-

意大利

政府希望高资产净值的个人取得意大利居留,并将在税收上提供优惠

23 12 月 2016

- 公司法

- 房地产

- 税务

Chinese outbound M&A was one of the main topics of interest at the 2017 Hong Kong IFLR Forum on M&A in Asia, a great event with an outstanding level of speakers and very interesting discussions on various themes related to international investments.

All the attendants shared the view that momentum for Chinese overseas investments is still strong, despite the recent policy aiming at curbing the outflow of capitals from China.

A particularly interesting session was that on “best practices to overcome credibility and experience gaps increasingly faced by “off the radar” Chinese bidders”.

Opening a one-to-one negotiation or letting a Chinese company bid at an auction involves often great deal of uncertainty, as most participants to the session shared the experience of having seeing their Chinese counterpart walk away from the negotiation without any explanation (the so-called “Random Investors”).

I have scribbled down the take-aways of the discussion as follows.

Main clues to spot early on the Random investor:

- the Company pops out from nowhere and has no track record of overseas investments;

- the Company has no legal or financial advisors, or if they do, their advisors are not experienced in overseas transactions;

- the Company has excellent advisors… but has not paid their fees (yes, that happens)

- the target does not belong to the Company’s core business (and there is no explanation for their interest for the deal);

What should you do to be on the safe side?

- request a written declaration of interest, expressing the reasons why the Company wants to invest in the target and what is their mid term strategy, signed and stamped by the legal representative (if they are not ready to hand over this letter the game can stop here).

- If the Company represents a group of investors, require full disclosure and letters of confirmation from all parties, from day one (AC Milan’s case is a good example of what happens later on if there is no disclosure of all players, and their stakes in the deal);

- request proof that the Company has filed the application for the authorisation to invest overseas (due to the recent tightening of controls on capital outflow, this step is fundamental);

- request proof that they have the finance needed for the deal (either onshore or, better, off-shore);

- make clear that you will require a “break fee” (which can vary from 5 to 10%) in case they walk away from the negotiation (we have heard of US companies expecting 30 to 50% break fee on the value of the deal…)

为重振意大利经济,随着 2017年1月1日起生效的Legge di Bilancio 2017(“预算法”),意大利议会开始执行一项新战略:通过采取一系列在财务和财政上支持初创企业和中小型企业的措施,使他们对外国投资更具吸引力。

预算法设计了一个涉及某些税收减免的完整计划,中小型企业可通过众筹平台筹集资金,“创新型”初创企业(意为符合某些法律规定的早期公司:如高新技术公司、研发公司以及拥有大量高科技人才的公司等)向上市公司出售、转移其税务亏损。总体而言,这些措施的主要目的为:解锁迄今为止还没有足够能力向早期初创企业和中小企业提供财政资源和税收优惠的经济制度,使他们发展创新资产并扩大业务。

该系列措施可根据目的被归类为以下四类,

- 培养创业精神,成立创新型公司;

- 刺激针对创新型初创企业及中小企业的直接投资;

- 支持研发支出,以及

- 随着创新科技的发展,以数字化和自动化的方式将公司现有资产现代化。

成立新公司的经济援助

议会制定的战略涉及经济发展部(Mise)、国家工伤事故协会(Inail),以及其他公共机构,如Invitalia,以促进初创企业的成立和创新型中小型企业的发展。

事实上,旨在提供软贷款以支持创新型初创企业成立的可持续增长基金(FCS – Fondo per la Crescita Sostenibile)的捐款,在2017和2018年均增长了4750万欧元。

此外, 2017及2018年,预算法均拨出4750万欧元以促进自雇就业和创业精神。这些基金将由Invitalia管理,政府机构为了促进内向型投资和企业发展,主要用于支持女性和青年企业家(18至35岁)创立公司。Invitalia将给予最长8年的零利息贷款补贴,这将可覆盖特定投资预算总支出的75%。之后,公司必须就商业计划中的剩余额度提供资金,并在签署贷款协议的24个月内开始执行计划中投资。

经济发展部还发布了一系列措施,以补贴和支持由初创公司执行的发展方案。该发展方案的重点为收购新机械及新技术设备,硬件和软件技术,专利和许可以及与生产/管理需要有直接关系的非专利技术的专业知识。

预算法在相关政府部门批准之前,还提出了Inail对封闭式基金的投资,该投资致力于参与或直接成立创新型初创企业及技术合资企业。

精简官僚机构

为了简化成立初创公司的程序而出台的一系列措施,如无须公证,无须印花税票以及其他行政费用。也可在起草公司章程之后,依靠合格的电子签名通过在线程序进行修订。

创初创企业和中小型企业投资税收减免

在欧洲委员会最终批准之前,预算法为向初创企业投资提出了新的激励措施。关于类似投资税收减免的政策并非首次提及。2012年提出的最初设想为临时性的,随着预算法的出台,这些措施不仅被转化为永久性奖励政策,而且个人和公司分别从过去的19%和20%增加至30%,对投资者(潜在股东)情况无区别对待,投资上限为个人100万欧元,实体180万欧元。

这些减税措施旨在鼓励对初创公司的投资,而该投资需要在目标公司至少停留3年(预算法条例将其从两年变更为三年),所以优惠政策抵消了其中的弊端。此外,预算法还将上述优惠延伸至创新型中小企业(即在任何时间成立、经营范围在技术创新领域的中小企业),如上所述,这些企业无须再为了获得其他优惠而提出创新型资产项目的计划。

可使初创公司和上市公司实现双赢的合作关系

在预算法的随附报告中,政府还强调了上市公司直接或间接资助初创公司的重要性,并提出了在符合某些要求的情况下,初创公司可向上市公司转移其前三年累计税收损失。

上述转移将根据公司税收抵免转移的相关条例执行;受让方将被要求弥补从转让方得到的好处,其向初创公司所支付的报酬不会被征税。通过这种机制,双方公司都将获益:初创公司找到财务“赞助商”,上市公司可用税收损失完全抵消其应纳所得税,并且还会考虑超出部分在下一年转结的可能性。

众筹

通过对意大利财政统一法案 (即Testo Unico Finanza) 的调整,预算法摆脱了一些组织众筹市场在意大利起飞的限制,并提出了所有中小企业进入股权众筹的可能性。以前的立法限制了通过此系统只向创新型中小企业筹集资金的可能性,因此限制了中小企业和众筹行业的发展。

管理股权众筹的规则将与运营方(即众筹平台)一样,现在中小型企业除了通过银行融资和证券上市交易所的传统渠道之外,还将有一个新的筹集资金的手段。

研发支出的税收减免

2013年推出的关于研发支出的税收减免已被延长至2020年12月,并已从全部符合要求的研发活动的25%曾至50%,年度上限为2000万欧元(就从前最高限额增长5倍)。

公司将可减少缴税,并就其研发支出的比例要求补偿。该规定现适用于所有研发支出,包括雇佣致力于研发活动的人员(对其资格无特殊要求)以及任何类型的公司(居民和非居民)、集团或联合企业。无论企业规模、法律地位和行业参考。

此财政激励可与其他政策相结合,使得所有创新型初创公司中持有股份的基层员工获得税收优惠。具体来说,意味着进行研发活动的员工将受益于任何股权计划工作,该公司将受益于上述两种税收减免。

大型投资项目的开发合同

开发合同(Contratti di sviluppo)的签署各方为:意大利经济发展部(Mise),Invitalia以及一家或若干家从事发展项目的公司(通过网络完成契约)。

2011年,为了支持规模至少为2000万欧元(其中750万欧元仅用于农业食品行业)的大型工业/生产性投资,这些合同首次被提出。

发展合同由Mise资助,相关大区也涉及其中(亦可参与投资)。Invitalia作为参照指示以促进公司并负责管理资源和应用/评估申请。

这些合同针对意大利公司以及在意大利的外国公司,并提供财务优惠如厂房和设备的补助金、软贷款和利息补贴,其比例可根据公司规模和涉及的项目类型而变化(研发支出,创新导向投资)。

