-

Francia

France – PFAS risks: impacts on professional liability for insurance sectors in France and Europe

6 Giugno 2024

- Contenzioso

PFAS are chemicals that have been used in industry for over 50 years. Between 4,000 and 5,000 varieties are used for various everyday consumer applications, and they are renowned for their non-stick, waterproofing, and heat-resistant properties. They have come under scrutiny in recent years, and are covered by European regulations, as they are in the USA, where the public authorities have imposed maximum use values, as well as reporting obligations. EU Regulation 2019/1021 (POP) restricts the production and use of certain categories of PFAS in specific industries or above certain values and their use with food products. France has gone further, regulating the levels of discharges into watercourses.

Scientific research suspects that PFAS cause illnesses such as cancer and reproductive disorders. Given the extent of contamination not only in everyday products but also in the environment, particularly waterways, the issue is likely to pose major public health problems in the years to come. This concern is more pressing given that PFASs are considered ‘eternal pollutants’, as there is currently no way of eliminating them from the environment.

The impact on companies’ and insurers’ liability is already significant. In the USA, more than 6,000 lawsuits have been filed since 2005. Three groups have already paid more than USD 1.2 billion in settlements due to contamination, and another group has paid more than USD 10 billion to end a class action.

In France, the Metropole of Lyon has brought a summary expert appraisal action against two chemical companies before considering bringing a liability action. In addition, several criminal complaints have been lodged for endangering the lives of others and damaging the environment.

Under French law, companies and their insurers could be liable on various legal grounds. In addition to ordinary civil liability law – based on article 1240 of the Civil Code – the special system of liability for defective products could also serve as a basis for a liability action (articles 1245 et seq. of the Civil Code), with French law defining a defect as any product that does not offer the safety that can legitimately be expected.

Although it is currently difficult to identify a causal link with an identified disease, asbestos-related case law has shown in the past that victims can take action if they can demonstrate that they suffered anxiety-related harm as a result of their exposure to the product, even if they are not positively suffering from a disease at the time of their claim.

In addition, the reporting obligations imposed by the public authorities will undoubtedly facilitate the filing of liability actions by facilitating the identification of the emitters and users of these pollutants.

Insurers are directly affected by this phenomenon, which for them constitutes an “emerging” risk (“silent cover”) because, for the most part, this risk was not identified when the policy was taken out, which exposes them directly and is all the more problematic because insurance premiums have not been able to take such a risk into account.

Civil liability or professional indemnity insurance policies, especially if they are drafted with “all risks except” clauses (“tous risques sauf” in French legal vocabulary, i.e. covering all liability risks vis-à-vis third parties except those strictly listed), as well as those including clauses relating to environmental risks, are particularly targeted.

Lloyd’s has already published model exclusion clauses for the attention of insurers, although such clauses can obviously only cover future insurance contracts or endorsements:

https://www.lmalloyds.com/LMA_Bulletins/LMA23-039-SD.aspx

The clauses contained in insurance policies must be drafted with particular care, considering each country’s specific features. In France, for example, to be enforceable against the insured, clauses must be “formal and limited”, which means that the exclusion must be both clearly expressed and that it must be possible to determine its content perfectly.

For example, the Court of Cassation recently ruled that the use of the terms “such as” or “in particular” (“tells que” “en particulier”) in an exclusion clause led to confusion in the interpretation of the exclusion clause, rendering it invalid (Civ. 2e, 26 Nov. 2020, no. 19-16.435). There was also a debate on the validity of an exclusion clause relating to bodily injury caused by asbestos, a risk which at the time had not been identified by insurers, who subsequently excluded it from most policies (Cass. 2e civ., 21 Sept. 2023, nos. 21-19801 and 21-19776). Similarly, policies should clearly indicate whether cover is provided based on a harmful event or based on a claim (i.e “base dommage” or “base reclamation”, which indicates if the risk is covered, depending on if the damage happened during the policy was valid, or if it depends on the moment when the risk was notified by the insured during such period).

One thing is sure: the risks associated with PFAS and claims are only just beginning to emerge in Europe, where the conditions for group actions have recently been extended with EU Directive 2020/1828, which came into force on 25 June 2023 and is currently the subject of a draft law under discussion in the French Parliament with a view to its transposition.

La legge contro l’ultra fast-fashion è stata concepita per fronteggiare la crescente preoccupazione riguardante l’impatto ambientale, economico e sulla salute provocato dall’inondazione del mercato con tessuti e accessori di moda da parte di giganti come SHEIN, TEMU, PRIMARK e altri. Queste aziende, spesso trascurando le conseguenze delle loro pratiche, hanno contribuito significativamente all’incremento delle emissioni di gas serra attribuite all’industria tessile, che ora si stima essere responsabile per circa l’8% del totale globale.

In un contesto dove la produzione globale di abbigliamento ha visto un raddoppio in soli 14 anni e la durata di vita degli indumenti si è ridotta di un terzo, il marchio SHEIN ha registrato una crescita esponenziale del 100% tra il 2021 e il 2022, evidenziando ulteriormente la problematica del fast fashion che domina il mercato francese, nonostante in alcuni settori si stia vivendo una rinascita dell’artigianalità e del design made in France.

La risposta delle autorità francesi si è concretizzata nel disegno di legge n. 2129, volto a ridurre l’impatto ambientale dell’industria tessile, proposto da un deputato del Governo e adottato all’unanimità dall’Assemblea Nazionale il 14 marzo 2024, che nelle prossime settimane verrà esaminato dal Senato con una procedura accelerata, prima della definitiva adozione.

Questa normativa si propone di sensibilizzare i consumatori sull’importanza della sobrietà e della sostenibilità nell’industria della moda, promuovendo pratiche di riutilizzo, riparazione, e riciclaggio, e introducendo penalizzazioni per i produttori che non rispettano determinati standard ecologici.

Di seguito le misure principali.

1. Definizione legale di fast-fashion e obblighi informativi

Viene istituita una definizione legale di fast-fashion, identificato come la pratica di “messa a disposizione o distribuzione di un gran numero di riferimenti a nuovi prodotti (…) anche attraverso un fornitore di mercato online” e gli operatori di questo settore hanno l’obbligo di “visualizzare sulle loro piattaforme di vendita online messaggi che incoraggino la sobrietà, il riutilizzo, la riparazione e il riciclaggio dei prodotti e che sensibilizzino sul loro impatto ambientale. Il messaggio deve essere visualizzato in modo chiaro, leggibile e comprensibile su qualsiasi formato utilizzato, in prossimità del prezzo. Il contenuto dei messaggi è definito per decreto.”

Questa norma disciplina tutte le vendite online (anche su piattaforme) mentre non include le piattaforme per la rivendita di prodotti invenduti.

La violazione di questa disposizione comporta sanzioni amministrative fino a 3.000 € per le persone fisiche e 15.000 € per le persone giuridiche.

2. Limiti alla pubblicità (anche tramite influencer)

Il disegno di legge vieta la pubblicità dei prodotti di fast fashion, anche tramite influencer, al fine di ridurre la promozione di pratiche insostenibili nell’industria della moda, incentivando così un cambiamento nei modelli di consumo.

In caso di adozione definitiva, questa disposizione entrerà in vigore a partire dal 1o gennaio 2025.

La violazione di questa disposizione comporta sanzioni amministrative fino a 20.000 € per le persone fisiche e 100.000 € per le persone giuridiche, e fino al raddoppio in caso di recidiva.

3. Altri obblighi e sistema di disincentivi

La legge riguarda tutti i produttori (industriali, fabbricanti, grossisti, importatori), distributori e rivenditori francesi al pubblico e prevede anche altri obblighi, come: l’adesione a un’organizzazione ecologica (Refashion), il pagamento di un eco-contributo, l’etichettatura conforme e l’obbligo di esporre i risultati della valutazione dell’impatto ambientale del prodotto, che può portare ad una sanzione o all’ottenimento di un bonus.

Etichettatura e sull’eco-contributo CTA

La legge AGEC prevede attualmente una sanzione massima del 20% del prezzo di vendita del prodotto, IVA esclusa, se questo presenta caratteristiche ambientali scadenti. Considerati i prezzi a cui i prodotti fast-fashion sono venduti ai consumatori, l’impatto sui produttori è minimo (ad esempio, una maglietta da 4 euro), pertanto ora la proposta è quella di innalzare questa sanzione a un massimo del 50% del prezzo di vendita del prodotto.

