-

塞浦路斯

Cyprus – Joint Ventures in practice

30 1 月 2018

- 公司法

- 税务

The Italian Budget Law for 2017 (Law No. 232 of 11 December 2016), with the specific purpose of attracting high net worth individuals to Italy, introduced the new article 24-bis in the Italian Income Tax Code (“ITC”) which regulates an elective tax regime for individuals who transfer their tax residence to Italy.

The special tax regime provides for the payment of an annual substitutive tax of EUR 100.000,00 and the exemption from:

- any foreign income (except specific capital gains);

- tax on foreign real estate properties (IVIE ) and tax on foreign financial assets (IVAFE);

- the obligation to report foreign assets in the tax return;

- inheritance and gift tax on foreign assets.

Eligibility

Persons entitled to opt for the special tax regime are individuals transferring their tax residence to Italy pursuant to the Italian law and who have not been resident in Italy for tax purposes for at least nine out of the ten years preceding the year in which the regime becomes effective.

According to art. 2 of the ITC, residents of Italy for income tax purposes are those persons who, for the greater part of the year, are registered within the Civil Registry of the Resident Population or have the residence or the domicile in Italy under the Italian Civil Code. About this, it is worth noting that persons who have moved to a black listed jurisdiction are considered to have their tax residence in Italy unless proof to the contrary is provided.

According to the Italian Civil Code, the residence is the place where a person has his/her habitual abode, whilst the domicile is the place where the person has the principal center of his businesses and interests.

Exemptions

The special tax regime exempts any foreign income from the Italian individual income tax (IRPEF).

In particular the exemption applies to:

- income from self-employment generated from activities carried out abroad;

- income from business activities carried out abroad through a permanent establishment;

- income from employment carried out abroad;

- income from a property owned abroad;

- interests from foreign bank accounts;

- capital gains from the sale of shares in foreign companies;

However, according to an anti-avoidance provision, the exemption does not apply to capital gains deriving from the sale of “substantial” participations that occur within the first five tax years of the validity of the special tax regime. “Substantial” participations are, in particular, those representing more than 2% of the voting rights or 5% of the capital of listed companies or 20% of the voting rights or 25% of the capital of non-listed companies.

Any Italian source income shall be subject to regular income taxation.

It must be underlined that, under the special tax regime no foreign tax credit will be granted for taxes paid abroad. However, the taxpayer is allowed to exclude income arising in one or more foreign jurisdictions from the application of the special regime. This income will then be subject to the ordinary tax rule and the foreign tax credit will be granted.

The special tax regime exempts the taxpayer also from the obligation to report foreign assets in the annual tax return and from the payment of the IVIE and the IVAFE.

Finally, the special tax regime provides for the exemption from the inheritance and gift tax with regard to transfers by inheritance or donations made during the period of validity of the regime. The exemption is limited to assets and rights existing in the Italian territory at the time of the donation or the inheritance.

Substitutive Tax and Family Members

The taxpayer must pay an annual substitutive tax of EUR 100,000 regardless of the amount of foreign income realised.

The special tax regime can be extended to family members by paying an additional EUR 25,000 substitutive tax for each person included in the regime, provided that the same conditions, applicable to the qualifying taxpayer, are met.

In particular, the extension is applicable to

- spouses;

- children and, in their absence, the direct relative in the descending line;

- parents and, in their absence, the direct relative in the ascending line;

- adopters;

- sons–in-law and daughters-in-law;

- fathers-in-law and mothers-in-law;

- brothers and sisters.

How to apply

The option shall be made either in the tax return regarding the year in which the taxpayer becomes resident in Italy, or in the tax return of the following year.

Qualifying taxpayer may also submit a non-binding ruling request to the Italian Revenue Agency, in order to prove that all requirements to access the special regime are met. The ruling can be filed before the transfer of the tax residence to Italy.

The Revenue Agency shall respond within 120 days as from the receipt of the request. The reply is not binding for the taxpayer, but it is binding for the Revenue Agency.

If no ruling request is filed, the same information provided in the request must be provided together with the tax return where the election is made.

Termination

The option for the special tax regime is automatically renewed each year and it ends, in any case, after fifteen years from the first tax year of validity. However, the option can be revoked by the taxpayer at any time.

In case of termination or revocation, family members included in the election are also automatically excluded from the regime.

After the ordinary termination or revocation, it is no longer possible to apply for the special tax regime.

The author of this post is Valerio Cirimbilla.

Like in other jurisdictions, in Cyprus the term ‘joint venture’ connotes business arrangements that involve the pooling of resources, knowledge and experiences of the participants for the purposes of accomplishing or implementing a specific task, whether this is a particular project or business activity. There is no specific statute governing joint ventures yet in practice such arrangements take one of the following structures.

-

Corporate Joint Venture

The cooperation materialises through the setting up of a legal entity separate from its participants with constitutional documents governing its operation and the relations between the participants and the entity in addition to the statutory provisions of the Cyprus Company Law, Cap 113. A shareholders’ agreement is typically executed operating in parallel. It is possible that further agreements such as licences for use of intellectual property etc. will be signed. This vehicle might be more appropriate where it is expected that the joint venture will need to enter into contractual arrangements with third parties due to the limited liability benefits. The termination is usually addressed in a shareholders’ agreement which specifies events of termination e.g. change of control, insolvency of a participant, attainment of objective etc. as well as the relevant processes e.g. sale of shares among participants, liquidation etc.

Taxation of income occurs at the level of the company. Participants are not taxed on dividends in Cyprus if they are not tax residents or if they are companies. If the company is to be taxed in Cyprus, the management and control will need to be exercised in Cyprus. Any assets, including intellectual property created by the company, become property of the new entity. The setting up of the company might be subject to notification to the competent competition authority under merger control rules. Corporate joint ventures are commonly used by international clients aiming to benefit from the network of double tax treaties maintained by Cyprus. They are also a vehicle often employed to enter the Cyprus market with the assistance of a local participant.

Advantages:

- Limited liability; liability of participants limited to capital.

- Participants control the company through the power of appointment of the board of directors.

- The company is governed by the Cyprus Companies Law, Cap. 113, a statute based on English company law rules, which gives more legal certainty and familiarity for participants as well as the counterparties. The relationship is not purely contractual.

- Tax optimisation possibilities given the low rate of corporate taxation applicable in Cyprus (at the rate of 12.5%). The numerous double tax treaties maintained by Cyprus may be exploited.

Disadvantages:

- Less flexibility compared to the other structures due to the applicable legal framework both in terms of operation and compliance.

- Governance and control questions might need to be addressed e.g. to deal with deadlocks.

- Restrictions and or conditions for the transfer of shares are typically adopted.

- Both the corporate profit and the dividends returned to participants might, under certain circumstances, be subject to taxation e.g. where participants are natural persons residing in Cyprus.

-

Partnership Joint Venture

The relationship is governed by the relevant statute which specifies the liability of each partner depending on whether the partnership would be a general or limited partnership. In the first case, each partner has unlimited liability with the other partners for all debts and liabilities of the partnership. In the second case, only the general partner has unlimited liability; limited partners are only liable for the capital they agreed to invest but should not participate in the running of the business. The relevant statute imposes default and overriding rules governing the arrangement e.g. in relation to the termination or profit sharing. The termination of the partnership will typically be governed by the partnership agreement, but the statute also provides for specified circumstances which would apply unless the parties agree otherwise. Business assets and intellectual property contributed by each party become the property of the partnership (except if agreed otherwise) and should be exploited in accordance with the partnership agreement for the purposes of the partnership.

Partnerships are tax transparent, accordingly, taxation occurs at the level of the participants and profits and losses accrue to them. Partnerships might be subject to competition law rules prohibiting the restriction of competition. Further, the creation of a partnership might be subject to notification to the competent competition authority under merger control rules. Partnership joint ventures are regularly used for economic activities of professionals. They have also been used as a vehicle in the context of tenders (public or other).