Invitalia为申请程序及后续的发展计划设置了快速步伐:一旦项目被批准,公司将有90日时间提交所有指定文件;其中有6个月的准备时间以及36个月执行时间。

作为国家意志的象征,为了富有成效地完成数字化相关的投资项目,该程序也将开通特别快速通道。

超级折旧和高度折旧

到2017年,预算法也就相关公司额外追加了40%的折旧减免(构成税收折旧总数为140%)。然后,公司可以扣除购买折旧率超过6.5%的有形资产的费用。该奖励只适用于采购订单已被供应商接受并于2017年12月31日前支付至少20%的资产。除此之外,该法律还就为获得雾化及数字化企业而购买(或租赁)如数控机械或设备的新技术资产(该法律全面概述了符合要求资产的完整范围),提出了150%的额外折旧减免(即“高度折旧”,加之现有的折旧规定,将获得250%的折旧减免)。

Sabatini-ter

预算法也提出了“Sabatini”,一项旨在促进中小企业购买(或租赁)资金货物的特别立法:即弥补数额在2万至200万欧元之间的部分银行贷款利息。该立法有效期被延长至2018年12月31日。一个具体并更宽松的措施将适用于购买与工业4.0计划相关的新资产。部分资源将用于支持创新、提高效率和创立数字化工业体系——该工业体系投资于例如云计算、宽带连接、网络安全、机器人、机电一体化等技术设备。

总而言之,上述措施适用于所有位于意大利的公司,是使意大利企业在全球市场中更具竞争力的战略里程碑,在技术和财政资源方面。由于没有进入的监管壁垒,该新规定将赋予意大利经济体系新的生命,并吸引外国投资者。

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

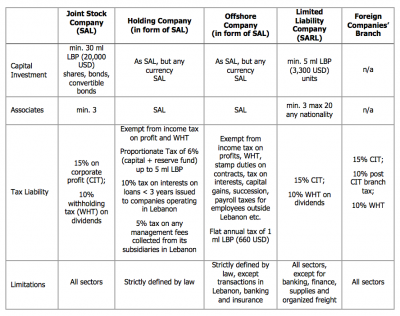

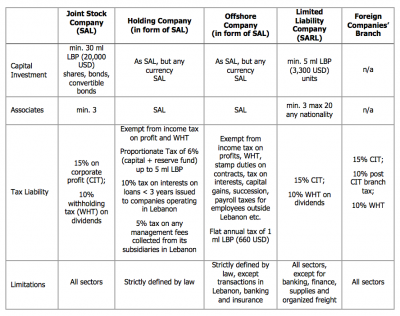

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

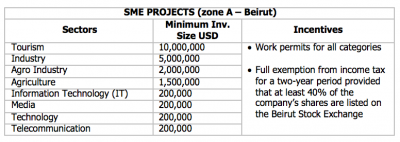

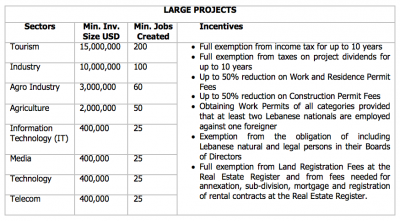

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

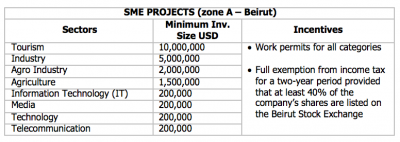

Investment Project by Zone (IPZ) scheme

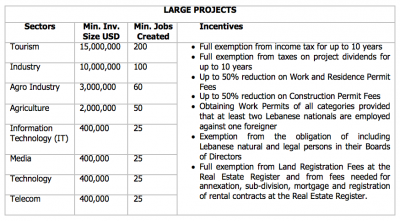

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.

The options available to foreign companies to set up business in Venezuela are (a) the registration of a branch; (b) the corporation; (c) the limited liability company; (d) the general partnership, (e) the limited partnership; (f) the stock limited partnership; and (g) the consortium. In this memorandum we use the term “company” to indistinctively refer to any of the options described in this paragraph, including the branch, the corporation or any of the partnership, but excluding the consortium.

The branch and the corporation are the two most common options used by foreign companies to do business in Venezuela. The corporate features of the companies are set forth in the Venezuelan code of commerce.

Corporation

The Venezuelan corporation is owned by shareholders and is a legal entity separate and distinct from its shareholders. The corporation is indistinctively known as compañía anónima (C.A.) or sociedad anónima (S.A.).

Limited Liability

The liability of the shareholders of a corporation is limited to the payment of the nominal value (and premium, if any) of the shares such shareholder owns. As a general rule, the shareholders of the corporation are not liable for the obligations of the corporation.

However, most Venezuelan commentators accept the piercing of the corporate veil by a Venezuelan court in the event of certain exceptional circumstances, such as: (a) when the corporate form −a legal and valid mean to conduct business− has been intentionally used against the purpose of the law to circumvent the application of a mandatory rule or to attain an otherwise illegal result (fraude a la ley or fraus legis); or (b) when there has been an abuse of the corporate form that has caused damages or an unfair consequence (abuso de derecho). Venezuelan courts have also accepted the application of the piercing of corporate veil when the separation of the legal entity from its shareholders would produce an unfair situation or when the corporate form is abused to avoid a legal consequence. In addition, the Constitutional Chamber of the Venezuelan Supreme Court issued a widely criticized opinion (Transporte Saet case) in which it applied the piercing of corporate veil doctrine without explaining or invoking an exceptional circumstance to do so. In the decision, the Supreme Court held that any company that is part of an economic group may be held liable for the obligations of any other party of the group. Note however, that this decision was related to a labor matter.

Foreign Direct Investments

The only areas currently reserved to companies owned or controlled by Venezuelan investors are open-air television, radio broadcasting, newspapers in Spanish and professional services regulated by law. There are other areas, such as oil, that are reserved to the Venezuelan government in which foreign investors may participate only through minority participations in joint venture companies with the Republic or Venezuelan state-owned companies.

Foreign investors (i.e., foreign companies (head offices), foreign shareholders or foreign partners) must register their direct foreign investments in a Venezuelan company (branch, corporation or partnership) with the Venezuelan foreign investment authority within 60 days following the date on which investment was made (the “foreign investment registration”).

Several documents must be submitted to the Venezuelan foreign investment authority by the foreign investor to obtain the foreign investment registration, including evidence that the capital of the company was paid with foreign currency or contribution in kind that entered Venezuela. To obtain such evidence, the foreign investor must (a) in case of payment in cash, order a wire transfer to the Venezuelan bank account of the company from an account of the foreign investor located outside Venezuela (as a result of the wire transfer, foreign currency transferred out of the offshore account of the investor will be converted into bolivars at the official exchange rate and deposited in bolivars in the Venezuelan bank account), and (b) in the case of contribution in kind, demonstrate that the asset being contributed to the capital of the company was imported into Venezuela (copies of the import manifest, commercial invoice and other custom documents).

The foreign investment registration must be updated annually by the foreign investor within 120 days of the end of the fiscal year.

Financing a company

The corporation must have a stated or subscribed capital (“stated capital”), which is the amount of capital that the shareholders of the corporation agree to subscribe.

Although there are no statutory minimum capital requirements applicable to the stated capital, each Venezuelan commercial registry sets forth a minimum stated capital requirement on a case-by-case basis or depending on the purpose of the corporation.

The stated capital of the corporation can be paid in cash or in kind. In case of payment in cash, at least 20% of the stated capital must be paid by the shareholders at the time of the registration of the shareholders’ meeting approving the incorporation of the corporation or the corresponding capital increase (the amount of stated capital already paid by the shareholders is known as “paid-in capital”). Payment in cash of the stated capital must be made by a deposit in bolivars in a bank account opened with a Venezuelan bank under the name of the corporation. In case of payment in kind, assets for a value equal to 100% of the stated capital must be contributed to the corporation. To be eligible for foreign investment registration, the stated capital must be paid out of foreign currency or assets brought into Venezuela from abroad.

The stated capital of the corporation is represented by shares. The shares can only be issued in registered form (bearer shares are not permitted). All shares must have a par value (valor nominal), and such par value must be denominated in bolivars. The stated capital of the corporation is equal to the sum of the nominal value of the shares.