Questa sanzione sarà determinata in base all’obbligo di mostrare l’analisi dell’impatto ambientale del prodotto. Le sanzioni saranno quindi fisse (e non in percentuale sul prezzo del prodotto), sotto forma di un malus progressivo fino al 2030:

- 5 euro per ogni prodotto immesso sul mercato nel 2025

- 6 euro per ogni prodotto immesso sul mercato nel 2026

- 7 euro per ogni prodotto immesso sul mercato nel 2027

- 8 euro per ogni prodotto immesso sul mercato nel 2028

- 9 euro per ogni prodotto immesso sul mercato nel 2029

- 10 euro per ogni prodotto immesso sul mercato nel 2030

Con un limite massimo fissato al 50% del prezzo di vendita.

Questo incremento avrà un impatto sul produttore un anno dopo, quando questi dichiarerà e verserà l’eco-contributo a Refashion e si applica esclusivamente ai produttori di prodotti di fast fashion. I fondi raccolti verranno utilizzati dagli organismi ecologici per finanziare infrastrutture di raccolta e riciclo in paesi al di fuori dell’Unione Europea.

Le società straniere sono soggette a questi obblighi?

Sì, se l’azienda ha sede legale all’estero, ma effettua vendite in Francia, sarà soggetta alle stesse obbligazioni e sanzioni previste dalla legislazione francese, secondo il principio del “produttore esteso”, stabilito dall’articolo L541-10 del codice dell’ambiente francese.

Le società straniere dovranno nominare un rappresentante in Francia a tal fine e non potranno in alcun modo aggirare gli obblighi e le sanzioni stabilite dalla normativa in oggetto.

A cosa prestare attenzione, adesso?

Il Senato sta attualmente esaminando il testo legislativo.

Parallelamente, il governo francese sta pianificando due iniziative aggiuntive: primo, avviare una campagna comunicativa per valorizzare il settore tessile francese e combattere l’ultra fast-fashion; secondo, proporre la creazione di una coalizione internazionale con l’obiettivo di vietare l’esportazione di rifiuti tessili verso i paesi incapaci di gestirli in maniera sostenibile, in linea con le disposizioni della Convenzione di Basilea. è attualmente all’esame del Senato.

Inoltre, è prevista la pubblicazione di un decreto che stabilirà i livelli di produzione, definendo così i produttori interessati da queste misure. Chiaramente questo decreto avrà un impatto estremamente rilevante, perché a seconda dei limiti individuati (si sta discutendo se individuare un limite giornaliero o annuale minimo di capi di abbigliamento) definirà il perimetro di applicazione della norma.

Given the significance of the influencer market (over €21 billion in 2023), which now encompasses all sectors, and with a view for transparency and consumer protection, France, with the law of June 9, 2023, proposed the world’s first regulation governing the activities of influencers, with the objective of defining and regulating influencer activities on social media platforms.

However, influencers are subject to multiple obligations stemming from various sources, necessitating the utmost vigilance, both in drafting influence agreements (between influencers and agencies or between influencers and advertisers) and in the behaviour they must adopt on social media or online platforms. This vigilance is particularly heightened as existing regulations do not cover the core of influencers’ activities, especially their status and remuneration, which remain subject to legal ambiguity, posing risks to advertisers as regulatory authorities’ scrutiny intensifies.

Key points to remember

- Influencers’ activity is subject to numerous regulations, including the law of June 9, 2023.

- This law not only regulates the drafting of influence contracts but also the influencer’s behaviour to ensure greater transparency for consumers.

- Every influencer whose audience includes French users is affected by the provisions of the law of June 9, 2023, even if they are not physically present in French territory.

- Both the law of June 9, 2023, and the “Digital Services Act,” as well as the proposed law on “fast fashion,” foresee increasing accountability for various actors in the commercial influence sector, particularly influencers and online platforms.

- Despite a plethora of regulations, the status and remuneration of influencers remain unaddressed issues that require special attention from advertisers engaging with influencers.

The law of June 9, 2023, regulating influencer activity

The definition of influencer professions

The law of June 9, 2023, provides two essential definitions for influencer activities:

- Influencers are defined as ‘natural or legal persons who, for consideration, mobilize their notoriety with their audience to communicate to the public, electronically, content aimed at promoting, directly or indirectly, goods, services, or any cause, engaging in commercial influence activities electronically.’

- The activity of an influencer agent is defined as ‘that which consists of representing, for consideration,’ the influencer or a possible agent ‘with the aim of promoting, for consideration, goods, services, or any cause‘ (article 7) The influencer agent must take ‘necessary measures to ensure the defense of the interests of the persons they represent, to avoid situations of conflict of interest, and to ensure the compliance of their activity‘ with the law of June 9, 2023.

The obligations imposed on commercial messages created by the influencer

The law sets forth obligations that influencers must adhere to regarding their publications:

- Mandatory particulars: When creating content, this law imposes an obligation on influencers to provide information to consumers, aiming for transparency towards their audience. Thus, influencers are required to clearly, legibly, and identifiably indicate on the influencer’s image or video, regardless of its format and throughout the entire viewing duration (according to modalities to be defined by decree):

– The mention “advertisement” or “commercial collaboration.” Violating this obligation constitutes deceptive commercial practice punishable by two years’ imprisonment and a fine of €300,000 (Article 5 of the law of June 9, 2023).

– The mention of “altered images” (modification by image processing methods aimed at refining or thickening the silhouette or modifying the appearance of the face) or “virtual images” (images created by artificial intelligence). Failure to do so may result in a one-year prison sentence and a fine of €4,500 (Article 5 of the law of June 9, 2023).

- Prohibited or regulated promotions: This law reminds certain prohibitions, subject to criminal and administrative sanctions, stemming from French law on the direct or indirect promotion of certain categories of products and services, under penalty of criminal or administrative sanctions. This includes the promotion of products and services related to:

– health: surgery, aesthetic medicine, therapeutic prescriptions, and nicotine products;

– non-domestic animals, unless it concerns an establishment authorized to hold them;

– financial: contracts, financial products, and services;

– sports-related: subscriptions to sports advice or predictions;

– crypto assets: if not from registered actors or have not received approval from the AMF;

– gambling: their promotion prohibited for those under 18 years old and regulated by law;

– professional training: their promotion is not prohibited but regulated.

The accountability of influencer behaviour

The law also holds influencers accountable from the contracting of their relationships and when they act as sellers:

- Regulation of commercial influence agreements: This law imposes, subject to nullity, from a certain threshold of influencer remuneration (defined by decree), the formalization in writing of the agreement between the advertiser and the influencer, but also, if applicable, between the influencer’s agent, and the mandatory stipulation of certain clauses (remuneration, mission description, etc.).

- Influencer responsibility as a cyber seller: Influencers engaging in drop shipping (selling products without handling their delivery, done by the supplier) must provide the buyer with all information in French as required by Article L. 221-5 of the Consumer Code about the product, such as its availability and legality (i.e., guarantee that the product is not counterfeit), applicable product warranty, and supplier identity. Additionally, influencers must ensure the proper delivery and receipt of products and, in case of default, compensate the buyer. Influencers are also logically subject to obligations regarding deceptive commercial practices (for more information, the DGCCRF website explain the dropshipping).

The accountability of other actors in the commercial influence ecosystem

Joint and several liability is set by law, for the advertiser, influencer, or influencer’s agent for damages caused to third parties in the execution of the commercial influence contract, allowing the victim of the damage to act against the most solvent party.

Furthermore, the law introduces accountability for online platforms by partially incorporating the European Regulation 2022/2065 on digital services (known as the “DSA“) of October 19, 2022.

French regulation and international influencers

Influencers established outside the European Union (including also Switzerland and the EEA) who promote products or services to a French audience must obtain professional liability insurance from an insurer established within the EU. They must also designate a legal or natural person providing “a form of representation” (SIC) within the EU. This representative (whose regime is not very clear) is remunerated to represent the influencer before administrative and judicial authorities and to ensure the compliance of the influencer’s activity with law of June 9, 2023.

