Directors for specific purposes (banking, administrative affairs, judicial, etc.).

Supervision SA: If the SA’s corporate capital is lower than ARS 10.000.000 no Syndic (a kind of internal auditor, with the duty to ensure that the company formally complies with the law) need to be appointed. If the capital is above said amount, the S.A. must organize a supervisory body composed of Syndics.

The SA that does not make public offer of its stock capital may appoint only one principal Syndic and one alternate Syndic. The principal Syndic and the alternate Syndic are elected by the Shareholders. To be elected Syndic it is necessary to be a lawyer or a public accountant domiciled in Argentina. Employees, directors or managers of the company or its parent or subsidiary companies may not be syndics. Shareholders may remove Syndics at their own discretion.

Governing body: The corporate authority governing the SA and adopting resolutions is the Shareholders’ Meeting, competent – among other issues – to approve the Annual Balance Sheet of the company, to appoint and/or remove its Directors and Syndics and to deal with any other item related to the company’s ordinary course of business.

Financial statements, Balance Sheets and Accounts SA: Annual financial statements must be submitted for the consideration of the Stakeholders’ Meeting. Argentine law provides that the Annual financial statements must be filed also with the Public Registry of Commerce.

The author of this post is Tomás García Navarro.

Nel momento in cui s’intraprende un’attività autonoma in Belgio, scatta immediatamente l’obbligo d’iscrizione presso un Fondo di assicurazione sociale (Caisse d’Assurances Sociales).

Inoltre, quando un datore di lavoro decide di assumere del personale, dovrà necessariamente assolvere delle incombenze:

- innanzitutto, è necessario che il datore di lavoro che assuma per la prima volta uno o più lavoratori si registri all’Ufficio nazionale di previdenza sociale (ONSS) quale datore di lavoro. Questa identificazione oggi potrà effettuarsi online tramite l’applicazione “Wide“;

- effettuata l’iscrizione, l’ONSS attribuisce un numero identificativo sulla base delle informazioni comunicate attraverso il formulario d’identificazione. Questo numero si compone di tre parti:

- una prima parte, composta da tre cifre, indica le particolarità applicabili al datore di lavoro per il calcolo dei contributi;

- il numero di identificazione vero e proprio, composto da sei o sette cifre;

- un numero di controllo di due cifre che permette di stabilire se il numero d’identificazione è corretto.

Durante tutto il periodo nel quale si è registrati quali datori di lavoro, occorre comunicare obbligatoriamente all’ONSS un determinato numero d’informazioni, come per esempio qualsiasi cambiamento riguardante l‘attività esercitata o una variazione relativa agli assegni familiari.

Inoltre sarà possibile comunicare un certo numero d’informazioni supplementari, le quali non sono tuttavia obbligatorie, in quanto la BCE aggiorna periodicamente l’ONSS sulle eventuali modifiche, quali per esempio le variazioni di indirizzo o la modifica della denominazione o della forma sociale.

Dall’1 gennaio 2005 ogni datore di lavoro è identificato presso la BCE attraverso l’attribuzione di un numero identificativo unico. In un’ottica di semplificazione amministrativa, il numero d’impresa costituirà il solo numero identificativo del datore di lavoro rimpiazzando anche il numero d’identificazione rilasciato dall’ ONSS.

Nel caso in cui il datore di lavoro non abbia lavoratori per un trimestre consecutivo dovrà avvisare entro la fine di detto trimestre l’ONSS, attraverso una dichiarazione effettuata tramite un apposito formulario.

Mentre nel caso in cui il datore di lavoro decida di interrompere la propria attività o rimanga senza personale per un periodo superiore ad un trimestre dovrà avvisare l’ONSS. Quest’ultimo provvederà a eliminare il numero d’identificazione. Se dovesse decidere di assumere nuovamente del personale, potrà richiedere la riattivazione del suo precedente numero d’identificazione in maniera telematica tramite l’applicazione “Wide“.

Inoltre, tutti i lavoratori stranieri (autonomi, dipendenti e stagisti/tirocinanti) che si recano in Belgio per effettuare delle prestazioni di lavoro anche temporanee hanno l’obbligo di comunicare la loro presenza alle autorità belghe prima di intraprendere qualsiasi attività lavorativa.

Questa comunicazione, chiamata “LIMOSA”, potrà farsi via internet per mezzo di un’applicazione Web e tra i dati richiesti si segnalano quelli relativi al lavoratore, all’attività da svolgere, all’orario di lavoro ed alla durata della prestazione.

L’autore di questo post è David Diris.

Chinese outbound M&A was one of the main topics of interest at the 2017 Hong Kong IFLR Forum on M&A in Asia, a great event with an outstanding level of speakers and very interesting discussions on various themes related to international investments.

All the attendants shared the view that momentum for Chinese overseas investments is still strong, despite the recent policy aiming at curbing the outflow of capitals from China.

A particularly interesting session was that on “best practices to overcome credibility and experience gaps increasingly faced by “off the radar” Chinese bidders”.

Opening a one-to-one negotiation or letting a Chinese company bid at an auction involves often great deal of uncertainty, as most participants to the session shared the experience of having seeing their Chinese counterpart walk away from the negotiation without any explanation (the so-called “Random Investors”).

I have scribbled down the take-aways of the discussion as follows.

Main clues to spot early on the Random investor:

- the Company pops out from nowhere and has no track record of overseas investments;

- the Company has no legal or financial advisors, or if they do, their advisors are not experienced in overseas transactions;

- the Company has excellent advisors… but has not paid their fees (yes, that happens)

- the target does not belong to the Company’s core business (and there is no explanation for their interest for the deal);

What should you do to be on the safe side?

- request a written declaration of interest, expressing the reasons why the Company wants to invest in the target and what is their mid term strategy, signed and stamped by the legal representative (if they are not ready to hand over this letter the game can stop here).

- If the Company represents a group of investors, require full disclosure and letters of confirmation from all parties, from day one (AC Milan’s case is a good example of what happens later on if there is no disclosure of all players, and their stakes in the deal);

- request proof that the Company has filed the application for the authorisation to invest overseas (due to the recent tightening of controls on capital outflow, this step is fundamental);

- request proof that they have the finance needed for the deal (either onshore or, better, off-shore);

- make clear that you will require a “break fee” (which can vary from 5 to 10%) in case they walk away from the negotiation (we have heard of US companies expecting 30 to 50% break fee on the value of the deal…)

Se per le persone fisiche il periodo d’imposta corrisponde sempre con l’anno solare, la situazione è differente per le società.

Il periodo d’imposta è l’anno finanziario ed il raccordo tra il periodo d’imposta e l’anno fiscale si basa sulla data di chiusura del bilancio.

Sono soggetti all’imposta delle società (d’ora in avanti I.Soc) le società, le associazioni, le istituzioni o le organizzazioni che:

- godono di personalità giuridica;

- hanno in Belgio la loro sede sociale, il loro principale stabilimento o la loro sede di direzione o di amministrazione;

- esercitano un’attività a scopo di lucro.

Le società devono effettuare dei versamenti anticipati al fine di evitare delle maggiorazioni d’imposta. Proprio per tale motivo è molto importante che la società effettui i versamenti anticipati in maniera corretta ed entro i termini.

Le società che dovranno effettuare tali versamenti in maniera anticipata sono:

- le società belghe che sono soggette all’imposta delle società;

- le società straniere che sono soggette all’imposta dei non residenti e che svolgono un’attività a carattere lucrativo.

Tuttavia, le società che sono considerate “piccole” ai sensi dell’art. 15 del Codice delle società (vedi infra) non sono obbligate ad effettuare i versamenti anticipati per i primi tre anni contabili a partire dalla loro costituzione.

Nel caso in cui le società obbligate ad effettuare i suddetti versamenti non adempiano o lo facciano in maniera tardiva, sarà applicata una maggiorazione d’imposta relativa al totale dei redditi imponibili.