Advantages:

- Relatively fewer formalities apply than in the case of corporate joint ventures.

- Registration requirements exist but no requirement for disclosure of the actual partnership agreement i.e. the constitutional document.

- Although the partnership has no legal personality, it may sue and be sued in its own name and may trade under its name.

- Apportionment of profits and losses on the basis of discretion.

- Attribution of profits to the partners; not to the partnership.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned. Wide options may be available due to the extensive network of double tax treaties maintained by Cyprus.

Disadvantages:

- Significant powers to unlimited partners. Given the powers of partners to bind the partnership, decision-making process needs to be addressed carefully.

- Liability comes with involvement in the management/control. Unlimited liability of general partners towards third parties. Solutions alleviating the effect of this may be possible.

- Tax transparency may not be beneficial where the partners are natural persons as they might be taxed at higher rates. Yet with appropriate structuring this may be avoided.

-

Contractual joint ventures

The basis of the cooperation of the participants is solely a contractual agreement between them. It is expected that such agreement will include detailed provisions regulating the rights and liabilities of the parties towards each other, the distinct role and input of each, their contributions, their share in the income generated etc. No separate legal personality is created. Business assets and intellectual property remain the property of the participant who contributed or developed them (unless of course the parties agree otherwise).

Profits and losses accrue to the participants and taxation is also incurred at the level of the participants. Such arrangements might be subject to competition law rules prohibiting the restriction of competition. Contractual joint ventures are commonly used in the context of tenders (public or other).

Advantages:

- Governed solely by contact law thus greater flexibility as to the operation and termination. Contract law in Cyprus is based on common law principles.

- No registration requirements.

- Minimal formalities compared to the other possible structures.

- No joint liability; liability towards third parties limited to own acts or omissions of each participant.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned.

Disadvantages:

- Lack of legal personality might cause difficulties in establishing commercial or contractual relationships with third parties.

- Need for detailed regulation of all aspects of the cooperation in the agreement due to the lack of legal framework for the relationship; careful and skilful planning is required.

- Depending on the facts and provisions adopted, risk of classification of the relationship as a partnership by a court with the consequence of joint liability.

-

European Economic Interest Grouping (EEIG)

A vehicle established and governed predominantly by European law (Council Regulation 2137/85) instead of national law. Specific purposes for EEIGs apply i.e. to facilitate or develop the economic activities of the members to enable them to improve their own results. In that context the activities of EEIGs must be related to the economic activities of the members but not replace them. The purpose is not to make profits for the EEIG itself. EEIGs are governed by a contract between their members and Council Regulation 2137/85. They have capacity, in their own name, to have rights and obligations of all kinds, to contract or accomplish other legal acts as well as to sue or be sued. There is unlimited joint liability of the participants for the debts and liabilities of the EEIG but the exclusion or restriction of liability of one or more members for a particular debt or liability is possible if it is specifically agreed between the third party and the EEIG. EEIGs enjoy tax transparency. Profits or losses are taxable at the hands of the participants.

Advantages:

- Established under European law; EEGIs might be ideal for alliances of firms in different member states of the European Union for joint promotion of activities.

- Relatively fewer formalities apply than in the case of corporate joint ventures though there are registration requirements.

- Tax transparency.

Disadvantages:

- Managers bind EEIGs as regards third parties, even if their acts do not fall within the objects (unless the third party had knowledge).

- Unlimited liability of participants.

- More limited scope for use due to the statutory purposes dictated.

Which option is the most appropriate and or efficient in terms of structuring in a particular case depends on the facts at hand and the actual needs of the participants. The different factors need to be carefully examined with the help of experts so that the most suitable solution is adopted.

Pursuant to the European Directive on administrative cooperation in the field of taxation (2011/16/EU), Member States must cooperate with each other with a view to exchanging information relevant for tax purposes. The directive allows, inter alia, that a Member State (the requesting Member State) requests another Member State (the requested Member State) to provide information concerning a specific taxpayer. The requested information must be ‘ foreseeably relevant ‘ to the tax authorities of the requesting Member State.

Based on the aforementioned directive, the tax authority of the requested Member State may request information from e.g. an affiliated company, a financial institution, an employer, … of the taxpayer. The tax authority of the requested Member State forwards the collected information to its counterpart in the requesting Member State.

A question that arises is whether that affiliated company, financial institution, employer, … may ask its national courts to verify the legality of the sanction imposed by its tax authority because of an incomplete answer and whether it may ask to vary the penalty. Another question is whether a court in the requested Member State may verify the relevance for tax purposes of the requested information.

These questions were raised in the Berlioz case of the Court of Justice (judgement of 16 May 2017): Berlioz (a Luxembourg company) only partially answered the request for information from the Luxembourg authorities (at the request of France). Berlioz stated in this regard that certain questions were irrelevant for tax purposes in the requesting Member State.

The answers to the questions raised are not obvious, as the starting point is that the requesting State has a margin of discretion as to what is foreseeably relevant for its tax purposes. This explains why (in this case the Luxembourg) courts doubted whether a relevance test was possible. The questions were referred for a preliminary ruling to the Court of Justice.

In its assessment, the court took into consideration the EU Charter of Fundamental Rights and, more specifically, the right to a fair hearing by an impartial judge.

The Court of Justice ruled that courts in the requested Member State may review the foreseeable relevance for tax purposes of the requested information and that they may vary the penalty imposed. The courts in the requested Member State should be reluctant however upon review of the legality of the request for information: the review is limited to verification whether the requested information manifestly has no relevance for tax purposes.

To this end, the courts must have access to the request for information. The affiliated company, financial institution, employer, … is only entitled to receive the identity of the person under investigation and to be informed about the tax purpose for which the information is sought. The Court of Justice indeed emphasizes in the interest of the investigation the principle that the request for information must remain secret.

Relevance of the judgment: When requested by a national tax authority to respond to a request for information from another Member State, it is important to check the relevance for tax purposes of the requested information. If the information requested is irrelevant to the tax investigation, a proceeding against the request for information or against the penalty may succeed. Regarding the foreseeable relevance for tax purposes, the national courts may only review whether the requested information manifestly has no relevance to the tax investigation in the requesting Member State.

Individuals coming to Portugal and here becoming residents for the first time, can be entitled to some important tax benefits under the “non habitual resident rules”. These rules are an important contribution for making Portugal one of the most attractive destinations for retired individuals, but also for entrepreneurs.

Who can benefit?

A non habitual resident is an individual becoming resident for tax purposes in Portugal for the first time in the last five years period. To become resident for tax purposes, one should be in Portugal for more than 183 days in any 12 months period or for a shorter period but in such conditions that the intention of becoming resident is sufficiently clear. After becoming resident for tax purposes and register as such before the Tax Authorities, the individual must register as a non habitual resident to be able to benefit from this regime.

High Value Added Activities.

Some of the benefits under the non habitual resident rules are only applicable to income arising from high value added activities. These activities include architects, engineers, artists, auditors and tax consultants, medical professions, university teachers, top managers and other liberal professionals in areas such as informatics (software and hardware) development and consultancy, science investigation and design.

For how long?

The benefits arising from the non habitual resident status are valid for a ten year period and depend on the individual remaining as resident in Portugal for tax purposes. If, for any reason, the individual ceases to be resident, he can later benefit from the remaining period by becoming resident again.

What are the benefits?

Individuals becoming non habitual resident benefit from a more favorable tax treatment regarding both income from Portuguese source and income from foreign sources.

As to the income from Portuguese source arising from employment and self-employment, it is subject to a special tax of 20%. This benefit is only applicable to non habitual residents earning income from high value added activities.

As to the income from foreign sources arising from employment and pensions, it is exempted from taxes in Portugal, in most cases. This exemption also includes income arising from self-employment in high value added activities, and from intellectual and industrial property, capital and real estate gains.