Furthermore, according to law of June 9, 2023, when the contract binding the influencer (or their agency) aims to implement a commercial influence activity electronically “targeting in particular an audience established in French territory” (SIC), this contract should be exclusively subject to French law (including the Consumer Code, the Intellectual Property Code, and the law of June 9, 2023). According to this law, the absence of such a stipulation would be sanctioned by the nullity of the contract. Law of June 9, 2023, seems to be established as an overriding mandatory law capable of setting aside the choice of a foreign law.

However, the legitimacy (what about compliance with the definition of overriding mandatory rules established by Regulation Rome I?) and effectiveness (what if the contract specifies a foreign law and a foreign jurisdiction?) of such a legal provision can be questioned, notably due to its vague and general wording. In fact, it should be the activity deployed by the “foreign” influencer to their community in France that should be apprehended by French overriding mandatory rules, rather than the content of the agreement concluded with the advertiser (which itself could also be foreign, by the way).

The other regulations governing the activity of influencers

The European regulations

The DSA further holds influencers accountable because, in addition to the reporting mechanism imposed on platforms to report illicit content (thus identifying a failing influencer), platforms must ensure (and will therefore shift this responsibility to the influencer) the identification of commercial communications and specific transparency obligations towards consumers.

The «soft law»

As early as 2015, the Advertising Regulatory Authority (“ARPP”) issued recommendations on best practices for digital advertising. Similarly, in March 2023, the French Ministry of Economy published a “code of conduct” for influencers and content creators. In 2023, the European Commission launched a legal information platform for influencers. Although non-binding, these rules, in addition to existing regulations, serve as guidelines for both influencers and content creators, as well as for judicial and administrative authorities.

The special status of child influencers

The law of October 19, 2020, aimed at regulating the commercial exploitation of children’s images on online platforms, notably opens up the possibility for child influencers to be recognized as salaried workers. However, this law only targeted video-sharing platforms. Article 2 of the law of June 9, 2023, extended the provisions regarding child influencer labor introduced by the 2020 law to all online platforms. Finally, a recent law aimed at ensuring respect for the image rights of children was published on February 19, 2024, introducing a principle of joint and several responsibility of both parents in protecting the minor’s image rights.

The status and remuneration of influencers: uncertainty persists

Despite the diversity of regulations applicable to influencers, none address their status and remuneration.

The status of the influencer

In the absence of regulations governing the status of influencers, a legal ambiguity persists regarding whether the influencer should be considered an independent contractor, an employee (as is partly the case for models or artists), or even as a brand representative (i.e. commercial agent), depending on the missions contractually entrusted to the influencer.

The nature of the contract and the applicable social security regime stem from the missions assigned to the influencer:

- In the case of an employment contract, the influencer will fall under the general regime for employees and assimilated persons, based on Articles L. 311-2 or 311-3 of the French Social Security Code.

- In the case of a service contract, the influencer will fall under the regime for self-employed workers.

The existence of a relationship of subordination between the advertiser and the influencer typically determines the qualification of an employment contract. Subordination is generally characterized when the employer gives orders and directives, has the power to control and sanction, and the influencer follows these directives. However, some activities are subject to a presumption of an employment contract; this is the case (at least in part) for artist contracts under Article L. 7121-3 of the French Labor Code and model contracts under Article L. 7123-2 of the French Labor Code.

The remuneration of the influencer

The influencer can be remunerated in cash (fixed or proportional) and/or in kind (for example: receiving a product from the brand, invitations to private or public events, coverage of travel expenses, etc.). The influencer’s remuneration must be specified in the influencer agreement and is directly impacted by the influencer’s status, as certain obligations (minimum wage, payment of social security contributions, etc.) apply in the case of an employment contract.

Furthermore, the remuneration (for the influencer’s services) must be distinguished from that of the transfer of their copyrights or image rights, which are subject to separate remuneration in exchange for the IP rights transferred.

The influencers… in the spotlight

The law of June 9, 2023, grants the French authority (i.e. the Consumer Affairs, Competition and Fraud Prevention Agency, “DGCCRF”) new injunction powers (with reinforced penalties). This comes in addition to the recent creation of a “commercial influence squad“, within the DGCCRF, tasked with monitoring social networks, and responding to reports received through Signal Conso. The law provides for fines and the possibility of blocking content.

As early as August 2023, the DGCCRF issued warnings to several influencers to comply with the new regulations on commercial influence and imposed on them the obligation to publicly disclose their conviction for non-compliance with the new provisions regarding transparency to consumers on their own social networks, a heavy penalty for actors whose activity relies on their popularity (DGCCRF investigation on the commercial practices of influencers).

On February 14, 2024, the European Commission and the national consumer protection authorities of 22 EU member states, Norway, and Iceland published the results of an analysis conducted on 570 influencers (the so-called “clean-up operation” of 2023 on influencers): only one in five influencers consistently presented their commercial content as advertising.

In response to environmental, ethical, and quality concerns related to “fast fashion,” a draft law aiming to ban advertising for fast fashion brands, including advertising done by influencers (Proposal for a law aiming to reduce the environmental impact of the textile industry), was adopted by the National Assembly on first reading on March 14, 2024.

Lastly, the law of June 9, 2023, has been criticized by the European Commission, which considers that the law would contravene certain principles provided by EU law, notably the principle of “country of origin,” according to which the company providing a service in other EU countries is exclusively subject to the law of its country of establishment (principle initially provided for by the E-commerce Directive of June 8, 2000, and included in the DSA). Some of its provisions, particularly those concerning the application of French law to foreign influencers, could therefore be subject to forthcoming – and welcome – modifications.

SUMMARY: In large-scale events such as the Paris Olympics certain companies will attempt to “wildly” associate their brand with the event through a practice called “ambush marketing”, defined by caselaw as “an advertising strategy implemented by a company in order to associate its commercial image with that of an event, and thus to benefit from the media impact of said event, without paying the related rights and without first obtaining the event organizer’s authorization” (Paris Court of Appeal, June 8, 2018, Case No 17/12912). A risky and punishable practice, that might sometimes yet be an option yet.

Key takeaways

- Ambush marketing might be a punished practice but is not prohibited as such;

- As a counterpart of their investment, sponsors and official partners benefit from an extensive legal protection against all forms of ambush marketing in the event concerned, through various general texts (counterfeiting, parasitism, intellectual property) or more specific ones (e.g. sport law);

- The Olympics Games are subject to specific regulations that further strengthen this protection, particularly in terms of intellectual property.

- But these rights are not absolute, and they are still thin opportunities for astute ambush marketing.

The protection offered to sponsors and official partners of sporting and cultural events from ambush marketing

With a budget of over 4 billion euros, the 2024 Olympic and Paralympic Games are financed mostly by various official partners and sponsors, who in return benefit from a right to use Olympic and Paralympic properties to be able to associate their own brand image and distinctive signs with these events.

Ambush marketing is not punishable as such under French law, but several scattered texts provide extensive protection against ambush marketing for sponsors and partners of sporting or cultural continental-wide or world-wide events. Indeed, sponsors are legitimately entitled to peacefully enjoy the rights offered to them in return for large-scale investments in events such as the FIFA or rugby World Cups, or the Olympic Games.

In particular, official sponsors and organizers of such events may invoke:

- the “classic” protections offered by intellectual property law (trademark law and copyright) in the context of infringement actions based on the French Intellectual Property Code,

- tort law (parasitism and unfair competition based on article 1240 of the French Civil Code);

- consumer law (misleading commercial practices) based on the French Consumer Code,

- but also more specific texts such as the protection of the exploitation rights of sports federations and sports event organizers derived from the events or competitions they organize, as set out in article L.333-1 of the French Sports Code, which gives sports event organizers an exploitation monopoly.