The corporation can issue different classes of shares. Issuance of shares of different classes is convenient where different shareholders or groups of shareholders are each entitled to appoint a number of directors. Preferred shares can also be issued, granting their holders preferences in the payment of dividends, liquidation or otherwise.

The ownership of the shares of a corporation is evidenced by the notations made in the book of shareholders kept by the corporation. Shares can also be represented in certificates, but the issuance of share certificates is not required

The corporation must have at least two shareholders at the time of incorporation. However, immediately after incorporation, all the shares of the corporation may be transferred to one of the shareholders and thus the corporation may become a wholly-owned subsidiary of such shareholder.

The only areas currently reserved to companies owned or controlled by Venezuelan investors are open-air television, radio broadcasting, newspapers in Spanish and professional services regulated by law. There are other areas, such as oil, that are reserved to the Venezuelan government in which foreign investors may participate only through minority participations in joint venture companies with the Republic or Venezuelan state-owned companies.

As in most other jurisdictions, there are certain controls on money laundering which generally require banks and other professional bodies to identify clients and their sources of funding and to report suspicious transactions.

Opening a branch office

The registration of a branch (sucursal) in Venezuela by a foreign company does not result in a separate legal entity being formed in Venezuela. Therefore, the foreign company (head office) will be liable for all the obligations assumed by the branch.

The branch must be registered with a Venezuelan commercial registry located in the city of domicile of the branch, and such registration must then be published in a Venezuelan newspaper. The foreign company can choose the domicile of the branch.

The name generally used for the branch is the same name of the foreign company (head office) or its abbreviation followed by the expression Sucursal Venezuela (which means Venezuelan branch).

The branch must have at least one representative. The branch representative will have full powers to represent and manage the branch, except for the power to sell or transfer the business (unless such power is expressly granted to the representative). Any limitations to the powers of the representative are not effective against third parties. If the branch representative is not a Venezuelan citizen, he may have to obtain a working visa in order to sign documents on behalf of the branch before public notaries or registries in Venezuela.

The foreign company must assign a capital to the branch (capital asignado or “branch capital”). The branch capital does not constitute a limitation of the liability of the foreign company (head office), since the branch is not considered a legal entity separate from the foreign company. Although there are no statutory minimum capital requirements applicable to the branch capital, the Venezuelan commercial registry sets forth a minimum branch capital requirement on a case-by-case basis.

The branch capital must be paid by the foreign company (head office), either in cash or in kind. In case of payment in cash, an amount in bolivars equal to the branch capital must be deposited in a bank account opened with a Venezuelan bank under the name of the branch. In case of payment in kind, assets for a value equal to the branch capital must be contributed to the branch. To be eligible for foreign investment registration, the branch capital must be paid out of foreign currency or assets brought into Venezuela from abroad.

Unlike the corporation, the branch is not required to appoint statutory auditors or file annual balance sheets with the commercial registry. However, the branch is required to keep accounting books for tax purposes, i.e. the journal book, the ledger book, the inventory book and the VAT books.

The branch capital and any subsequent increases in the branch capital are subject to a registration tax equal to 1-2% of the branch capital, plus other registration fees and expenses, the tax depend on the commercial registry.

Filings with the Commercial Registry

All Venezuelan companies must be registered with a Commercial Registry. The Commercial Registry contains copies of the company’s articles of incorporation and by-laws, information on its standing (i.e. annual financial statements, liquidation or bankruptcy proceedings), registered address, directors and officers, the existence of branches, and other information. All information filed with the Commercial Registries is public. Companies must notify the Commercial Registry of changes to their articles of incorporation and by-laws and update other information filed with the registry. Companies must also file annual financial statements and periodically file minutes of shareholders appointing directors and officers.

Opening a bank account

Opening a Venezuelan bank account is required to incorporate a corporation or register a branch in Venezuela. The bank account shall be opened with a Venezuelan bank under the name of the corporation or the branch by one of its authorized representatives.

A non-resident (individual or corporation) can also open a bank account in Venezuela. The bank must only check the non-resident’s identity and capacity. In the case of a corporation, the requirements are: (i) the articles of incorporation duly apostilled or legalized by the Consulate of Venezuela in the respective country and translated in Spanish by interpreter public; (ii) the Fiscal Information Registry (RIF) issued by the Venezuelan fiscal authorities; (iii) the Identity Card for Venezuelan or foreign natural persons resident in the country, empowered to mobilize the account; and (iv) the minutes of shareholders meeting in which the authorization granted to the persons empowered to mobilize the account to act on behalf of the Company.

Additional information may be required by banks to better identify the corporation or the persons authorized to mobilize the account in accordance with anti-money laundering and other banking regulation.

Utilising office space

Office spaces may either be owned by the Company or rented. Multinational companies may often acquire offices or acquire land and construct their own offices, especially given the existing Venezuelan exchange controls, see section on Regulatory Compliance below.

Rental rates in Venezuela, and in particular in Caracas, are usually high, even when compared to international standards, Residential leases are strictly controlled under Venezuelan law; these controls do not apply to commercial leases.

Immigration controls

Foreign individuals intending to work in Venezuela are required to obtain a working visa or a business visa. Working visas grant their holders the right to a continued stay in Venezuela for an extendable one-year term, renewable for the same term, and authorize their holders to work in Venezuela as well as to enter into and depart from Venezuelan without restrictions. Business visas are granted to foreign citizens traveling to Venezuela to conduct business or to take part in commercial, technical, advisory, scientific, or cultural activities. Business visas are primarily designed for brief stays in the country and are valid for one year from the date of issue, renewable for the same term, entitling the holders to multiple entries during that term. However, under this type of visa the holder is limited to a maximum length of stay in the country of not more than six months. The process to obtain visas may be cumbersome.

The author of this post is Fulvio Italiani

There are three bodies in a Swiss corporation, namely: the general meeting of shareholders (the supreme body), the board of directors and the auditors.

Shareholder’s meeting

The general meeting of shareholders is the supreme authority of the company and is composed of all shareholders. There are two types of meetings:

- Ordinary general meeting. This is held annually within six months after the close of the business year;

- Extraordinary general meeting, which is called as often as considered necessary.

The general meeting of shareholders has the right to adopt and amend the articles, to appoint directors and auditors, to approve the financial statements and the directors’ report, to ratify certain decisions of the Board, and, in general, to make all important decisions which are not delegated to any other body. The shareholders must also approve the proposal of the Board relative to the distribution of annual profits. A general meeting is called by the board or, if it fails in its duties, by the auditors. One or more shareholders, representing together at least 10 % of the share capital, may at any time request the calling of an extraordinary shareholders’ meeting. This must be done in writing, indicating the purpose of the meeting. In general, a simple majority of votes represented at the general meeting is sufficient to pass a resolution and hold elections. However, certain decisions require a vote of two thirds of the votes represented and the absolute majority of the· par value of the shares represented (such as change of corporate purpose, extension of scope of business, distribution of shares with privileged voting rights etc.).

Shareholders cannot be deprived of their acquired rights without their consent. The term acquired rights includes the right to vote, to dividends, to a share of the liquidation proceeds and to receive sufficient information on the financial condition of the company. The Swiss Code distinguishes two kinds of shareholders rights: financial interests and personal membership rights.

Each shareholder has the right to a proportionate share of the profits distributed. Dividends may only be paid out of net profits or out of reserves specially created for this purpose. There is no interest payable on the ordinary share capital and a company may not declare interim dividends out of current year profits. Dividends can only be declared by the general meeting of shareholders and after attribution to the legal reserve. A share of the net profits may be paid to members of the board of directors if:

- the articles specifically provide for such payments,

- the allocations to the legal reserve fund have been made and,

- a dividend of at least five percent has been paid to the shareholders.

Unless otherwise stated in the articles or in the resolution for the increase in share capital, each shareholder has an option to subscribe to new shares in the same proportion that his original holding bears to the total shares issued.

Each shareholder is entitled to a proportionate share of the proceeds of liquidation unless the articles of incorporation provide otherwise. The proceeds are calculated in proportion to the amounts paid in on the share capital.