Relativamente all’esercizio d’imposta 2016 (redditi 2015) sono imponibili:

- i ricavi realizzati o incassati nel 2015 dalle società che tengono la loro contabilità per anno solare;

- per le società che tengono la loro contabilità in maniera differente, i ricavi relativi ad un esercizio che si è concluso prima del 31 dicembre.

La base per il calcolo della maggiorazione è uguale al 103% dell’imposta dovuta sui ricavi che hanno dato luogo all’aumento. Questi ricavi saranno eventualmente diminuiti per un valore pari agli anticipi ed agli altri versamenti già effettuati (crediti di imposta, quota forfettaria di imposta straniera, etc…).

La tassa della maggiorazione è 1,125% per l’esercizio d’imposta 2016 (redditi 2015).

Per ottenere il valore della maggiorazione dovuta, la base della maggiorazione è quindi moltiplicata per 1,125%.

Nel caso in cui tale valore non raggiunga l’1% dell’imposta che rappresenta la base del suo calcolo o non abbia un valore di almeno 40 euro, non sarà dovuta alcuna maggiorazione.

Per le società il cui esercizio contabile coincide con l’anno civile, l’ammontare dei versamenti anticipati per l’anno 2015 si calcola come segue:

- occorre valutare l’ammontare dei ricavi per i quali l’imposta è soggetta a maggiorazione,

- si determina in maniera approssimativa l’imposta che sarà dovuta sull’ammontare precedentemente calcolato;

- si moltiplica questa imposta per 103%;

- si sottrae, se presente, il valore degli anticipi già versati;

- si divide per quattro l’ammontare dell’imposta annuale ottenuta;

- si versa quanto ottenuto ogni trimestre.

Come detto, effettuando i versamenti anticipati entro i termini si evita di incorrere in una maggiorazione d’imposta.

Per l’esercizio d’imposta 2016 (redditi 2015), l’ammontare di questa maggiorazione sarà calcolata come riportato di seguito.

Primo versamento anticipato (VA1): (VA1) x 1,50 %

Secondo versamento anticipato (VA2): (VA2) x 1,25 %

Terzo versamento anticipato (VA3): (VA3) x 1,00 %

Quarto versamento anticipato (VA4): (VA4) x 0,75 %

I versamenti dovranno essere effettuati entro i termini fissati che per l’anno di esercizio 2016 (redditi 2015) sono:

- per il primo trimestre, il 10 aprile 2015 (il primo versamento);

- per il secondo trimestre, il 10 luglio 2015 (il secondo versamento);

- per il terzo trimestre, il 12 ottobre 2015 (il terzo versamento);

- per il quarto trimestre, il 21 dicembre 2015 (il quarto versamento).

Tutti i versamenti effettuati oltre i termini previsti verranno automaticamente imputati al trimestre successivo.

Elementi del reddito imponibile

Per regola generale, ogni incremento dell’attivo di una società nato dalla sua attività costituisce un reddito imponibile. Alle riserve apparenti (riserve contabili) vanno aggiunte le riserve occulte, mentre non verranno conteggiate le riserve esenti al fine di determinare correttamente l’ammontare delle riserve tassabili.

- Riserve apparenti: tutti gli utili destinati a riserva che concorrono alla formazione del reddito imponibile qualunque sia il nome loro attribuito (riserva legale, riserva disponibile, riserva indisponibile, statutaria, etc…);

- Riserve occulte: la sottostima dell’attivo ed la sopravvalutazione del passivo formano delle riserve occulte che faranno comunque parte dei redditi imponibili;

- Riserve esenti: sono considerate tali quelle derivanti da:

- Plusvalenze: sono considerate tali quelle che rispettano la condizione di intangibilità;

- Fondi per rischi e oneri: condizione necessaria è che riguardino dei rischi e/o degli oneri ben precisi ed infatti la costituzione di tali fondi dovrà essere ben motivata;

- Riduzione del valore dei crediti commerciali: tale riduzione sarà integralmente deducibile quando si abbia una perdita certa e liquida.

La riforma dell’I.Soc. entrata in vigore nel 2003 concede la possibilità di costituire un’immunizzazione fiscale sotto forma di una riserva di investimento. Questa possibilità è concessa soltanto alle PMI (piccole e medie imprese) ai sensi del Codice delle società.

Una cifra uguale a tale riserva dovrà essere investita dalla società nel termine di 3 anni in immobilizzazioni ammortizzabili che possano portare a deduzioni per investimenti: il periodo di 3 anni inizia a decorrere dal primo giorno del periodo imponibile nel quale la riserva è stata costituita.

Le PMI secondo il Codice delle Società

Secondo l’art. 15 del Codice delle società sono « piccole » quelle società dotate di personalità giuridica che rispettino almeno due di questi valori:

- Media di lavoratori annuale: 50;

- Fatturato annuo: € 7.300.000;

- Bilancio: € 3.650.000.

Sono tuttavia escluse d’ufficio da tale definizione quelle aziende che pur rispettando gli altri requisiti hanno una media di lavoratori annui superiore alle 100 unità.

Per la definizione d’insieme dei criteri si veda l’art. 15 § 1-6 del Codice delle società.

Calcolo dell’imposta

L’imposta delle società (I.Soc.) è fissata al 33%, tuttavia potranno essere applicate delle imposte ridotte in maniera proporzionale nel caso in cui il reddito imponibile non superi € 322.500.

Reddito imponibile: 0 – 25.000 € à imposta applicabile: 24,25%

Reddito imponibile: 25.000 – 90.000 € à imposta applicabile: 31%

Reddito imponibile: 90.000 – 322.500 € à imposta applicabile: 34,50%

Reddito imponibile: 322.500 € à imposta applicabile: 33%

Tuttavia, per poter beneficiare di queste imposte ridotte, la società dovrà soddisfare degli altri requisiti che riguardano:

- l’attività della società: la società non potrà, infatti, detenere azioni o quote il cui valore d’investimento ecceda il 50% sia del valore rivalutato del capitale liberato sia di detto valore aumentato delle riserve tassate e delle plusvalenza contabili;

- l’azionariato della società: la possibilità di beneficiare di queste imposte ridotte non è concessa alla società le cui quote/azioni sono detenute per almeno la metà da uno o più soci;

- la remunerazione del capitale sociale: la possibilità di beneficiare di queste imposte ridotte non è concessa nel caso in cui il tasso di remunerazione del capitale sociale realmente liberato ancora da rimborsare all’inizio del periodo d’imposta superi il 13%;

- la remunerazione dei dirigenti d’impresa: la società è tenuta a stanziare nei confronti di almeno un dirigente, a conto del risultato del periodo d’imposta, una remunerazione uguale o superiore al risultato imponibile della società quando questo non superi i € 36.000.

Comparazione imposizione fiscale IVA – TVA (in %)

L’aliquota ridotta in Italia ammonta al 10%, mentre in Belgio vi sono due fasce, al 6% e al 12%. A differenza dell’Italia (4%), in Belgio non c’è un’aliquota minima.

L’aliquota normale è simile: 21 % per il Belgio, 22% per l’Italia.

In Belgio è dovuta un’aliquota del 12% detta “parking” su alcuni pneumatici e camere d’aria e su altri prodotti quali:

- carbone e combustibili solidi ottenuti da carboni fossili;

- lignite;

- coke e semi-coke di carbon fossile, lignite e torba;

- coke di oli incombusti usati come combustibili.

L’autore di questo post è David Diris.

Contrariamente ad altri paesi, il Belgio prevede delle fasi ben definite per la costituzione di una società. Innanzitutto occorre realizzare, tramite l’aiuto di un commercialista, un Business Plan che serva a determinare l’ammontare del capitale utile per la costituzione e per il funzionamento della società. Al piano finanziario dovranno necessariamente seguire la redazione dello statuto, l’apertura di un conto corrente bancario (per depositare il capitale), la sottoscrizione dei documenti dinnanzi al notaio ed infine la registrazione della società.