更加看重海外资本的意大利政府出台了《预算法2017》,向特别是将业务中心移至意大利的外国投资者提供更多机遇。我们来看一下相关重要信息。

固定税:希望将其税务居所转移至意大利的外国人。

首先,《预算法2017》向希望将税务居所转移至意大利的外国人提供了年度额为10万欧元的固定税(即无论其在意大利境外盈利规模,每年只向意大利政府缴纳10万欧元固定税)。

固定税的众多益处:

- 不论意大利境外的盈利规模;

- 可延伸至家庭成员:每个家庭成员可缴纳2.5万欧元的替代固定税;

- 可享受15年的固定税优惠。

今年3月,意大利税务局亦做出通知:已出台详细的适用规则和条款。

所以,固定税的适用规则必须依照税务局颁布的规则和程序进行。

只要符合条件的外国人在申报的纳税年度内已将纳税居所转移至意大利或马上将转移至意大利,则可在提交纳税申报的同时申请缴纳该固定税。

或者,也可以通过邮局或挂号邮箱,提前向意大利税务局提交申请。申请包括:

- 个人信息数据、税号(若已申请)、申请人的居住地址(若已驻留);

- 在该申请生效日期前十个纳税年度中至少九个纳税年度没有住在意大利;

- 该申请生效前最后一个税务居所的所在国家;

- 申请人有盈利,但决定不包括在固定税收中的国家名单。

纳税人还需填写一份清单,以及提交后续的相应文件,以证明其符合申请条件。

在任何情况下,即使意大利税务局还未给出答复,该申请都必须在提交纳税申报的最后期限前提交。

投资者签证

除了固定税,预算法还为申请滞留3个月以上的外国投资人提出了“投资者签证”,该签证不设年度人数上限,并且每年都可以颁发。申请人须符合以下要求:

- 至少购买200万欧元政府债券并至少持有两年;

- 在注册地址为意大利、并在意大利运营的公司股本的权益工具中投资至少100万欧元,并维持至少两年,或向在特别登记处注册的创新型初创公司投资至少50万欧元;

- 用于文化、教育、移民管理、科学研究、文化遗产和景观修复领域的至少100万欧元的公益慈善捐款。

该签证申请人必须:

- 证明申请人有能力执行上述投资或捐赠;

- 以书面形式郑重承诺,将在进入意大利之后的三个月之内执行上述投资或捐赠;

- 证明申请人有足够的资源维持上述投资或捐赠。

对于是否符合上述要求,以获得相关外交或领事机构颁发的“投资者签证”,必须经过一系列严格的程序和步骤进行核实。

通过“投资者签证”获得的为期两年的居留卡,会被标明“投资者居留”,在没有履行投资承诺的情况下会被撤销。若两年期满,在核实其承诺的投资仍在进行中之后,会另外颁发为期三年的居留。

为重振意大利经济,随着 2017年1月1日起生效的Legge di Bilancio 2017(“预算法”),意大利议会开始执行一项新战略:通过采取一系列在财务和财政上支持初创企业和中小型企业的措施,使他们对外国投资更具吸引力。

预算法设计了一个涉及某些税收减免的完整计划,中小型企业可通过众筹平台筹集资金,“创新型”初创企业(意为符合某些法律规定的早期公司:如高新技术公司、研发公司以及拥有大量高科技人才的公司等)向上市公司出售、转移其税务亏损。总体而言,这些措施的主要目的为:解锁迄今为止还没有足够能力向早期初创企业和中小企业提供财政资源和税收优惠的经济制度,使他们发展创新资产并扩大业务。

该系列措施可根据目的被归类为以下四类,

- 培养创业精神,成立创新型公司;

- 刺激针对创新型初创企业及中小企业的直接投资;

- 支持研发支出,以及

- 随着创新科技的发展,以数字化和自动化的方式将公司现有资产现代化。

成立新公司的经济援助

议会制定的战略涉及经济发展部(Mise)、国家工伤事故协会(Inail),以及其他公共机构,如Invitalia,以促进初创企业的成立和创新型中小型企业的发展。

事实上,旨在提供软贷款以支持创新型初创企业成立的可持续增长基金(FCS – Fondo per la Crescita Sostenibile)的捐款,在2017和2018年均增长了4750万欧元。

此外, 2017及2018年,预算法均拨出4750万欧元以促进自雇就业和创业精神。这些基金将由Invitalia管理,政府机构为了促进内向型投资和企业发展,主要用于支持女性和青年企业家(18至35岁)创立公司。Invitalia将给予最长8年的零利息贷款补贴,这将可覆盖特定投资预算总支出的75%。之后,公司必须就商业计划中的剩余额度提供资金,并在签署贷款协议的24个月内开始执行计划中投资。

经济发展部还发布了一系列措施,以补贴和支持由初创公司执行的发展方案。该发展方案的重点为收购新机械及新技术设备,硬件和软件技术,专利和许可以及与生产/管理需要有直接关系的非专利技术的专业知识。

预算法在相关政府部门批准之前,还提出了Inail对封闭式基金的投资,该投资致力于参与或直接成立创新型初创企业及技术合资企业。

精简官僚机构

为了简化成立初创公司的程序而出台的一系列措施,如无须公证,无须印花税票以及其他行政费用。也可在起草公司章程之后,依靠合格的电子签名通过在线程序进行修订。

创初创企业和中小型企业投资税收减免

在欧洲委员会最终批准之前,预算法为向初创企业投资提出了新的激励措施。关于类似投资税收减免的政策并非首次提及。2012年提出的最初设想为临时性的,随着预算法的出台,这些措施不仅被转化为永久性奖励政策,而且个人和公司分别从过去的19%和20%增加至30%,对投资者(潜在股东)情况无区别对待,投资上限为个人100万欧元,实体180万欧元。

这些减税措施旨在鼓励对初创公司的投资,而该投资需要在目标公司至少停留3年(预算法条例将其从两年变更为三年),所以优惠政策抵消了其中的弊端。此外,预算法还将上述优惠延伸至创新型中小企业(即在任何时间成立、经营范围在技术创新领域的中小企业),如上所述,这些企业无须再为了获得其他优惠而提出创新型资产项目的计划。

可使初创公司和上市公司实现双赢的合作关系

在预算法的随附报告中,政府还强调了上市公司直接或间接资助初创公司的重要性,并提出了在符合某些要求的情况下,初创公司可向上市公司转移其前三年累计税收损失。

上述转移将根据公司税收抵免转移的相关条例执行;受让方将被要求弥补从转让方得到的好处,其向初创公司所支付的报酬不会被征税。通过这种机制,双方公司都将获益:初创公司找到财务“赞助商”,上市公司可用税收损失完全抵消其应纳所得税,并且还会考虑超出部分在下一年转结的可能性。

众筹

通过对意大利财政统一法案 (即Testo Unico Finanza) 的调整,预算法摆脱了一些组织众筹市场在意大利起飞的限制,并提出了所有中小企业进入股权众筹的可能性。以前的立法限制了通过此系统只向创新型中小企业筹集资金的可能性,因此限制了中小企业和众筹行业的发展。

管理股权众筹的规则将与运营方(即众筹平台)一样,现在中小型企业除了通过银行融资和证券上市交易所的传统渠道之外,还将有一个新的筹集资金的手段。

研发支出的税收减免

2013年推出的关于研发支出的税收减免已被延长至2020年12月,并已从全部符合要求的研发活动的25%曾至50%,年度上限为2000万欧元(就从前最高限额增长5倍)。

公司将可减少缴税,并就其研发支出的比例要求补偿。该规定现适用于所有研发支出,包括雇佣致力于研发活动的人员(对其资格无特殊要求)以及任何类型的公司(居民和非居民)、集团或联合企业。无论企业规模、法律地位和行业参考。