The following ambush marketing practices were sanctioned on the abovementioned grounds:

- The use of a tennis competition name and of the trademark associated with it during the sporting event: The organization of online bets, by an online betting operator, on the Roland Garros tournament, using the protected sign and trademark Roland Garros to target the matches on which the bets were organized. The unlawful exploitation of the sporting event, was punished and 400 K€ were allowed as damages, based on article L. 333-1 of the French Sports Code, since only the French Tennis Federation (F.F.T.) owns the right to exploit Roland Garros. The use of the trademark was also punished as counterfeiting (with 300 K€ damages) and parasitism (with 500 K€ damages) (Paris Court of Appeal, Oct. 14, 2009, Case No 08/19179);

- An advertising campaign taking place during a film festival and reproducing the event’s trademark: The organization, during the Cannes Film Festival, of a digital advertising campaign by a cosmetics brand through the publication on its social networks of videos showing the beauty makeovers of the brand’s muses, in some of which the official poster of the Cannes Film Festival was visible, one of which reproduced the registered trademark of the “Palme d’Or”, was punished on the grounds of copyright infringement and parasitism with a 50 K€ indemnity (Paris Judicial Court, Dec. 11, 2020, Case No19/08543);

- An advertising campaign aimed at falsely claiming to be an official partner of an event: The use, during the Cannes Film Festival, of the slogan “official hairdresser for women” together with the expressions “Cannes” and “Cannes Festival”, and other publications falsely leading the public to believe that the hairdresser was an official partner, to the detriment of the only official hairdresser of the Cannes festival, was punished on the grounds of unfair competition and parasitism with a 50 K€ indemnity (Paris Court of Appeal, June 8, 2018, Case No 17/12912).

These financial penalties may be combined with injunctions to cease these behaviors, and/or publication in the press under penalty.

An even greater protection for the Paris 2024 Olympic Games

The Paris 2024 Olympic Games are also subject to specific regulations.

Firstly, Article L.141-5 of the French Sports Code, enacted for the benefit of the “Comité national olympique et sportif français” (CNOSF) and the “Comité de l’organisation des Jeux Olympiques et Paralympiques de Paris 2024” (COJOP), protects Olympic signs such as the national Olympic emblems, but also the emblems, the flag, motto and Olympic symbol, Olympic anthem, logo, mascot, slogan and posters of the Olympic Games, the year of the Olympic Games “city + year”, the terms “Jeux Olympiques”, “Olympisme”, “Olympiade”, “JO”, “olympique”, “olympien” and “olympienne”. Under no circumstances may these signs be reproduced or even imitated by third-party companies. The COJOP has also published a guide to the protection of the Olympic trademark, outlining the protected symbols, trademarks and signs, as well as the protection of the official partners of the Olympic Games.

Secondly, Law no. 2018-202 of March 26, 2018 on the organization of the 2024 Olympic and Paralympic Games adds even more specific prohibitions, such as the reservation for official sponsors of advertising space located near Olympic venues, or located on the Olympic and Paralympic torch route. This protection is unique in the context of the Olympic Games, but usually unregulated in the context of simple sporting events.

The following practices, for example, have already been sanctioned on the above-mentioned grounds:

- Reproduction of a logo imitating the well-known “Olympic” trademark on a clothing collection: The marketing of a collection of clothing, during the 2016 Olympic Games, bearing a logo (five hearts in the colors of the 5 Olympic colors intersecting in the image of the Olympic logo) imitating the Olympic symbol in association with the words “RIO” and “RIO 2016”, was punished on the grounds of parasitism (10 K€ damages) and articles L. 141-5 of the French Sports Code (35 K€) and L. 713-1 of the French Intellectual Property Code (10 K€ damages) (Paris Judicial Court, June 7, 2018, Case No16/10605);

- The organization of a contest on social networks using protected symbols: During the 2018 Olympic Games in PyeongChang, a car rental company organized an online game inviting Internet users to nominate the athletes they wanted to win a clock radio, associated with the hashtags “#JO2018” (“#OJ2018”), “#Jeuxolympiques” (“#Olympicsgame”) or “C’est parti pour les jeux Olympiques” (“let’s go for the Olympic Games”) without authorization from the CNOSF, owner of these distinctive signs under the 2018 law and article L.141-5 of the French Sport Code and punished on these grounds with 20 K€ damages and of 10 K€ damages for parasitism (Paris Judicial Court, May 29, 2020, n°18/14115).

These regulations offer official partners greater protection for their investments against ambush marketing practices from non-official sponsors.

Some marketing operations might be exempted

An analysis of case law and promotional practices nonetheless reveals the contours of certain advertising practices that could be authorized (i.e. not sanctioned by the above-mentioned texts), provided they are skillfully prepared and presented. Here are a few exemples :

- Communication in an offbeat or humorous tone: An offbeat or even humorous approach can help to avoid the above-mentioned sanctions:

In 2016, for example, the Intersnack group’s Vico potato chips brand launched a promotional campaign around the slogan “Vico, partner of home fans” in the run-up to the Euro and Olympic Games.

Irish online betting company Paddy Power had sponsored a simple egg-in-the-spoon race in “London” (… a village in Burgundy, France), to display in London during the 2012 Olympics the slogan “Official Sponsor of the largest athletics event in London this year! There you go, we said it. (Ahem, London France that is)“. At the time, the Olympic Games organizing committee failed to stop the promotional poster campaign.

During Euro 2016, for which Carlsberg was the official sponsor, the Dutch group Heineken marketed a range of beer bottles in the colors of the flags of 21 countries that had “marked its history”, the majority of which were however participating in the competition.

- Communication of information for advertising purposes: The use of the results of a rugby match and the announcement of a forthcoming match in a newspaper to promote a motor vehicle and its distinctive features was deemed lawful: “France 13 Angleterre 24 – the Fiat 500 congratulates England on its victory and looks forward to seeing the French team on March 9 for France-Italy” (France 13 Angleterre 24 – la Fiat 500 félicite l’Angleterre pour sa victoire et donne rendez-vous à l’équipe de France le 9 mars pour France-Italie) the judges having considered that this publication “merely reproduces a current sporting result, acquired and made public on the front page of the sports newspaper, and refers to a future match also known as already announced by the newspaper in a news article” (Court of cassation, May 20, 2014, Case No 13-12.102).

- Sponsorship of athletes, including those taking part in Olympic competitions: Subject to compliance with the applicable regulatory framework, particularly as regards models, any company may enter into partnerships with athletes taking part in the Olympic Games, for example by donating clothing bearing the desired logo or brand, which they could wear during their participation in the various events. Athletes may also, under certain conditions, broadcast acknowledgements from their partner (even if unofficial). Rule 40 of the Olympic Charter governs the use of athletes’, coaches’ and officials’ images for advertising purposes during the Olympic Games.

The combined legal and marketing approach to the conception and preparation of the message of such a communication operation is essential to avoid legal proceedings, particularly on the grounds of parasitism; one might therefore legitimately contemplate advertising campaigns, particularly clever, or even malicious ones.

La legge antispreco detta « Anti-gaspillage pour une économie circulaire » AGEC n°2020-105 è stata promulgata il 10.02.2020 ed è entrata in vigore il 1.08.2021, nata con l’obiettivo di cambiare profondamente il sistema attuale da un’economia lineare (produrre, consumare, smaltire) ad una economia circolare.

Cosa prevede la normativa:

- introduzione del principio «chi inquina paga»;

- un migliore sistema di informazione del consumatore.

La legge è composta da 130 articoli delimitata in 5 aree principali di intervento:

- abbandonare la plastica mono-uso;

- informare meglio i consumatori;

- lotta allo spreco e al riutilizzo solidale;

- agire contro l’obsolescenza programmata;

- miglioramento della produzione

Lotta al greenwashing

Inoltre, la legge protegge il consumatore dell’effeto greenwashing vietando l’uso delle parole “biodegradabile”, “ecologico” o qualsiasi altra indicazione simile per qualsiasi prodotto o imballaggio.

Cosa cambia

Dal 1° gennaio 2022, tutti “metteurs sur le marché” cioè quelli che fabbricano o fanno fabbricare, quelli che importano o introducono sul territorio nazionale e che non hanno un proprio sistema di riciclaggio approvato dal governo devono secondo il tipo di prodotto venduto :

- aderire ad un eco-organismo (ce ne sono per ciascun tipologia di prodotto),

- dichiarare il volume di vendita e pagare il contributo corrispondente

- adattare l’etichetta del prodotto con le menzione obbligatorie in Francia ed il logo Triman.