Most personal membership rights are acquired rights which means that even with the general meeting’s consent, the shareholder cannot be deprived thereof. These include the following:

- Shareholders exercise their rights at the general meeting of shareholders. Every shareholder may attend the meeting in person or be represented by his proxy. A holder of bearer shares is considered authorized to attend if he presents the share. On the other hand, registered shares can only be represented if a written proxy is produced.

- Voting rights.

- Shareholders are entitled to review the financial statements, which must be available for inspection at the address of the company not later than 20 day prior to the annual general meeting. Any shareholder may request a copy to be sent to him before the meeting.

Board of Directors

The company is managed by the board composed of one or more individual directors who must be shareholders. A majority of board members must be Swiss citizens residing in Switzerland. If the board consists of a single member, he or she must be a Swiss citizen residing in Switzerland. The directors are elected at the general meeting for a period fixed by the articles (maximum six years). The directors can however be re-elected indefinitely.

The articles may require that during their term of office they must deposit a certain number of shares at the corporation’s registered domicile. This is designed to protect the corporation against damages that directors may cause in the fulfilment of their duties. The board can delegate part of its authority to either an executive committee or to individual directors, to officers or to agents. At least one director must have power and authority to represent the company. The board designates the individuals authorized to represent the company vis-a-vis third parties and determines the details concerning the signatory powers. The company is unrestricted in the selection of its executive personnel, such as managers and officers, although managers and employees of foreign nationality require a permit to take up residence and employment in Switzerland.

The board is responsible for the preparation of the general meeting. It gives the necessary instructions to the management for the proper conduct of the company’s business and supervises those authorized to act on behalf of the company. It is the primary responsibility of the board, although generally delegated to management, to keep the accounting records and to prepare the annual financial statements. Furthermore, the board must submit a written annual report on the company’s financial position and the results of its activities to the general meeting of shareholders.

Auditors

The general meeting of shareholders elects one or more independent auditors who may be individuals or legal entities. Auditors must be professionally qualified to fulfil their duties. At least one auditor must have his domicile, registered office, or a registered branch in Switzerland. The auditors may not serve as directors nor be otherwise employed by the company, nor may they assume managerial functions for the company. Auditors may be elected for a maximum period of three years. Re-election is possible.

Auditors must have special professional qualifications if the audited entity:

- has outstanding bond issues;

- has shares listed on a Swiss stock exchange;

- exceeds two of the following parameters in two consecutive years:

- Balance sheet total: CHF 20’000’000

- Revenues: CHF 40’000’000

- Average number of employees: 200

The auditors must report on whether the accounting records and the financial statements, as well as the proposal concerning the appropriation of the available profit, comply with the law and the articles of incorporation. If the auditors, in the course of their examination, find violations either of law or of the articles, they report this in writing to the board of directors and, in important cases, to the general meeting of shareholders. In the event of obvious over-indebtedness, the auditors must notify the judge if the board fails to do so. Auditors are liable to the shareholders and creditors for damage caused by intentional or negligent failure to perform their duties. The auditors are required to attend the general meeting of shareholders.

The Bolivarian Republic of Venezuela (“Venezuela” or the “Republic”) is one of the largest Latin American economies, given its status as one of the world’s largest oil producers and exporters.

Over the last few years, however, the Venezuelan Government has nationalized a number of businesses in the telecom, power, oil, oil service, bank, and several other industries. The Government has also imposed price controls on many core goods and significant exchange control restrictions that limit the ability to purchase foreign currency.

Despite all these setbacks, Venezuela continues to be a country with significant business opportunities for foreign investors willing to assume risks.

The business environment

Venezuela has the fifth largest proven oil reserves in the world (and the largest in the Western Hemisphere), and the second largest proved natural gas reserves in the Western Hemisphere. If we include an estimated 235 billion barrels of extra heavy crude oil in the Orinoco Belt region, Venezuela holds the largest hydrocarbons reserves in the world. PDVSA, Venezuela’s oil and gas state-owned company, is one of the world’s largest oil companies: they have acknowledged that significant additional foreign investment would be required to achieve its production goals. The Government has signed joint venture agreements for the development of oil and gas projects with international partners from China, India, Italy, Japan, Russia, Spain, the United States of America, and Vietnam among others. All of this creates enormous business opportunities for companies in the oil and gas sector.

The Venezuelan market is also a significant source of profits for several multinational consumer-products makers operating in the country since Venezuelans spend a relatively high proportion of discretionary income on personal products and services, beverages and tobacco, apparel, communications (mobile and smartphones), TV and electronic products. In the next few years, imports are expected to increase much faster than exports with the expansion of consumer demand and the decreasing in the national production of consumer goods.

Venezuela has signed economic cooperation treaties with several countries, including Brazil, China and Russia, providing an adequate framework for investments in projects by companies from such countries.

Venezuela is also a party to international treaties to avoid double taxation with several countries that protect investors against certain changes in tax legislation and is a party to bilateral investment treaties with several European, Latin American and Asian countries, which provide for adequate compensation in case of expropriation or nationalization and access to international arbitration in a neutral forum. Despite Venezuela’s withdrawal from the International Centre for Settlement of Investment Disputes, several of the existing bilateral investment treaties permit arbitration under the UNCITRAL Arbitration Rules and the ICSID’s Additional Facility rules. In certain cases, the Venezuelan Government has reached agreements with foreign investors in businesses subject to nationalization and has paid compensation in U.S. dollars.

The Venezuelan government has engaged in infrastructure and other strategic projects with foreign investors under contracts providing for payments in foreign currency and, in certain cases, for international arbitration to settle potential disputes.

Venezuela is divided into three levels of government: the national level, the state level and the municipal level. There are 23 states, a capital district and various federal dependencies, and each state is divided into several municipalities. The political structure of Venezuela is governed by the Constitution of 1999, as amended in February 2009.

At the national level, the government is divided in the executive, legislative, judicial, civic and electoral branches. The President of Venezuela (the “President”) is the head of state, head of the national executive branch, and the commander-in-chief of Venezuela’s armed forces. All executive powers are vested in the President. The President is also entitled to veto laws passed by the National Assembly.

The national legislative power is vested in the Asamblea Nacional or National Assembly. The National Assembly has only one chamber, and its members (diputados) are elected by universal suffrage for terms of five years, and may be re-elected for unlimited five-year terms. The National Assembly is empowered to enact laws, which require the promulgation of the President and its publication in the Official Gazette to become effective. The work of the members of the National Assembly is done through several Commissions and Sub-Commissions.

The judicial branch is vested in the Venezuelan Supreme Tribunal (Tribunal Supremo de Justicia) and various lower tribunals. The Supreme Tribunal is the final court of appeals. It has the power to void laws, regulations and other acts or decisions of the executive or legislative branches that conflict with the Constitution or the laws. The current number of justices of the Supreme Tribunal is 32. Justices of the Supreme Tribunal are appointed by the National Assembly for twelve-year terms

The Supreme Court has five chambers, the Constitutional Chamber, the Social Cassation Chamber, the Civil Cassation Chamber, the Criminal Chamber, Electoral Chamber and the Political-Administrative Chamber. Each Chamber is composed of three justices, except for the Constitutional Chamber which is composed by five.

The Venezuelan court system is a national system; there are no state courts, but there are national courts sitting in each respective state. Judges are appointed by the Supreme Court. The jurisdictions of courts are divided by subject matter: civil, commercial, labor, tax, administrative, criminal and family, among others.

Venezuelan courts are generally biased in favor of the Venezuelan government (the Republic or Venezuelan state-owned companies); therefore, it would be very difficult to win a case against the Venezuelan government in a Venezuelan court. In addition, bringing judicial proceedings against the Venezuelan government may have adverse effects on the business of the claimant and on its ability to be awarded further projects or contracts from the government.

At the state level, the government is divided in the executive and legislative branches. The executive branch of a state is in charge of its governor (gobernador) elected by universal suffrage within each state. State legislative power is vested in state assemblies whose members are also elected by universal suffrage within each state. States have virtually no taxing power but they may create taxes on non-precious metals and minerals that are not reserved to the State.