此财政激励可与其他政策相结合,使得所有创新型初创公司中持有股份的基层员工获得税收优惠。具体来说,意味着进行研发活动的员工将受益于任何股权计划工作,该公司将受益于上述两种税收减免。

大型投资项目的开发合同

开发合同(Contratti di sviluppo)的签署各方为:意大利经济发展部(Mise),Invitalia以及一家或若干家从事发展项目的公司(通过网络完成契约)。

2011年,为了支持规模至少为2000万欧元(其中750万欧元仅用于农业食品行业)的大型工业/生产性投资,这些合同首次被提出。

发展合同由Mise资助,相关大区也涉及其中(亦可参与投资)。Invitalia作为参照指示以促进公司并负责管理资源和应用/评估申请。

这些合同针对意大利公司以及在意大利的外国公司,并提供财务优惠如厂房和设备的补助金、软贷款和利息补贴,其比例可根据公司规模和涉及的项目类型而变化(研发支出,创新导向投资)。

Invitalia为申请程序及后续的发展计划设置了快速步伐:一旦项目被批准,公司将有90日时间提交所有指定文件;其中有6个月的准备时间以及36个月执行时间。

作为国家意志的象征,为了富有成效地完成数字化相关的投资项目,该程序也将开通特别快速通道。

超级折旧和高度折旧

到2017年,预算法也就相关公司额外追加了40%的折旧减免(构成税收折旧总数为140%)。然后,公司可以扣除购买折旧率超过6.5%的有形资产的费用。该奖励只适用于采购订单已被供应商接受并于2017年12月31日前支付至少20%的资产。除此之外,该法律还就为获得雾化及数字化企业而购买(或租赁)如数控机械或设备的新技术资产(该法律全面概述了符合要求资产的完整范围),提出了150%的额外折旧减免(即“高度折旧”,加之现有的折旧规定,将获得250%的折旧减免)。

Sabatini-ter

预算法也提出了“Sabatini”,一项旨在促进中小企业购买(或租赁)资金货物的特别立法:即弥补数额在2万至200万欧元之间的部分银行贷款利息。该立法有效期被延长至2018年12月31日。一个具体并更宽松的措施将适用于购买与工业4.0计划相关的新资产。部分资源将用于支持创新、提高效率和创立数字化工业体系——该工业体系投资于例如云计算、宽带连接、网络安全、机器人、机电一体化等技术设备。

总而言之,上述措施适用于所有位于意大利的公司,是使意大利企业在全球市场中更具竞争力的战略里程碑,在技术和财政资源方面。由于没有进入的监管壁垒,该新规定将赋予意大利经济体系新的生命,并吸引外国投资者。

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

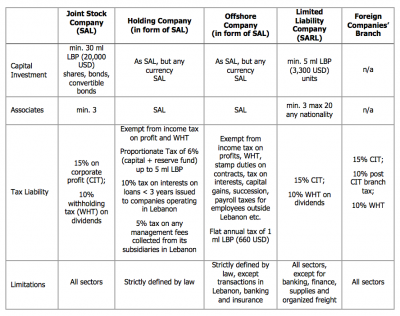

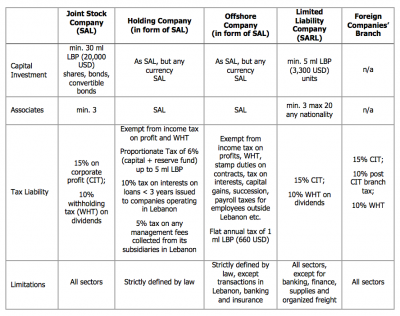

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

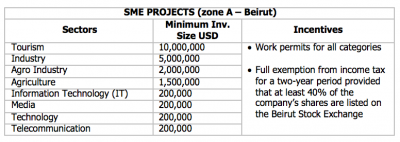

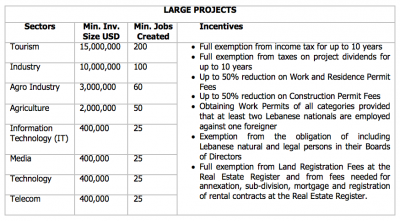

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.

意大利政府在即将由意大利议会审议的《预算法草案》中建议:为在意大利投资的外籍富裕个人提供简便的入境签证。若自雇人员以工作为目的移居意大利,则通过自雇所得的收入可申请税收减免。意大利的新税务优惠制度,类似于“英国税务居民但非英国居籍”制度(UK resident-not-domiciled regime)。

为了吸引外国资本,意大利政府正重点关注有意移居意大利的非居籍个人的税收新优惠。

一方面,人民迁移权和迁移流程的法律框架被修改:加入了为期两年的特别签证制度(可续签,在某些情况下或为三年)。上述签证制度适用于在意大利持续居住超过三个月的个人。

若要申请上述优惠,则非居籍个人需要证明其满足以下条件,或证明将在意大利进行以下投资:(1)购买并持有至少200万欧元政府债券至少两年,(2)在注册地址为意大利、并在意大利运营的公司股本的权益工具中投资至少100万欧元,并维持至少两年,(3)用于文化、教育、移民管理、科学研究或文化产品修复的至少100万欧元慈善捐款。

对于是否符合上述要求,相关部门会通过非居籍个人提交的一系列文件(根据待定程序)进行核实。如果得到积极的评价结果,那么符合要求的非居籍个人将获得“投资者签证”。

其他修正案将涉及所谓的《2015国际化法令》(第147/2015号法令,第16条),尤其雇员由于工作原因移居至意大利的特别制度。该制度内容将被扩展,以在税收优惠方面更具吸引力。

事实上,在意大利停留两周以上的自雇人员也将受益于该制度内容的扩展修改。此外,政府似乎愿意扩大无税区:至今为止,在意大利自雇工作或受雇工作收入的30%无需缴税,但之后该百分比可能提高至50%。

目前,税收减免只适用于欧洲公民。根据草案,该税收优惠覆盖范围可扩大至:所居住国已与意大利签署双重税务协定或互相交换信息协议的非欧盟国家居籍个人。此外,申请人必须持有大学学位并且在过去至少24个月持续受雇或自雇。

《预算法草案》为符合条件的非意大利居籍及其亲属制定新的税收制度,使他们愿意移居意大利。该草案类似于“英国税务居民但非英国居籍”制度,规定在意大利境外产生的所有收入与收益,在提交税收支配预算的正式申请之后,每年只需缴纳10万欧元的固定替代税。上述申请最多可持续15年,期间可撤销或提前终止。

此项规定无疑极具吸引力,如果得以实现,将可推动大量高资产净值个人居住在意大利。如此优惠的税制在过去从未被提出过。

写信给 Christi

EU – Request of exchange of information for tax purposes: the Berlioz case

26 10 月 2017

-

欧洲

- 税务

The Italian Budget Law for 2017 (Law No. 232 of 11 December 2016), with the specific purpose of attracting high net worth individuals to Italy, introduced the new article 24-bis in the Italian Income Tax Code (“ITC”) which regulates an elective tax regime for individuals who transfer their tax residence to Italy.

The special tax regime provides for the payment of an annual substitutive tax of EUR 100.000,00 and the exemption from:

- any foreign income (except specific capital gains);

- tax on foreign real estate properties (IVIE ) and tax on foreign financial assets (IVAFE);

- the obligation to report foreign assets in the tax return;

- inheritance and gift tax on foreign assets.

Eligibility

Persons entitled to opt for the special tax regime are individuals transferring their tax residence to Italy pursuant to the Italian law and who have not been resident in Italy for tax purposes for at least nine out of the ten years preceding the year in which the regime becomes effective.

According to art. 2 of the ITC, residents of Italy for income tax purposes are those persons who, for the greater part of the year, are registered within the Civil Registry of the Resident Population or have the residence or the domicile in Italy under the Italian Civil Code. About this, it is worth noting that persons who have moved to a black listed jurisdiction are considered to have their tax residence in Italy unless proof to the contrary is provided.