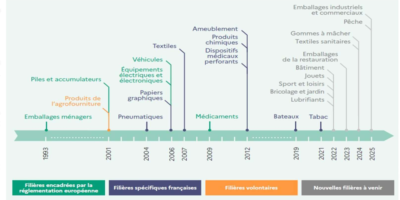

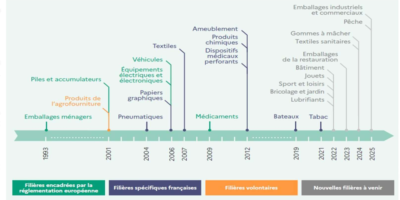

Le filiere esistenti

Il logo Triman

Esistono diversi tipi di logo Triman a seconda del tipo di prodotti. Ecco alcuni esempi e scadenze

- TESSILI, BIANCHERIA E CALZATURE

Al 01.02.2023 (oppure 01.08.2023 per I prodotti fabbricati prima del 01.02.2023), il logo deve essere apposto su tutti i prodotti tessili, la biancheria per la casa e le calzature. Inoltre va apposto il logo della raccolta differenziata e vanno indicate le informazioni obbligatorie su come smaltire i rifiuti.

Le altre informazioni obbligatorie devono essere riportate in lingua francese su vari supporti come l’etichetta di composizione, temporanea, direttamente sul prodotto mediante stampa o ricamo, adesivo.

Infine, si deve aderire all’eco-organismo Re-fashion.

- MOBILI

Tutti i mobili prodotti dopo il 9.12.2022 per essere venduti in Francia devono avere il logo Triman con il corretto avviso di smistamento sul prodotto o sull’imballaggio. Gli articoli già prodotti senza il marchio possono essere venduti fino al 9.06.2023.

A partire dal momento che i distributori/ fornitori vendono direttamente sul territorio francese, devono essere iscritti all’organismo Eco-mobilier ed indicare la tassa corrispondente per ciascun mobile durante tutto il percorso di acquisto del consumatore.

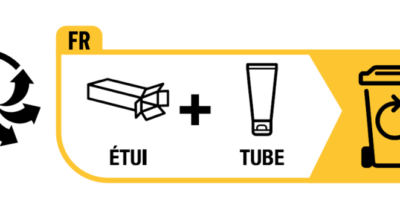

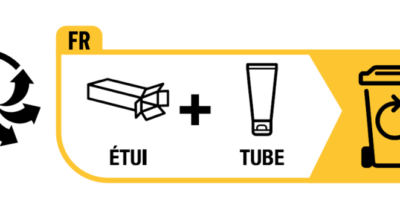

- PACKAGING

Il logo è obbligatorio dal 30.11.2022 con periodo di transizione per i prodotti già immessi sul mercato francese prima di tale data, fino al 30.05.2023.

Se l’etichetta italiana corrisponde agli standard francesi, oltre ad apporre il logo Triman qui sotto, si dovrà tradurre il testo in francese.

Sanzioni

Ai sensi dell’art. L541-9-4 della legge AGEC , qualsiasi violazione degli obblighi di marcatura e di informazione comporta sanzioni pecuniarie. Tali sanzioni possono arrivare a 3.000 euro per le persone fisiche e a 15.000 euro per le persone giuridiche.

Conclusioni

Ho indicato in questo articolo sono solo esempi: gli obblighi per certi prodotti (come gli articoli sportivi) sono ancora in fase di elaborazione, ma generalmente l’iscrizione all’eco-organismo corrispondente è già obbligatoria.

E’ importante dunque, per chi esporta i propri prodotti in Francia, tenere monitorata la situazione per essere certi di adempiere alle normative, che son sempre più puntuali e stringenti.

A quali condizioni si può revocare l’incarico all’amministratore di una società in Francia?

Dipende dalla forma della società stessa.

Prendiamo le forme più comuni di società commerciali.

L’amministratore di una società a responsabilità limitata può essere revocato solo per giusta causa, cioè per negligenza, o se la revoca è necessaria per proteggere gli interessi della società.

In una società per azioni ordinaria i membri del consiglio di amministrazione e il presidente del consiglio di amministrazione possono essere revocati “ad nutum”, cioè in qualsiasi momento e senza dover fornire alcuna motivazione. Questa regola non può essere derogata. L’amministratore delegato, invece, può essere revocato solo per giusta causa.

Nelle società per azioni semplificate (“SAS”) è lo statuto a determinare le condizioni di gestione della società e, in particolare, le condizioni per la revoca dell’amministratore. Le SAS sono una forma societaria creata nel 1994, e rappresentano attualmente la forma societaria di maggior successo in Francia, al punto che una società di nuova costituzione su due è una SAS.

In questo tipo di società gli amministratori sono in linea di principio revocabili “ad nutum”, ma lo statuto può derogare a questa regola e prevedere che l’amministratore possa essere revocato solo per giusta causa.

Riguardo ai limiti della libertà statutaria, una recente decisione della Corte di Cassazione francese, la più alta corte giudiziaria francese, è di particolare interesse.

Infatti, la sentenza della Corte di Cassazione del 12 ottobre 2022 (n. 21-15.382) ha stabilito il principio per cui gli atti extra-statutari possono integrare lo statuto, ma non possono derogarvi.

Nel caso oggetto della decisione, lo statuto di una SAS prevedeva che l’amministratore delegato potesse essere licenziato in qualsiasi momento senza che fosse necessario alcun motivo, per decisione dei soci o del socio unico, e che il licenziamento dell’amministratore delegato non desse diritto ad alcun risarcimento.

L’amministratore delegato era stato nominato dall’azionista unico. Lo stesso giorno, l’azionista unico aveva inviato una lettera all’amministratore delegato in cui dichiarava che, in caso di revoca senza giusta causa, avrebbe ricevuto una somma forfettaria pari a sei mesi di retribuzione.

Qualche anno dopo, l’azienda aveva effettivamente revocato l’amministratore delegato, che aveva pertanto chiesto il pagamento dellasomma forfettaria concordata. Quando l’azienda si era rifiutata di pagarlo, l’ex amministratore delegato aveva fatto causa per ottenere il pagamento dell’indennità.

La Corte d’Appello e poi la Corte di Cassazione hanno dato ragione alla società: l’ex amministratore non aveva diritto all’indennità in quanto, per la Corte di Cassazione, è lo statuto a stabilire i termini di revoca dell’amministratore delegato ed è lo statuto a prevalere su ogni patto aggiunto. Sebbene atti extra-statutari possano integrare lo statuto, non possono derogarvi. Questo vale anche se l’atto extrastatutario proviene dall’unico socio, o se tutti i soci sono d’accordo.

Il nostro consiglio

E’ importante analizzare con attenzione lo statuto e gli atti extra-statutari come i patti parasociali o gli accordi con gli amministratori per evitare i rischi in caso di revoca di un amministratore nelle società per azioni semplificate.

Summary

Political, environmental or health crises (like the Covid-19 outbreak and the attack of Ukraine by the Russian army) can cause an increase in the price of raw materials and components and generalized inflation. Both suppliers and distributors find themselves faced with problems related to the often sudden and very substantial increase in the price of their own supplies. French law lays down specific rules in that regard.

Two main situations can be distinguished: where the parties have just established a simple flow of orders and where the parties have concluded a framework agreement fixing firm prices for a fixed term.

Price increase in a business relationship

The situation is as follows: the parties have not concluded a framework agreement, each sales contract concluded (each order) is governed by the General T&Cs of the supplier; the latter has not undertaken to maintain the prices for a minimum period and applies the prices of the current tariff.

In principle, the supplier can modify its prices at any time by sending a new tariff. However, it must give written and reasonable notice in accordance with the provisions of Article L. 442-1.II of the Commercial Code, before the price increase comes into effect. Failure to respect sufficient notice, it could be accused of a sudden “partial” termination of commercial relations (and subject to damages).

A sudden termination following a price increase would be characterized when the following conditions are met:

- the commercial relationship must be established: broader concept than the simple contract, taking into account the duration but also the importance and the regularity of the exchanges between the parties;

- the price increase must be assimilated to a rupture: it is mainly the size of the price increase (+1%, 10% or 25%?) that will lead a judge to determine whether the increase constitutes a “partial” termination (in the event of a substantial modification of the relationship which is nevertheless maintained) or a total termination (if the increase is such that it involves a termination of the relationship) or if it does not constitute a termination (if the increase is minimal);

- the notice granted is insufficient by comparing the duration of the notice actually granted with that of the notice in accordance with Article L. 442-1.II, taking into account in particular the duration of the commercial relationship and the possible dependence of the victim of the termination with respect to the other party.