In questo breve articolo verranno riepilogati i 6 step necessari per costituire una società ed elencate tutte le spese che dovranno essere affrontate.

1. Le fasi di costituzione

Fase 1: l’atto costitutivo (statuto). Si tratta di un atto giuridico che consente la nascita di nuovi diritti. Quest’atto può assumere due forme: l’atto pubblico o la scrittura privata autenticata. In seguito occorrerà depositarlo presso la cancelleria del tribunale del commercio al fine di ottenere un numero identificativo dell’impresa.

Fase 2: apertura di un conto corrente bancario intestato alla società. Questo conto deve necessariamente essere differente da quello privato e dovrà essere utilizzato unicamente per il compimento delle operazioni relative all’attività del lavoratore autonomo o della società. Tale numero di conto dovrà comparire su tutti i documenti commerciali.

Fase 3: iscrizione al registro (Banque-Carrefour des entreprises). Si tratta di un registro dell’amministrazione belga che contiene tutti i dati identificativi di un’impresa. L’iscrizione a detto registro si effettua per mezzo degli sportelli d’impresa (guichets d’entreprises).

Fase 4: capacità imprenditoriale. Verifica delle condizioni d’accesso alle professioni regolamentate sul territorio. Esistono delle autorizzazioni amministrative che consentono di esercitare certe professioni all’interno del territorio belga. A tal fine occorre dimostrare le proprie competenze nella gestione, possedere determinati titoli di studio e certificare una conoscenza pratica professionale sufficiente.

Fase 5: iscrizione alla TVA. Questa fase sarà possibile una volta ottenuto il numero identificativo di impresa e non prevede alcun costo. Per ottenere l’iscrizione bisogna recarsi presso l’ufficio di controllo TVA del comune dove ha sede l’azienda o richiederla tramite lo sportello d’impresa (guichet d’entreprise).

Fase 6: occorre iscriversi presso un fondo di previdenza ed assistenza sociale. Questa iscrizione concede il diritto all’ottenimento delle prestazioni familiari, al trattamento pensionistico ed all’assicurazione per malattia.

La legge belga vieta qualsiasi domiciliazione fittizia di una società nel proprio territorio. Per questo motivo, prima di procedere alla registrazione della società, è molto frequente che vengano disposti dei controlli da parte degli “agenti di quartiere” che avranno il compito di verificare la veridicità o meno della sede sociale.

2. Le spese di costituzione

Indipendentemente dal costo proprio di ogni società al fine di dotarla del capitale sociale iniziale, è importante analizzare le spese relative alla creazione di un’impresa aggiornate al 2014:

Atto pubblico: da € 750 a € 1000 (a seconda della complessità). Obbligatorio per la costituzione di una SPRL, SPRL-starter, SA, SCRL e SCA

Diritti di scrittura degli atti notarili: € 95.

Spese di registrazione: € 25

Pubblicazione dell’atto sulla Gazzetta Ufficiale Belga: € 262,21 in formato cartaceo € 211,75 in formato elettronico. Tutte le pubblicazioni modificative dello statuto hanno un costo di € 153,79 cadauna.

Attivazione numero identificativo: € 82,50 (se la società ha diversi stabilimenti il costo è di € 82,50 per ogni stabilimento). La Banque-Carrefour des Entreprises (BCE) rilascia tale numero che deve essere convalidato e validato presso uno sportello di impresa (guichet d’entreprise).

Le spese di costituzione quindi ammontano a circa 1200 euro per una società in cui la responsabilità dei soci è limitata ed a circa 350 euro per una società in cui la responsabilità dei soci è illimitata: non occorre ovviamente dimenticare il capitale sociale che bisogna liberare per una SPRL e per una SA!

Ovviamente possono aggiungersi delle altre spese a quelle viste:

- se ci si affida a dei consulenti esterni per svolgere delle ricerche di mercato: potrebbe trattarsi di una spesa potenzialmente elevata;

- se si affida la redazione del piano finanziario ad un contabile;

- nel caso in cui l’oggetto del conferimento di uno o più soci è un bene in natura: in questo caso occorre una relazione da parte di un revisore d’impresa.

L’autore di questo post è David Diris.

With the Legge di Bilancio 2017 (Budget Law), in force since January 1st 2017, the Parliament has implemented a new strategy in order to kick-start the Italian economy with the adoption of a wide array of measures to support startups and small-medium enterprises both financially and fiscally with the purpose of making them more appealing to foreign investors.

The Budget Law has designed a comprehensive plan that involves certain tax breaks, the possibility for SMEs to raise funds through crowdfunding platforms and for the so-called “innovative” startups (meaning early-stage companies that meet certain criteria set by the law: i.e. high level technology of the company’s scope, R&D expenditure or number of graduates employed, etc.) to sell transfer their tax losses to listed companies. Overall, these tools mainly aim at unlocking the economic system that so far has not proved to be capable enough to provide early-stage startups and SMEs both with financial resources and tax benefits they need to develop innovative assets and scale up their business.

This set of measures can be divided under four groups, based on the relevant purposes:

- Fostering entrepreneurship and setting up innovative companies;

- Stimulating private investments directed to innovative startup/small-medium enterprises;

- Supporting R&D expenditure and

- Modernizing existing companies’ assets by their digitalization and automation, along with the development of innovative technologies.

Economic relief for setting up new companies

The strategy laid down by the Parliament involves the Ministry of the Economic Development (Mise), the National Institute for Insurance against Accidents at Work (Inail), and other public agencies, such as Invitalia, in order to boost the incorporation of startup companies and the development of innovative SMEs.

As matter of fact, the endowment of the Fund for Sustainable Growth (FCS – Fondo per la Crescita Sostenibile), aimed at providing soft loans to support the incorporation of innovative startup companies, has increased by Euro 47,5 millions for 2017 and 2018, respectively.

Furthermore, the Budget Law has also allocated the same amount of Euro 47,5 millions for both 2017 and 2018 in order to foster self-employment and entrepreneurship. These funds will be managed by Invitalia, the Government agency for inward investment promotion and enterprise development, and will be mostly employed to sustain the incorporation of companies by women and young entrepreneurs (aged 18 to 35 years). Invitalia shall be able to grant subsidized zero-interest loans for a maximum of eight years, which could cover up to 75% of total expenses as budgeted for specific investments. Companies will then have to fund the remaining amount as allocated in the business plan and carry out the envisaged investment within 24 months of the signing the loan agreement.

The Ministry of the Economic Development (Mise) has also issued a sets of measures that grant subsidies to support development programs carried out by startup companies with a focus to the acquisition of new machineries and technological equipment; hardware and software technologies; patents and licenses along with non-patented technical know-how directly connected to production/managerial needs.

The Budget Law – pending the approval of the relevant Ministries – also introduces the possibility for Inail to invest in closed-end funds dedicated to innovative startups or to directly set up and participate in technological business ventures.

Streamlining bureaucracy

No need for a notary and exemption from stamp duty and other administrative fees are some of the measures aimed at streamlining the procedure to set up a startup company. It will also be possible to draw up the articles of association and its subsequent amendments through the online procedure by means of qualified electronic signature.

Tax breaks for investments in innovative start-ups and SMEs

Pending the final approval of the European Commission, the Budget Law has introduced new incentives for those subjects that will invest in startup companies. Tax breaks concerning this kind of investments are not something new. Introduced in 2012 and originally conceived as temporary, with the Budget Law, these measures has not only been converted into permanent incentives, but also increased from 19% and 20%, for individuals and companies respectively, to 30% with no distinction as to the status of the investor (potential shareholder) for investment capped at Euro 1 million for individuals and Euro 1,8 millions for entities.