According to the Italian Civil Code, the residence is the place where a person has his/her habitual abode, whilst the domicile is the place where the person has the principal center of his businesses and interests.

Exemptions

The special tax regime exempts any foreign income from the Italian individual income tax (IRPEF).

In particular the exemption applies to:

- income from self-employment generated from activities carried out abroad;

- income from business activities carried out abroad through a permanent establishment;

- income from employment carried out abroad;

- income from a property owned abroad;

- interests from foreign bank accounts;

- capital gains from the sale of shares in foreign companies;

However, according to an anti-avoidance provision, the exemption does not apply to capital gains deriving from the sale of “substantial” participations that occur within the first five tax years of the validity of the special tax regime. “Substantial” participations are, in particular, those representing more than 2% of the voting rights or 5% of the capital of listed companies or 20% of the voting rights or 25% of the capital of non-listed companies.

Any Italian source income shall be subject to regular income taxation.

It must be underlined that, under the special tax regime no foreign tax credit will be granted for taxes paid abroad. However, the taxpayer is allowed to exclude income arising in one or more foreign jurisdictions from the application of the special regime. This income will then be subject to the ordinary tax rule and the foreign tax credit will be granted.

The special tax regime exempts the taxpayer also from the obligation to report foreign assets in the annual tax return and from the payment of the IVIE and the IVAFE.

Finally, the special tax regime provides for the exemption from the inheritance and gift tax with regard to transfers by inheritance or donations made during the period of validity of the regime. The exemption is limited to assets and rights existing in the Italian territory at the time of the donation or the inheritance.

Substitutive Tax and Family Members

The taxpayer must pay an annual substitutive tax of EUR 100,000 regardless of the amount of foreign income realised.

The special tax regime can be extended to family members by paying an additional EUR 25,000 substitutive tax for each person included in the regime, provided that the same conditions, applicable to the qualifying taxpayer, are met.

In particular, the extension is applicable to

- spouses;

- children and, in their absence, the direct relative in the descending line;

- parents and, in their absence, the direct relative in the ascending line;

- adopters;

- sons–in-law and daughters-in-law;

- fathers-in-law and mothers-in-law;

- brothers and sisters.

How to apply

The option shall be made either in the tax return regarding the year in which the taxpayer becomes resident in Italy, or in the tax return of the following year.

Qualifying taxpayer may also submit a non-binding ruling request to the Italian Revenue Agency, in order to prove that all requirements to access the special regime are met. The ruling can be filed before the transfer of the tax residence to Italy.

The Revenue Agency shall respond within 120 days as from the receipt of the request. The reply is not binding for the taxpayer, but it is binding for the Revenue Agency.

If no ruling request is filed, the same information provided in the request must be provided together with the tax return where the election is made.

Termination

The option for the special tax regime is automatically renewed each year and it ends, in any case, after fifteen years from the first tax year of validity. However, the option can be revoked by the taxpayer at any time.

In case of termination or revocation, family members included in the election are also automatically excluded from the regime.

After the ordinary termination or revocation, it is no longer possible to apply for the special tax regime.

The author of this post is Valerio Cirimbilla.

Like in other jurisdictions, in Cyprus the term ‘joint venture’ connotes business arrangements that involve the pooling of resources, knowledge and experiences of the participants for the purposes of accomplishing or implementing a specific task, whether this is a particular project or business activity. There is no specific statute governing joint ventures yet in practice such arrangements take one of the following structures.

-

Corporate Joint Venture

The cooperation materialises through the setting up of a legal entity separate from its participants with constitutional documents governing its operation and the relations between the participants and the entity in addition to the statutory provisions of the Cyprus Company Law, Cap 113. A shareholders’ agreement is typically executed operating in parallel. It is possible that further agreements such as licences for use of intellectual property etc. will be signed. This vehicle might be more appropriate where it is expected that the joint venture will need to enter into contractual arrangements with third parties due to the limited liability benefits. The termination is usually addressed in a shareholders’ agreement which specifies events of termination e.g. change of control, insolvency of a participant, attainment of objective etc. as well as the relevant processes e.g. sale of shares among participants, liquidation etc.

Taxation of income occurs at the level of the company. Participants are not taxed on dividends in Cyprus if they are not tax residents or if they are companies. If the company is to be taxed in Cyprus, the management and control will need to be exercised in Cyprus. Any assets, including intellectual property created by the company, become property of the new entity. The setting up of the company might be subject to notification to the competent competition authority under merger control rules. Corporate joint ventures are commonly used by international clients aiming to benefit from the network of double tax treaties maintained by Cyprus. They are also a vehicle often employed to enter the Cyprus market with the assistance of a local participant.

Advantages:

- Limited liability; liability of participants limited to capital.

- Participants control the company through the power of appointment of the board of directors.

- The company is governed by the Cyprus Companies Law, Cap. 113, a statute based on English company law rules, which gives more legal certainty and familiarity for participants as well as the counterparties. The relationship is not purely contractual.

- Tax optimisation possibilities given the low rate of corporate taxation applicable in Cyprus (at the rate of 12.5%). The numerous double tax treaties maintained by Cyprus may be exploited.

Disadvantages:

- Less flexibility compared to the other structures due to the applicable legal framework both in terms of operation and compliance.

- Governance and control questions might need to be addressed e.g. to deal with deadlocks.

- Restrictions and or conditions for the transfer of shares are typically adopted.

- Both the corporate profit and the dividends returned to participants might, under certain circumstances, be subject to taxation e.g. where participants are natural persons residing in Cyprus.

-

Partnership Joint Venture

The relationship is governed by the relevant statute which specifies the liability of each partner depending on whether the partnership would be a general or limited partnership. In the first case, each partner has unlimited liability with the other partners for all debts and liabilities of the partnership. In the second case, only the general partner has unlimited liability; limited partners are only liable for the capital they agreed to invest but should not participate in the running of the business. The relevant statute imposes default and overriding rules governing the arrangement e.g. in relation to the termination or profit sharing. The termination of the partnership will typically be governed by the partnership agreement, but the statute also provides for specified circumstances which would apply unless the parties agree otherwise. Business assets and intellectual property contributed by each party become the property of the partnership (except if agreed otherwise) and should be exploited in accordance with the partnership agreement for the purposes of the partnership.

Partnerships are tax transparent, accordingly, taxation occurs at the level of the participants and profits and losses accrue to them. Partnerships might be subject to competition law rules prohibiting the restriction of competition. Further, the creation of a partnership might be subject to notification to the competent competition authority under merger control rules. Partnership joint ventures are regularly used for economic activities of professionals. They have also been used as a vehicle in the context of tenders (public or other).

Advantages:

- Relatively fewer formalities apply than in the case of corporate joint ventures.

- Registration requirements exist but no requirement for disclosure of the actual partnership agreement i.e. the constitutional document.

- Although the partnership has no legal personality, it may sue and be sued in its own name and may trade under its name.

- Apportionment of profits and losses on the basis of discretion.

- Attribution of profits to the partners; not to the partnership.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned. Wide options may be available due to the extensive network of double tax treaties maintained by Cyprus.

Disadvantages:

- Significant powers to unlimited partners. Given the powers of partners to bind the partnership, decision-making process needs to be addressed carefully.

- Liability comes with involvement in the management/control. Unlimited liability of general partners towards third parties. Solutions alleviating the effect of this may be possible.

- Tax transparency may not be beneficial where the partners are natural persons as they might be taxed at higher rates. Yet with appropriate structuring this may be avoided.

-

Contractual joint ventures

The basis of the cooperation of the participants is solely a contractual agreement between them. It is expected that such agreement will include detailed provisions regulating the rights and liabilities of the parties towards each other, the distinct role and input of each, their contributions, their share in the income generated etc. No separate legal personality is created. Business assets and intellectual property remain the property of the participant who contributed or developed them (unless of course the parties agree otherwise).