At the municipal level, the government is divided in the executive and legislative branches. The executive branch of a municipality is in charge of its mayor (alcalde), elected by universal suffrage within each municipality. Municipal legislative power is vested in municipal assemblies (consejos municipales) whose members (concejales) are also elected by universal suffrage within each state. Municipalities are empowered to levy business tax on gross income and to approve construction projects in cities and other population centers.

The author of this post is Fulvio Italiani

Founders

At least one founder (either individual or legal entity) is necessary to form a corporation. Founders and shareholders are not subject to any nationality or residence requirements. Directors must be shareholders and at least one director must be resident in Switzerland. Another restriction relates to the acquisition by non-resident aliens of shares in a Swiss company whose assets consist mainly of Swiss real estate: these transactions are subject to prior authorization. Prior authorization is further required for non-residents to own and operate a Swiss bank, or to acquire an existing Swiss bank.

Articles of incorporation

Articles of incorporation must have the following minimum content:

- the company name and address;

- the business purpose of the company;

- the amount of share capital and the contributions made thereto;

- the number, par value and type of shares;

- the calling of the general meeting of shareholders and the voting rights of the shareholders;

- the naming of the bodies which take care of the management and the auditing of the company;

- the form in which the company must publish its notices.

Optional clauses are those which must only be listed if founders intend to adopt additional provisions, such as the directors’ participation in the net profits, the issue of preferred shares, the delegation of directors’ authority, the issue of authorized capital or conditional capital.

Founders report

The founders must provide a written statement giving particulars of the nature and condition of contributions in kind or proposed acquisitions of assets, and the appropriateness of their valuation. A founders’ statement is also required when the capital of a company shall be contributed by conversion of shareholder loans and advances. The auditors have to review the founders report and confirm in writing that it is complete and truthful.

Raising of Funds

After subscription to all shares of capital stock, a minimum of 20% of the par value but not less than CHF 50,000 must be placed in escrow with a bank. The funds may only be released to the management after the company has been registered in the Commercial Register.

Incorporation Meeting

The corporation is formed at the incorporation meeting, which is held in the presence of all the shareholders and a public notary. This latter declares that the capital stock is fully subscribed and that the minimum payments have been made. Thereafter, the shareholders adopt the articles of incorporation and appoint the bodies corporate (board of directors, auditors etc.). Finally, a notarised deed must be drawn up recording the resolutions of the general meeting.

Registration

After incorporation, the company must be registered with the Commercial Register. This registration is published in the Swiss Official Gazette of Commerce. It discloses details such as the purpose of the company, its seat, the names of the shareholders (unless they opted for issuing bearer shares) and the names of the directors. Only at the time of registration the company acquires legal entity status. Shares may not be issued prior to registration.

Upon formation, a one-time federal stamp duty of 3% is due on the capitalisation of the company. This stamp duty is assessed on the price at which the shareholder buys the shares. Any premium above par value is also subject to this duty. Furthermore, there are registration and notary fees and, generally, fees due to agents who act as founders to the new entity.

Corporate Name

The corporation is registered under a firm name, which must be distinguished from those of all other corporations already existing in Switzerland. In principle, the corporation is free to choose any kind of name. The name may not however be misleading or otherwise untruthful. The use of national or territorial designations is not permitted unless specifically authorized by the Federal and Cantonal Registers of Commerce. If a personal name is used, a designation showing the corporate nature must be added.

Share Capital

A public company is required to have a minimum capital of CHF 100,000 divided into shares with a minimum face value of CHF 0,01, while a limited liability company is required to have a minimum capital of CHF 20,000. In the case of a public company, all shares must be subscribed at the time of formation. Capital contributions may be in cash or in kind. If the contribution is made in kind, the company must have access to such assets immediately after registration in the Commercial Register. The articles must describe the property, its value, the shareholder from whom it is received and the number of shares issued in return. The acceptance by the company of contributions in kind requires the approval of at least two thirds of the shares represented at the incorporation meeting.

The general meeting of shareholders may authorize the board to increase the share capital within a period of 2 years. It is within the competence of the Board to decide if, when, and to what extent, the capital should be increased.

The general meeting may provide in the articles for a conditional capital increase. The purpose of issuing conditional capital is, alternatively, to secure options and conversion rights in connection with warrant issues or convertible bonds, or to create employee shares. The increase of capital takes place at the same time, and to the same extent, as the exercise of the respective rights.

Different Types of Shares

Swiss corporation law distinguishes between the following categories of shares:

- Bearer shares – Bearer shares may not be issued until the full issue price has been paid in. They are transferable by delivery and the corporation cannot restrict their transfer. Bearer shares are very popular in Switzerland because many owners prefer to protect their identity.

- Registered shares – Registered shares are subscribed as called by the corporation and do not need to be fully paid in on issue. They are transferable by endorsement or assignment, generally without restriction. The company must keep a share ledger listing the owners’ names and places of residence. The entry must be certified on the share certificate by the Board. The buyer of incorrectly transferred registered shares cannot exercise personal membership rights. The articles may provide for subsequent conversion of registered shares into bearer shares and vice versa.

- Restricted transferability of registered shares – To prevent unfriendly takeovers, the articles may provide for restrictions on the free transferability of shares. By law those restrictions are however limited.

- Preferred shares – The general meeting of shareholders is entitled to issue preferred shares or to convert existing common shares into preferred shares. The holders of preferred shares enjoy certain preferences such as cumulative or non-cumulative dividends, priority in the proceeds of liquidation and a preferential right to subscribe to new shares. This preferential treatment must be provided for by the articles or be adopted by the votes of at least two thirds of all shares represented.

- Voting shares – In general, each share is entitled to one vote. Since shares of differing value may be issued, each vote may not represent the same amount of capital contribution. Voting shares, therefore, provide those shareholders who represent a financial minority with the decision making power within the corporation. The issue of voting shares is permitted in the ratio of 1 : 10 to ordinary shares.

- Profit sharing certificates – The general meeting of shareholders can issue profit sharing certificates in favour of persons who have an interest in the company through previous capital contributions, shareholdings, creditors’ claims, employees, or similar relationships. Profit sharing certificates may grant rights to a share in profits, a share in the liquidation proceeds or rights to subscribe to new shares. They do not procure any membership rights. By law, profit sharing certificates must not have a par value nor be issued in exchange for contributions characterized as assets.

- Certificates of participation – The certificate of participation is a non-voting share, with the holder of such certificates having basically the same status as shareholders apart from the right to vote. The participation capital must not exceed double the share capital. Companies have until June 30, 1997 to comply with this requirement unless their participation capital was more than double the share capital on January l, 1985.

意大利政府在即将由意大利议会审议的《预算法草案》中建议:为在意大利投资的外籍富裕个人提供简便的入境签证。若自雇人员以工作为目的移居意大利,则通过自雇所得的收入可申请税收减免。意大利的新税务优惠制度,类似于“英国税务居民但非英国居籍”制度(UK resident-not-domiciled regime)。

为了吸引外国资本,意大利政府正重点关注有意移居意大利的非居籍个人的税收新优惠。

一方面,人民迁移权和迁移流程的法律框架被修改:加入了为期两年的特别签证制度(可续签,在某些情况下或为三年)。上述签证制度适用于在意大利持续居住超过三个月的个人。

若要申请上述优惠,则非居籍个人需要证明其满足以下条件,或证明将在意大利进行以下投资:(1)购买并持有至少200万欧元政府债券至少两年,(2)在注册地址为意大利、并在意大利运营的公司股本的权益工具中投资至少100万欧元,并维持至少两年,(3)用于文化、教育、移民管理、科学研究或文化产品修复的至少100万欧元慈善捐款。

对于是否符合上述要求,相关部门会通过非居籍个人提交的一系列文件(根据待定程序)进行核实。如果得到积极的评价结果,那么符合要求的非居籍个人将获得“投资者签证”。

其他修正案将涉及所谓的《2015国际化法令》(第147/2015号法令,第16条),尤其雇员由于工作原因移居至意大利的特别制度。该制度内容将被扩展,以在税收优惠方面更具吸引力。