Since these tax breaks are aimed at encouraging investments in startups, these benefits are balanced out by the condition that the investment which has benefited from these measures is maintained in the target company for three years (instead of two, as provided for under the previous Budget Law). Furthermore, the Budget Law has extended these benefits also to innovative SMEs, that is all the small-medium enterprises operating in the field of technological innovation, regardless of their date of incorporation, since these companies will be relieved from presenting a plan attesting their innovative assets programs in order to access the benefits, as provided for previously.

A partnership between startups and listed companies that may benefit both parties

In the accompanying report to the Budget Law, the Government also has stressed the importance of involving listed companies in financing directly or indirectly startup projects and therefore it has introduced the possibility for startup companies to transfer the tax losses accrued in the first three fiscal years to a listed company provided that the certain requirements are met.

The transfer will be conducted according to the rule provided for the transfer of corporate tax credits; the transferee will be called to make up for the benefit received from the transferor and the remuneration paid to the startup will not be subject to taxation. Through this mechanism, the companies would benefit one another: the startup would find a financial “sponsor” and the listed company would be able to fully offset its taxable income with the tax losses received, considering also the possibility to carry forward the exceeding part to the following year.

Crowdfunding

Through a tweak to the Italian Consolidated Law on Finance (i.e. Testo Unico Finanza), the Budget Law got rid of some of the restrictions that prevented crowdfunding market to take off in Italy and introduced the possibility for any kind of SMEs to access equity crowdfunding. Previous legislation limited the possibility to raise funds through this system only to the innovative startups thus limiting the development of both SMEs and crowdfunding industry.

While the rules governing equity crowdfunding will be the same from the operators’ side (i.e. crowdfunding platforms), small-middle size companies will now have a new mean for collecting capital aside from those traditional channels such as bank financing and stock exchange listing.

Tax credit on R&D expenses

The tax credit related to the Research & Development expenses, introduced in 2013, has been extended until December 2020 and enhanced passing from 25% to 50% on all the eligible expenses in R&D activities, with an annual threshold capped at Euro 20 million (five times higher than the previous maximum limit).

Companies will be able to reduce their tax bill and claim compensation as a proportion of their R&D expenditure. The provision is now applicable to all R&D expenses, including the hiring of staff dedicated to R&D activities (with no particular requirement as to their qualification) and to any kind of company (resident and non-resident), group or network of enterprises, regardless of the dimension of the firm, its legal status and industry of reference.

This fiscal incentive can be combined with another one applicable to any employee benefiting the tax incentives provided for under work for equity schemes by innovative startups. Breaking it down, this means that in case the staff carrying out the R&D activities is benefiting of any work for equity plan, the company at issue will benefit of both of the tax breaks.

Development contracts for large investment projects

The development contracts (Contratti di sviluppo) are agreements between the Ministry of Economic Development (Mise), Invitalia and one or several companies (the latter through network contracts) engaged in development projects.

First introduced in 2011, these contracts have been devised to support large industrial/productive investments with a size of at least 20 million euro (7,5 millions only with regards to the agro-food industry).

Development contracts are financed by the Mise, with the participation of the relevant Regions involved (which could also participate in the investment). Invitalia acts as a referent for the promoting companies and it is also the subjects in charge of managing the resources along with the assessment of the applications.

These “contracts” target Italian as well as Italian-based foreign companies and provide financial benefits such as block grants on plant and equipment, soft loans and interest subsidies, whose dimension could vary depending on the size of the company and the type of project at issue (R&D expenditure, innovation-directed investments).

Invitalia sets a fast pace for the admission procedure as well as for the subsequent development plan: once the project has been approved, the companies will have 90 days to submit all the documents required; they will then have 6 months to start and 36 months to carry out the investment project.

As a token of the country’s will to come through, the program also provides for special fast-track courses for particular productive and digitalization-related investment projects.

Super Depreciation and Hyper depreciation

With regard to companies as widely considered, the Budget Law also extends the extra 40% depreciation deduction (which makes up a total tax depreciation of 140%) through 2017. Then, companies could deduct the expenses borne in order purchase tangible assets whose depreciation rate exceeds 6,5%. The incentive will be applicable only to those assets whose purchase order has been accepted by the supplier and paid for at least 20% by 31 December 2017. Aside from this, the Law has introduced a new extra 150% depreciation deduction (the so-called “hyper depreciation” that combined with the existing would make a total 250% depreciation deduction) for the purchase (or lease) of new technological assets, such as digitally-controlled machineries, equipment and so forth (the law outlines the complete range of eligible assets), acquired in order to atomize and digitalize enterprises.

Sabatini-ter

The Budget Law has also reintroduced the so-called “Sabatini”, a special legislation aimed at facilitating the purchase (or lease) of capital goods by small-medium enterprises by covering part of the interests on bank loans between Euro 20,000 and Euro 2 million, that has been extended until 31 December 2018. A specific and more generous measure will apply to the purchase of new assets connected with the Industry 4.0 plan. Part of the resources allocated will be directed to support innovation, efficiency and the creation of a “digital” industrial system that invests in new technological equipment such as cloud computing, broadband connections, cybersecurity, robotics, mechatronics and so forth.

In conclusion, the above-mentioned measures, applicable to any company based in Italy, represent a strategic milestone in the way to making Italian companies more competitive in the global market, in terms of both technology and financial resources. Given the lack of regulatory barriers to entry, this set of new rules can vitalize the Italian economic system also attracting foreign investors.

The author of this post is Milena Prisco.

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

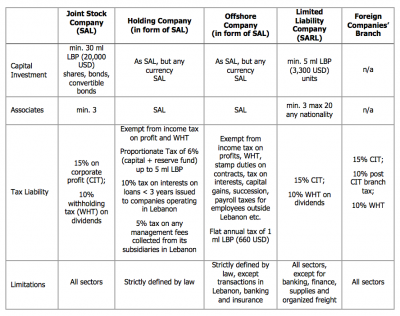

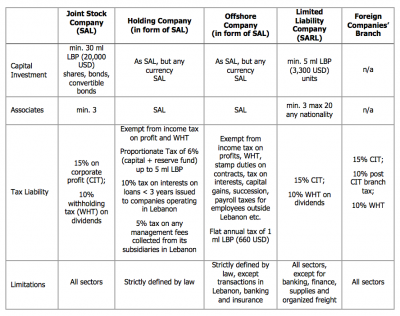

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

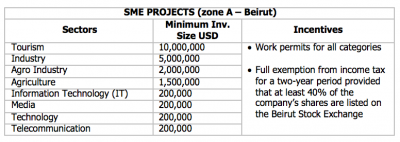

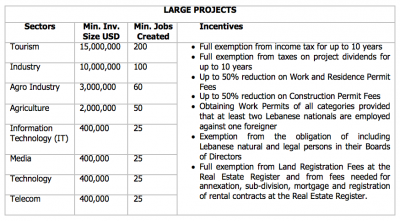

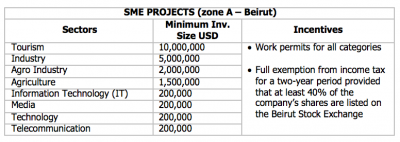

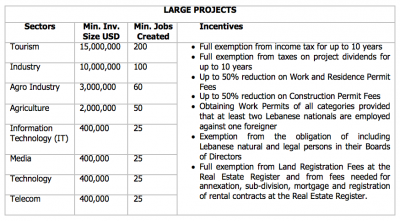

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.

The options available to foreign companies to set up business in Venezuela are (a) the registration of a branch; (b) the corporation; (c) the limited liability company; (d) the general partnership, (e) the limited partnership; (f) the stock limited partnership; and (g) the consortium. In this memorandum we use the term “company” to indistinctively refer to any of the options described in this paragraph, including the branch, the corporation or any of the partnership, but excluding the consortium.

The branch and the corporation are the two most common options used by foreign companies to do business in Venezuela. The corporate features of the companies are set forth in the Venezuelan code of commerce.