Article L. 442-1.II must be respected as soon as French law applies to the relation. In international business relations, to know how to deal with Article L.442-1.II and conflicts of laws and jurisdiction of competent courts, please see our previous article published on Legalmondo blog.

Price increase in a framework contract

If the parties have concluded a framework contract (such as supply, manufacturing, …) for several years and the supplier has committed to fixed prices, how, in this case, can it change these prices?

In addition to any indexation clause or renegotiation (hardship) clause which would be stipulated in the contract (and besides specific legal provisions applicable to special agreements as to their nature or economic sector), the supplier may seek to avail himself of the legal mechanism of “unforeseeability” provided for by article 1195 of the civil code.

Three prerequisites must be cumulatively met:

- an unforeseeable change in circumstances at the time of the conclusion of the contract (i.e.: the parties could not reasonably anticipate this upheaval);

- a performance of the contract that has become excessively onerous (i.e.: beyond the simple difficulty, the upheaval must cause a disproportionate imbalance);

- the absence of acceptance of these risks by the debtor of the obligation when concluding the contract.

The implementation of this mechanism must stick to the following steps:

- first, the party in difficulty must request the renegotiation of the contract from its co-contracting party;

- then, in the event of failure of the negotiation or refusal to negotiate by the other party, the parties can (i) agree together on the termination of the contract, on the date and under the conditions that they determine, or (ii) ask together the competent judge to adapt it;

- finally, in the absence of agreement between the parties on one of the two aforementioned options, within a reasonable time, the judge, seized by one of the parties, may revise the contract or terminate it, on the date and under the conditions that he will set.

The party wishing to implement this legal mechanism must also anticipate the following points:

- article 1195 of the Civil Code only applies to contracts concluded on or after October 1, 2016 (or renewed after this date). Judges do not have the power to adapt or rebalance contracts concluded before this date;

- this provision is not of public order. Therefore, the parties can exclude it or modify its conditions of application and/or implementation (the most common being the framework of the powers of the judge);

- during the renegotiation, the supplier must continue to sell at the initial price because, unlike force majeure, unforeseen circumstances do not lead to the suspension of compliance with the obligations.

Key takeaways:

- analyse carefully the framework of the commercial relationship before deciding to notify a price increase, in order to identify whether the prices are firm for a minimum period and the contractual levers for renegotiation;

- correctly anticipate the length of notice that must be given to the partner before the entry into force of the new pricing conditions, depending on the length of the relationship and the degree of dependence;

- document the causes of the price increase;

- check if and how the legal mechanism of unforeseeability has been amended or excluded by the framework contract or the General T&Cs;

- consider alternatives strategies, possibly based on stopping production/delivery justified by a force majeure event or on the significant imbalance of the contractual provisions.

Under French Law, franchisors and distributors are subject to two kinds of pre-contractual information obligations: each party has to spontaneously inform his future partner of any information which he knows is decisive for his consent. In addition, for certain contracts – i.e franchise agreement – there is a duty to disclose a limited amount of information in a document. These pre-contractual obligations are mandatory. Thus these two obligations apply simultaneously to the franchisor, distributor or dealer when negotiating a contract with a partner.

General duty of disclosure for all contractors

What is the scope of this pre-contractual information?

This obligation is imposed on all co-contractors, to any kind of contract. Indeed, article 1112-1 of the Civil Code states that:

(§. 1) The party who knows information of decisive importance for the consent of the other party must inform the other party if the latter legitimately ignores this information or trusts its co-contractor.

(§. 3) Of decisive importance is the information that is directly and necessarily related to the content of the contract or the quality of the parties. »

This obligation applies to all contracting parties for any type of contract.

Who must prove the compliance with such provision ?

The burden of proof rests on the person who claims that the information was due to him. He must then prove (i) that the other party owed him the information but (ii) did not provide it (Article 1112-1 (§. 4) of the Civil Code)

Special duty of disclosure for franchise and distribution agreements

Which contracts are subject to this special rule?

French law requires (art. L.330-3 French Commercial Code) communication of a pre-contractual information document (in French “DIP”) and the draft contract, by any person:

- which grants another person the right to use a trade mark, trade name or sign,

- while requiring an exclusive or quasi-exclusive commitment for the exercise of its activity (e.g. exclusive purchase obligation).

Concretely, DIP must be provided, for example, to the franchisee, distributor, dealer or licensee of a brand, by its franchisor, supplier or licensor as soon as the two above conditions are met.

When the DIP must be provided?

DIP and draft contract must be provided at least 20 days before signing the contract, and, where applicable, before the payment of the sum required to be paid prior to the signature of the contract (for a reservation).

What information must be disclosed in the DIP?

Article R. 330-1 of the French Commercial Code requires that DIP mentions the following information (non-detailed list) concerning:

- Franchisor (identity and experience of the managers, career path, etc.);

- Franchisor’s business (in particular creation date, head office, bank accounts, historical of the development of the business, annual accounts, etc.);

- Operating network (members list with indication of signing date of contracts, establishments list offering the same products/services in the area of the planned activity, number of members having ceased to be part of the network during the year preceding the issue of the DIP with indication of the reasons for leaving, etc.);

- Trademark licensed (date of registration, ownership and use);

- General state of the market (about products or services covered by the contract)and local state of the market (about the planned area) and information relating to factors of competition and development perspective;

- Essential element of the draft contract and at least: its duration, contract renewal conditions, termination and assignment conditions and scope of exclusivities;

- Financial obligations weighing in on contracting party: nature and amount of the expenses and investments that will have to be incurred before starting operations (up-front entry fee, installation costs, etc.).

How to prove the disclosure of information?

The burden of proof for the delivery of the DIP rests on the debtor of this obligation: the franchisor (Cass. Com., 7 July 2004, n°02-15.950). The ideal for the franchisor is to have the franchisee sign and date his DIP on the day it is delivered and to keep the proof thereof.

The clause of contract indicating that the franchisee acknowledges having received a complete DIP does not provide proof of the delivery of a complete DIP (Cass. com, 10 January 2018, n° 15-25.287).

Sanction for breach of pre-contractual information duties

Criminal sanction

Failing to comply with the obligations relating to the DIP, franchisor or supplier can be sentenced to a criminal fine of up to 1,500 euros and up to 3,000 euros in the event of a repeat offence, the fine being multiplied by five for legal entities (article R.330-2 French commercial Code).

Cancellation of the contract for deceit

The contract may be declared null and void in case of breach of either article 1112-1 or article L. 330-3. In both cases, failure to comply with the obligation to provide information is sanctioned if the applicant demonstrates that his or her consent has been vitiated by error, deceit or violence. Where applicable, the parties must return to the state they were in before the contract.

Regarding deceit, Courts strictly assess its two conditions which are:

- (a material element) the existence of a lie or deceptive reticence (article 1137 French Civil Code);

- And (an intentional element) the intention to deceive his co-contractor (article 1130 French Civil Code).

Damages

Although the claims for contract cancellation are subject to very strict conditions, it remains that franchisees/distributors may alternatively obtain damages on the basis of tort liability for non-compliance with the pre-contractual information obligation, subject to proof of fault (incomplete or incorrect information), damage (loss of chance of not contracting or contracting on more advantageous terms) and the causal link between the two.

French case law

Franchisee/distributor must demonstrate that he would not have actually entered into the contract if he had had the missing or correct information

Courts reject motion for cancellation of a franchise contract when the franchisee cannot prove that this deceit would have misled its consent or that it would not have entered into the contract if it had had such information (for instance: Versailles Court of Appeal, December 3, 2020, no. 19/01184).

The significant experience of the franchisee/distributor greatly mitigates the possible existence of a defect in consent.

In a ruling of January 20, 2021 (no. 19/03382) the Paris Court of Appeal rejected an application for cancellation of a franchise contract where the franchisor had submitted a DIP manifestly and deliberately deficient and an overly optimistic turnover forecast.