事实上,在意大利停留两周以上的自雇人员也将受益于该制度内容的扩展修改。此外,政府似乎愿意扩大无税区:至今为止,在意大利自雇工作或受雇工作收入的30%无需缴税,但之后该百分比可能提高至50%。

目前,税收减免只适用于欧洲公民。根据草案,该税收优惠覆盖范围可扩大至:所居住国已与意大利签署双重税务协定或互相交换信息协议的非欧盟国家居籍个人。此外,申请人必须持有大学学位并且在过去至少24个月持续受雇或自雇。

《预算法草案》为符合条件的非意大利居籍及其亲属制定新的税收制度,使他们愿意移居意大利。该草案类似于“英国税务居民但非英国居籍”制度,规定在意大利境外产生的所有收入与收益,在提交税收支配预算的正式申请之后,每年只需缴纳10万欧元的固定替代税。上述申请最多可持续15年,期间可撤销或提前终止。

此项规定无疑极具吸引力,如果得以实现,将可推动大量高资产净值个人居住在意大利。如此优惠的税制在过去从未被提出过。

写信给 Roberto

Santo Domingo – How to set up a company

19 12 月 2016

-

多米尼加共和国

- 公司法

- 分销协议

Chinese outbound M&A was one of the main topics of interest at the 2017 Hong Kong IFLR Forum on M&A in Asia, a great event with an outstanding level of speakers and very interesting discussions on various themes related to international investments.

All the attendants shared the view that momentum for Chinese overseas investments is still strong, despite the recent policy aiming at curbing the outflow of capitals from China.

A particularly interesting session was that on “best practices to overcome credibility and experience gaps increasingly faced by “off the radar” Chinese bidders”.

Opening a one-to-one negotiation or letting a Chinese company bid at an auction involves often great deal of uncertainty, as most participants to the session shared the experience of having seeing their Chinese counterpart walk away from the negotiation without any explanation (the so-called “Random Investors”).

I have scribbled down the take-aways of the discussion as follows.

Main clues to spot early on the Random investor:

- the Company pops out from nowhere and has no track record of overseas investments;

- the Company has no legal or financial advisors, or if they do, their advisors are not experienced in overseas transactions;

- the Company has excellent advisors… but has not paid their fees (yes, that happens)

- the target does not belong to the Company’s core business (and there is no explanation for their interest for the deal);

What should you do to be on the safe side?

- request a written declaration of interest, expressing the reasons why the Company wants to invest in the target and what is their mid term strategy, signed and stamped by the legal representative (if they are not ready to hand over this letter the game can stop here).

- If the Company represents a group of investors, require full disclosure and letters of confirmation from all parties, from day one (AC Milan’s case is a good example of what happens later on if there is no disclosure of all players, and their stakes in the deal);

- request proof that the Company has filed the application for the authorisation to invest overseas (due to the recent tightening of controls on capital outflow, this step is fundamental);

- request proof that they have the finance needed for the deal (either onshore or, better, off-shore);

- make clear that you will require a “break fee” (which can vary from 5 to 10%) in case they walk away from the negotiation (we have heard of US companies expecting 30 to 50% break fee on the value of the deal…)

为重振意大利经济,随着 2017年1月1日起生效的Legge di Bilancio 2017(“预算法”),意大利议会开始执行一项新战略:通过采取一系列在财务和财政上支持初创企业和中小型企业的措施,使他们对外国投资更具吸引力。

预算法设计了一个涉及某些税收减免的完整计划,中小型企业可通过众筹平台筹集资金,“创新型”初创企业(意为符合某些法律规定的早期公司:如高新技术公司、研发公司以及拥有大量高科技人才的公司等)向上市公司出售、转移其税务亏损。总体而言,这些措施的主要目的为:解锁迄今为止还没有足够能力向早期初创企业和中小企业提供财政资源和税收优惠的经济制度,使他们发展创新资产并扩大业务。

该系列措施可根据目的被归类为以下四类,

- 培养创业精神,成立创新型公司;

- 刺激针对创新型初创企业及中小企业的直接投资;

- 支持研发支出,以及

- 随着创新科技的发展,以数字化和自动化的方式将公司现有资产现代化。

成立新公司的经济援助

议会制定的战略涉及经济发展部(Mise)、国家工伤事故协会(Inail),以及其他公共机构,如Invitalia,以促进初创企业的成立和创新型中小型企业的发展。

事实上,旨在提供软贷款以支持创新型初创企业成立的可持续增长基金(FCS – Fondo per la Crescita Sostenibile)的捐款,在2017和2018年均增长了4750万欧元。

此外, 2017及2018年,预算法均拨出4750万欧元以促进自雇就业和创业精神。这些基金将由Invitalia管理,政府机构为了促进内向型投资和企业发展,主要用于支持女性和青年企业家(18至35岁)创立公司。Invitalia将给予最长8年的零利息贷款补贴,这将可覆盖特定投资预算总支出的75%。之后,公司必须就商业计划中的剩余额度提供资金,并在签署贷款协议的24个月内开始执行计划中投资。

经济发展部还发布了一系列措施,以补贴和支持由初创公司执行的发展方案。该发展方案的重点为收购新机械及新技术设备,硬件和软件技术,专利和许可以及与生产/管理需要有直接关系的非专利技术的专业知识。

预算法在相关政府部门批准之前,还提出了Inail对封闭式基金的投资,该投资致力于参与或直接成立创新型初创企业及技术合资企业。

精简官僚机构

为了简化成立初创公司的程序而出台的一系列措施,如无须公证,无须印花税票以及其他行政费用。也可在起草公司章程之后,依靠合格的电子签名通过在线程序进行修订。

创初创企业和中小型企业投资税收减免

在欧洲委员会最终批准之前,预算法为向初创企业投资提出了新的激励措施。关于类似投资税收减免的政策并非首次提及。2012年提出的最初设想为临时性的,随着预算法的出台,这些措施不仅被转化为永久性奖励政策,而且个人和公司分别从过去的19%和20%增加至30%,对投资者(潜在股东)情况无区别对待,投资上限为个人100万欧元,实体180万欧元。

这些减税措施旨在鼓励对初创公司的投资,而该投资需要在目标公司至少停留3年(预算法条例将其从两年变更为三年),所以优惠政策抵消了其中的弊端。此外,预算法还将上述优惠延伸至创新型中小企业(即在任何时间成立、经营范围在技术创新领域的中小企业),如上所述,这些企业无须再为了获得其他优惠而提出创新型资产项目的计划。

可使初创公司和上市公司实现双赢的合作关系

在预算法的随附报告中,政府还强调了上市公司直接或间接资助初创公司的重要性,并提出了在符合某些要求的情况下,初创公司可向上市公司转移其前三年累计税收损失。

上述转移将根据公司税收抵免转移的相关条例执行;受让方将被要求弥补从转让方得到的好处,其向初创公司所支付的报酬不会被征税。通过这种机制,双方公司都将获益:初创公司找到财务“赞助商”,上市公司可用税收损失完全抵消其应纳所得税,并且还会考虑超出部分在下一年转结的可能性。

众筹

通过对意大利财政统一法案 (即Testo Unico Finanza) 的调整,预算法摆脱了一些组织众筹市场在意大利起飞的限制,并提出了所有中小企业进入股权众筹的可能性。以前的立法限制了通过此系统只向创新型中小企业筹集资金的可能性,因此限制了中小企业和众筹行业的发展。

管理股权众筹的规则将与运营方(即众筹平台)一样,现在中小型企业除了通过银行融资和证券上市交易所的传统渠道之外,还将有一个新的筹集资金的手段。

研发支出的税收减免

2013年推出的关于研发支出的税收减免已被延长至2020年12月,并已从全部符合要求的研发活动的25%曾至50%,年度上限为2000万欧元(就从前最高限额增长5倍)。

公司将可减少缴税,并就其研发支出的比例要求补偿。该规定现适用于所有研发支出,包括雇佣致力于研发活动的人员(对其资格无特殊要求)以及任何类型的公司(居民和非居民)、集团或联合企业。无论企业规模、法律地位和行业参考。

此财政激励可与其他政策相结合,使得所有创新型初创公司中持有股份的基层员工获得税收优惠。具体来说,意味着进行研发活动的员工将受益于任何股权计划工作,该公司将受益于上述两种税收减免。

大型投资项目的开发合同

开发合同(Contratti di sviluppo)的签署各方为:意大利经济发展部(Mise),Invitalia以及一家或若干家从事发展项目的公司(通过网络完成契约)。

2011年,为了支持规模至少为2000万欧元(其中750万欧元仅用于农业食品行业)的大型工业/生产性投资,这些合同首次被提出。

发展合同由Mise资助,相关大区也涉及其中(亦可参与投资)。Invitalia作为参照指示以促进公司并负责管理资源和应用/评估申请。

这些合同针对意大利公司以及在意大利的外国公司,并提供财务优惠如厂房和设备的补助金、软贷款和利息补贴,其比例可根据公司规模和涉及的项目类型而变化(研发支出,创新导向投资)。

Invitalia为申请程序及后续的发展计划设置了快速步伐:一旦项目被批准,公司将有90日时间提交所有指定文件;其中有6个月的准备时间以及36个月执行时间。

作为国家意志的象征,为了富有成效地完成数字化相关的投资项目,该程序也将开通特别快速通道。

超级折旧和高度折旧

到2017年,预算法也就相关公司额外追加了40%的折旧减免(构成税收折旧总数为140%)。然后,公司可以扣除购买折旧率超过6.5%的有形资产的费用。该奖励只适用于采购订单已被供应商接受并于2017年12月31日前支付至少20%的资产。除此之外,该法律还就为获得雾化及数字化企业而购买(或租赁)如数控机械或设备的新技术资产(该法律全面概述了符合要求资产的完整范围),提出了150%的额外折旧减免(即“高度折旧”,加之现有的折旧规定,将获得250%的折旧减免)。

Sabatini-ter

预算法也提出了“Sabatini”,一项旨在促进中小企业购买(或租赁)资金货物的特别立法:即弥补数额在2万至200万欧元之间的部分银行贷款利息。该立法有效期被延长至2018年12月31日。一个具体并更宽松的措施将适用于购买与工业4.0计划相关的新资产。部分资源将用于支持创新、提高效率和创立数字化工业体系——该工业体系投资于例如云计算、宽带连接、网络安全、机器人、机电一体化等技术设备。

总而言之,上述措施适用于所有位于意大利的公司,是使意大利企业在全球市场中更具竞争力的战略里程碑,在技术和财政资源方面。由于没有进入的监管壁垒,该新规定将赋予意大利经济体系新的生命,并吸引外国投资者。

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.

The options available to foreign companies to set up business in Venezuela are (a) the registration of a branch; (b) the corporation; (c) the limited liability company; (d) the general partnership, (e) the limited partnership; (f) the stock limited partnership; and (g) the consortium. In this memorandum we use the term “company” to indistinctively refer to any of the options described in this paragraph, including the branch, the corporation or any of the partnership, but excluding the consortium.

The branch and the corporation are the two most common options used by foreign companies to do business in Venezuela. The corporate features of the companies are set forth in the Venezuelan code of commerce.

Corporation

The Venezuelan corporation is owned by shareholders and is a legal entity separate and distinct from its shareholders. The corporation is indistinctively known as compañía anónima (C.A.) or sociedad anónima (S.A.).

Limited Liability

The liability of the shareholders of a corporation is limited to the payment of the nominal value (and premium, if any) of the shares such shareholder owns. As a general rule, the shareholders of the corporation are not liable for the obligations of the corporation.

However, most Venezuelan commentators accept the piercing of the corporate veil by a Venezuelan court in the event of certain exceptional circumstances, such as: (a) when the corporate form −a legal and valid mean to conduct business− has been intentionally used against the purpose of the law to circumvent the application of a mandatory rule or to attain an otherwise illegal result (fraude a la ley or fraus legis); or (b) when there has been an abuse of the corporate form that has caused damages or an unfair consequence (abuso de derecho). Venezuelan courts have also accepted the application of the piercing of corporate veil when the separation of the legal entity from its shareholders would produce an unfair situation or when the corporate form is abused to avoid a legal consequence. In addition, the Constitutional Chamber of the Venezuelan Supreme Court issued a widely criticized opinion (Transporte Saet case) in which it applied the piercing of corporate veil doctrine without explaining or invoking an exceptional circumstance to do so. In the decision, the Supreme Court held that any company that is part of an economic group may be held liable for the obligations of any other party of the group. Note however, that this decision was related to a labor matter.

Foreign Direct Investments

The only areas currently reserved to companies owned or controlled by Venezuelan investors are open-air television, radio broadcasting, newspapers in Spanish and professional services regulated by law. There are other areas, such as oil, that are reserved to the Venezuelan government in which foreign investors may participate only through minority participations in joint venture companies with the Republic or Venezuelan state-owned companies.

Foreign investors (i.e., foreign companies (head offices), foreign shareholders or foreign partners) must register their direct foreign investments in a Venezuelan company (branch, corporation or partnership) with the Venezuelan foreign investment authority within 60 days following the date on which investment was made (the “foreign investment registration”).

Several documents must be submitted to the Venezuelan foreign investment authority by the foreign investor to obtain the foreign investment registration, including evidence that the capital of the company was paid with foreign currency or contribution in kind that entered Venezuela. To obtain such evidence, the foreign investor must (a) in case of payment in cash, order a wire transfer to the Venezuelan bank account of the company from an account of the foreign investor located outside Venezuela (as a result of the wire transfer, foreign currency transferred out of the offshore account of the investor will be converted into bolivars at the official exchange rate and deposited in bolivars in the Venezuelan bank account), and (b) in the case of contribution in kind, demonstrate that the asset being contributed to the capital of the company was imported into Venezuela (copies of the import manifest, commercial invoice and other custom documents).

The foreign investment registration must be updated annually by the foreign investor within 120 days of the end of the fiscal year.

Financing a company

The corporation must have a stated or subscribed capital (“stated capital”), which is the amount of capital that the shareholders of the corporation agree to subscribe.

Although there are no statutory minimum capital requirements applicable to the stated capital, each Venezuelan commercial registry sets forth a minimum stated capital requirement on a case-by-case basis or depending on the purpose of the corporation.

The stated capital of the corporation can be paid in cash or in kind. In case of payment in cash, at least 20% of the stated capital must be paid by the shareholders at the time of the registration of the shareholders’ meeting approving the incorporation of the corporation or the corresponding capital increase (the amount of stated capital already paid by the shareholders is known as “paid-in capital”). Payment in cash of the stated capital must be made by a deposit in bolivars in a bank account opened with a Venezuelan bank under the name of the corporation. In case of payment in kind, assets for a value equal to 100% of the stated capital must be contributed to the corporation. To be eligible for foreign investment registration, the stated capital must be paid out of foreign currency or assets brought into Venezuela from abroad.

The stated capital of the corporation is represented by shares. The shares can only be issued in registered form (bearer shares are not permitted). All shares must have a par value (valor nominal), and such par value must be denominated in bolivars. The stated capital of the corporation is equal to the sum of the nominal value of the shares.

The corporation can issue different classes of shares. Issuance of shares of different classes is convenient where different shareholders or groups of shareholders are each entitled to appoint a number of directors. Preferred shares can also be issued, granting their holders preferences in the payment of dividends, liquidation or otherwise.

The ownership of the shares of a corporation is evidenced by the notations made in the book of shareholders kept by the corporation. Shares can also be represented in certificates, but the issuance of share certificates is not required

The corporation must have at least two shareholders at the time of incorporation. However, immediately after incorporation, all the shares of the corporation may be transferred to one of the shareholders and thus the corporation may become a wholly-owned subsidiary of such shareholder.

The only areas currently reserved to companies owned or controlled by Venezuelan investors are open-air television, radio broadcasting, newspapers in Spanish and professional services regulated by law. There are other areas, such as oil, that are reserved to the Venezuelan government in which foreign investors may participate only through minority participations in joint venture companies with the Republic or Venezuelan state-owned companies.