Corporation

The Venezuelan corporation is owned by shareholders and is a legal entity separate and distinct from its shareholders. The corporation is indistinctively known as compañía anónima (C.A.) or sociedad anónima (S.A.).

Limited Liability

The liability of the shareholders of a corporation is limited to the payment of the nominal value (and premium, if any) of the shares such shareholder owns. As a general rule, the shareholders of the corporation are not liable for the obligations of the corporation.

However, most Venezuelan commentators accept the piercing of the corporate veil by a Venezuelan court in the event of certain exceptional circumstances, such as: (a) when the corporate form −a legal and valid mean to conduct business− has been intentionally used against the purpose of the law to circumvent the application of a mandatory rule or to attain an otherwise illegal result (fraude a la ley or fraus legis); or (b) when there has been an abuse of the corporate form that has caused damages or an unfair consequence (abuso de derecho). Venezuelan courts have also accepted the application of the piercing of corporate veil when the separation of the legal entity from its shareholders would produce an unfair situation or when the corporate form is abused to avoid a legal consequence. In addition, the Constitutional Chamber of the Venezuelan Supreme Court issued a widely criticized opinion (Transporte Saet case) in which it applied the piercing of corporate veil doctrine without explaining or invoking an exceptional circumstance to do so. In the decision, the Supreme Court held that any company that is part of an economic group may be held liable for the obligations of any other party of the group. Note however, that this decision was related to a labor matter.

Foreign Direct Investments

The only areas currently reserved to companies owned or controlled by Venezuelan investors are open-air television, radio broadcasting, newspapers in Spanish and professional services regulated by law. There are other areas, such as oil, that are reserved to the Venezuelan government in which foreign investors may participate only through minority participations in joint venture companies with the Republic or Venezuelan state-owned companies.

Foreign investors (i.e., foreign companies (head offices), foreign shareholders or foreign partners) must register their direct foreign investments in a Venezuelan company (branch, corporation or partnership) with the Venezuelan foreign investment authority within 60 days following the date on which investment was made (the “foreign investment registration”).

Several documents must be submitted to the Venezuelan foreign investment authority by the foreign investor to obtain the foreign investment registration, including evidence that the capital of the company was paid with foreign currency or contribution in kind that entered Venezuela. To obtain such evidence, the foreign investor must (a) in case of payment in cash, order a wire transfer to the Venezuelan bank account of the company from an account of the foreign investor located outside Venezuela (as a result of the wire transfer, foreign currency transferred out of the offshore account of the investor will be converted into bolivars at the official exchange rate and deposited in bolivars in the Venezuelan bank account), and (b) in the case of contribution in kind, demonstrate that the asset being contributed to the capital of the company was imported into Venezuela (copies of the import manifest, commercial invoice and other custom documents).

The foreign investment registration must be updated annually by the foreign investor within 120 days of the end of the fiscal year.

Financing a company

The corporation must have a stated or subscribed capital (“stated capital”), which is the amount of capital that the shareholders of the corporation agree to subscribe.

Although there are no statutory minimum capital requirements applicable to the stated capital, each Venezuelan commercial registry sets forth a minimum stated capital requirement on a case-by-case basis or depending on the purpose of the corporation.

The stated capital of the corporation can be paid in cash or in kind. In case of payment in cash, at least 20% of the stated capital must be paid by the shareholders at the time of the registration of the shareholders’ meeting approving the incorporation of the corporation or the corresponding capital increase (the amount of stated capital already paid by the shareholders is known as “paid-in capital”). Payment in cash of the stated capital must be made by a deposit in bolivars in a bank account opened with a Venezuelan bank under the name of the corporation. In case of payment in kind, assets for a value equal to 100% of the stated capital must be contributed to the corporation. To be eligible for foreign investment registration, the stated capital must be paid out of foreign currency or assets brought into Venezuela from abroad.

The stated capital of the corporation is represented by shares. The shares can only be issued in registered form (bearer shares are not permitted). All shares must have a par value (valor nominal), and such par value must be denominated in bolivars. The stated capital of the corporation is equal to the sum of the nominal value of the shares.

The corporation can issue different classes of shares. Issuance of shares of different classes is convenient where different shareholders or groups of shareholders are each entitled to appoint a number of directors. Preferred shares can also be issued, granting their holders preferences in the payment of dividends, liquidation or otherwise.

The ownership of the shares of a corporation is evidenced by the notations made in the book of shareholders kept by the corporation. Shares can also be represented in certificates, but the issuance of share certificates is not required

The corporation must have at least two shareholders at the time of incorporation. However, immediately after incorporation, all the shares of the corporation may be transferred to one of the shareholders and thus the corporation may become a wholly-owned subsidiary of such shareholder.

The only areas currently reserved to companies owned or controlled by Venezuelan investors are open-air television, radio broadcasting, newspapers in Spanish and professional services regulated by law. There are other areas, such as oil, that are reserved to the Venezuelan government in which foreign investors may participate only through minority participations in joint venture companies with the Republic or Venezuelan state-owned companies.

As in most other jurisdictions, there are certain controls on money laundering which generally require banks and other professional bodies to identify clients and their sources of funding and to report suspicious transactions.

Opening a branch office

The registration of a branch (sucursal) in Venezuela by a foreign company does not result in a separate legal entity being formed in Venezuela. Therefore, the foreign company (head office) will be liable for all the obligations assumed by the branch.

The branch must be registered with a Venezuelan commercial registry located in the city of domicile of the branch, and such registration must then be published in a Venezuelan newspaper. The foreign company can choose the domicile of the branch.

The name generally used for the branch is the same name of the foreign company (head office) or its abbreviation followed by the expression Sucursal Venezuela (which means Venezuelan branch).

The branch must have at least one representative. The branch representative will have full powers to represent and manage the branch, except for the power to sell or transfer the business (unless such power is expressly granted to the representative). Any limitations to the powers of the representative are not effective against third parties. If the branch representative is not a Venezuelan citizen, he may have to obtain a working visa in order to sign documents on behalf of the branch before public notaries or registries in Venezuela.

The foreign company must assign a capital to the branch (capital asignado or “branch capital”). The branch capital does not constitute a limitation of the liability of the foreign company (head office), since the branch is not considered a legal entity separate from the foreign company. Although there are no statutory minimum capital requirements applicable to the branch capital, the Venezuelan commercial registry sets forth a minimum branch capital requirement on a case-by-case basis.

The branch capital must be paid by the foreign company (head office), either in cash or in kind. In case of payment in cash, an amount in bolivars equal to the branch capital must be deposited in a bank account opened with a Venezuelan bank under the name of the branch. In case of payment in kind, assets for a value equal to the branch capital must be contributed to the branch. To be eligible for foreign investment registration, the branch capital must be paid out of foreign currency or assets brought into Venezuela from abroad.

Unlike the corporation, the branch is not required to appoint statutory auditors or file annual balance sheets with the commercial registry. However, the branch is required to keep accounting books for tax purposes, i.e. the journal book, the ledger book, the inventory book and the VAT books.

The branch capital and any subsequent increases in the branch capital are subject to a registration tax equal to 1-2% of the branch capital, plus other registration fees and expenses, the tax depend on the commercial registry.

Filings with the Commercial Registry

All Venezuelan companies must be registered with a Commercial Registry. The Commercial Registry contains copies of the company’s articles of incorporation and by-laws, information on its standing (i.e. annual financial statements, liquidation or bankruptcy proceedings), registered address, directors and officers, the existence of branches, and other information. All information filed with the Commercial Registries is public. Companies must notify the Commercial Registry of changes to their articles of incorporation and by-laws and update other information filed with the registry. Companies must also file annual financial statements and periodically file minutes of shareholders appointing directors and officers.

Opening a bank account

Opening a Venezuelan bank account is required to incorporate a corporation or register a branch in Venezuela. The bank account shall be opened with a Venezuelan bank under the name of the corporation or the branch by one of its authorized representatives.