Profits and losses accrue to the participants and taxation is also incurred at the level of the participants. Such arrangements might be subject to competition law rules prohibiting the restriction of competition. Contractual joint ventures are commonly used in the context of tenders (public or other).

Advantages:

- Governed solely by contact law thus greater flexibility as to the operation and termination. Contract law in Cyprus is based on common law principles.

- No registration requirements.

- Minimal formalities compared to the other possible structures.

- No joint liability; liability towards third parties limited to own acts or omissions of each participant.

- Independent tax planning possibilities for each participant as regards losses incurred and profits earned.

Disadvantages:

- Lack of legal personality might cause difficulties in establishing commercial or contractual relationships with third parties.

- Need for detailed regulation of all aspects of the cooperation in the agreement due to the lack of legal framework for the relationship; careful and skilful planning is required.

- Depending on the facts and provisions adopted, risk of classification of the relationship as a partnership by a court with the consequence of joint liability.

-

European Economic Interest Grouping (EEIG)

A vehicle established and governed predominantly by European law (Council Regulation 2137/85) instead of national law. Specific purposes for EEIGs apply i.e. to facilitate or develop the economic activities of the members to enable them to improve their own results. In that context the activities of EEIGs must be related to the economic activities of the members but not replace them. The purpose is not to make profits for the EEIG itself. EEIGs are governed by a contract between their members and Council Regulation 2137/85. They have capacity, in their own name, to have rights and obligations of all kinds, to contract or accomplish other legal acts as well as to sue or be sued. There is unlimited joint liability of the participants for the debts and liabilities of the EEIG but the exclusion or restriction of liability of one or more members for a particular debt or liability is possible if it is specifically agreed between the third party and the EEIG. EEIGs enjoy tax transparency. Profits or losses are taxable at the hands of the participants.

Advantages:

- Established under European law; EEGIs might be ideal for alliances of firms in different member states of the European Union for joint promotion of activities.

- Relatively fewer formalities apply than in the case of corporate joint ventures though there are registration requirements.

- Tax transparency.

Disadvantages:

- Managers bind EEIGs as regards third parties, even if their acts do not fall within the objects (unless the third party had knowledge).

- Unlimited liability of participants.

- More limited scope for use due to the statutory purposes dictated.

Which option is the most appropriate and or efficient in terms of structuring in a particular case depends on the facts at hand and the actual needs of the participants. The different factors need to be carefully examined with the help of experts so that the most suitable solution is adopted.

Pursuant to the European Directive on administrative cooperation in the field of taxation (2011/16/EU), Member States must cooperate with each other with a view to exchanging information relevant for tax purposes. The directive allows, inter alia, that a Member State (the requesting Member State) requests another Member State (the requested Member State) to provide information concerning a specific taxpayer. The requested information must be ‘ foreseeably relevant ‘ to the tax authorities of the requesting Member State.

Based on the aforementioned directive, the tax authority of the requested Member State may request information from e.g. an affiliated company, a financial institution, an employer, … of the taxpayer. The tax authority of the requested Member State forwards the collected information to its counterpart in the requesting Member State.

A question that arises is whether that affiliated company, financial institution, employer, … may ask its national courts to verify the legality of the sanction imposed by its tax authority because of an incomplete answer and whether it may ask to vary the penalty. Another question is whether a court in the requested Member State may verify the relevance for tax purposes of the requested information.

These questions were raised in the Berlioz case of the Court of Justice (judgement of 16 May 2017): Berlioz (a Luxembourg company) only partially answered the request for information from the Luxembourg authorities (at the request of France). Berlioz stated in this regard that certain questions were irrelevant for tax purposes in the requesting Member State.

The answers to the questions raised are not obvious, as the starting point is that the requesting State has a margin of discretion as to what is foreseeably relevant for its tax purposes. This explains why (in this case the Luxembourg) courts doubted whether a relevance test was possible. The questions were referred for a preliminary ruling to the Court of Justice.

In its assessment, the court took into consideration the EU Charter of Fundamental Rights and, more specifically, the right to a fair hearing by an impartial judge.

The Court of Justice ruled that courts in the requested Member State may review the foreseeable relevance for tax purposes of the requested information and that they may vary the penalty imposed. The courts in the requested Member State should be reluctant however upon review of the legality of the request for information: the review is limited to verification whether the requested information manifestly has no relevance for tax purposes.

To this end, the courts must have access to the request for information. The affiliated company, financial institution, employer, … is only entitled to receive the identity of the person under investigation and to be informed about the tax purpose for which the information is sought. The Court of Justice indeed emphasizes in the interest of the investigation the principle that the request for information must remain secret.

Relevance of the judgment: When requested by a national tax authority to respond to a request for information from another Member State, it is important to check the relevance for tax purposes of the requested information. If the information requested is irrelevant to the tax investigation, a proceeding against the request for information or against the penalty may succeed. Regarding the foreseeable relevance for tax purposes, the national courts may only review whether the requested information manifestly has no relevance to the tax investigation in the requesting Member State.

Individuals coming to Portugal and here becoming residents for the first time, can be entitled to some important tax benefits under the “non habitual resident rules”. These rules are an important contribution for making Portugal one of the most attractive destinations for retired individuals, but also for entrepreneurs.

Who can benefit?

A non habitual resident is an individual becoming resident for tax purposes in Portugal for the first time in the last five years period. To become resident for tax purposes, one should be in Portugal for more than 183 days in any 12 months period or for a shorter period but in such conditions that the intention of becoming resident is sufficiently clear. After becoming resident for tax purposes and register as such before the Tax Authorities, the individual must register as a non habitual resident to be able to benefit from this regime.

High Value Added Activities.

Some of the benefits under the non habitual resident rules are only applicable to income arising from high value added activities. These activities include architects, engineers, artists, auditors and tax consultants, medical professions, university teachers, top managers and other liberal professionals in areas such as informatics (software and hardware) development and consultancy, science investigation and design.

For how long?

The benefits arising from the non habitual resident status are valid for a ten year period and depend on the individual remaining as resident in Portugal for tax purposes. If, for any reason, the individual ceases to be resident, he can later benefit from the remaining period by becoming resident again.

What are the benefits?

Individuals becoming non habitual resident benefit from a more favorable tax treatment regarding both income from Portuguese source and income from foreign sources.

As to the income from Portuguese source arising from employment and self-employment, it is subject to a special tax of 20%. This benefit is only applicable to non habitual residents earning income from high value added activities.

As to the income from foreign sources arising from employment and pensions, it is exempted from taxes in Portugal, in most cases. This exemption also includes income arising from self-employment in high value added activities, and from intellectual and industrial property, capital and real estate gains.

更加看重海外资本的意大利政府出台了《预算法2017》,向特别是将业务中心移至意大利的外国投资者提供更多机遇。我们来看一下相关重要信息。

固定税:希望将其税务居所转移至意大利的外国人。

首先,《预算法2017》向希望将税务居所转移至意大利的外国人提供了年度额为10万欧元的固定税(即无论其在意大利境外盈利规模,每年只向意大利政府缴纳10万欧元固定税)。

固定税的众多益处:

- 不论意大利境外的盈利规模;

- 可延伸至家庭成员:每个家庭成员可缴纳2.5万欧元的替代固定税;

- 可享受15年的固定税优惠。

今年3月,意大利税务局亦做出通知:已出台详细的适用规则和条款。

所以,固定税的适用规则必须依照税务局颁布的规则和程序进行。

只要符合条件的外国人在申报的纳税年度内已将纳税居所转移至意大利或马上将转移至意大利,则可在提交纳税申报的同时申请缴纳该固定税。

或者,也可以通过邮局或挂号邮箱,提前向意大利税务局提交申请。申请包括:

- 个人信息数据、税号(若已申请)、申请人的居住地址(若已驻留);

- 在该申请生效日期前十个纳税年度中至少九个纳税年度没有住在意大利;