Thus, while the presentation of the national market was not updated and too vague and that of the local market was just missing, the Court rejected the legal qualification of the franchisee’s error or the franchisor’s willful misrepresentation, because the franchisee “had significant experience” for several years in the same sector (See another example for a Master franchisee)

Similarly, the Court reminds that “An error concerning the profitability of the concept of a franchise cannot lead to the nullity of the contract for lack of consent of the franchisee if it does not result from data established and communicated by the franchisor“, it does not accept the error resulting from the communication by the franchisor of a very optimistic turnover forecast tripling in three years. Indeed, according to the Court, “the franchisee’s knowledge of the local market was likely to enable it to put the franchisor’s exaggerations into perspective, at least in part. The franchisee was well aware that the forecast document provided by the franchisor had no contractual value and did not commit the franchisor to the announced results. It was in fact the franchisee’s responsibility to conduct its own market research, so that if the franchisee misunderstood the profitability of the operation at the business level, this error was not caused by information prepared and communicated by the franchisor“.

The path is therefore narrow for the franchisee: he cannot invoke error concerning profitability when it is him who draws up his plan, and even when this plan is drawn up by the franchisor or based on information drawn up and transmitted by the franchisor, the experience of the franchisee who knew the local market may exonerate the franchisor.

Takeaways

- The information required by the DIP must be fully completed and updated ;

- The information not required by the DIP but communicated by the franchisor must be carefully selected and sincere;

- Franchisee must be given the opportunity to request additional information from the franchisor;

- Franchisee’s experience in the economic sector enables the franchisor to considerably limit its exposure to the risk of contract cancellation due to a defect in the franchisee’s consent;

- Franchisor must keep the proof of the actual disclosure of pre-contractual information (whether mandatory or not).

Scrivi a Alexandre

Francia – Nuova legge contro l’ultra fast-fashion

15 Aprile 2024

-

Francia

- Distribuzione

PFAS are chemicals that have been used in industry for over 50 years. Between 4,000 and 5,000 varieties are used for various everyday consumer applications, and they are renowned for their non-stick, waterproofing, and heat-resistant properties. They have come under scrutiny in recent years, and are covered by European regulations, as they are in the USA, where the public authorities have imposed maximum use values, as well as reporting obligations. EU Regulation 2019/1021 (POP) restricts the production and use of certain categories of PFAS in specific industries or above certain values and their use with food products. France has gone further, regulating the levels of discharges into watercourses.

Scientific research suspects that PFAS cause illnesses such as cancer and reproductive disorders. Given the extent of contamination not only in everyday products but also in the environment, particularly waterways, the issue is likely to pose major public health problems in the years to come. This concern is more pressing given that PFASs are considered ‘eternal pollutants’, as there is currently no way of eliminating them from the environment.

The impact on companies’ and insurers’ liability is already significant. In the USA, more than 6,000 lawsuits have been filed since 2005. Three groups have already paid more than USD 1.2 billion in settlements due to contamination, and another group has paid more than USD 10 billion to end a class action.

In France, the Metropole of Lyon has brought a summary expert appraisal action against two chemical companies before considering bringing a liability action. In addition, several criminal complaints have been lodged for endangering the lives of others and damaging the environment.

Under French law, companies and their insurers could be liable on various legal grounds. In addition to ordinary civil liability law – based on article 1240 of the Civil Code – the special system of liability for defective products could also serve as a basis for a liability action (articles 1245 et seq. of the Civil Code), with French law defining a defect as any product that does not offer the safety that can legitimately be expected.

Although it is currently difficult to identify a causal link with an identified disease, asbestos-related case law has shown in the past that victims can take action if they can demonstrate that they suffered anxiety-related harm as a result of their exposure to the product, even if they are not positively suffering from a disease at the time of their claim.

In addition, the reporting obligations imposed by the public authorities will undoubtedly facilitate the filing of liability actions by facilitating the identification of the emitters and users of these pollutants.

Insurers are directly affected by this phenomenon, which for them constitutes an “emerging” risk (“silent cover”) because, for the most part, this risk was not identified when the policy was taken out, which exposes them directly and is all the more problematic because insurance premiums have not been able to take such a risk into account.

Civil liability or professional indemnity insurance policies, especially if they are drafted with “all risks except” clauses (“tous risques sauf” in French legal vocabulary, i.e. covering all liability risks vis-à-vis third parties except those strictly listed), as well as those including clauses relating to environmental risks, are particularly targeted.

Lloyd’s has already published model exclusion clauses for the attention of insurers, although such clauses can obviously only cover future insurance contracts or endorsements:

https://www.lmalloyds.com/LMA_Bulletins/LMA23-039-SD.aspx

The clauses contained in insurance policies must be drafted with particular care, considering each country’s specific features. In France, for example, to be enforceable against the insured, clauses must be “formal and limited”, which means that the exclusion must be both clearly expressed and that it must be possible to determine its content perfectly.

For example, the Court of Cassation recently ruled that the use of the terms “such as” or “in particular” (“tells que” “en particulier”) in an exclusion clause led to confusion in the interpretation of the exclusion clause, rendering it invalid (Civ. 2e, 26 Nov. 2020, no. 19-16.435). There was also a debate on the validity of an exclusion clause relating to bodily injury caused by asbestos, a risk which at the time had not been identified by insurers, who subsequently excluded it from most policies (Cass. 2e civ., 21 Sept. 2023, nos. 21-19801 and 21-19776). Similarly, policies should clearly indicate whether cover is provided based on a harmful event or based on a claim (i.e “base dommage” or “base reclamation”, which indicates if the risk is covered, depending on if the damage happened during the policy was valid, or if it depends on the moment when the risk was notified by the insured during such period).

One thing is sure: the risks associated with PFAS and claims are only just beginning to emerge in Europe, where the conditions for group actions have recently been extended with EU Directive 2020/1828, which came into force on 25 June 2023 and is currently the subject of a draft law under discussion in the French Parliament with a view to its transposition.

La legge contro l’ultra fast-fashion è stata concepita per fronteggiare la crescente preoccupazione riguardante l’impatto ambientale, economico e sulla salute provocato dall’inondazione del mercato con tessuti e accessori di moda da parte di giganti come SHEIN, TEMU, PRIMARK e altri. Queste aziende, spesso trascurando le conseguenze delle loro pratiche, hanno contribuito significativamente all’incremento delle emissioni di gas serra attribuite all’industria tessile, che ora si stima essere responsabile per circa l’8% del totale globale.

In un contesto dove la produzione globale di abbigliamento ha visto un raddoppio in soli 14 anni e la durata di vita degli indumenti si è ridotta di un terzo, il marchio SHEIN ha registrato una crescita esponenziale del 100% tra il 2021 e il 2022, evidenziando ulteriormente la problematica del fast fashion che domina il mercato francese, nonostante in alcuni settori si stia vivendo una rinascita dell’artigianalità e del design made in France.

La risposta delle autorità francesi si è concretizzata nel disegno di legge n. 2129, volto a ridurre l’impatto ambientale dell’industria tessile, proposto da un deputato del Governo e adottato all’unanimità dall’Assemblea Nazionale il 14 marzo 2024, che nelle prossime settimane verrà esaminato dal Senato con una procedura accelerata, prima della definitiva adozione.

Questa normativa si propone di sensibilizzare i consumatori sull’importanza della sobrietà e della sostenibilità nell’industria della moda, promuovendo pratiche di riutilizzo, riparazione, e riciclaggio, e introducendo penalizzazioni per i produttori che non rispettano determinati standard ecologici.

Di seguito le misure principali.

1. Definizione legale di fast-fashion e obblighi informativi

Viene istituita una definizione legale di fast-fashion, identificato come la pratica di “messa a disposizione o distribuzione di un gran numero di riferimenti a nuovi prodotti (…) anche attraverso un fornitore di mercato online” e gli operatori di questo settore hanno l’obbligo di “visualizzare sulle loro piattaforme di vendita online messaggi che incoraggino la sobrietà, il riutilizzo, la riparazione e il riciclaggio dei prodotti e che sensibilizzino sul loro impatto ambientale. Il messaggio deve essere visualizzato in modo chiaro, leggibile e comprensibile su qualsiasi formato utilizzato, in prossimità del prezzo. Il contenuto dei messaggi è definito per decreto.”