A non-resident (individual or corporation) can also open a bank account in Venezuela. The bank must only check the non-resident’s identity and capacity. In the case of a corporation, the requirements are: (i) the articles of incorporation duly apostilled or legalized by the Consulate of Venezuela in the respective country and translated in Spanish by interpreter public; (ii) the Fiscal Information Registry (RIF) issued by the Venezuelan fiscal authorities; (iii) the Identity Card for Venezuelan or foreign natural persons resident in the country, empowered to mobilize the account; and (iv) the minutes of shareholders meeting in which the authorization granted to the persons empowered to mobilize the account to act on behalf of the Company.

Additional information may be required by banks to better identify the corporation or the persons authorized to mobilize the account in accordance with anti-money laundering and other banking regulation.

Utilising office space

Office spaces may either be owned by the Company or rented. Multinational companies may often acquire offices or acquire land and construct their own offices, especially given the existing Venezuelan exchange controls, see section on Regulatory Compliance below.

Rental rates in Venezuela, and in particular in Caracas, are usually high, even when compared to international standards, Residential leases are strictly controlled under Venezuelan law; these controls do not apply to commercial leases.

Immigration controls

Foreign individuals intending to work in Venezuela are required to obtain a working visa or a business visa. Working visas grant their holders the right to a continued stay in Venezuela for an extendable one-year term, renewable for the same term, and authorize their holders to work in Venezuela as well as to enter into and depart from Venezuelan without restrictions. Business visas are granted to foreign citizens traveling to Venezuela to conduct business or to take part in commercial, technical, advisory, scientific, or cultural activities. Business visas are primarily designed for brief stays in the country and are valid for one year from the date of issue, renewable for the same term, entitling the holders to multiple entries during that term. However, under this type of visa the holder is limited to a maximum length of stay in the country of not more than six months. The process to obtain visas may be cumbersome.

The author of this post is Fulvio Italiani

Setting up a company in Switzerland: Corporate bodies

30 Gennaio 2017

-

Svizzera

- Diritto societario

In a previous post we outlined how a foreign investor may conduct a business in Argentina and, specifically, we analysed the main characteristics of the Limited Liability Companies (Sociedades de Responsabilidad Limitada “SRL”).

In this post we are going to focus the attention on another type of company: the Joint Stock Corporation – Sociedades Anónimas (“SA”).

The main differences between Sociedades de Responsabilidad Limitada and Sociedades Anónimas are the following:

- The transfer of SRL quotas shall be registered in the Registry of Commerce. On the contrary, the transfer of shares shall only be registered in the Shareholders’ Register of the SA.

- Number of partners cannot be more than 50 in the SRL, while in the SA there is only the minimum number of 2.

- Board of Directors of a SA has the obligation of meeting at least every 3 months, while in the SRL the management does not have such obligation.

- In a SRL, the partner who has the majority vote does not need the vote of another partner to approve decisions. On the other hand, one shareholder with the majority vote can manage a SA without the favorable vote of any other shareholder.

Main characteristics of the Argentinian Stock Corporations: las Sociedades Anónimas (“SA”)

Shareholders: A minimum of two shareholders is required, and they may be resident or non-resident in Argentina.

Corporate capital: The minimum capital currently required by law is equal to Argentina Pesos (ARS) 100.000 (approximately USD 6.250), of which only 25% must be paid in at the time of the corporate organization. The balance shall be paid within a maximum term of two years from the incorporation. However, the Public Registry of Commerce may require an initial corporate capital amount higher than ARS 100,000 in case – having regards to the nature and characteristics of the businesses involved by the corporate purpose – the corporate capital is considered overtly inappropriate.

Liability SA: Shareholders liability is limited to the amount of capital invested. The sole limitation to this rule is the “lifting of the corporate veil” doctrine, applicable only when a company has been organized or used for fraudulent purposes, in order to abuse the liability limitation.

Legal Books and Records SA: There are 4 company books and records provided by the law: 1) Shareholders’ Register; 2) Register of attendance at General Meetings; 3) Minutes of General Meetings; and 4) Minutes of Directors’ Meetings.

Administration: The Board of Directors is the body in charge of the company administration. Its members do not need to be shareholders or residents in Argentina. However, the law requires that the Board of Directors meets at least four times a year with the physical presence of the majority of its members. The law also requires that the majority of the Directors are domiciled in Argentina.

If the corporate capital amounts to ARS 10.000.000 (approximately USD 625.000) or more, the minimum number of Directors is three; otherwise, the law does not impose any minimum number of directors.

The President of the Board of Directors has the power of legal representation of the company and, in case of his/her absence, the Vice President may act as the company’s legal representative.

In addition to and notwithstanding the above, the company’s representation may be conferred through powers of attorney issued by the Board of Directors for specific purposes (banking, administrative affairs, judicial, etc.).

Supervision SA: If the SA’s corporate capital is lower than ARS 10.000.000 no Syndic (a kind of internal auditor, with the duty to ensure that the company formally complies with the law) need to be appointed. If the capital is above said amount, the S.A. must organize a supervisory body composed of Syndics.

The SA that does not make public offer of its stock capital may appoint only one principal Syndic and one alternate Syndic. The principal Syndic and the alternate Syndic are elected by the Shareholders. To be elected Syndic it is necessary to be a lawyer or a public accountant domiciled in Argentina. Employees, directors or managers of the company or its parent or subsidiary companies may not be syndics. Shareholders may remove Syndics at their own discretion.

Governing body: The corporate authority governing the SA and adopting resolutions is the Shareholders’ Meeting, competent – among other issues – to approve the Annual Balance Sheet of the company, to appoint and/or remove its Directors and Syndics and to deal with any other item related to the company’s ordinary course of business.

Financial statements, Balance Sheets and Accounts SA: Annual financial statements must be submitted for the consideration of the Stakeholders’ Meeting. Argentine law provides that the Annual financial statements must be filed also with the Public Registry of Commerce.

The author of this post is Tomás García Navarro.

Nel momento in cui s’intraprende un’attività autonoma in Belgio, scatta immediatamente l’obbligo d’iscrizione presso un Fondo di assicurazione sociale (Caisse d’Assurances Sociales).

Inoltre, quando un datore di lavoro decide di assumere del personale, dovrà necessariamente assolvere delle incombenze:

- innanzitutto, è necessario che il datore di lavoro che assuma per la prima volta uno o più lavoratori si registri all’Ufficio nazionale di previdenza sociale (ONSS) quale datore di lavoro. Questa identificazione oggi potrà effettuarsi online tramite l’applicazione “Wide“;

- effettuata l’iscrizione, l’ONSS attribuisce un numero identificativo sulla base delle informazioni comunicate attraverso il formulario d’identificazione. Questo numero si compone di tre parti:

- una prima parte, composta da tre cifre, indica le particolarità applicabili al datore di lavoro per il calcolo dei contributi;

- il numero di identificazione vero e proprio, composto da sei o sette cifre;

- un numero di controllo di due cifre che permette di stabilire se il numero d’identificazione è corretto.

Durante tutto il periodo nel quale si è registrati quali datori di lavoro, occorre comunicare obbligatoriamente all’ONSS un determinato numero d’informazioni, come per esempio qualsiasi cambiamento riguardante l‘attività esercitata o una variazione relativa agli assegni familiari.

Inoltre sarà possibile comunicare un certo numero d’informazioni supplementari, le quali non sono tuttavia obbligatorie, in quanto la BCE aggiorna periodicamente l’ONSS sulle eventuali modifiche, quali per esempio le variazioni di indirizzo o la modifica della denominazione o della forma sociale.

Dall’1 gennaio 2005 ogni datore di lavoro è identificato presso la BCE attraverso l’attribuzione di un numero identificativo unico. In un’ottica di semplificazione amministrativa, il numero d’impresa costituirà il solo numero identificativo del datore di lavoro rimpiazzando anche il numero d’identificazione rilasciato dall’ ONSS.

Nel caso in cui il datore di lavoro non abbia lavoratori per un trimestre consecutivo dovrà avvisare entro la fine di detto trimestre l’ONSS, attraverso una dichiarazione effettuata tramite un apposito formulario.

Mentre nel caso in cui il datore di lavoro decida di interrompere la propria attività o rimanga senza personale per un periodo superiore ad un trimestre dovrà avvisare l’ONSS. Quest’ultimo provvederà a eliminare il numero d’identificazione. Se dovesse decidere di assumere nuovamente del personale, potrà richiedere la riattivazione del suo precedente numero d’identificazione in maniera telematica tramite l’applicazione “Wide“.

Inoltre, tutti i lavoratori stranieri (autonomi, dipendenti e stagisti/tirocinanti) che si recano in Belgio per effettuare delle prestazioni di lavoro anche temporanee hanno l’obbligo di comunicare la loro presenza alle autorità belghe prima di intraprendere qualsiasi attività lavorativa.

Questa comunicazione, chiamata “LIMOSA”, potrà farsi via internet per mezzo di un’applicazione Web e tra i dati richiesti si segnalano quelli relativi al lavoratore, all’attività da svolgere, all’orario di lavoro ed alla durata della prestazione.

L’autore di questo post è David Diris.

Chinese outbound M&A was one of the main topics of interest at the 2017 Hong Kong IFLR Forum on M&A in Asia, a great event with an outstanding level of speakers and very interesting discussions on various themes related to international investments.

All the attendants shared the view that momentum for Chinese overseas investments is still strong, despite the recent policy aiming at curbing the outflow of capitals from China.

A particularly interesting session was that on “best practices to overcome credibility and experience gaps increasingly faced by “off the radar” Chinese bidders”.

Opening a one-to-one negotiation or letting a Chinese company bid at an auction involves often great deal of uncertainty, as most participants to the session shared the experience of having seeing their Chinese counterpart walk away from the negotiation without any explanation (the so-called “Random Investors”).

I have scribbled down the take-aways of the discussion as follows.

Main clues to spot early on the Random investor:

- the Company pops out from nowhere and has no track record of overseas investments;

- the Company has no legal or financial advisors, or if they do, their advisors are not experienced in overseas transactions;

- the Company has excellent advisors… but has not paid their fees (yes, that happens)

- the target does not belong to the Company’s core business (and there is no explanation for their interest for the deal);

What should you do to be on the safe side?

- request a written declaration of interest, expressing the reasons why the Company wants to invest in the target and what is their mid term strategy, signed and stamped by the legal representative (if they are not ready to hand over this letter the game can stop here).

- If the Company represents a group of investors, require full disclosure and letters of confirmation from all parties, from day one (AC Milan’s case is a good example of what happens later on if there is no disclosure of all players, and their stakes in the deal);

- request proof that the Company has filed the application for the authorisation to invest overseas (due to the recent tightening of controls on capital outflow, this step is fundamental);

- request proof that they have the finance needed for the deal (either onshore or, better, off-shore);

- make clear that you will require a “break fee” (which can vary from 5 to 10%) in case they walk away from the negotiation (we have heard of US companies expecting 30 to 50% break fee on the value of the deal…)

Se per le persone fisiche il periodo d’imposta corrisponde sempre con l’anno solare, la situazione è differente per le società.

Il periodo d’imposta è l’anno finanziario ed il raccordo tra il periodo d’imposta e l’anno fiscale si basa sulla data di chiusura del bilancio.

Sono soggetti all’imposta delle società (d’ora in avanti I.Soc) le società, le associazioni, le istituzioni o le organizzazioni che:

- godono di personalità giuridica;

- hanno in Belgio la loro sede sociale, il loro principale stabilimento o la loro sede di direzione o di amministrazione;

- esercitano un’attività a scopo di lucro.

Le società devono effettuare dei versamenti anticipati al fine di evitare delle maggiorazioni d’imposta. Proprio per tale motivo è molto importante che la società effettui i versamenti anticipati in maniera corretta ed entro i termini.

Le società che dovranno effettuare tali versamenti in maniera anticipata sono:

- le società belghe che sono soggette all’imposta delle società;

- le società straniere che sono soggette all’imposta dei non residenti e che svolgono un’attività a carattere lucrativo.

Tuttavia, le società che sono considerate “piccole” ai sensi dell’art. 15 del Codice delle società (vedi infra) non sono obbligate ad effettuare i versamenti anticipati per i primi tre anni contabili a partire dalla loro costituzione.

Nel caso in cui le società obbligate ad effettuare i suddetti versamenti non adempiano o lo facciano in maniera tardiva, sarà applicata una maggiorazione d’imposta relativa al totale dei redditi imponibili.

Relativamente all’esercizio d’imposta 2016 (redditi 2015) sono imponibili:

- i ricavi realizzati o incassati nel 2015 dalle società che tengono la loro contabilità per anno solare;

- per le società che tengono la loro contabilità in maniera differente, i ricavi relativi ad un esercizio che si è concluso prima del 31 dicembre.

La base per il calcolo della maggiorazione è uguale al 103% dell’imposta dovuta sui ricavi che hanno dato luogo all’aumento. Questi ricavi saranno eventualmente diminuiti per un valore pari agli anticipi ed agli altri versamenti già effettuati (crediti di imposta, quota forfettaria di imposta straniera, etc…).

La tassa della maggiorazione è 1,125% per l’esercizio d’imposta 2016 (redditi 2015).

Per ottenere il valore della maggiorazione dovuta, la base della maggiorazione è quindi moltiplicata per 1,125%.

Nel caso in cui tale valore non raggiunga l’1% dell’imposta che rappresenta la base del suo calcolo o non abbia un valore di almeno 40 euro, non sarà dovuta alcuna maggiorazione.

Per le società il cui esercizio contabile coincide con l’anno civile, l’ammontare dei versamenti anticipati per l’anno 2015 si calcola come segue:

- occorre valutare l’ammontare dei ricavi per i quali l’imposta è soggetta a maggiorazione,

- si determina in maniera approssimativa l’imposta che sarà dovuta sull’ammontare precedentemente calcolato;

- si moltiplica questa imposta per 103%;

- si sottrae, se presente, il valore degli anticipi già versati;

- si divide per quattro l’ammontare dell’imposta annuale ottenuta;

- si versa quanto ottenuto ogni trimestre.

Come detto, effettuando i versamenti anticipati entro i termini si evita di incorrere in una maggiorazione d’imposta.

Per l’esercizio d’imposta 2016 (redditi 2015), l’ammontare di questa maggiorazione sarà calcolata come riportato di seguito.

Primo versamento anticipato (VA1): (VA1) x 1,50 %

Secondo versamento anticipato (VA2): (VA2) x 1,25 %

Terzo versamento anticipato (VA3): (VA3) x 1,00 %

Quarto versamento anticipato (VA4): (VA4) x 0,75 %

I versamenti dovranno essere effettuati entro i termini fissati che per l’anno di esercizio 2016 (redditi 2015) sono:

- per il primo trimestre, il 10 aprile 2015 (il primo versamento);

- per il secondo trimestre, il 10 luglio 2015 (il secondo versamento);

- per il terzo trimestre, il 12 ottobre 2015 (il terzo versamento);

- per il quarto trimestre, il 21 dicembre 2015 (il quarto versamento).

Tutti i versamenti effettuati oltre i termini previsti verranno automaticamente imputati al trimestre successivo.

Elementi del reddito imponibile

Per regola generale, ogni incremento dell’attivo di una società nato dalla sua attività costituisce un reddito imponibile. Alle riserve apparenti (riserve contabili) vanno aggiunte le riserve occulte, mentre non verranno conteggiate le riserve esenti al fine di determinare correttamente l’ammontare delle riserve tassabili.

- Riserve apparenti: tutti gli utili destinati a riserva che concorrono alla formazione del reddito imponibile qualunque sia il nome loro attribuito (riserva legale, riserva disponibile, riserva indisponibile, statutaria, etc…);

- Riserve occulte: la sottostima dell’attivo ed la sopravvalutazione del passivo formano delle riserve occulte che faranno comunque parte dei redditi imponibili;

- Riserve esenti: sono considerate tali quelle derivanti da:

- Plusvalenze: sono considerate tali quelle che rispettano la condizione di intangibilità;

- Fondi per rischi e oneri: condizione necessaria è che riguardino dei rischi e/o degli oneri ben precisi ed infatti la costituzione di tali fondi dovrà essere ben motivata;

- Riduzione del valore dei crediti commerciali: tale riduzione sarà integralmente deducibile quando si abbia una perdita certa e liquida.

La riforma dell’I.Soc. entrata in vigore nel 2003 concede la possibilità di costituire un’immunizzazione fiscale sotto forma di una riserva di investimento. Questa possibilità è concessa soltanto alle PMI (piccole e medie imprese) ai sensi del Codice delle società.

Una cifra uguale a tale riserva dovrà essere investita dalla società nel termine di 3 anni in immobilizzazioni ammortizzabili che possano portare a deduzioni per investimenti: il periodo di 3 anni inizia a decorrere dal primo giorno del periodo imponibile nel quale la riserva è stata costituita.

Le PMI secondo il Codice delle Società

Secondo l’art. 15 del Codice delle società sono « piccole » quelle società dotate di personalità giuridica che rispettino almeno due di questi valori:

- Media di lavoratori annuale: 50;

- Fatturato annuo: € 7.300.000;

- Bilancio: € 3.650.000.

Sono tuttavia escluse d’ufficio da tale definizione quelle aziende che pur rispettando gli altri requisiti hanno una media di lavoratori annui superiore alle 100 unità.

Per la definizione d’insieme dei criteri si veda l’art. 15 § 1-6 del Codice delle società.

Calcolo dell’imposta

L’imposta delle società (I.Soc.) è fissata al 33%, tuttavia potranno essere applicate delle imposte ridotte in maniera proporzionale nel caso in cui il reddito imponibile non superi € 322.500.

Reddito imponibile: 0 – 25.000 € à imposta applicabile: 24,25%

Reddito imponibile: 25.000 – 90.000 € à imposta applicabile: 31%

Reddito imponibile: 90.000 – 322.500 € à imposta applicabile: 34,50%

Reddito imponibile: 322.500 € à imposta applicabile: 33%

Tuttavia, per poter beneficiare di queste imposte ridotte, la società dovrà soddisfare degli altri requisiti che riguardano:

- l’attività della società: la società non potrà, infatti, detenere azioni o quote il cui valore d’investimento ecceda il 50% sia del valore rivalutato del capitale liberato sia di detto valore aumentato delle riserve tassate e delle plusvalenza contabili;

- l’azionariato della società: la possibilità di beneficiare di queste imposte ridotte non è concessa alla società le cui quote/azioni sono detenute per almeno la metà da uno o più soci;

- la remunerazione del capitale sociale: la possibilità di beneficiare di queste imposte ridotte non è concessa nel caso in cui il tasso di remunerazione del capitale sociale realmente liberato ancora da rimborsare all’inizio del periodo d’imposta superi il 13%;

- la remunerazione dei dirigenti d’impresa: la società è tenuta a stanziare nei confronti di almeno un dirigente, a conto del risultato del periodo d’imposta, una remunerazione uguale o superiore al risultato imponibile della società quando questo non superi i € 36.000.

Comparazione imposizione fiscale IVA – TVA (in %)

L’aliquota ridotta in Italia ammonta al 10%, mentre in Belgio vi sono due fasce, al 6% e al 12%. A differenza dell’Italia (4%), in Belgio non c’è un’aliquota minima.

L’aliquota normale è simile: 21 % per il Belgio, 22% per l’Italia.

In Belgio è dovuta un’aliquota del 12% detta “parking” su alcuni pneumatici e camere d’aria e su altri prodotti quali:

- carbone e combustibili solidi ottenuti da carboni fossili;

- lignite;

- coke e semi-coke di carbon fossile, lignite e torba;

- coke di oli incombusti usati come combustibili.

L’autore di questo post è David Diris.

Contrariamente ad altri paesi, il Belgio prevede delle fasi ben definite per la costituzione di una società. Innanzitutto occorre realizzare, tramite l’aiuto di un commercialista, un Business Plan che serva a determinare l’ammontare del capitale utile per la costituzione e per il funzionamento della società. Al piano finanziario dovranno necessariamente seguire la redazione dello statuto, l’apertura di un conto corrente bancario (per depositare il capitale), la sottoscrizione dei documenti dinnanzi al notaio ed infine la registrazione della società.

In questo breve articolo verranno riepilogati i 6 step necessari per costituire una società ed elencate tutte le spese che dovranno essere affrontate.

1. Le fasi di costituzione

Fase 1: l’atto costitutivo (statuto). Si tratta di un atto giuridico che consente la nascita di nuovi diritti. Quest’atto può assumere due forme: l’atto pubblico o la scrittura privata autenticata. In seguito occorrerà depositarlo presso la cancelleria del tribunale del commercio al fine di ottenere un numero identificativo dell’impresa.

Fase 2: apertura di un conto corrente bancario intestato alla società. Questo conto deve necessariamente essere differente da quello privato e dovrà essere utilizzato unicamente per il compimento delle operazioni relative all’attività del lavoratore autonomo o della società. Tale numero di conto dovrà comparire su tutti i documenti commerciali.

Fase 3: iscrizione al registro (Banque-Carrefour des entreprises). Si tratta di un registro dell’amministrazione belga che contiene tutti i dati identificativi di un’impresa. L’iscrizione a detto registro si effettua per mezzo degli sportelli d’impresa (guichets d’entreprises).

Fase 4: capacità imprenditoriale. Verifica delle condizioni d’accesso alle professioni regolamentate sul territorio. Esistono delle autorizzazioni amministrative che consentono di esercitare certe professioni all’interno del territorio belga. A tal fine occorre dimostrare le proprie competenze nella gestione, possedere determinati titoli di studio e certificare una conoscenza pratica professionale sufficiente.

Fase 5: iscrizione alla TVA. Questa fase sarà possibile una volta ottenuto il numero identificativo di impresa e non prevede alcun costo. Per ottenere l’iscrizione bisogna recarsi presso l’ufficio di controllo TVA del comune dove ha sede l’azienda o richiederla tramite lo sportello d’impresa (guichet d’entreprise).

Fase 6: occorre iscriversi presso un fondo di previdenza ed assistenza sociale. Questa iscrizione concede il diritto all’ottenimento delle prestazioni familiari, al trattamento pensionistico ed all’assicurazione per malattia.

La legge belga vieta qualsiasi domiciliazione fittizia di una società nel proprio territorio. Per questo motivo, prima di procedere alla registrazione della società, è molto frequente che vengano disposti dei controlli da parte degli “agenti di quartiere” che avranno il compito di verificare la veridicità o meno della sede sociale.

2. Le spese di costituzione

Indipendentemente dal costo proprio di ogni società al fine di dotarla del capitale sociale iniziale, è importante analizzare le spese relative alla creazione di un’impresa aggiornate al 2014:

Atto pubblico: da € 750 a € 1000 (a seconda della complessità). Obbligatorio per la costituzione di una SPRL, SPRL-starter, SA, SCRL e SCA

Diritti di scrittura degli atti notarili: € 95.

Spese di registrazione: € 25

Pubblicazione dell’atto sulla Gazzetta Ufficiale Belga: € 262,21 in formato cartaceo € 211,75 in formato elettronico. Tutte le pubblicazioni modificative dello statuto hanno un costo di € 153,79 cadauna.