As in most other jurisdictions, there are certain controls on money laundering which generally require banks and other professional bodies to identify clients and their sources of funding and to report suspicious transactions.

Opening a branch office

The registration of a branch (sucursal) in Venezuela by a foreign company does not result in a separate legal entity being formed in Venezuela. Therefore, the foreign company (head office) will be liable for all the obligations assumed by the branch.

The branch must be registered with a Venezuelan commercial registry located in the city of domicile of the branch, and such registration must then be published in a Venezuelan newspaper. The foreign company can choose the domicile of the branch.

The name generally used for the branch is the same name of the foreign company (head office) or its abbreviation followed by the expression Sucursal Venezuela (which means Venezuelan branch).

The branch must have at least one representative. The branch representative will have full powers to represent and manage the branch, except for the power to sell or transfer the business (unless such power is expressly granted to the representative). Any limitations to the powers of the representative are not effective against third parties. If the branch representative is not a Venezuelan citizen, he may have to obtain a working visa in order to sign documents on behalf of the branch before public notaries or registries in Venezuela.

The foreign company must assign a capital to the branch (capital asignado or “branch capital”). The branch capital does not constitute a limitation of the liability of the foreign company (head office), since the branch is not considered a legal entity separate from the foreign company. Although there are no statutory minimum capital requirements applicable to the branch capital, the Venezuelan commercial registry sets forth a minimum branch capital requirement on a case-by-case basis.

The branch capital must be paid by the foreign company (head office), either in cash or in kind. In case of payment in cash, an amount in bolivars equal to the branch capital must be deposited in a bank account opened with a Venezuelan bank under the name of the branch. In case of payment in kind, assets for a value equal to the branch capital must be contributed to the branch. To be eligible for foreign investment registration, the branch capital must be paid out of foreign currency or assets brought into Venezuela from abroad.

Unlike the corporation, the branch is not required to appoint statutory auditors or file annual balance sheets with the commercial registry. However, the branch is required to keep accounting books for tax purposes, i.e. the journal book, the ledger book, the inventory book and the VAT books.

The branch capital and any subsequent increases in the branch capital are subject to a registration tax equal to 1-2% of the branch capital, plus other registration fees and expenses, the tax depend on the commercial registry.

Filings with the Commercial Registry

All Venezuelan companies must be registered with a Commercial Registry. The Commercial Registry contains copies of the company’s articles of incorporation and by-laws, information on its standing (i.e. annual financial statements, liquidation or bankruptcy proceedings), registered address, directors and officers, the existence of branches, and other information. All information filed with the Commercial Registries is public. Companies must notify the Commercial Registry of changes to their articles of incorporation and by-laws and update other information filed with the registry. Companies must also file annual financial statements and periodically file minutes of shareholders appointing directors and officers.

Opening a bank account

Opening a Venezuelan bank account is required to incorporate a corporation or register a branch in Venezuela. The bank account shall be opened with a Venezuelan bank under the name of the corporation or the branch by one of its authorized representatives.

A non-resident (individual or corporation) can also open a bank account in Venezuela. The bank must only check the non-resident’s identity and capacity. In the case of a corporation, the requirements are: (i) the articles of incorporation duly apostilled or legalized by the Consulate of Venezuela in the respective country and translated in Spanish by interpreter public; (ii) the Fiscal Information Registry (RIF) issued by the Venezuelan fiscal authorities; (iii) the Identity Card for Venezuelan or foreign natural persons resident in the country, empowered to mobilize the account; and (iv) the minutes of shareholders meeting in which the authorization granted to the persons empowered to mobilize the account to act on behalf of the Company.

Additional information may be required by banks to better identify the corporation or the persons authorized to mobilize the account in accordance with anti-money laundering and other banking regulation.

Utilising office space

Office spaces may either be owned by the Company or rented. Multinational companies may often acquire offices or acquire land and construct their own offices, especially given the existing Venezuelan exchange controls, see section on Regulatory Compliance below.

Rental rates in Venezuela, and in particular in Caracas, are usually high, even when compared to international standards, Residential leases are strictly controlled under Venezuelan law; these controls do not apply to commercial leases.

Immigration controls

Foreign individuals intending to work in Venezuela are required to obtain a working visa or a business visa. Working visas grant their holders the right to a continued stay in Venezuela for an extendable one-year term, renewable for the same term, and authorize their holders to work in Venezuela as well as to enter into and depart from Venezuelan without restrictions. Business visas are granted to foreign citizens traveling to Venezuela to conduct business or to take part in commercial, technical, advisory, scientific, or cultural activities. Business visas are primarily designed for brief stays in the country and are valid for one year from the date of issue, renewable for the same term, entitling the holders to multiple entries during that term. However, under this type of visa the holder is limited to a maximum length of stay in the country of not more than six months. The process to obtain visas may be cumbersome.

The author of this post is Fulvio Italiani

There are three bodies in a Swiss corporation, namely: the general meeting of shareholders (the supreme body), the board of directors and the auditors.

Shareholder’s meeting

The general meeting of shareholders is the supreme authority of the company and is composed of all shareholders. There are two types of meetings:

- Ordinary general meeting. This is held annually within six months after the close of the business year;

- Extraordinary general meeting, which is called as often as considered necessary.

The general meeting of shareholders has the right to adopt and amend the articles, to appoint directors and auditors, to approve the financial statements and the directors’ report, to ratify certain decisions of the Board, and, in general, to make all important decisions which are not delegated to any other body. The shareholders must also approve the proposal of the Board relative to the distribution of annual profits. A general meeting is called by the board or, if it fails in its duties, by the auditors. One or more shareholders, representing together at least 10 % of the share capital, may at any time request the calling of an extraordinary shareholders’ meeting. This must be done in writing, indicating the purpose of the meeting. In general, a simple majority of votes represented at the general meeting is sufficient to pass a resolution and hold elections. However, certain decisions require a vote of two thirds of the votes represented and the absolute majority of the· par value of the shares represented (such as change of corporate purpose, extension of scope of business, distribution of shares with privileged voting rights etc.).

Shareholders cannot be deprived of their acquired rights without their consent. The term acquired rights includes the right to vote, to dividends, to a share of the liquidation proceeds and to receive sufficient information on the financial condition of the company. The Swiss Code distinguishes two kinds of shareholders rights: financial interests and personal membership rights.

Each shareholder has the right to a proportionate share of the profits distributed. Dividends may only be paid out of net profits or out of reserves specially created for this purpose. There is no interest payable on the ordinary share capital and a company may not declare interim dividends out of current year profits. Dividends can only be declared by the general meeting of shareholders and after attribution to the legal reserve. A share of the net profits may be paid to members of the board of directors if:

- the articles specifically provide for such payments,

- the allocations to the legal reserve fund have been made and,

- a dividend of at least five percent has been paid to the shareholders.

Unless otherwise stated in the articles or in the resolution for the increase in share capital, each shareholder has an option to subscribe to new shares in the same proportion that his original holding bears to the total shares issued.

Each shareholder is entitled to a proportionate share of the proceeds of liquidation unless the articles of incorporation provide otherwise. The proceeds are calculated in proportion to the amounts paid in on the share capital.

Most personal membership rights are acquired rights which means that even with the general meeting’s consent, the shareholder cannot be deprived thereof. These include the following:

- Shareholders exercise their rights at the general meeting of shareholders. Every shareholder may attend the meeting in person or be represented by his proxy. A holder of bearer shares is considered authorized to attend if he presents the share. On the other hand, registered shares can only be represented if a written proxy is produced.

- Voting rights.

- Shareholders are entitled to review the financial statements, which must be available for inspection at the address of the company not later than 20 day prior to the annual general meeting. Any shareholder may request a copy to be sent to him before the meeting.

Board of Directors

The company is managed by the board composed of one or more individual directors who must be shareholders. A majority of board members must be Swiss citizens residing in Switzerland. If the board consists of a single member, he or she must be a Swiss citizen residing in Switzerland. The directors are elected at the general meeting for a period fixed by the articles (maximum six years). The directors can however be re-elected indefinitely.