- 该申请生效前最后一个税务居所的所在国家;

- 申请人有盈利,但决定不包括在固定税收中的国家名单。

纳税人还需填写一份清单,以及提交后续的相应文件,以证明其符合申请条件。

在任何情况下,即使意大利税务局还未给出答复,该申请都必须在提交纳税申报的最后期限前提交。

投资者签证

除了固定税,预算法还为申请滞留3个月以上的外国投资人提出了“投资者签证”,该签证不设年度人数上限,并且每年都可以颁发。申请人须符合以下要求:

- 至少购买200万欧元政府债券并至少持有两年;

- 在注册地址为意大利、并在意大利运营的公司股本的权益工具中投资至少100万欧元,并维持至少两年,或向在特别登记处注册的创新型初创公司投资至少50万欧元;

- 用于文化、教育、移民管理、科学研究、文化遗产和景观修复领域的至少100万欧元的公益慈善捐款。

该签证申请人必须:

- 证明申请人有能力执行上述投资或捐赠;

- 以书面形式郑重承诺,将在进入意大利之后的三个月之内执行上述投资或捐赠;

- 证明申请人有足够的资源维持上述投资或捐赠。

对于是否符合上述要求,以获得相关外交或领事机构颁发的“投资者签证”,必须经过一系列严格的程序和步骤进行核实。

通过“投资者签证”获得的为期两年的居留卡,会被标明“投资者居留”,在没有履行投资承诺的情况下会被撤销。若两年期满,在核实其承诺的投资仍在进行中之后,会另外颁发为期三年的居留。

为重振意大利经济,随着 2017年1月1日起生效的Legge di Bilancio 2017(“预算法”),意大利议会开始执行一项新战略:通过采取一系列在财务和财政上支持初创企业和中小型企业的措施,使他们对外国投资更具吸引力。

预算法设计了一个涉及某些税收减免的完整计划,中小型企业可通过众筹平台筹集资金,“创新型”初创企业(意为符合某些法律规定的早期公司:如高新技术公司、研发公司以及拥有大量高科技人才的公司等)向上市公司出售、转移其税务亏损。总体而言,这些措施的主要目的为:解锁迄今为止还没有足够能力向早期初创企业和中小企业提供财政资源和税收优惠的经济制度,使他们发展创新资产并扩大业务。

该系列措施可根据目的被归类为以下四类,

- 培养创业精神,成立创新型公司;

- 刺激针对创新型初创企业及中小企业的直接投资;

- 支持研发支出,以及

- 随着创新科技的发展,以数字化和自动化的方式将公司现有资产现代化。

成立新公司的经济援助

议会制定的战略涉及经济发展部(Mise)、国家工伤事故协会(Inail),以及其他公共机构,如Invitalia,以促进初创企业的成立和创新型中小型企业的发展。

事实上,旨在提供软贷款以支持创新型初创企业成立的可持续增长基金(FCS – Fondo per la Crescita Sostenibile)的捐款,在2017和2018年均增长了4750万欧元。

此外, 2017及2018年,预算法均拨出4750万欧元以促进自雇就业和创业精神。这些基金将由Invitalia管理,政府机构为了促进内向型投资和企业发展,主要用于支持女性和青年企业家(18至35岁)创立公司。Invitalia将给予最长8年的零利息贷款补贴,这将可覆盖特定投资预算总支出的75%。之后,公司必须就商业计划中的剩余额度提供资金,并在签署贷款协议的24个月内开始执行计划中投资。

经济发展部还发布了一系列措施,以补贴和支持由初创公司执行的发展方案。该发展方案的重点为收购新机械及新技术设备,硬件和软件技术,专利和许可以及与生产/管理需要有直接关系的非专利技术的专业知识。

预算法在相关政府部门批准之前,还提出了Inail对封闭式基金的投资,该投资致力于参与或直接成立创新型初创企业及技术合资企业。

精简官僚机构

为了简化成立初创公司的程序而出台的一系列措施,如无须公证,无须印花税票以及其他行政费用。也可在起草公司章程之后,依靠合格的电子签名通过在线程序进行修订。

创初创企业和中小型企业投资税收减免

在欧洲委员会最终批准之前,预算法为向初创企业投资提出了新的激励措施。关于类似投资税收减免的政策并非首次提及。2012年提出的最初设想为临时性的,随着预算法的出台,这些措施不仅被转化为永久性奖励政策,而且个人和公司分别从过去的19%和20%增加至30%,对投资者(潜在股东)情况无区别对待,投资上限为个人100万欧元,实体180万欧元。

这些减税措施旨在鼓励对初创公司的投资,而该投资需要在目标公司至少停留3年(预算法条例将其从两年变更为三年),所以优惠政策抵消了其中的弊端。此外,预算法还将上述优惠延伸至创新型中小企业(即在任何时间成立、经营范围在技术创新领域的中小企业),如上所述,这些企业无须再为了获得其他优惠而提出创新型资产项目的计划。

可使初创公司和上市公司实现双赢的合作关系

在预算法的随附报告中,政府还强调了上市公司直接或间接资助初创公司的重要性,并提出了在符合某些要求的情况下,初创公司可向上市公司转移其前三年累计税收损失。

上述转移将根据公司税收抵免转移的相关条例执行;受让方将被要求弥补从转让方得到的好处,其向初创公司所支付的报酬不会被征税。通过这种机制,双方公司都将获益:初创公司找到财务“赞助商”,上市公司可用税收损失完全抵消其应纳所得税,并且还会考虑超出部分在下一年转结的可能性。

众筹

通过对意大利财政统一法案 (即Testo Unico Finanza) 的调整,预算法摆脱了一些组织众筹市场在意大利起飞的限制,并提出了所有中小企业进入股权众筹的可能性。以前的立法限制了通过此系统只向创新型中小企业筹集资金的可能性,因此限制了中小企业和众筹行业的发展。

管理股权众筹的规则将与运营方(即众筹平台)一样,现在中小型企业除了通过银行融资和证券上市交易所的传统渠道之外,还将有一个新的筹集资金的手段。

研发支出的税收减免

2013年推出的关于研发支出的税收减免已被延长至2020年12月,并已从全部符合要求的研发活动的25%曾至50%,年度上限为2000万欧元(就从前最高限额增长5倍)。

公司将可减少缴税,并就其研发支出的比例要求补偿。该规定现适用于所有研发支出,包括雇佣致力于研发活动的人员(对其资格无特殊要求)以及任何类型的公司(居民和非居民)、集团或联合企业。无论企业规模、法律地位和行业参考。

此财政激励可与其他政策相结合,使得所有创新型初创公司中持有股份的基层员工获得税收优惠。具体来说,意味着进行研发活动的员工将受益于任何股权计划工作,该公司将受益于上述两种税收减免。

大型投资项目的开发合同

开发合同(Contratti di sviluppo)的签署各方为:意大利经济发展部(Mise),Invitalia以及一家或若干家从事发展项目的公司(通过网络完成契约)。

2011年,为了支持规模至少为2000万欧元(其中750万欧元仅用于农业食品行业)的大型工业/生产性投资,这些合同首次被提出。

发展合同由Mise资助,相关大区也涉及其中(亦可参与投资)。Invitalia作为参照指示以促进公司并负责管理资源和应用/评估申请。

这些合同针对意大利公司以及在意大利的外国公司,并提供财务优惠如厂房和设备的补助金、软贷款和利息补贴,其比例可根据公司规模和涉及的项目类型而变化(研发支出,创新导向投资)。

Invitalia为申请程序及后续的发展计划设置了快速步伐:一旦项目被批准,公司将有90日时间提交所有指定文件;其中有6个月的准备时间以及36个月执行时间。

作为国家意志的象征,为了富有成效地完成数字化相关的投资项目,该程序也将开通特别快速通道。

超级折旧和高度折旧

到2017年,预算法也就相关公司额外追加了40%的折旧减免(构成税收折旧总数为140%)。然后,公司可以扣除购买折旧率超过6.5%的有形资产的费用。该奖励只适用于采购订单已被供应商接受并于2017年12月31日前支付至少20%的资产。除此之外,该法律还就为获得雾化及数字化企业而购买(或租赁)如数控机械或设备的新技术资产(该法律全面概述了符合要求资产的完整范围),提出了150%的额外折旧减免(即“高度折旧”,加之现有的折旧规定,将获得250%的折旧减免)。

Sabatini-ter

预算法也提出了“Sabatini”,一项旨在促进中小企业购买(或租赁)资金货物的特别立法:即弥补数额在2万至200万欧元之间的部分银行贷款利息。该立法有效期被延长至2018年12月31日。一个具体并更宽松的措施将适用于购买与工业4.0计划相关的新资产。部分资源将用于支持创新、提高效率和创立数字化工业体系——该工业体系投资于例如云计算、宽带连接、网络安全、机器人、机电一体化等技术设备。

总而言之,上述措施适用于所有位于意大利的公司,是使意大利企业在全球市场中更具竞争力的战略里程碑,在技术和财政资源方面。由于没有进入的监管壁垒,该新规定将赋予意大利经济体系新的生命,并吸引外国投资者。

A small country, 10452 km sq. on the Mediterranean Sea, Lebanon is a multicultural and multilingual land of merchants directly descending from the ancient Phoenicians. Due to its history and territorial position, it is characterized by a free market economy based on an unrestricted exchange of goods, services and capital, and serves as a privileged platform for access to the markets of the Middle East region and the Gulf.

As part of the strategy to integrate Lebanon further into the international community and the global economy, trade agreements were signed with many Arab and European Countries.

Since 2003 the Euro-Mediterranean Partnership provided the conditions for a progressive and reciprocal liberalization of trade in goods with a view to establishing a bilateral free trade area. Later on, in 2004, the Free Trade Agreement with the European Free Trade Association gave free access to Lebanese products into EFTA countries. Moreover, since 2005 Lebanon is a member of the Greater Arab Free Trade Area (GAFTA), receiving full exemption of tariffs on all agricultural and industrial goods traded between the 17 Arab member countries. Last but not least, the Council of Ministers recently signed the Extracted Industries Transparency Initiative (EITI), even before starting the exploration of its offshore. The EITI is a global standard by which information on the oil, gas and mining industries is published, to promote the open and accountable management of oil gas and mineral resources.

Lebanon is well known as a financial hub for banking activities. It has one of the most sophisticated banking sectors in the region: solid and growing, it is considered the true spine of the economy. Thanks to the strict control exercised by the Central Bank, among several factors, the system has showed good resilience to internal and external shocks and made its way through the overall context of the international financial crisis.

Tax regulation is also very favorable for those who want to restructure their global business and invest in the country. Nationals and foreigners can take advantage of the Double Taxation Agreements that Lebanon has signed with 32 countries, including Italy, France, Malta, Cyprus, Egypt, UAE, and Iran.

Business structures established under Lebanese law are governed by the Lebanese Code of Commerce (LCC) and the rules of the Code of Obligations and Contracts on Partnership Agreements, provided they do not contradict the LLC rules.

A joint venture may take a number of forms. This gives parties significant flexibility in designing a suitable structure for their projects. The joint venture can be a simple contractual arrangement or create a separate legal structure, either a stock corporation (société de capitaux) or a partnership (société de personnes) established to carry out the project.

Several factors must be considered when deciding which structure a business should adopt.

Hereby, the main characteristics of the corporations in Lebanon:

In addition, a call for foreign investments is now in place to improved infrastructure all over the country in various sectors like oil and gas, energy, information technology, telecommunications, water-sewage, and tourism.

While specific sector, such as oil and gas, follow their own procedure and tenders, there are two incentive schemes that investors can choose. According to Law n. 360/2001, they differ in the extent of exemptions provided and in the eligibility criteria required.

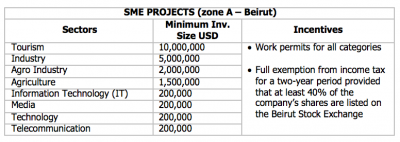

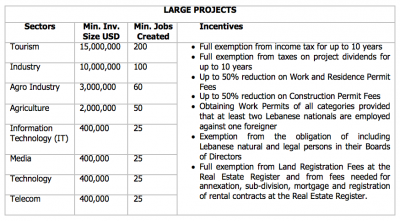

Investment Project by Zone (IPZ) scheme

Package Deal Contract (PDC) scheme

To conclude this overview, it is worth to mention the young, dynamic, and polyglot population, that is another feature of Lebanon’s economic attractiveness, especially in sectors with high-value added, such as ICT, considered of the main drivers of knowledge-based economies.

In the latest Global Competitiveness Report by the World Economic Forum for 2016-2017, Lebanon ranked 18th globally in the overall quality of the educational system (for higher education and training), and 6th globally in the quality of math and science education. That surely makes it one of the best sources of talent not only to serve the region but also the international scene.

In general, salaries in Lebanon are relatively lower than regional averages.

According to the World Bank, 70% of the population generates an annual income of less than USD 10,000. The latter combined with the aforesaid highly skilled labor force would form an attractive combination for any company willing to invest in Lebanon.

The author of this post is Claudia Caluori.

意大利政府在即将由意大利议会审议的《预算法草案》中建议:为在意大利投资的外籍富裕个人提供简便的入境签证。若自雇人员以工作为目的移居意大利,则通过自雇所得的收入可申请税收减免。意大利的新税务优惠制度,类似于“英国税务居民但非英国居籍”制度(UK resident-not-domiciled regime)。

为了吸引外国资本,意大利政府正重点关注有意移居意大利的非居籍个人的税收新优惠。

一方面,人民迁移权和迁移流程的法律框架被修改:加入了为期两年的特别签证制度(可续签,在某些情况下或为三年)。上述签证制度适用于在意大利持续居住超过三个月的个人。

若要申请上述优惠,则非居籍个人需要证明其满足以下条件,或证明将在意大利进行以下投资:(1)购买并持有至少200万欧元政府债券至少两年,(2)在注册地址为意大利、并在意大利运营的公司股本的权益工具中投资至少100万欧元,并维持至少两年,(3)用于文化、教育、移民管理、科学研究或文化产品修复的至少100万欧元慈善捐款。

对于是否符合上述要求,相关部门会通过非居籍个人提交的一系列文件(根据待定程序)进行核实。如果得到积极的评价结果,那么符合要求的非居籍个人将获得“投资者签证”。

其他修正案将涉及所谓的《2015国际化法令》(第147/2015号法令,第16条),尤其雇员由于工作原因移居至意大利的特别制度。该制度内容将被扩展,以在税收优惠方面更具吸引力。

事实上,在意大利停留两周以上的自雇人员也将受益于该制度内容的扩展修改。此外,政府似乎愿意扩大无税区:至今为止,在意大利自雇工作或受雇工作收入的30%无需缴税,但之后该百分比可能提高至50%。

目前,税收减免只适用于欧洲公民。根据草案,该税收优惠覆盖范围可扩大至:所居住国已与意大利签署双重税务协定或互相交换信息协议的非欧盟国家居籍个人。此外,申请人必须持有大学学位并且在过去至少24个月持续受雇或自雇。

《预算法草案》为符合条件的非意大利居籍及其亲属制定新的税收制度,使他们愿意移居意大利。该草案类似于“英国税务居民但非英国居籍”制度,规定在意大利境外产生的所有收入与收益,在提交税收支配预算的正式申请之后,每年只需缴纳10万欧元的固定替代税。上述申请最多可持续15年,期间可撤销或提前终止。

此项规定无疑极具吸引力,如果得以实现,将可推动大量高资产净值个人居住在意大利。如此优惠的税制在过去从未被提出过。