Questa norma disciplina tutte le vendite online (anche su piattaforme) mentre non include le piattaforme per la rivendita di prodotti invenduti.

La violazione di questa disposizione comporta sanzioni amministrative fino a 3.000 € per le persone fisiche e 15.000 € per le persone giuridiche.

2. Limiti alla pubblicità (anche tramite influencer)

Il disegno di legge vieta la pubblicità dei prodotti di fast fashion, anche tramite influencer, al fine di ridurre la promozione di pratiche insostenibili nell’industria della moda, incentivando così un cambiamento nei modelli di consumo.

In caso di adozione definitiva, questa disposizione entrerà in vigore a partire dal 1o gennaio 2025.

La violazione di questa disposizione comporta sanzioni amministrative fino a 20.000 € per le persone fisiche e 100.000 € per le persone giuridiche, e fino al raddoppio in caso di recidiva.

3. Altri obblighi e sistema di disincentivi

La legge riguarda tutti i produttori (industriali, fabbricanti, grossisti, importatori), distributori e rivenditori francesi al pubblico e prevede anche altri obblighi, come: l’adesione a un’organizzazione ecologica (Refashion), il pagamento di un eco-contributo, l’etichettatura conforme e l’obbligo di esporre i risultati della valutazione dell’impatto ambientale del prodotto, che può portare ad una sanzione o all’ottenimento di un bonus.

Etichettatura e sull’eco-contributo CTA

La legge AGEC prevede attualmente una sanzione massima del 20% del prezzo di vendita del prodotto, IVA esclusa, se questo presenta caratteristiche ambientali scadenti. Considerati i prezzi a cui i prodotti fast-fashion sono venduti ai consumatori, l’impatto sui produttori è minimo (ad esempio, una maglietta da 4 euro), pertanto ora la proposta è quella di innalzare questa sanzione a un massimo del 50% del prezzo di vendita del prodotto.

Questa sanzione sarà determinata in base all’obbligo di mostrare l’analisi dell’impatto ambientale del prodotto. Le sanzioni saranno quindi fisse (e non in percentuale sul prezzo del prodotto), sotto forma di un malus progressivo fino al 2030:

- 5 euro per ogni prodotto immesso sul mercato nel 2025

- 6 euro per ogni prodotto immesso sul mercato nel 2026

- 7 euro per ogni prodotto immesso sul mercato nel 2027

- 8 euro per ogni prodotto immesso sul mercato nel 2028

- 9 euro per ogni prodotto immesso sul mercato nel 2029

- 10 euro per ogni prodotto immesso sul mercato nel 2030

Con un limite massimo fissato al 50% del prezzo di vendita.

Questo incremento avrà un impatto sul produttore un anno dopo, quando questi dichiarerà e verserà l’eco-contributo a Refashion e si applica esclusivamente ai produttori di prodotti di fast fashion. I fondi raccolti verranno utilizzati dagli organismi ecologici per finanziare infrastrutture di raccolta e riciclo in paesi al di fuori dell’Unione Europea.

Le società straniere sono soggette a questi obblighi?

Sì, se l’azienda ha sede legale all’estero, ma effettua vendite in Francia, sarà soggetta alle stesse obbligazioni e sanzioni previste dalla legislazione francese, secondo il principio del “produttore esteso”, stabilito dall’articolo L541-10 del codice dell’ambiente francese.

Le società straniere dovranno nominare un rappresentante in Francia a tal fine e non potranno in alcun modo aggirare gli obblighi e le sanzioni stabilite dalla normativa in oggetto.

A cosa prestare attenzione, adesso?

Il Senato sta attualmente esaminando il testo legislativo.

Parallelamente, il governo francese sta pianificando due iniziative aggiuntive: primo, avviare una campagna comunicativa per valorizzare il settore tessile francese e combattere l’ultra fast-fashion; secondo, proporre la creazione di una coalizione internazionale con l’obiettivo di vietare l’esportazione di rifiuti tessili verso i paesi incapaci di gestirli in maniera sostenibile, in linea con le disposizioni della Convenzione di Basilea. è attualmente all’esame del Senato.

Inoltre, è prevista la pubblicazione di un decreto che stabilirà i livelli di produzione, definendo così i produttori interessati da queste misure. Chiaramente questo decreto avrà un impatto estremamente rilevante, perché a seconda dei limiti individuati (si sta discutendo se individuare un limite giornaliero o annuale minimo di capi di abbigliamento) definirà il perimetro di applicazione della norma.

Given the significance of the influencer market (over €21 billion in 2023), which now encompasses all sectors, and with a view for transparency and consumer protection, France, with the law of June 9, 2023, proposed the world’s first regulation governing the activities of influencers, with the objective of defining and regulating influencer activities on social media platforms.

However, influencers are subject to multiple obligations stemming from various sources, necessitating the utmost vigilance, both in drafting influence agreements (between influencers and agencies or between influencers and advertisers) and in the behaviour they must adopt on social media or online platforms. This vigilance is particularly heightened as existing regulations do not cover the core of influencers’ activities, especially their status and remuneration, which remain subject to legal ambiguity, posing risks to advertisers as regulatory authorities’ scrutiny intensifies.

Key points to remember

- Influencers’ activity is subject to numerous regulations, including the law of June 9, 2023.

- This law not only regulates the drafting of influence contracts but also the influencer’s behaviour to ensure greater transparency for consumers.

- Every influencer whose audience includes French users is affected by the provisions of the law of June 9, 2023, even if they are not physically present in French territory.

- Both the law of June 9, 2023, and the “Digital Services Act,” as well as the proposed law on “fast fashion,” foresee increasing accountability for various actors in the commercial influence sector, particularly influencers and online platforms.

- Despite a plethora of regulations, the status and remuneration of influencers remain unaddressed issues that require special attention from advertisers engaging with influencers.

The law of June 9, 2023, regulating influencer activity

The definition of influencer professions

The law of June 9, 2023, provides two essential definitions for influencer activities:

- Influencers are defined as ‘natural or legal persons who, for consideration, mobilize their notoriety with their audience to communicate to the public, electronically, content aimed at promoting, directly or indirectly, goods, services, or any cause, engaging in commercial influence activities electronically.’

- The activity of an influencer agent is defined as ‘that which consists of representing, for consideration,’ the influencer or a possible agent ‘with the aim of promoting, for consideration, goods, services, or any cause‘ (article 7) The influencer agent must take ‘necessary measures to ensure the defense of the interests of the persons they represent, to avoid situations of conflict of interest, and to ensure the compliance of their activity‘ with the law of June 9, 2023.

The obligations imposed on commercial messages created by the influencer

The law sets forth obligations that influencers must adhere to regarding their publications:

- Mandatory particulars: When creating content, this law imposes an obligation on influencers to provide information to consumers, aiming for transparency towards their audience. Thus, influencers are required to clearly, legibly, and identifiably indicate on the influencer’s image or video, regardless of its format and throughout the entire viewing duration (according to modalities to be defined by decree):

– The mention “advertisement” or “commercial collaboration.” Violating this obligation constitutes deceptive commercial practice punishable by two years’ imprisonment and a fine of €300,000 (Article 5 of the law of June 9, 2023).

– The mention of “altered images” (modification by image processing methods aimed at refining or thickening the silhouette or modifying the appearance of the face) or “virtual images” (images created by artificial intelligence). Failure to do so may result in a one-year prison sentence and a fine of €4,500 (Article 5 of the law of June 9, 2023).

- Prohibited or regulated promotions: This law reminds certain prohibitions, subject to criminal and administrative sanctions, stemming from French law on the direct or indirect promotion of certain categories of products and services, under penalty of criminal or administrative sanctions. This includes the promotion of products and services related to:

– health: surgery, aesthetic medicine, therapeutic prescriptions, and nicotine products;

– non-domestic animals, unless it concerns an establishment authorized to hold them;

– financial: contracts, financial products, and services;

– sports-related: subscriptions to sports advice or predictions;

– crypto assets: if not from registered actors or have not received approval from the AMF;

– gambling: their promotion prohibited for those under 18 years old and regulated by law;

– professional training: their promotion is not prohibited but regulated.

The accountability of influencer behaviour

The law also holds influencers accountable from the contracting of their relationships and when they act as sellers: